Investing in ESG (Environment, Social, Governance) funds

Managed funds with the highest Morningstar ESG Risk Rating and/or Low Carbon Designation

This page lists funds available on the Super and Wealth Accelerator Plus investment menu that hold the highest Morningstar ESG Risk Rating (5 globes) and/or a Low Carbon Designation as at the date this page is published.

Investors can use the Morningstar ESG Risk Rating to understand and manage the ESG implications on their investments and compare ESG risk across various managed funds within the same Morningstar Global Category.

Investors can use the Morningstar Low Carbon Designation to identify low-carbon funds across the global universe. The designation is an indicator that the companies held in a portfolio are in general alignment with the transition to a low-carbon economy.

The Morningstar ESG Risk Rating helps investors evaluate the relative risks of their investment options on environmental, social, and governance (ESG) factors. The Morningstar ESG Risk Rating is depicted on fund profiles by globe icons where a low ESG risk score equals 5 globes and a high ESG risk score equals 1 globe. Morningstar ESG Risk Ratings are updated monthly. It is is calculated using Sustainalytics’ ESG Risk Ratings for corporate issuers and Sustainalytics’ Country Risk Ratings for sovereign issuers and is based on historical holdings.

Morningstar has a number of requirements for a fund to receive a ESG Risk Rating. That include: 1) At least 67% of a fund’s qualified holdings must be eligible to receive an ESG risk score (ESG Risk Rating for corporate holdings or Country Risk Rating for sovereign holdings), 2) Morningstar ESG Risk Rating is assigned to a fund in a Morningstar Global Category with more than 30 funds, and 3) Morningstar must be in receipt of full portfolio holdings data for a fund to attain a Morningstar ESG Risk Rating. The latest portfolio data must be less than nine months old.

The Morningstar® Low Carbon Designation™ is assigned to portfolios that have low carbon-risk scores and low levels of fossil-fuel exposure. The designation is an indicator that the companies held in a portfolio are in general alignment with the transition to a low-carbon economy. Unlike the Morningstar ESG Risk Rating, the Low Carbon Designation is not a relative ranking against peers.

The Morningstar Portfolio Carbon Risk Score is the asset-weighted carbon-risk score from the equity or corporate-bond holdings in a portfolio. The Portfolio Fossil Fuel Involvement is the portfolio’s percentage exposure to fossil fuels, Both the Carbon Risk Score and Fossil Fuel Involvement is averaged over the trailing 12 months. To receive a Morningstar Portfolio Carbon Risk Score, at least 67% of portfolio assets must have a carbon-risk rating from Sustainalytics. Funds with a Carbon Risk Score below 10, and Fossil Fuel Involvement less than 7% of assets will receive the Low Carbon designation.

Before using Morningstar ESG Risk Rating or Low Carbon Designation, you should understand the underlying methodology which can be found at www.morningstar.com/research/signature

Here is a selection of the top-rated ESG managed funds available through the Netwealth platform.

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

ETL2716AU |

Coolabah Active Composite Bond Fund |

|

99 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

PER0758AU |

JPMorgan Global Macro Opps Class A Units |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL0046AU |

Select International Alpha Fund² |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

MUA0002AU |

Munro Global Growth |

|

98 |

30-Apr-25 |

Yes |

91 |

30-Apr-25 |

|

MAQ5143AU |

P/E Global FX Alpha Fund |

|

Yes |

95 |

30-Sep-23 |

||

|

PIC9659AU |

PIMCO TRENDS Managed Futures Stgy Wholsl |

|

|

|

Yes |

68 |

30-Apr-25 |

|

WHT1465AU |

Plato Global Alpha A |

|

95 |

30-Apr-25 |

Yes |

90 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

BFL0001AU |

Bennelong Australian Equities |

|

91 |

30-Apr-25 |

Yes |

91 |

30-Apr-25 |

|

PIM8302AU |

DNR Capital Australian Equities Income |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

