Netwealth Unify

A cloud based data management platform that helps you aggregate, analyse and act on data.

Request a demo

Unify integrates with over 30 software solutions to centralise and clean client and business data, creating a single source of truth across your organisation.

It brings your client data to life through purpose-built data connectors, data management tools, and data dashboards for insights, unlocking actionable intelligence across your business. Leverage your data to drive performance, deliver whole-of-business reporting, automate workflows, identify compliance and business risks, and uncover new opportunities to better serve your clients.

Unify seamlessly integrates with over 30 systems, securely aggregating raw data: like client records, revenue, investments, and compliance indicators into one central location. Its out-of-the-box connectors align with common tech stacks, eliminating the need for custom builds and enabling fast, scalable deployment.

Unify’s intelligent, points-based matching engine compares records across systems to detect duplicates and gaps. High-confidence matches are automatically merged to form a single client profile, including related family or entity groupings, while lower-confidence matches are flagged for review. This helps maintain a complete and accurate record for each client and entity.

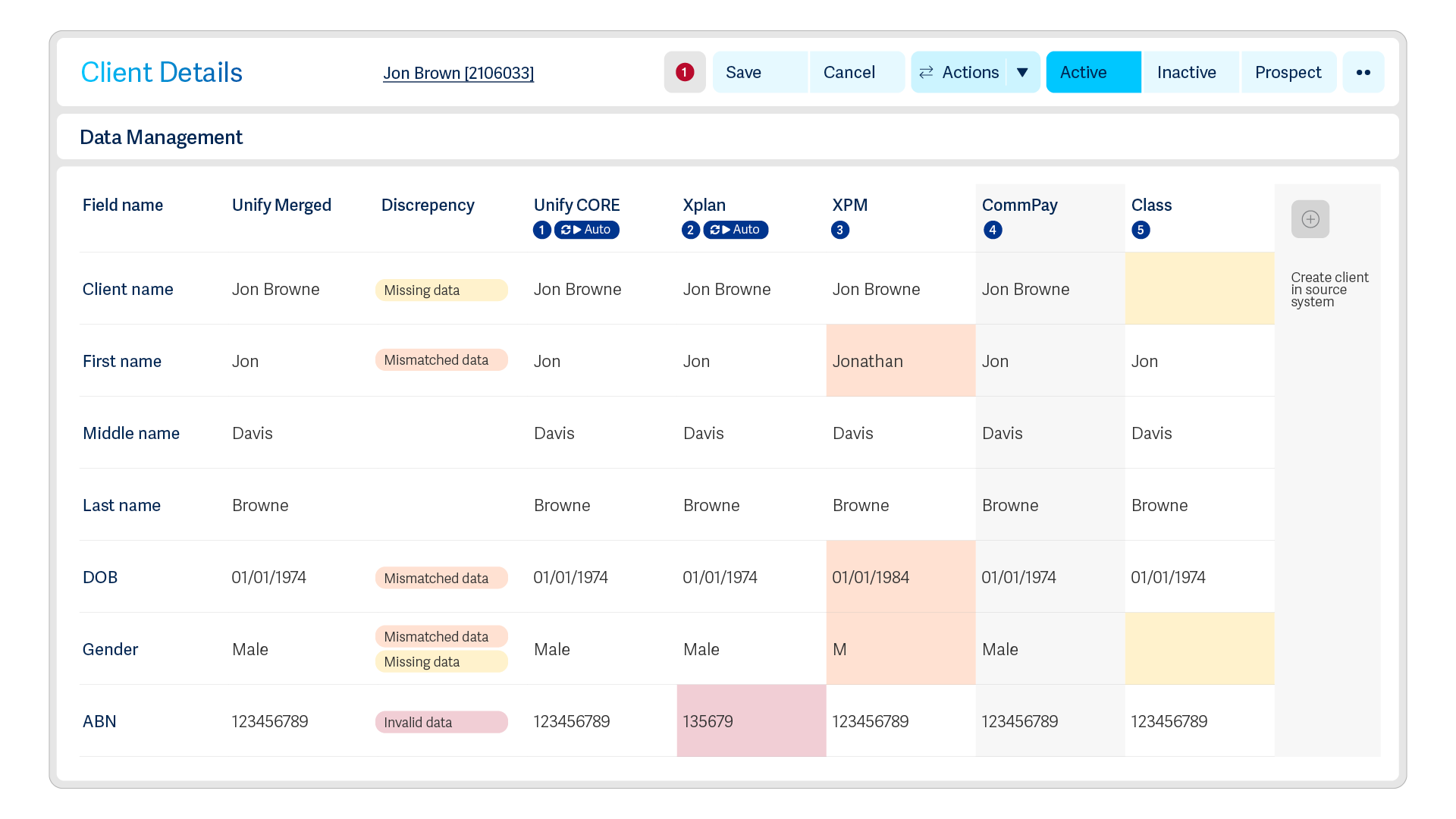

Once records are matched and organised, Unify offers a user-friendly interface to clean and correct data hygiene issues. Users can easily review records, identify inconsistencies, resolve errors, and fill in missing information. Updates made in Unify are securely pushed to selected systems, keeping your entire tech stack aligned and up to date.

Unify integrates with your systems in a way that suits your business, whether through direct connectors, automated data feeds, or public APIs, ensuring seamless, two-way data flow.

With Unify’s purpose-built dashboards, advisers gain a complete view of each client, practices get a whole-of-business perspective on KPIs, and licensees can monitor, benchmark, and support their entire network - all in one place.

Get a complete, connected view of every client. From individuals and family groups to super funds, trusts, investments, insurance policies, and revenue. Unify brings everything together so you can segment, compare, and prioritise with confidence.

