There’s no slowing down

With $47.97 billion in managed accounts funds under management (FUM) as at 30 June 20171 and a prediction of $60b by 2020 from Morgan Stanley2, managed account momentum shows no signs of slowing down. A seemingly endless stream of new, enhanced and ever-changing models continues to roll out to stimulate, excite and confuse advice and wealth management.

But which managed account option is best for you? In this article, we discuss each of the available options and highlight many of the questions to ask yourself as a business to help you choose the right path. Our experience at Netwealth tells us each group is different and has unique needs. Some of these needs may appear quite small, but the finer detail is important as it can be pivotal to making the right choices.

Choices, choices, choices

As with most business decisions, the best option will be the one which most closely fits with your key strategic purpose.

So… what is the service you want to offer that your clients will value and how will it also create value for you?

The best option also will be the one that allows you to retain important existing business practices while also helping you to develop and improve your business.

To help your analysis we suggest the following four areas of your business are worth considering:

- Regulations

- Resourcing

- Revenue

- Relationships

Specifically, how you answer the questions below will determine which of the five managed accounts options discussed is best suited to you. The options don’t address absolutely every situation – but for most advice-oriented businesses, they are a good place to start.

Regulations

- Do we have our own licence? Or will we need to access a separate licence?

- What authorisations do we already hold or are we prepared to apply for?

- Is our business set up to manage these authorisations?

- How strong is our compliance culture?

Resourcing

- Do the Responsible Managers on our licence have sufficient expertise for the option we are choosing?

- Do we have an investment committee and is the current investment capability sufficient to

undertake a robust portfolio management service? - Do we want our management team spending time on services which we could outsource wholly or in part?

- What administration capability do we already have, or will we need going forward?

- What resources will be required to implement the option we choose?

Revenue

- Do we want to earn explicit portfolio management revenue from the service, separate to the advice revenue?

- What level of costs are our clients already incurring and what would be the effect of a portfolio management fee?

Relationships

- Which platform are we using for our current managed account service (if applicable) and what options do they offer?

- Will our advisers adopt a managed account service we develop and incorporate it into their advice?

- What is the service our clients believe we provide and how would any new service fit with the client’s best interest?

Five managed account options for you to consider

Some of the following options involve moving to a more formal use of one type of managed account. These include platform-based managed accounts (MAs) or a managed discretion account (MDA) service, on or off a platform.

- Establish a ‘private label’ on your preferred super and investment platform - Construct models that reflect your own investment philosophy and style, using an external licence often provided by the platform

- Become an MDA provider - Apply for an MDA provider authorisation and continue to use your preferred platform if it supports the operation of your models

- Utilise a platform’s public menu MA models - Increase your approved products list (APL) and utilise MAs on your preferred platform

- Become an external MDA Adviser - Engage a specialist MDA provider to offer your models and advise on this service

- Utilise a third-party MA responsible entity (RE) – Although some platforms may not offer a facility for the platform operator to be the responsible entity of a licensee-specific MA, they will support an external responsible entity acting in this capacity.

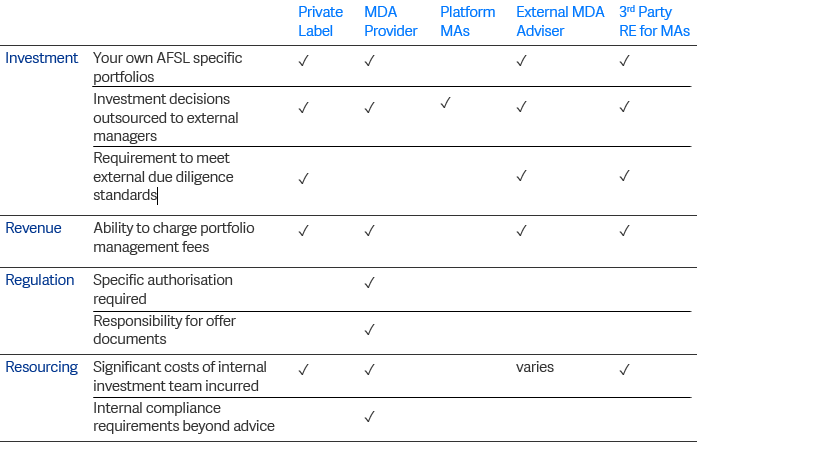

Outlined below are some of the main features and requirements of the five managed account options.

