As private markets grow in scale, sophistication, and accessibility, both investors and advisers should look to adapt to emerging trends, evolving structures, and expanding opportunities.

Key takeaways:

- Private markets are growing in scale, sophistication, and accessibility

- Secondaries and co-investments are unlocking liquidity and high-return opportunities

- Evergreen structures are reshaping access making private markets more flexible and transparent

Against a background of volatile public markets, a quiet revolution has been building. Private markets, once inaccessible to all but the largest institutions and most wealthy investors, are being reshaped by new structures and soaring demand.

As a result, private markets are often becoming a core component of diversified investment portfolios. They can offer something different: the ability to access less correlated (to public markets) opportunities that behave differently over economic cycles. From early-stage venture deals to infrastructure and royalties, the breadth of investment choices also continues to grow.

With heightened market uncertainty, these characteristics, low correlation, potential for alpha, and access to unique assets are more valuable than ever. But with this is often a growing complexity that cannot be ignored.

A shifting landscape

In Netwealth’s special report, The advanced playbook to private markets, we explore the shifting landscape of private markets.

“Private markets have exploded in the past 18 months, whether that’s venture capital, private equity, private infrastructure, private property or royalty programs,” says Heath Ueckermann, partner at Lipman Burgon.

“For example, we just finished a due diligence in the unlisted infrastructure space and got no less than 10 high quality infrastructure names.”

That breadth is part of the challenge. The sheer variety of asset types and deal structures available has led to a shift in language and thinking.

Charlie Viola, executive chair and founder at Viola Private Wealth says they’ve moved away from the label ‘alternatives’.

“We started using the term private market investments because we still have to do a lot of due diligence on those investments.”

Secondaries and co-investments expand opportunities

An example of fast-growing area is the secondary market, where investors buy existing stakes in private equity or credit from others looking to rebalance. Endowments in the US, facing liquidity pressures and tax changes, are seen as fertile sellers in the secondary market.

“In the US, major education endowments like Harvard and Yale are under pressure and facing higher taxes. Some managers we work with are already in contact with them to potentially buy assets on the secondary market,” Heath explains.

Ashmi Mehrotra, managing director, private equity group at JP Morgan Asset Management says secondaries and co-investments are key parts of their approach.

“When combined, secondaries and co-investments can be powerful tools. Not only do they give us access to high-quality managers and transactions, but they also represent some of the most alpha-generative parts of our overall strategy.”

An example of one of their recent-co-investments was with a long-standing, sub-$900 million manager that acquires overlooked brands from large companies. As part of the investment they put in place leadership, marketing, manufacturing, and distribution through major retailers. The business was recently sold to a strategic buyer, delivering a return of more than 2x.

Hagai Netser, head of core and opportunistic portfolios, Koda Capital says they’ve recently committed to a closed-end secondary fund focused on older private equity assets. “The average discount for these kinds of managers is around 30 to 40 per cent… they tend to be shorter duration than traditional private equity.”

Eric Greer, associate investment director – private markets, Australia, Schroders Capital says they’re already taking advantage of dislocation in real estate, selectively buying assets from funds under redemption stress.

Evergreen structures change the game

However, the growth is private markets is not just about what assets are available, but how they’re accessed.