BNT0003AU |

Hyperion Australian Growth Companies |

|

97 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

PER0116AU |

Perpetual ESG Australia Share |

|

95 |

30-Apr-25 |

Yes |

88 |

30-Apr-25 |

|

PER0046AU |

Perpetual Industrial |

Yes |

99 |

30-Apr-25 |

|

98 |

30-Apr-25 |

|

AUS0030AU |

Platypus Australian Equities - Wholesale |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

VAN4509AU |

Vanguard Ethically Cons Aust Shrs Whlsl |

Yes |

98 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

RFA0025AU |

Pendal Horizon Sustainable Aus Shr |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

DFA2068AU |

Dimensional Australian Sustainability |

|

97 |

30-Apr-25 |

Yes |

94 |

30-Apr-25 |

|

ETL1479AU |

Blackwattle Mid Cap Quality |

|

89 |

31-May-24 |

Yes |

89 |

31-May-24 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

PPL5308AU |

Antares Ex-20 Australian Equities |

|

97 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

AAP3940AU |

Ausbil Active Sustainable Equity |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ASX6124AU |

Auscap High Conviction Aus Eqs DailyPlfm |

|

98 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

ASX8411AU |

Auscap High Conviction Aus Eqs- Mly |

|

98 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

AUG0018AU |

Australian Ethical Australian Shr WS |

|

91 |

30-Apr-25 |

Yes |

84 |

30-Apr-25 |

|

BFL0002AU |

Bennelong Concentrated Australian Eq |

|

89 |

30-Apr-25 |

Yes |

89 |

30-Apr-25 |

|

BFL0004AU |

Bennelong ex-20 Australian Equities |

|

97 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

PIM4357AU |

DNR Capital Australian Emerging Coms |

|

90 |

30-Apr-25 |

Yes |

87 |

30-Apr-25 |

|

OPS2991AU |

ECP Growth Companies |

|

95 |

30-Apr-25 |

Yes |

90 |

30-Apr-25 |

|

FSF8777AU |

First Sentier Australian MidCap Fd |

|

98 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

BNT0101AU |

Hyperion Small Growth Companies |

Yes |

95 |

30-Apr-25 |

Yes |

94 |

30-Apr-25 |

|

IML0010AU |

Investors Mutual Concentrated Aus Share |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

HOW3590AU |

Lennox Australian Small Companies |

|

82 |

30-Apr-25 |

Yes |

74 |

30-Apr-25 |

|

SSB0026AU |

Martin Currie Real Income A |

Yes |

100 |

30-Apr-25 |

|

93 |

30-Apr-25 |

|

PER0270AU |

Pengana Emerging Companies |

|

81 |

30-Apr-25 |

Yes |

70 |

30-Apr-25 |

|

WPC5600AU |

Perennial Better Future Trust |

|

90 |

30-Apr-25 |

Yes |

72 |

30-Apr-25 |

|

ETL0062AU |

ICE Fund |

|

88 |

30-Apr-25 |

Yes |

73 |

30-Apr-25 |

|

WHT0008AU |

Spheria Australian Smaller Companies |

Yes |

80 |

30-Apr-25 |

|

67 |

30-Apr-25 |

|

ETL7964AU |

Elston Australian Emerging Leaders A |

|

89 |

30-Apr-25 |

Yes |

79 |

30-Apr-25 |

|

PIM4806AU |

Melior Australian Impact |

Yes |

100 |

30-Apr-25 |

|

100 |

30-Apr-25 |

|

UBS0004AU |

UBS Australian Small Companies Fund |

|

97 |

30-Apr-25 |

Yes |

87 |

30-Apr-25 |

|

WHT0025AU |

Spheria Opportunities² |

|

93 |

30-Apr-25 |

Yes |

93 |

30-Apr-25 |

|

FID0026AU |

Fidelity Future Leaders |

|

98 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

MGE1188AU |

Airlie Small Companies Fund |

Yes |

74 |

30-Apr-25 |

Yes |

70 |

30-Apr-25 |

|

PIM1925AU |

First Sentier ex-20 Australian Share |

|

97 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

MPL1241AU |

Maple-Brown Abbott Australian Small Comp |

|

83 |

30-Apr-25 |

Yes |

79 |

30-Apr-25 |

|

JBW0010AU |

Yarra Emerging Leaders Fund |

|

97 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

UGF4955AU |

U Ethical Australian Equities Tr - Ins |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