Managed accounts: A business transformation solution

Better understand the different types of managed account structures that are available and their pros and cons

Option 1: Private Label managed account

What is it?

A private label solution via a platform is a solution that allows you to construct models that reflect your own investment philosophy and style, using an external licence often provided by the platform itself which has a responsible entity licence. Your managed account can be constructed using your own internal investment capability and/or using one or more external asset consultants. These can be a selection of individual manager MA models or diversified MA models based on your portfolio models.

In addition, if you select a full-service platform provider, they will typically provide platform administration, custody, superannuation administration plus an online member and administration portal.

This approach may suit you if:

- You already have a well-functioning investment process, delivered through a well-resourced and suitably experienced investment committee

- You use the services of an external researcher for asset allocation and possibly manager selection (There are also a growing number of providers with expertise in the regulatory and compliance aspects of running investment models within advice businesses)

- Your portfolio management processes are sufficiently well developed to meet the standards set by the responsible entity

- You want to outsource some or all security selection decisions to external managers – for example, you may choose to retain some ASX listed securities in-house

- You want to control the branding and presentation of the managed account service to supplement your value proposition

- You want to charge an explicit fee for the work which you undertake in the portfolio management area

- You don’t want the costs, management time obligations and compliance risk of acting as the responsible entity or MDA provider.

This may not be the best solution for you if:

- You feel you need to maintain full control of your own service – in this case you will want to be the responsible entity or MDA provider

- You don’t feel the need to have your own specific managed accounts, but instead rely on a public menu of MA models

- You don’t want to be subjected to external due diligence – in this case being the responsible entity or MDA provider will be your best option – although of course you would carry your own licensing obligations under your selected structure.

Netwealth has helped around 15 private wealth and advice groups set up their own private label. It is a sometimes slow but rewarding journey, and one that forces the business to thoroughly examine what is currently happening within their organisation. Only then can you put together the pieces that will result in a scalable business model going forward.

A private label is not just an investment outcome but a holistic business solution which will define how a business runs. We therefore like to spend a lot of time with each business navigating the best way for them to achieve their objectives. This includes discussing the key areas outlined in the previous table.

As part of the private label process, platforms perform varying levels of due diligence on advice groups. The infancy of the managed accounts industry in Australia has likely contributed to this outcome. Given in many cases the business will be using the platform’s responsible entity licence, the platform must fully understand the advice business and the advice business must gain a comprehensive understanding of how they will provide the services to their clients.

Option 2: Becoming an MDA Provider

What is it?

An MDA service (or managed discretionary account service) is a service under which a client makes contributions and agrees that those contributions will be managed in accordance with an agreed investment program. The person who provides the service is the MDA provider. As an MDA provider, you have greater control over the investment proposition you offer to your clients, but take on the additional responsibilities of being the MDA provider, which are summarised in the table on the next page. This includes the requirement (which will apply to all MDA providers from 1 October 2017) to have specific AFSL authorisations to deal in MDA services, in addition to authorisations to deal in all of the assets that may be acquired through the MDA service. You would usually also need authorisations to advise on MDA services.

LMDA and No Action letter

In the past, some advisers have operated a “limited MDA service” on the basis of a limited power of attorney from their clients and a “no-action” letter issued by ASIC in 2004 (“No-Action Letter”).

However, in September 2016, ASIC took the opportunity to undertake a thorough review of its policy in relation to MDA services, including the No Action service. The result was that ASIC determined that, by October 2018, the No-Action Letter would be withdrawn and an adviser or licensee using this approach could no longer provide discretionary management without some other structure such as a managed investment scheme or MDA service.

For many advisers and licensees, the default response to the withdrawal of the No Action Letter has been to assume that they would apply for an MDA provider’s authorisation and (assuming ASIC grants the necessary authorisations) carry on as before. This default choice isn’t necessarily the only or best option and this paper sets out a wide range of alternative options and the pros and cons of each.C in 2004 (“No-Action Letter”).