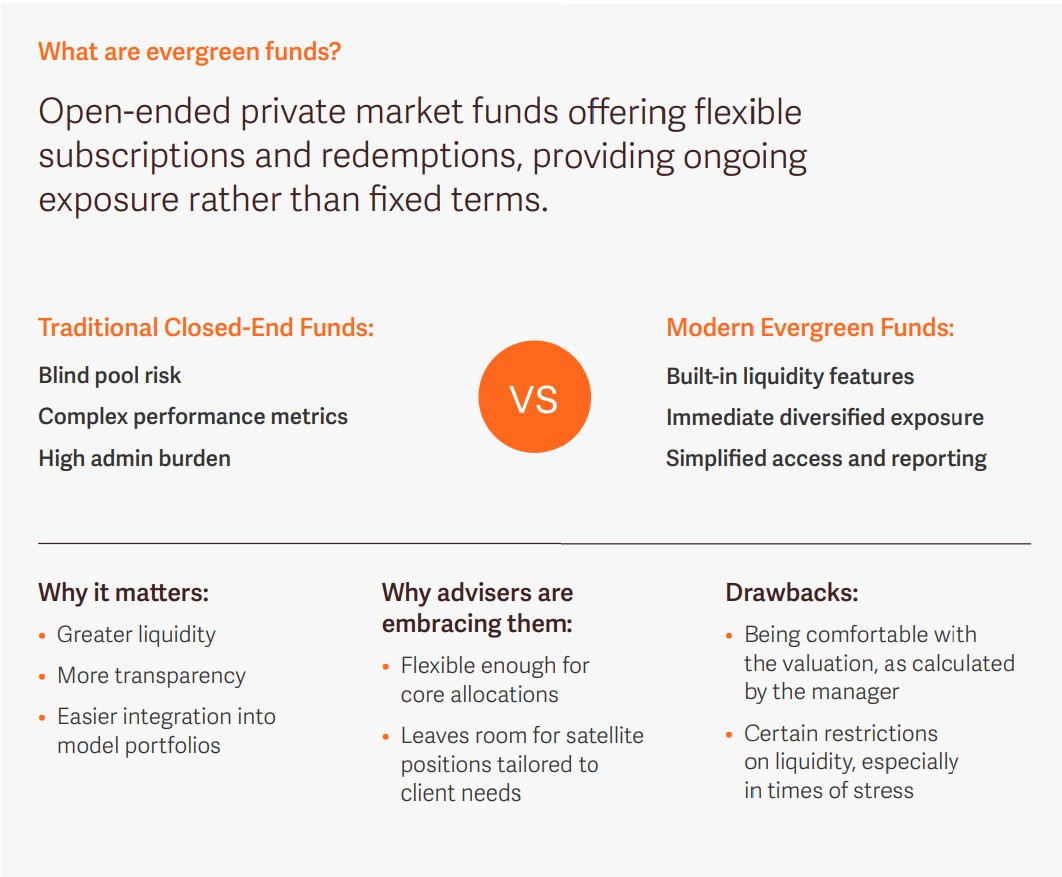

Among the biggest structural shifts has been the rise of evergreen funds or open-ended private market vehicles that allow for ongoing subscriptions and redemptions. These funds simplify access, increase transparency and can integrate more smoothly into managed account structures and model portfolios.

“Evergreen products provide the liquidity and flexibility needed for model portfolios, allowing private markets to play a more central role while still leaving room for satellite allocations tailored to client interests or gaps in exposure,” explains Kunal Shah managing director at iCapital, calling them a “game changer for advisers.”

Charlie notes that while closed-end funds may offer higher IRRs on paper, evergreen structures can provide more consistent, accessible returns.

“Viola has come to prefer evergreen over closed-ended, as while sometimes the IRR in close-ended and single asset funds looks better, the money on money return from evergreen fully invested options will be superior.”

Heath from Lipman Burgon agrees there has been significant evolution toward more flexible and accessible formats. “Closed ended structures carried blind pool risk, complex performance metrics, and high administrative burdens.”

“Open-ended funds with liquidity features provide immediate, diversified exposure across regions, vintages, and asset types. This approach simplifies access and improves transparency for investors,” Heath says.

In general Lipman Burgon use more evergreen private market offerings than closed ones, which they tend to only pursue on an opportunistic basis looking to match the right structure with the right underlying assets.

However, evergreen does not mean unlimited liquidity. “It is crucial for investors to understand private asset investments are generally illiquid,” says Nathan Lim, chief investment strategist at Evidentia Group. “Unlike publicly traded assets, private assets cannot be easily sold or converted to cash without the potential loss in value.”

The common theme across all these developments is that private markets are getting more accessible and offering a wider variety of choice for advisers navigating this growing range of investments.

Related articles

Making private markets work for clients – a global perspective

Making private markets work for clients – a global perspective

As traditional portfolios face new challenges, private markets are stepping into the spotlight. Discover how advances in technology and platform integration are making private assets more accessible and operationally viable.

Read nowBeyond the pitch deck: raising the bar on private markets due diligence

Beyond the pitch deck: raising the bar on private markets due diligence

Discover how to raise the bar on private markets due diligence. Explore how disciplined due diligence, transparency, and expert oversight can help you select the right managers and safeguard your clients’ portfolios.

Read nowBeyond alternatives: redefining private market allocations

Beyond alternatives: redefining private market allocations

Private markets are moving past the old ‘alternatives’ label. Discover how new strategies and asset types are reshaping portfolios for greater growth, resilience, and smarter diversification.

Read now