ETL8268AU |

Artesian Corporate Bond Fund A |

|

Yes |

78 |

31-Mar-24 |

||

|

CHN0005AU |

CC JCB Active Bond |

|

100 |

30-Apr-25 |

Yes |

73 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

SLT0052AU |

Coolabah Short Term Income Assisted Inv |

|

97 |

30-Apr-25 |

Yes |

86 |

30-Apr-25 |

|

PRM8256AU |

Mutual Credit |

|

75 |

30-Apr-25 |

Yes |

73 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

APN0008AU |

Dexus AREIT |

Yes |

96 |

30-Apr-25 |

Yes |

90 |

30-Apr-25 |

|

COL0001AU |

Charter Hall Maxim Property Securities |

Yes |

95 |

30-Apr-25 |

Yes |

93 |

30-Apr-25 |

|

CRM0008AU |

Cromwell Phoenix Property Securities |

|

81 |

30-Apr-25 |

Yes |

69 |

30-Apr-25 |

|

FSF0004AU |

First Sentier Property Securities |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

BGL0108AU |

iShares Australian Listed Property Index |

Yes |

99 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

NET0010AU |

BlackRock GSS Australian Property Index |

Yes |

99 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

ETL0119AU |

SGH Property Income |

Yes |

86 |

30-Apr-25 |

Yes |

81 |

30-Apr-25 |

|

VAN0004AU |

Vanguard Australian Property Secs Idx |

Yes |

99 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

ZUR0064AU |

Zurich Investments Aus Property Secs |

Yes |

93 |

30-Apr-25 |

Yes |

88 |

30-Apr-25 |

|

AMP0255AU |

Macquarie Australian Listed Real EstateA |

Yes |

96 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

PCL8246AU |

Pengana High Conviction Property Secs A |

|

100 |

30-Apr-25 |

Yes |

87 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

ACM0009AU |

AB Global Equities |

Yes |

97 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

CRS0005AU |

Abrdn Sustainable International Equities |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

EQI0015AU |

abrdn International Equity |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

HOW0164AU |

Alphinity Global Equity |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ANT0005AU |

Altrinsic Global Equities Trust |

|

97 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

AUG0025AU |

Australian Ethical Intl Shr WS |

Yes |

100 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

FSF4018AU |

Baillie Gifford Sustain Growth-Class A² |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

BPF0016AU |

Bell Global Equities Platform Class |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ARO0006AU |

BNP Paribas C WorldWide Global Eq Trust |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

AAP0001AU |

Candriam Sustainable Global Equity |

|

98 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

CIM0006AU |

Capital Group New Perspective (AU) |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

CIM0008AU |

Capital Group New Perspective Hdg (AU) |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

ETL0390AU |

Claremont Global Fund |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

FID0023AU |

Fidelity Global Demographics |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

FRT0009AU |

Franklin Global Growth A |

|

97 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

FRT6321AU |

Franklin Global Growth A (Hedged) |

|

97 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

SSB3125AU |

Franklin Global Rspnb Inv M |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

SSB0126AU |

Franklin Global Systematic Equity A |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

GMO1447AU |

GMO Quality Trust² |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

WHT8435AU |

Hyperion Global Growth Companies B |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

MAQ0404AU |

IFP Global Franchise Fund |

|

100 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

MAQ0631AU |

IFP Global Franchise Fund (Hedged) |

|

100 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

MAQ3060AU |

IFP Global Franchise Fund II |

Yes |

100 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

PPL0036AU |

Intermede Global Equities Fund |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