See how your practice is performing in real time and uncover gaps, spot risks, and identify opportunities. Track revenue and FUM per adviser, monitor client activity, uncover segmentation trends, and view compliance and performance indicators - all from one interactive dashboard.

Monitor business health across your adviser or entire business network. Benchmark performance across groups, identify key compliance risks, and compare practice performance against peers, giving you the oversight needed to support, guide, and grow.

Unify centralises data so your business can make informed decisions, run efficiently and lead with confidence.

Centralised access to data - no more switching software systems or chasing spreadsheets.

Deliver informed business recommendations with clean, connected data and real-time insights.

Whether you're servicing 100s of clients or overseeing an entire network, Unify scales to deliver insights at every level.

30+ native integrations and an OpenAPI means you can keep your systems in sync and your data flowing.

Automated integrations, matching, and flagging reduce manual work and minimise discrepancies.

Benchmark your business against industry standards, compare adviser performance within a practice, or evaluate practices across a network - all using consistent, reliable data.

Monitor key compliance metrics (KRIs) in real time, helping businesses embed risk detection into their operational rhythm and identify issues early.

Hear from The Wealth Designers on how Unify has helped them turn data into decisions and a more efficient business.

Data is spread across many systems and new tools arrive every week. The firms that are growing are the ones connecting their tech, automating routine tasks, and using AI where it saves time. They treat client data as an asset and build trust by design.

Netwealth’s AdviceTech 2025 research reveals how these firms operate. We call them AdviceTech Stars. This report explores six key trends, with benchmarks, checklists, and real-world examples to help you plan your next move.

Complete the below form to connect with a Netwealth Distribution Manager

By submitting your details, you agree to receive further marketing communications from Netwealth. It is, however, possible to unsubscribe from within each communication received, by clicking the unsubscribe link at the bottom of the email. Alternatively, you can visit the following webpage or contact us on 1800 888 223 and ask to be unsubscribed. Please visit our website www.netwealth.com.au to read our Privacy Policy. By clicking Download, you agree to our Terms & Conditions.