The following table shows the principal similarities and differences between MDA and the “limited MDA services” which many advisers have relied upon as a result of the No Action letter.

MDA (LMDA) services which many advisers have relied upon as a result of the No Action letter:

| MDA Authorisation | "Limited" MDA | |

| Need for an AFS licence | ✓ | ✓ |

| Need for MDA authorisation | ✓ | ✓ |

| Additional FSG disclosure | ✓ | ✓ |

| Contract with your client | ✓ | ✓ |

| Statement of Advice | ✓ | ✓ |

| Investment Program | ✓ | ✓ |

| Corporate actions | ✓ | ✓ |

| Professional Indemnity Insurance | Min $5m | Min $2m |

| Documented compliance measures | ✓ | ✓ |

| Audit Report | ✓ | x |

| Quarterly Reports | ✓ | Platform |

| Annual Report | ✓ | Platform |

| Review Investment Program Annually | ✓ | ✓ |

| Keep 7-year records - MDA contract, FSG, SoA and Reports | ✓ | ✓ |

| Report significant failures to ASIC | ✓ | ✓ |

Table 1 - Source: The Fold Legal

Becoming an MDA provider could suit you if:

- Your platform has the capability to support MDA services including the portfolio management technology (such as rebalancing), reporting and audit functions that MDA services require

- You have the resources to manage a substantial compliance obligation in accordance with the requirements of the relevant legislative and regulatory regime

- You have responsible managers with experience in providing MDA services, as this is a prerequisite to ASIC approving your application for the necessary MDA authorisations

- You feel you need more flexibility in client portfolios than you can obtain from outsourcing to an external licensee

- You accept the risk that ASIC may apply a net tangible assets (NTA) capital requirement on MDA assets in the future (possibly as soon as within the next two years), which may require MDA operators to hold amounts of capital based on certain conditions.

This may not be the best solution for you if:

- You don’t want the significant business overheads required to adhere to the additional regulatory and compliance obligations or are unwilling to insource them.

If heading down the MDA provider route, the decision on whether to partner with a platform or not can be very important, especially if you are looking for a system that will assist the implementation of investment decisions.

Obviously, each MDA practice is different, but outlined below are capabilities of a platform that are worth inspecting.

Can the platform or technology partner do the following?

- Establish investment templates that allow easy investment into and out of your models

- Administer the full suite of asset classes and assets that you use within your models

- Facilitate the different revenue/fee options you have in place with clients and associated paperwork

- Provide audit trails of all transactions Help you in facilitating client reporting requirements under your MDA

- Provide branding that helps promote your core proposition.

Option 3: Use a platform’s public menu of managed account models

What is it?

Many platforms offer a large number of MA model options as part of their ‘public menu’ which include diversified, multi asset class or sector choices where the investment management is provided by a professional investment manager.

This option could suit you if:

- You want the benefits of well managed diversified portfolios where your clients receive the benefits of transparency perceived to be offered by managed accounts

- You are looking for increased efficiency in managing investment portfolios

- You are looking for greater transparency when understanding whether changes to the investment selection or asset allocation are implemented immediately in your clients’ portfolios

- You want superior risk management compared to adviser directed portfolios

- You want the relative simplicity and reduced risk of a managed account service compared to the additional complexity of providing or advising on an MDA service.

This may not be the best solution for you if:

- You have adequate resources within your business to develop your own portfolios and implement these through a private label solution

- Part of your service and revenue model is the provision of investment services and the earning of an investment management fee

- You want to offer a service in which the branding is integrated with your advice service.

If deciding to use platform retail managed account models, you need to ensure that the range of asset classes and underlying models provide you with enough flexibility to meet the needs of your clients in a way that is aligned with your own investment philosophy. A well-constructed platform-approved product list should include:

- A range of diversified risk profile models – specific managers will have biases towards using either managed funds or direct listed assets so check the diversified options to ensure alignment with your current needs

- Coverage across the primary asset classes including Australian equities and ETFs, international equities, fixed interest, cash and property

- Coverage of investment management techniques, including strategic, dynamic and tactical asset allocation, as well as index managers and alpha managers

- If using MA models made up of managed funds, then the ability for the manager to negotiate rebates and the platform to administer them is important to keep down the overall cost of running the portfolio.