MGL0004AU |

Ironbark Brown Advisory Global Share |

|

98 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

HGI7127AU |

Janus Henderson Global Sustainable Eq |

Yes |

98 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

ETL1954AU |

L1 Capital International Daily |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

OMF1140AU |

Lakehouse Global Growth Fund |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

LAZ0025AU |

Lazard Global Equity Franchise |

Yes |

100 |

30-Apr-25 |

|

100 |

30-Apr-25 |

|

MMC0110AU |

Loftus Peak Global Disruption |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

MGE0007AU |

Magellan Global (Hedged) |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

MGE0001AU |

Magellan Global Open Class |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

MGE0005AU |

Magellan High Conviction - A |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

MGE9885AU |

Magellan High Conviction - B |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL0172AU |

MFS Concentrated Global Equity Trust W |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

MIA0001AU |

MFS Global Equity Trust W |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

ETL0041AU |

MFS Hedged Global Equity Trust W |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

ETL9199AU |

Morgan Stanley Global Sustain |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL5365AU |

Morgan Stanley Global Sustain Hdg |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

INT0050AU |

Morningstar International Shares Hdgd A |

|

99 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

INT0052AU |

Morningstar International Shares Unhdg A |

|

99 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

SUN0031AU |

Yarra Global Share |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

HOW0002AU |

Pengana Axiom International |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

HHA0002AU |

Pengana Axiom International H |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

PCL0026AU |

Pengana Harding Loevner International |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

PLA0006AU |

Platinum Global Fund (Long Only)² |

|

100 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

PLA0100AU |

Platinum International Brands Fund² |

|

92 |

30-Apr-25 |

Yes |

87 |

30-Apr-25 |

|

PLA0002AU |

Platinum International Fund |

|

100 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

WHT0061AU |

Plato Global Shares Income A |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

FHT1389AU |

Polen Capital Global Growth B |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

PDL4608AU |

Regnan Global Equity Impact Solutions |

|

92 |

30-Apr-25 |

Yes |

91 |

30-Apr-25 |

|

SST0057AU |

State Street Climate ESG Intl Eq |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

FSF1675AU |

Stewart Investors Wrldwide Sustnby |

|

99 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

ETL0312AU |

T. Rowe Price Global Equity (Hedged) |

|

99 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

ETL0071AU |

T. Rowe Price Global Equity I |

|

99 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

ETL6342AU |

T. Rowe Price Global Impact Equity I |

|

98 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

VAN0722AU |

Vanguard Active Global Growth |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

VAN8175AU |

Vanguard Ethically Cons Intl Shrs Idx |

|

100 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

MAQ0410AU |

Walter Scott Global Equity Fund |

Yes |

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

MAQ0557AU |

Walter Scott Global Equity Hedged |

Yes |

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

MAQ9692AU |

Walter Scott Global Equity No.1 Fund |

Yes |

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

ZUR0617AU |

Zurich Investments Concentrated Glbl Gr |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

PDL6767AU |

Pendal Global Select R |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL0391AU |

Claremont Global Fund (hedged) |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL8069AU |

Mirova Global Sustainable Equity Fund |

Yes |

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

HOW1000AU |

Alphinity Global Sust Eq |

|

100 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

ETL0561AU |

Robeco Glb Dev Sust Enhncd Idx Eq (AUD)B |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

BPF6914AU |

Bell Global Sustainable Unhedged² |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

DFA0041AU |

Dimensional Glb Sstnblty Trust Unhdg |

|

99 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

DFA0042AU |

Dimensional Glb Sstnblty Trust Hdg |

|

99 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

DFA4137AU |

Dimensional Sustainability World Eq Trst |

|

98 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

ETL0171AU |

AXA IM Sustainable Equity |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL0186AU |

Janus Henderson Global Rsrch Gr |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

