With growing regulatory scrutiny raising questions about transparency and risk, it’s understandable to be cautious about private markets. But client interest is only increasing, and wealth professionals need to be ready with answers, not avoidance.

Key takeaways:

- Client demand for private markets is surging, with investors actively seeking more information and access

- Private markets offer broader opportunities and smoother returns, but advisers must understand risks like illiquidity, valuation uncertainty, and transparency gaps

- Rigorous manager selection and due diligence are critical - look for transparency, consistent strategy, and strong governance

- Liquidity remains a key challenge, but some firms address this by customising liquidity to each client’s profile and providing clear communication about access and trade-offs

It often starts with a question.

A client reads about private equity returns, hears a friend mention private debt, or wonders why they’re not in that infrastructure fund their neighbour just invested in. Suddenly, their adviser finds themselves fielding questions about private markets – where to invest, how to manage risk, and what it all means for their portfolio.

“Private markets have exploded in the past 18 months, including venture capital, private equity, infrastructure, property, and even royalty programs,” says Heath Ueckermann, partner at Lipman Burgon.

“Clients, especially sophisticated investors, are now expecting this exposure as part of a portfolio.”

With more accessible options available such as evergreen funds, advice firms need to understand how private markets can enhance outcomes, as well as where these assets fit, how to manage the risks, and how to build the right advice proposition around them.

Why private markets matter

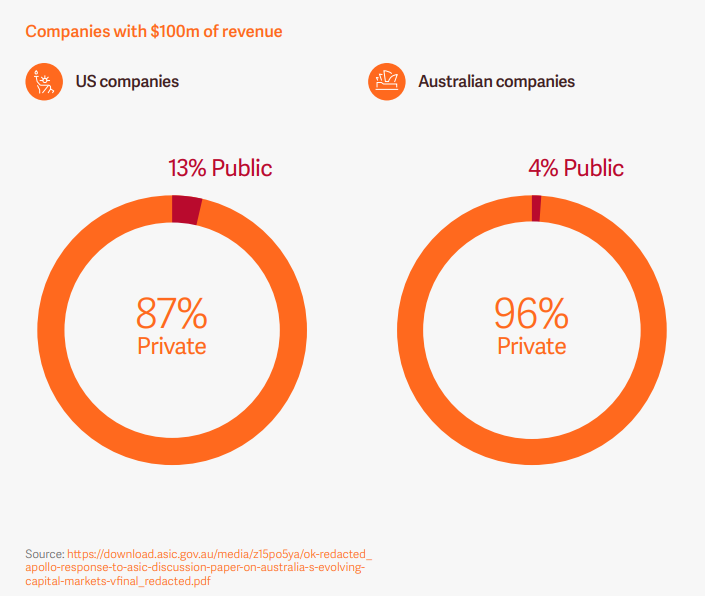

From a portfolio construction perspective, private markets offer access to businesses and opportunities that don’t exist on public exchanges.

“In order to justify being listed, a company needs to be of a certain size and sophistication,” says Claire Smith, head of business development Australia, private markets at Schroders, who specialises in small and mid-cap private equity space.

“So private businesses can grow faster and may be less reactive to daily market sentiment.”

For clients unsettled by public market volatility, private markets can also smooth the ride. Paul O’Connor, head of strategy & development – investment choice at Netwealth notes that listed assets are revalued daily, often triggering emotional responses.

“Private assets are typically valued monthly or quarterly, which creates a more stable return profile,” he says.

The opportunity set is also much broader.

“If you’re only looking at public markets, you’re missing most of what’s available,” adds Mark Carlile, managing director, head of wholesale, Australia, and New Zealand from JP Morgan. “Private markets offer exposure that’s less correlated to the rest of the portfolio.”

Managing risks

However, there are some risks to manage in private markets.

“Opacity, conflicts, valuation uncertainty, illiquidity and leverage in private markets are the key risks I am concerned for ASIC to focus on,” the regulator noted in its February 2025 report in private markets.

