Introducing an objective framework to technology decision making

When making business decisions about fintech solutions (or any other technology products) it is important not to let personal biases get in the way. Biases such as past experiences, or even your preferences to adopting the latest technology can lead to bad decision making.

To remove bias from decision making, many people rely on frameworks or methodologies to help them to achieve the best outcomes.

There are a number of frameworks available to help you in the fintech adoption decision process. Netwealth has developed its own ‘build, buy, partner’ framework based on a framework developed by Insinga and Werle. (Source: Linking Outsourcing to Business Strategy, The Academy of Management Journal, 2000).

The framework helps organisations to conduct a systematic review of their internal business activities and capabilities, to assist them in objectively determining whether to build, buy or partner for a technology solution.

Let's start with some definitions

- ‘Build’ refers to in-house development. This involves managing the entire IT development process to essentially produce your own piece of software from scratch.

- ‘Buy’ is the action you will take if you decide to access the acquisition of your technology product ‘as is’ or ‘off the shelf’ from another business who has already produced it for sale to other business.

- ‘Partner’ refers to the co-development of a mutually beneficial solution utilising your partner’s technology and skills.

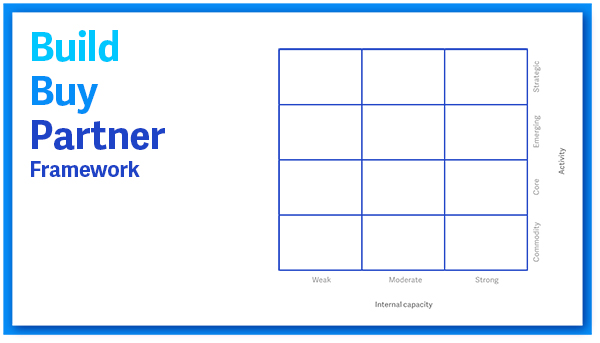

Overview: Build, Buy or Partner Framework

The Build, Buy or Partner Framework asks a business to consider:

1. What is, or will be, their competitive advantage? (The vertical axis: Activity)

And as a result, what are the commodity, core, emerging, and strategic activities of the business?

- Commodity activities are those that are necessary, but provide no real competitive advantage;

- Core activities are a necessity of the business, that the business’ competitors do as well, and that are expected by the customer;

- Emerging activities are those that a business believes will deliver strategic advantages, but of which the benefits are not yet clear. They are activities that the business wants to test so that they can learn something;

- Strategic activities are those that are proven to provide a large competitive advantage, aiding growth to the organisation.

2. What internal capabilities does the business have (or should it have) to develop the technology solution? (The horizontal axis)

This asks the business to consider the resources they have full control over, the amount of resources and staff they have, and their technical capabilities.

In other words, “can your business efficiently utilise resources to build this new technology?”

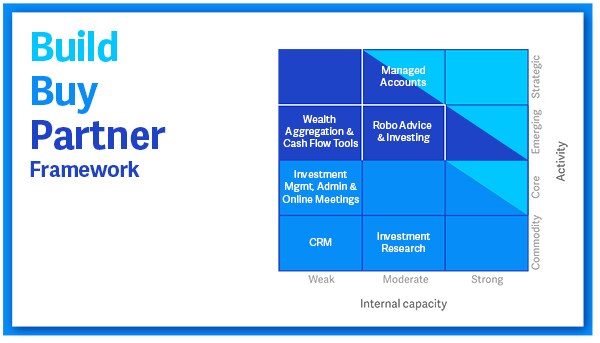

When to build?

The framework suggests to build only when the business has good internal capabilities to develop the solution, and it will absolutely provide for a strategic advantage to the business.

Given the nature of most financial advice practices with low levels of IT resources, this capability is not typical.

A financial advice business who really wanted to build would need to hire a development team or acquire a technology business.

Unfortunately, from an objective decision making perspective, the build option is rare within the local IFA market.

When to buy?

On the other extreme, a business should look to buy when the activities are not strategic to the business (i.e. they are core or commodity activities). This is regardless of the business’ internal capabilities. In this scenario, it makes sense for a business to buy a solution as its key resources should be used to develop and launch more strategic projects.

A good example of when to buy technology would be your strategic planning, CRM technology or customer engagement tools like video conferencing. Arguably these solutions are core as they are important because they help 'to keep the lights on' in your business, they may offer you a strategic advantage but given most advisers use or plan to use them - probably not.

When to partner?

The partner approach is most relevant when the business has identified that their internal capabilities to deliver on a fintech solution pose a risk of execution failure, and the activities will might, or definitely will provide a competitive advantage.

Managed accounts, robo-advice investing and wealth aggregation tools are good examples of when you should partner. These solutions can be implemented in different ways based on a business’ investment philosophy, their business objectives and the way their business is run. They are thus often bespoke in nature so that an 'off the shelf' solution just will not do. A partner with these types of technologies thus makes sense so you can develop your own customised offer to the market.

Once you have decided on the best approach to take in building your technology solution, the finished result can have a big impact on your business. We recently wrote an eBook on how fintech can positively impact advice practices, click here to download it.