Key takeaways:

- Private markets, especially private credit, are now essential for portfolio diversification and income

- Picking the right manager is crucial as returns can vary dramatically

- New tech and partnerships are making private market access easier for Australian investors

- Advisers must focus on long-term strategy and client education, not just short-term gains

As the traditional 60/40 portfolio grapples with volatility and correlation breakdowns, another option has emerged for wealth managers seeking reliable income and diversification: private debt. Once reserved for institutional investors and the ultra-wealthy, private credit is now increasingly accessible for a wider client base. The key challenge? Making it operationally viable and strategically effective in the hands of wealth advisers.

At Netwealth’s 2025 Overseas Study Tour, senior executives from BlackRock and iCapital laid out a compelling case for why private markets must become a fixture in modern client portfolios—and how the infrastructure is finally in place to deliver on that promise.

Beyond public markets: Why private assets are key

The investment landscape itself is changing. Advisers and their clients are looking for more stable income, less volatility, and differentiated sources of return. That’s where private markets come in.

In their presentation, iCapital’s Kunal Shah and Joe Burns offered a macro view of the shift: “What worked well for two decades—stocks and bonds—isn’t working as well anymore,” Burns said. “The game is on to find new return sources, and private markets are critical to that.”

Shah noted that most clients today still have limited exposure to private equity or credit—despite the asset class representing roughly 10% of global equity markets. “That gap is the opportunity,” he said. “Private equity offers upside potential; private credit delivers consistent income. Together, they can create a more balanced equity profile.”

One of the most compelling arguments from both BlackRock and iCapital was around efficiency. Research shows that adding alternatives to a portfolio—particularly in the 15–25% range—can meaningfully improve the return-to-volatility ratio. Shah referred to this as “portfolio optimisation by design.”

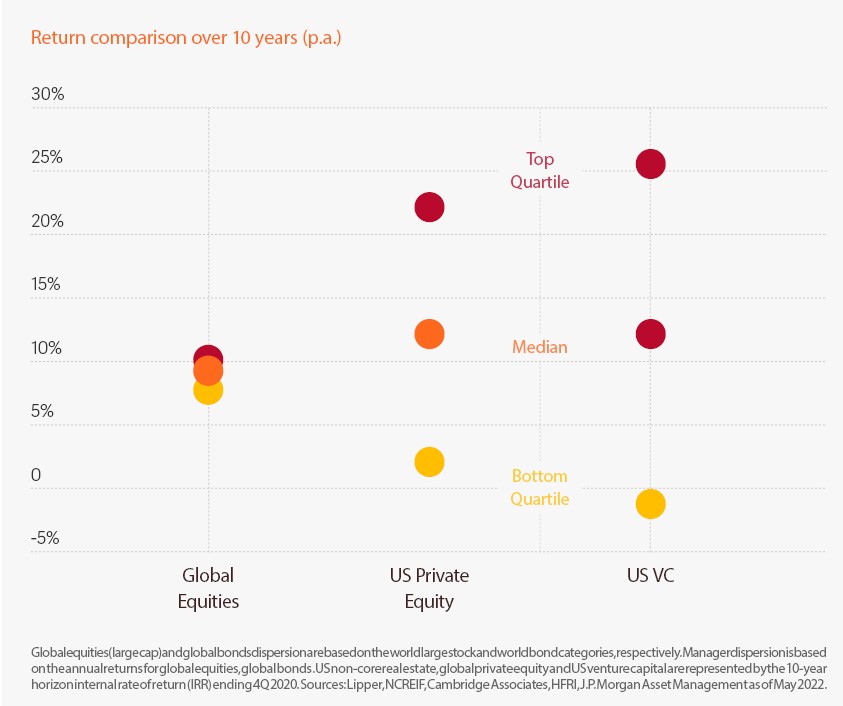

But manager selection matters. According to Shah, the alpha from picking top-tier private managers ranges from 5–6% in green assets to as much as 20% in venture capital. “We’re not just building access,” he said. “We’re curating it. That’s where real value is added.”

iCapital supports this through pre-packaged portfolios, guided allocations, and ongoing due diligence, all aimed at helping advisers allocate effectively across alternatives without needing a family office infrastructure. In Australia, many of iCapital’s investments are available via Netwealth for wholesale investors.

The strategic shift to private credit

“The game is on,” said Joe Burns, Managing Director and Head of Hedge Fund Research at iCapital, reflecting on the seismic changes unfolding in portfolio construction. “What worked really well for literally two decades is now, in the last several years, not working.”

He and his colleague Kunal Shah, Managing Director and Head of Private Asset Research, pointed to a striking reversal: for 14 consecutive months, every time both the S&P 500 and MSCI World indices fell, Bloomberg’s broad bond index also declined. This co-movement of stocks and bonds—once considered rare—is now challenging the foundational assumptions of balanced portfolios.

Private markets, and private credit in particular, offer a response. Shah explained that private credit delivers “upside with stability,” particularly attractive to clients entering the second stage of their financial lives, when income generation and capital preservation take precedence.”

“Private credit is becoming a foundational allocation,” Shah said. “Not just a diversifier, but a primary return source—especially when rethinking traditional fixed income allocations.”