ETL8364AU |

AXA IM Sustainable Equity A (H) AUD² |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

SSB3170AU |

Clearbridge Global Growth A² |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

PIM5678AU |

Pella Global Generations B |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ZUR4756AU |

Zurich Investments Global Thematic Focus² |

Yes |

97 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

ACM3679AU |

AB Global Strategic Core Equities Fund² |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

MGE9179AU |

Vinva Global Equity² |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

EQI0028AU |

abrdn Sustainable Asian Opportunities A |

|

100 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

ETL0032AU |

abrdn Sustainable Emerging Opportunities |

|

98 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

FSF1978AU |

Acadian Global Equity Long Short-Class A |

|

94 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

FSF1240AU |

Acadian Glb Mgd Volatility Eqty-Class A |

|

95 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

FSF0891AU |

CFS FC-Acadian Geared Global Equity |

|

99 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

PIM0058AU |

Aoris International Fund B |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

PIM1812AU |

Aoris International Fund D Hedged |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL0438AU |

Apostle Dundas Global Equity Class C |

Yes |

100 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

OPS8304AU |

Artisan Global Discovery |

|

97 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

FSF5774AU |

Baillie Gifford LT Global Growth-Class A |

|

99 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

BPF0029AU |

Bell Global Emerging Companies |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

CIM8680AU |

Capital Group New World (AU) |

|

97 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

ECL8388AU |

Ellerston Global Mid Small Cap Unhedged |

|

95 |

30-Apr-25 |

Yes |

87 |

30-Apr-25 |

|

PIM0941AU |

Fairlight Global Small & Mid Cap Hedged |

Yes |

95 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

PIM7802AU |

Fairlight Global Small & Mid Cap Ord |

Yes |

95 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

FID0010AU |

Fidelity Asia |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

FID0031AU |

Fidelity Global Emerging Markets |

Yes |

100 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

FID5543AU |

Fidelity Global Future Leaders |

Yes |

100 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

FSF1773AU |

FSSA Asian Growth Fund² |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL8171AU |

Impax Sustainable Leaders Fund A |

Yes |

94 |

30-Apr-25 |

Yes |

94 |

30-Apr-25 |

|

LAZ0014AU |

Lazard Global Listed Infrastructure |

Yes |

100 |

30-Apr-25 |

|

100 |

30-Apr-25 |

|

IML0341AU |

Loomis Sayles Global Equity |

|

100 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

MGE0002AU |

Magellan Infrastructure |

Yes |

100 |

30-Apr-25 |

|

100 |

30-Apr-25 |

|

MGE0006AU |

Magellan Infrastructure (Unhedged) |

Yes |

100 |

30-Apr-25 |

|

100 |

30-Apr-25 |

|

ETL0201AU |

Martin Currie Emerging Markets A |

|

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

SSB0066AU |

Martin Currie Glbl LT Uncon A |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL6156AU |

