A typical day in financial advice involves numerous processes, whether they are for administrative tasks, client interactions, or regulatory compliance. As automation and artificial intelligence (AI) technology advances, process automation means leveraging these tools to take on some of the key steps in these activities. Automation tools can perform many repetitive manual tasks, taking the burden off employees and freeing them to focus on client service, innovation, and to enjoy more meaningful work. However, adopting automation is not just a matter of installing software and hoping it will deliver the outcomes you desire. A key step in preparation is to focus on your processes, and to uncover which ones could be ideal for automation.

In this article, Netwealth has partnered with Elixir Consulting (powered by VBP), who has been helping financial advisers evolve their business to thrive in the everchanging landscape of advice though since 2007. Together we look at the value of processes, and the potential benefits of automating them in advice firms. We consider how to select the best processes for automation, and how to document them in preparation. To conclude, we offer top tips on how to implement automation to get the best results.

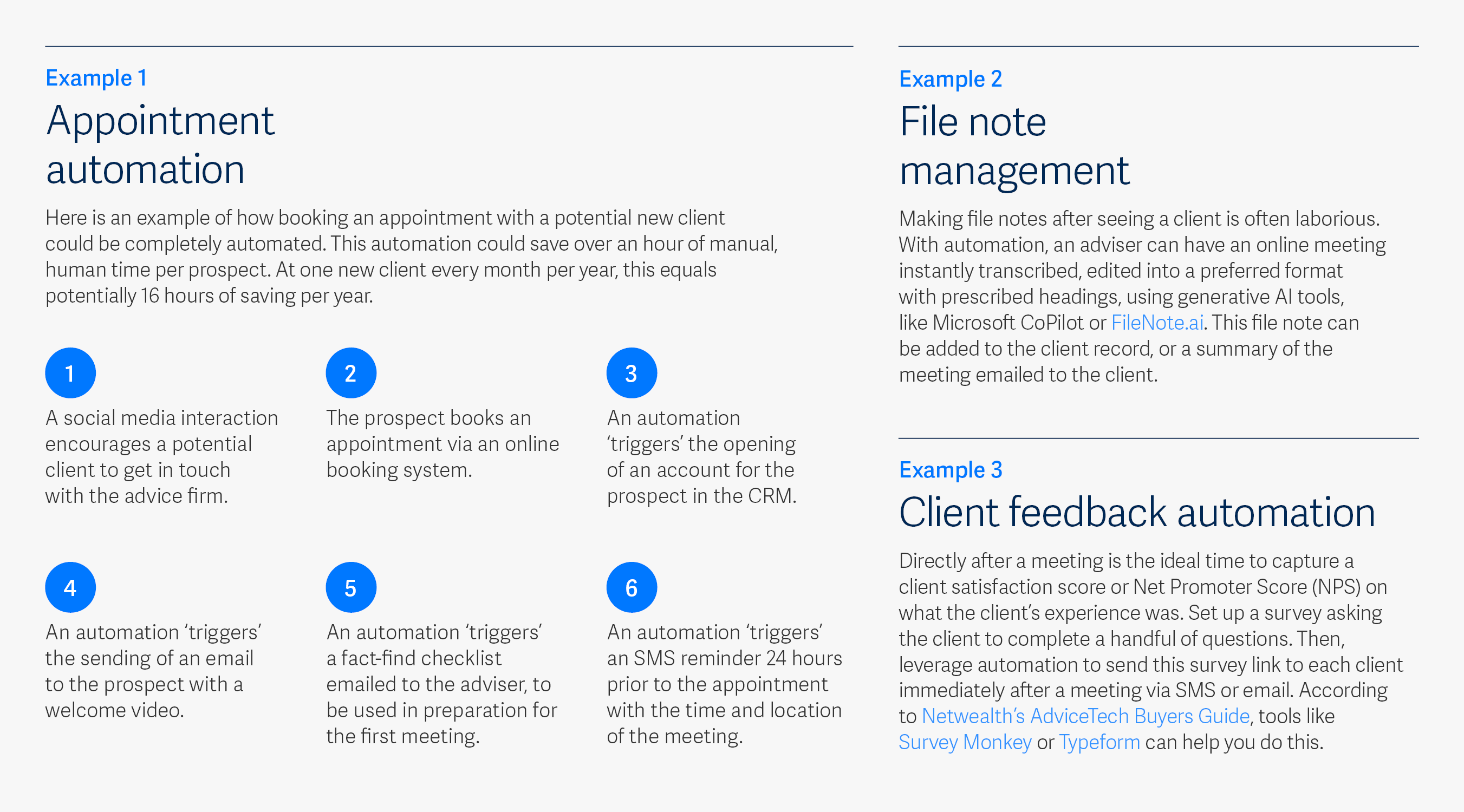

The potential use cases for process automation

There are many ways technology can be used to automate processes. Specifically, they can be used to reduce tasks such as:

- Data collection, data management, and analysis.