Of course, intention is only half the equation. Historically, integrating private assets into portfolios has been fraught with obstacles: high minimums, illiquidity, cumbersome administration. That is changing.

From allocation to implementation

Of course, portfolios don’t exist in a vacuum. For clients, the success of a strategy is measured not in basis points, but in outcomes: retirement readiness, wealth transfer, peace of mind.

“Less than 10% of our adviser interactions are transactional,” Burns said. “Ninety percent are strategic. Advisers are asking us: ‘How do I get from where I am today to a portfolio that truly reflects my clients’ goals, risk tolerance, and long-term objectives?’”

Both BlackRock and iCapital stressed the importance of pairing high-level allocation frameworks with practical execution strategies. For instance, when adding private credit to a portfolio, it’s not enough to designate a target percentage, but advisers need to also manage liquidity, tax implications, and client expectations around drawdowns and capital calls.

This also requires a new approach to communication. Mueller and the iCapital team stressed the need for transparency around private market liquidity, drawdowns, and the role of each asset in the portfolio.

Manager selection: The alpha multiplier

For all the focus on models and platforms, iCapital’s Shah reminded the audience that “the manager still matters.”

The dispersion in private market outcomes is significant. Shah noted that alpha from manager selection in green assets can range from five to six percentage points, while in venture capital, the spread can be as high as twenty.

“That’s why Joe and I have jobs,” Shah joked, “but it’s also why clients need trusted partners. Access without insight can be dangerous.”

To support this, iCapital curates fund lists, performs deep due diligence, and provides pre-packaged investment options designed to help advisors allocate effectively without building infrastructure from scratch. And many are available today via Netwealth.

Eric Mueller, Managing Director in BlackRock’s Multi-Asset team agrees on the value of model portfolios as a delivery mechanism for private markets: “You can’t rebalance an illiquid asset every quarter. But you can design a liquid sleeve that flexes around it, so the overall portfolio adjusts while the private asset allocation remains stable.”

He suggests this scaffolding allows advisors to offer sophisticated exposures while maintaining day-to-day portfolio agility—a long-standing pain point when dealing with alternatives. He believes this kind of architecture is vital for advice firms seeking operational simplicity without sacrificing personalisation.

In their presentation Mueller describes a recent Blackrock launch: “Two weeks ago, we launched our first platform-based model portfolio combining private equity, private credit, public equity, and liquid alternatives. It trades twice a year, with mechanisms built in to handle the liquidity constraints of private assets.”

“We’re building the infrastructure that allows public and private assets to live side by side in a single account, across five risk profiles,” he said. “And we’re doing it in a way that’s scalable.”

Communicating the strategy

Integrating private debt into client portfolios isn’t just about numbers—it’s about narratives. Clients must understand not only what they own, but why.

Burns explained that only a small percentage of adviser interactions are transactional. “Ninety percent of the time, it’s strategic,” he said. “Help me figure out how to get from where I am today to where I want to be in five or ten years, with meaningful exposure to alternatives that support my long-term goals.”

To support this journey, iCapital and BlackRock offer tools for scenario analysis, stress testing, and risk modeling. These capabilities, embedded into platforms like Blackrock’s Aladdin, help advisers articulate the rationale for private market allocations and show clients how their portfolios may behave in different market environments.

The Australian Opportunity

While these advances are largely U.S.-driven, they are beginning to find a foothold abroad. Mueller acknowledged the limitations still present in markets like Australia—particularly around the availability and liquidity of certain private market vehicles—but noted that expansion is underway.

Meanwhile, iCapital’s partnership with Netwealth is designed to do exactly that: “We’re building the on-ramps,” Burns said. “The goal is to make private market access as seamless as possible—without compromising on due diligence or customization.”

Making it work

For wealth managers, the implication is clear: the infrastructure, the products, and the demand are converging. Private markets are no longer a “nice to have”—it’s increasingly a client expectation.

But executing effectively requires more than selecting the right fund. It means embedding private assets into a cohesive portfolio strategy, delivered through technology, and supported by data and risk controls.

It also requires a shift in mindset. Advise businesses must think in years, not quarters. They must educate clients on drawdown schedules and liquidity profiles. And they must deliver a client experience that feels as seamless and responsive as traditional equities and bonds.

As Mueller put it, “We’re not just trying to deliver excess alpha. We’re trying to keep clients invested through the cycle, with confidence that their portfolio is built for where the world is going—not where it’s been.”

Related articles

Private markets 2.0: preparing for opportunities

Private markets 2.0: preparing for opportunities

From secondaries and co-investments to evergreen funds, advisers are navigating a more complex, diversified landscape. Explore how to harness this momentum and position portfolios for long-term success.

Read nowBeyond the pitch deck: raising the bar on private markets due diligence

Beyond the pitch deck: raising the bar on private markets due diligence

Discover how to raise the bar on private markets due diligence. Explore how disciplined due diligence, transparency, and expert oversight can help you select the right managers and safeguard your clients’ portfolios.

Read nowNew challenges and opportunities in private equity

New challenges and opportunities in private equity

Discover how private equity is becoming a core strategy for modern portfolios and what advisers need to know to stay ahead. See why manager selection and innovation are more important than ever, and how fast-growing sectors like climate tech are transforming the private equity landscape.

Read now