MFS Global New Discovery Trust W² |

|

97 |

30-Apr-25 |

Yes |

94 |

30-Apr-25 |

|

GSF9808AU |

Munro Concentrated Global Growth A |

|

97 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

SLT2171AU |

Nanuk New World |

Yes |

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

NIK1854AU |

Nikko AM ARK Global Disruptive Innovt |

|

95 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

HOW6479AU |

Ox Capital Dynamic Emerging Markets |

|

91 |

30-Apr-25 |

Yes |

87 |

30-Apr-25 |

|

ETL0365AU |

Paradice Global Small Cap Fund |

|

97 |

30-Apr-25 |

Yes |

93 |

30-Apr-25 |

|

BTA0419AU |

Pendal Global Emerging Mkts Oppes - WS |

|

100 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

PCL0022AU |

Pengana Global Small Companies |

|

96 |

30-Apr-25 |

Yes |

93 |

30-Apr-25 |

|

HHA0007AU |

Pengana WHEB Sustainable Impact |

Yes |

92 |

30-Apr-25 |

Yes |

90 |

30-Apr-25 |

|

PLA0004AU |

Platinum Asia |

|

95 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

MAQ0441AU |

Antipodes China Fund |

|

96 |

30-Apr-25 |

Yes |

91 |

30-Apr-25 |

|

ETL0381AU |

Robeco Emerging Conservative Equity AUD |

|

100 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

WHT6704AU |

Spheria Global Opportunities |

|

93 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

AUS0035AU |

Talaria Global Equity |

|

95 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

WFS0547AU |

Talaria Global Equity Hedged |

|

95 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

PER2095AU |

Trillium ESG Global Equity |

Yes |

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

PER4964AU |

Trillium Global Sustainable Opportunties |

|

99 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

OPS4597AU |

TT Global Environmental Impact |

|

96 |

30-Apr-25 |

Yes |

85 |

30-Apr-25 |

|

MAQ0651AU |

Walter Scott Emerging Markets Fund² |

Yes |

98 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

WRA4779AU |

Warakirri Global Emerging Markets |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

SWI1413AU |

WCM Quality Global Growth (Mng) A UnH |

|

100 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

AMP7497AU |

Fiera Atlas Global Companies Class A |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

BFL3229AU |

Skerryvore Global Em Mkts All-Cap Eq |

|

100 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

ETL3590AU |

Ashmore Emerging Markets Equity |

|

97 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

FSF8443AU |

FSSA Global Emerg Markets Focus Fund |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

WHT7794AU |

Firetrail S3 Global Opportunities A |

|

95 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

ACM8902AU |

AB Sustainable Global Thematic Equities² |

|

98 |

30-Apr-25 |

Yes |

98 |

30-Apr-25 |

|

BFL3029AU |

Canopy Global Small & Mid Cap Fund² |

Yes |

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

DFA8887AU |

Dimensional Emerging Mrkts Sustnblty Tr |

|

95 |

30-Apr-25 |

Yes |

88 |

30-Apr-25 |

|

ETL1845AU |

Jennison Global Equity Opportunities² |

|

95 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

ETL7452AU |

American Century Global Small Cap |

|

96 |

30-Apr-25 |

Yes |

93 |

30-Apr-25 |

|

SPC5039AU |

GCQ Flagship P |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

WHT2409AU |

Aikya Emerging Markets Opportunities |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

WHT7072AU |

Langdon Global Smaller Companies A |

|

94 |

30-Apr-25 |

Yes |

81 |

30-Apr-25 |

|

ETL0535AU |

Nanuk New World Fund (Currency Hedged) |

Yes |

99 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

GSF6910AU |

Man GLG Asia Opportunities A² |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

BEG8747AU |

Vinva Global Alpha Extension A |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

FHT8533AU |

Polen Capital Global Small and Mid Cap |

|

94 |

30-Apr-25 |

Yes |

89 |

30-Apr-25 |

|

PIM6160AU |

CFS FC W - Stewart Inv WldWde Ldrs Sstby |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ZUR0614AU |