- Document generation.

- Portfolio management rebalance.

- Compliance checks.

- Client communications, such as appointment reminders, newsletters, and follow-up emails.

- Modelling and scenario analysis.

- Billing and invoicing.

- Marketing activities, such as social media posts.

The benefits of process automation

When building out your automation programs, make sure they look to deliver on these types of benefits:

- Improve accuracy and reliability: Machines don’t make errors in the same way humans do, so automating workflows could help with accuracy and reliability, and increase output consistency.

- Time and cost savings: Employees can devote their attention to higher value tasks.

- Gain productivity and operational efficiency: Automation can streamline data analysis, client strategies, and progress tracking. This all helps to speed up day-to-day processes, and make it easier to adapt to changing client needs and regulatory demands.

- Potential to scale: Automation can help facilitate business growth, doing more with less, without

proportionate increases in cost or labour. - The chance to embrace AI: AI tools such as chatbots can provide immediate assistance to team members and your clients. For example, answering common compliance questions, or pointing them to the right documents or information.

- Prevent burnout: Automating repetitive, manual tasks eases the burden on employees and reduces errors.

- Knowledge preservation: With automation, organisational knowledge can be retained during employee turnover, and can help with training during times of change management.

- Compliance, risk, and audit-readiness: Automation has the potential to make it easier to manage risk and compliance, as regulatory requirements can be built in at the right steps.

“ Adopting automation is not just a matter of installing software and hoping it will deliver the outcomes you desire. A key step in preparation is to focus on your processes... ”

How to select processes for automation

With the benefits of automating processes clear, you can identify which processes in your firm could be replaced or enhanced with automation. Here are some tips on where to look.

Unpack your workflow

Consider, what is the sequence of jobs to get a task done? Does one task trigger another seamlessly? For example, does a client enquiry trigger document submission, then compliance checks? Where are manual interventions required, such as data entry, client communication, and document review? Are these causing delays in service delivery and reduced operational efficiency?

Performance analysis

Identify slow turnaround times on key tasks, and which steps in the process are causing this. Onboarding is an example. Your firm may seem efficient at onboarding, but if you look at the micro processes, you might find room for improvement. It is not uncommon for an adviser to meet a new client, and for the meeting to go well, but for it to take weeks to get the client’s information in to start processing. What steps are making this difficult for the client?

Consider task frequency and complexity

Which tasks are the most repetitive? For example, data entry, report generation, and client communications. Which complicated tasks can be broken down into smaller parts that can be automated?

Find repeated errors

Look for opportunities for process improvement in places where you have errors. Are there inconsistent procedures, a lack of training, or unclear communication?

Performance metrics

Find out where metrics are underperforming and dig deeper into the processes behind those metrics. Some metrics to look at could be: Client loyalty: Net Promoter Score (NPS) or Client Satisfaction Score (CSAT), Compliance: Consider the type and number of issues found in an audit, Service level agreements (SLA): Are there any SLA metrics that are constantly not being met?

Consider the cost and benefits

Start by considering upfront costs, such as software, hardware, third party providers, development and integration costs and the cost of training team members. Then think about any ongoing costs, which may include system upgrade costs. And finally consider the benefits, both tangible and intangible in nature, such as a reduction in errors, or an improved ability to focus on higher value work or increased workloads without hiring more people and increasing salary expense.

Look for risk or compliance challenges

Find where you could automate processes to minimise the risk of non-compliance, make it easier to incorporate regulatory updates, and to maintain accurate records.

Machines don’t make errors in the same way humans do, so automating workflows could help with accuracy and reliability, and increase output consistency.

Documentation for automation

When you have identified processes that could be improved, the first step is to document every step in those processes in preparation for applying automation. Documenting your process allows you to understand and analyse it end-to-end, identifying bottlenecks in the process, or the steps that could be easily replaced via technology.

Here are some tips on how to document yours processes (click to expand):

1. Involve key team members

Work together, discussing every step in the process so that nothing is missed.

2. Avoid assumptions

Be prepared to dig deep to really understand how things are done.

3. Choose a documentation method

Documentation can be done via one-on-one sessions with the people that undertake the processes; analysing and enhancing existing documentation; or through direct observation.

4. Select a documentation tool

There are several technology tools that can make process documentation easier. Some options include diagram and flowchart creator apps such as Lucidchart, Sweet Process and MS Visio.

5. Build a process map

Map out every step in the process: For each step, add a brief description. For very important steps, add a more detailed description. Where useful, include screenshots or perhaps a video guide of the step. Consider using colour and swim lanes so that each part of the process is easily identifiable, and it is very clear who does what.

6. Highlight decision points

Demonstrate clearly who makes what decisions and when.

7. Extract repeatable processes

Find the steps that are done consistently but require little human expertise.

8. Identify risk management and controls

Highlight where they could be automated.