Option 4: Use a third-party MDA provider

What is it?

Many licensees appreciate the flexibility that offering an MDA service provides them but don’t want to apply to ASIC for authorisation to be an MDA provider in their own right. This may be because they lack sufficient capital to justify the costs of MDA compliance, the AFSL’s responsible managers lack the expertise to operate an MDA service or because they would rather concentrate on the advice and investment functions.

So what options are available if you want to be able to determine the composition of the investment portfolios they recommend to their clients?

One solution is to find an MDA provider prepared to operate MDA services for you, using investment portfolios that you are responsible for developing and on the platform of your choice. For many AFSLs using this operating model, this represents an opportunity to develop tailored portfolios for their clients and earn revenue for undertaking the portfolio management function. Some third-party MDA providers are also investment managers with an extensive track record.

Under this option, if you are to act as the investment manager, you will likely need to comply with the due diligence requirements of the MDA provider as well as their requirements for the way advice is provided.

This option may suit you if:

- The administration of the MDA services is undertaken on the platform that you use in your business

- You want to be actively responsible for the changes to the investment models your clients invest in

- You want the benefits of the increased efficiency in your practice that come from adopting managed accounts

- You want superior risk management compared to adviser directed portfolios

- Part of your service and revenue model is the provision of portfolio management and the earning of portfolio management fees

- The annual review and other advice requirements of an MDA service can be integrated into your advice processes.

This may not be the best solution for you if:

- You do not want the additional cost of a third party involved in providing services to your clients

- The administration of the MDA service cannot be easily integrated into the platforms you use in your business.

Option 5: Third-party responsible entity

What is it?

In addition to the platform offering its own MA services, a number of platforms allow an advice business to work with a third-party responsible entity to act as the legal issuer of their platform MA.

This may be because, as a medium or larger advice business, you have a related company in your organisation which is already a responsible entity for managed funds or because the platform you work with prefers to operate in this way.

Under this option, the third-party responsible entity acts as issuer of your MA models and may appoint your organisation as investment manager to these models. You will need to comply with the due diligence requirements of the responsible entity. If you are performing the functions of the investment manager you may be entitled to receive portfolio management fees.

This option will suit you if:

- The platform that you use in your business supports third-party issuers of MAs

- You already have a relationship with an organisation that has the relevant responsible entity AFSL authorisation

- You want to be actively responsible for the changes to the investment models your clients invest in

- You want the benefits of increased efficiency in your practice that come from adopting managed accounts

- You want superior risk management compared to adviser directed portfolios

- You want to earn the portfolio management fees.

This may not be the best solution for you if:

- You do not want the additional cost of a third party involved in providing services to your clients

- You use multiple platforms and this service is not available on all of them.

A final note: beware of platform leakage

Once you have decided on the correct managed account options, managed account model, and you are in the process of selecting a platform, it could be worth looking at the nitty gritty of how your selected platforms algorithms work.

Given the potential impact on performance, leakage that may occur as a result of fees (including brokerage) and transaction timing are important considerations.

Consider the following:

- How does your platform trade assets? What are the costs of managed funds trading and shares trading?

- Are all equity trades placed the same way, e.g. volume weighted average price (VWAP) or are fixed interest and ETFs managed into the market given their potential liquidity issues and resultant higher values?

- What times throughout the day are trades placed? What are the cut-off times when trades are added to the following days queue?

- How does your platforms algorithm handle partial trades?

- How is income treated within the models?

Netwealth has been working with many MA investment managers over the past two years, looking at how, as a platform, we can minimise tracking error on client portfolios. Prior to adding new managers to our retail ‘public menu’ list, we ensure they pass a stringent due diligence process which, amongst other things, ensures alignment between the manager and our platform.

1 IMAP FUM Census Release June 2017

2 Morgan Stanley: Disruptors – Australia Financials (June 2016)

More from the Managed Accounts Special Report

Six questions to consider when implementing a managed account solution