Zurich Investments Emerging Markets Eq² |

|

99 |

30-Apr-25 |

Yes |

97 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

FSF7298AU |

MetLife Global Bond - Class A |

Yes |

94 |

30-Apr-25 |

Yes |

77 |

30-Apr-25 |

|

PIC6396AU |

PIMCO ESG Global Bond Fund - Wholesale |

|

87 |

30-Apr-25 |

Yes |

82 |

30-Apr-25 |

|

ETL0018AU |

PIMCO Global Bond W |

|

79 |

30-Apr-25 |

Yes |

73 |

30-Apr-25 |

|

ETL0019AU |

PIMCO Global Credit W |

|

86 |

30-Apr-25 |

Yes |

71 |

30-Apr-25 |

|

SSB8320AU |

Western Asset Global Bond A |

|

94 |

30-Apr-25 |

Yes |

86 |

30-Apr-25 |

|

DFA0108AU |

Dimensional Five-Year Diversified F/I |

Yes |

85 |

30-Apr-25 |

|

62 |

30-Apr-25 |

|

DFA0642AU |

Dimensional Glbl Bond Sustainability AUD |

|

93 |

30-Apr-25 |

Yes |

77 |

30-Apr-25 |

|

ETL0650AU |

Colchester Green Bond I² |

|

100 |

30-Apr-25 |

Yes |

100 |

30-Apr-25 |

|

ETL9010AU |

AXA IM Global Green Bond Fund² |

Yes |

97 |

30-Sep-24 |

|

83 |

30-Sep-24 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

HOW0098AU |

Ardea Real Outcome Fund |

Yes |

100 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

|

ETL0445AU |

PIMCO Capital Securities Wholesale |

|

95 |

30-Apr-25 |

Yes |

94 |

30-Apr-25 |

|

ETL0458AU |

PIMCO Income Wholesale |

|

83 |

30-Apr-25 |

Yes |

76 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

FSF0454AU |

First Sentier Global Property Securities |

|

99 |

30-Apr-25 |

Yes |

93 |

30-Apr-25 |

|

WHT0015AU |

Resolution Capital Global Property Secs |

|

100 |

30-Apr-25 |

Yes |

89 |

30-Apr-25 |

|

ETL0005AU |

SGH LaSalle Global Listed Property Secs² |

|

100 |

30-Apr-25 |

Yes |

95 |

30-Apr-25 |

|

HML0016AU |

CBRE Global Property Securities |

|

99 |

30-Apr-25 |

Yes |

88 |

30-Apr-25 |

|

VAN0018AU |

Vanguard International Property Secs Idx |

|

99 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

VAN0019AU |

Vanguard International Prpty Secs IdxHdg |

|

99 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

AMP0974AU |

Macquarie Global Listed Real Estate A |

|

98 |

30-Apr-25 |

Yes |

86 |

30-Apr-25 |

|

BLK0252AU |

iShares Global Listed Property Idx Hdg D |

|

99 |

30-Apr-25 |

Yes |

93 |

30-Apr-25 |

|

PIM2485AU |

First Sentier Global Property Sec Hdg |

|

99 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

DFA0005AU |

Dimensional Global Real Estate Trust |

|

99 |

30-Apr-25 |

Yes |

93 |

30-Apr-25 |

|

IOF0081AU |

Resolution Capital Global Prpt Secs II |

|

100 |

30-Apr-25 |

Yes |

89 |

30-Apr-25 |

|

MGL0011AU |

Ironbark DWS Global Property Secs |

|

99 |

30-Apr-25 |

Yes |

91 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

AUG6267AU |

Australian Ethical Conservative Wholsl² |

|

87 |

30-Apr-25 |

Yes |

77 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

PER0728AU |

CT Pyrford Global Absolute Return |

Yes |

100 |

30-Apr-25 |

|

100 |

30-Apr-25 |

|

PER0761AU |

Perpetual ESG Real Return |

|

92 |

30-Apr-25 |

Yes |

89 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

AUG0017AU |

Australian Ethical Balanced WS |

|

96 |

30-Apr-25 |

Yes |

92 |

30-Apr-25 |

|

DFA7518AU |

Dimensional Sustnby Wld Allc 70/30 Tr |

|

97 |

30-Apr-25 |

Yes |

91 |

30-Apr-25 |

|

APIR Code |

Name |

Top Morningstar ESG Risk Rating™ |

% AUM Covered - ESG[1] |

Sustainability Rating Date |

Low Carbon Designation™ |

% AUM Covered - Carbon |

Carbon Date |

|

AUG0019AU |

Australian Ethical Diversified Shr WS |

Yes |

100 |

30-Apr-25 |

Yes |

99 |

30-Apr-25 |

|

PER0731AU |

PineBridge Global Dynamic Asset Alloc I |

|

99 |

30-Sep-24 |

Yes |

97 |

30-Sep-24 |

|

AUG0020AU |

Australian Ethical High Growth Class B |

Yes |

98 |

30-Apr-25 |

Yes |

96 |

30-Apr-25 |

[1] At least 67% of a fund’s qualified holdings must be eligible to receive an ESG risk score, which would either be an ESG Risk Rating (for corporate holdings) or Country Risk Rating (for sovereign holdings). For a full description of the ratings process please see the Morningstar ESG Risk Rating Methodology available at https://www.morningstar.com/research/signature