Helping clients navigate private markets requires a well-defined advice proposition grounded in education, due diligence and suitability.

Ashmi Mehrotra, managing director, private equity group at JP Morgan says the key is understanding the ‘how’ behind performance such as governance, risk processes and manager culture. Kunal Shah, managing director at iCapital adds that portfolio construction needs to be aligned with the client’s liquidity tolerance and investment horizon.

“The right questions, of both clients and managers, are the foundation of a good outcome,” he says.

These risks underscore the need for a structured, adviser-led approach that prioritises manager selection from the outset.

Due diligence is core to this process. However it is more demanding than in public markets, particularly since there is no Bloomberg Terminal or other publicly available documents, as Kunal points out.

“You need to do your own research, make reference calls, and spend time understanding the manager’s philosophy, process and track record.”

Charlie Viola, executive chair and founder at Viola Private Wealth compares it to watching tradespeople assess a renovation. “Every fund manager tells you they’ve got the best process. But unless you know what you’re looking for, it’s hard to judge.”

Their firm uses a 15-point questionnaire to assess managers across areas such as governance, valuation practices, team experience, crisis response and operational capability.

To get started in picking a private market manager you can look out for red and green flags. Green flags include transparency, a consistent strategy, experienced teams and a culture of investor alignment. Red flags include opaque reporting, overly complex structures and regulatory issues.

Other key areas to look out for when assessing a manager as part of your due diligence process include:

- Investment philosophy and process

- Track record across market cycles

- Crisis response and team depth

- Governance and independence

- Transparency around fees and valuations

- Repeatability of performance

Liquidity trade-offs

Even with the rise of evergreen funds, liquidity remains a key issue, and education is critical.

“If an adviser’s coming to this fresh, they need to have their eyes wide open to liquidity,” says Vincent O’Neil, CEO of Stanford Brown.

But at the same time, less liquidity often comes with a premium.

“Private equity typically outperforms listed equity by 3 to 4 percent annually, and private debt by 2 to 3 percent. That’s the illiquidity premium,” explains Hagai Netser, head of core and opportunistic portfolios at Koda Capital.

Koda’s approach is to tailor liquidity to each client’s profile.

“We quantify their liquidity needs and structure portfolios accordingly,” Hagai says.

“We can tell you exactly what percentage of capital is accessible monthly if the portfolio goes into panic mode, both at the fund and total portfolio level.”

Beyond access, how assets are valued can dramatically impact performance reporting and client expectations. Valuation methodology is therefore critical.

Eric Greer, associate investment director – private markets, Australia at Schroders advises understanding whether the fund uses its own valuations or relies on underlying managers, and whether it follows recognised international standards such as IPEV (International Private Equity and Venture Capital Valuation).

Private markets can offer powerful diversification and performance benefits, but they demand stronger processes, more research and deeper conversations. And while it’s understandable for advice firms to be cautious about areas like liquidity, transparency and consistency, this should not hold them back from getting started.

Advisers should instead build the capability for thorough due diligence, and bring transparency, discipline and clarity to their advice. With the right frameworks in place, they’ll be well-positioned to help clients invest confidently in an increasingly complex space.

To learn more about private markets, Netwealth has several special reports that can help: Unlocking Private Markets, Building your value proposition with private markets, and The advanced playbook to private markets.

Related articles

Private markets 2.0: preparing for opportunities

Private markets 2.0: preparing for opportunities

From secondaries and co-investments to evergreen funds, advisers are navigating a more complex, diversified landscape. Explore how to harness this momentum and position portfolios for long-term success.

Read nowBeyond alternatives: redefining private market allocations

Beyond alternatives: redefining private market allocations

Private markets are moving past the old ‘alternatives’ label. Discover how new strategies and asset types are reshaping portfolios for greater growth, resilience, and smarter diversification.

Read nowMaking private markets work for clients – a global perspective

Making private markets work for clients – a global perspective

As traditional portfolios face new challenges, private markets are stepping into the spotlight. Discover how advances in technology and platform integration are making private assets more accessible and operationally viable.

Read now