Portfolio holdings

View your portfolio the way you want to.

Netwealth's online portfolio tools provide annuity, super and investment account holders the ability to view and analyse their accounts and holdings. There are three Portfolio tools available:

In this module we will cover the features available on the holdings tab.

Once logged in, you'll see the Portfolio dashboard. Click on the Holdings Tab or select one of the accounts on the dashboard to access the Portfolio holdings page.

To get the most out of this page:

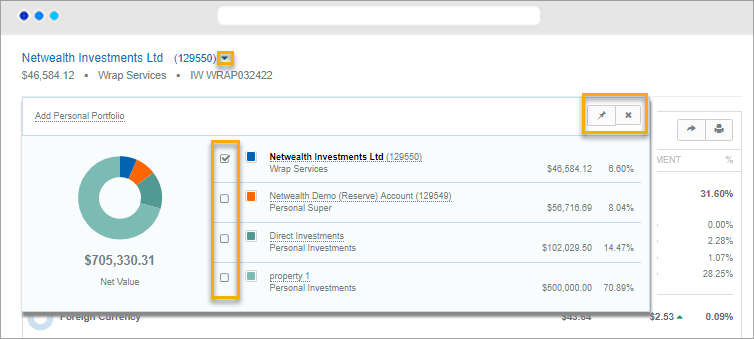

a) Click on the account selector to view all accounts associated with your username. This will display a list of accounts and the $ and % value of that account as a part of your portfolios net value.

b) To view the holdings for one account, select the tick box next to the account.

c) To view the aggregation of holdings for multiple accounts, select the tick boxes next to the relevant accounts.

Advanced tip: To pin this list of accounts to the top of the page, click the ‘pin’ icon. To unpin the list of accounts widget, click the ‘cross’ icon.

Holdings are displayed with details of their code, current number of units, current price, value, movement (since inception/initial purchase) and current percentage of the portfolio. Further details are available for liabilities too (eg margin loans).

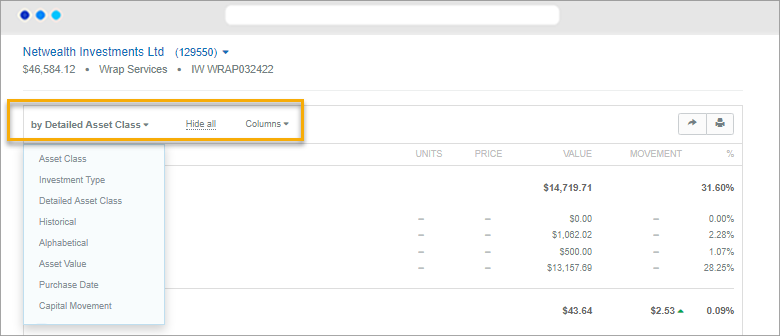

a) To change the view to show different groupings of holdings, click the drop down next to ‘by’.

Selection |

Definition |

| Asset class |

Allows you to categorise holdings by asset class. i.e. Australian Equities, Australian Fixed Interest etc. |

| Detailed asset class |

Allows you to categorise holdings by using extra information that Netwealth receives about that asset including asset class, exchange; and investment types. i.e. ASX – Australian Shares, Managed Funds – Multi-sector 40%- 6-0% Growth |

| Investment type |

Allows you to categorise holdings by the type of investment. i.e. Australian Equities, Managed Funds, Exchange Traded Funds etc. |

| Historical | Lists all holdings since inception, including sold assets by asset class. |

| Alphabetical | Lists current holdings alphabetically from A to Z, with A at the top. |

| Asset value | Lists current holdings by largest holding by value at the top. |

| Purchase date | Lists current holdings by the date they were purchased, with the most recent purchased at the top not specifying any asset class. |

| Capital movement | Lists assets by capital movement with largest movement at the top. |

b) The ‘Hide all’ / ‘Show all’ link toggles between hiding and showing details for all holdings versus showing totals for each of the sub-groupings.

c) To add or remove columns from the view, click the ‘Column’ drop down. Additional columns include: (Asset) Code and Capital Movement.

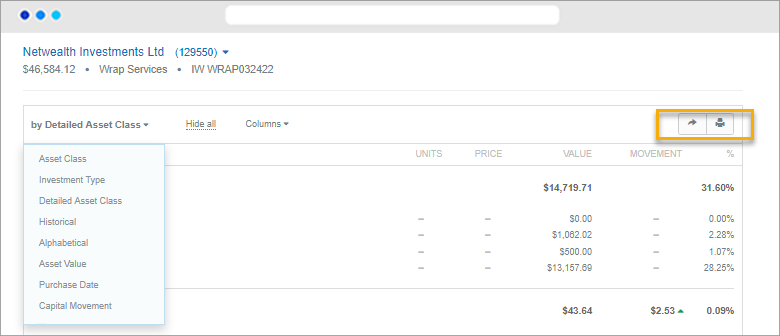

a) Select the ‘arrow’ icon to export an excel report of holdings grouped in the same way as your current chosen view.

b) Select the ‘print icon to generate a PDF report of holdings grouped in the same way as your current chosen view.

a) Understanding the Cash account

The following information may be shown in the cash account area:

| Item | Description |

| Pending | The amount of cash that is allocated to outstanding transactions. |

| Managed account cash | The aggregate amount of cash in your managed account/s. |

| Minimum cash | The amount of cash required to meet Netwealth’s minimum cash level. |

| Available cash | Cash over and above your minimum cash requirement that is available for investment/withdrawal. |

Advanced Tips:

b) View unit holdings for assets

Where a hyperlink appears under an asset name, click on it to be shown the following details:

The prices displayed are the latest daily prices calculated by Netwealth. The values of managed funds displayed in your portfolio are based upon the latest prices available to Netwealth and are not the guaranteed prices you would receive should you request to purchase or redeem units.

ASX securities have prices updated every 20 minutes during trading hours.