[2] Available on IDPS only

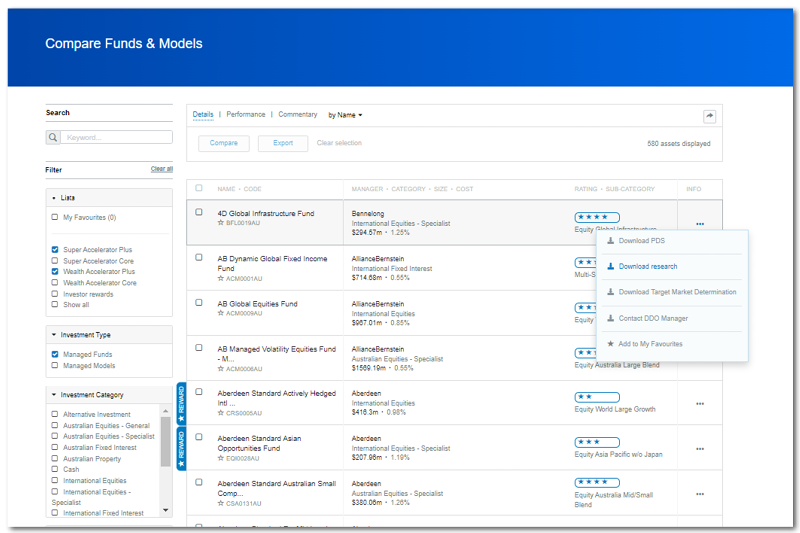

To view the research and ratings you will need to login to your Netwealth account or sign up for a free research account.

Login to your Netwealth account.

Click 'Research' and then 'Compare Funds & Models.'

Click the 3 dots and select 'Download research.'

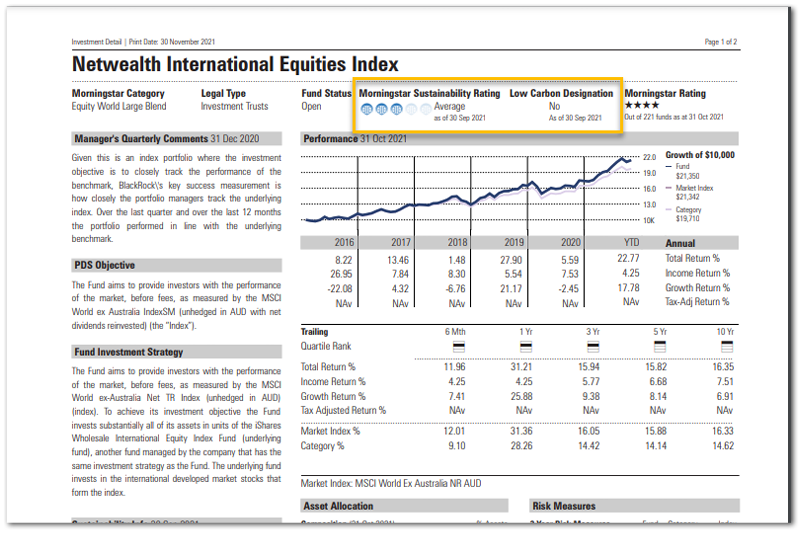

Open the pdf download and view the Morningstar ESG Risk Rating and Low Carbon Designation at the top. There are definitions on the back page, as well as Sustainability information in the bottom left corner.

Morningstar Disclaimer

© [2023] Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report or data has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar’s publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.