Take outs

- Understanding concepts such as duration, yield curve, credit risk and credit spreads can be essential to success in fixed income investing

- Fixed income investors should be aware of the risk they take when seeking a higher yield from locking their money away for a significant period of time

- Investors should look at the downside case, rather than average return over time, to determine whether a fixed income investment makes sense for them

When considering the choice of fixed income investments over cash or term deposits, investors should understand a number of key concepts, such as duration, yield curve, credit risk and credit spreads. This can help them to avoid common pitfalls associated with passive investing, chasing performance over a long duration and reaching for yield without considering risk.

In the Netwealth webinar, Exploring the opportunities and challenges in fixed income investing, Daintree Capital co-founders Mark Mitchell and Justin Tyler discuss some of the common pitfalls in fixed income and provide an overview of the products available (such as term deposits, government bonds, equity income funds, listed hybrids, high yield funds etc). They also offer a detailed market outlook from the perspective of volatile markets in September 2020.

As an introduction to this discussion, Mark and Justin explain some of the key concepts for fixed income investors.

The concept of ‘duration’

The first concept in this jargon-heavy area of the market involves the word ‘duration’. Many bonds are sensitive to interest rate movements. This sensitivity is called duration.

In simple terms, a long duration means a high sensitivity to interest rates. It typically means that the more interest rates move, the more an investor will see price fluctuations. A long duration, therefore, means a higher sensitivity to interest rates and to higher risk.

The concept of 'yield curve'

Linked to duration is the concept of the yield curve. All bonds pay a yield, and an investor can expect that the longer they invest, the more they get, so the higher their expected return should be.

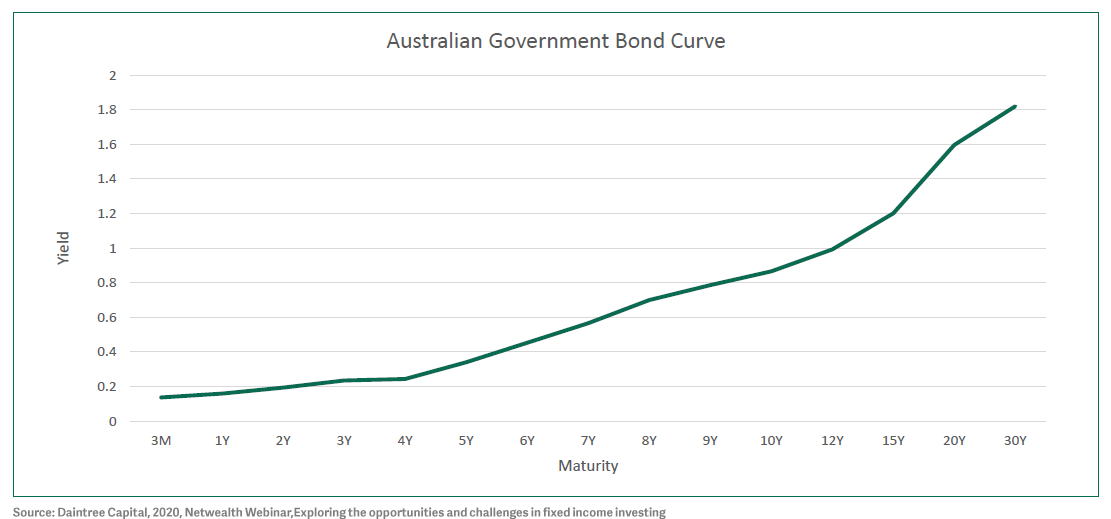

The following chart demonstrates the current movement of the Australian Government bond curve. The longer someone invests, the higher the expected return.

There are higher yields on offer for investors who lock their money away for a longer period of time. However, that comes with higher risk, because longer bonds come with higher duration.

It’s a natural tendency for investors to try to get the best yield they can for the lowest risk. However, it’s important to understand that – especially when investing passively – the composition of the market changes over time, so what an investor gets from a passive product also changes.

The concept of 'credit risk'

The next key concept, credit risk, is one that many people need to be aware of, because many of the fixed income products available feature credit risk.

Credit risk is the chance that, when an investor lends money to a company (as opposed to a government), the company decides to not pay them back.

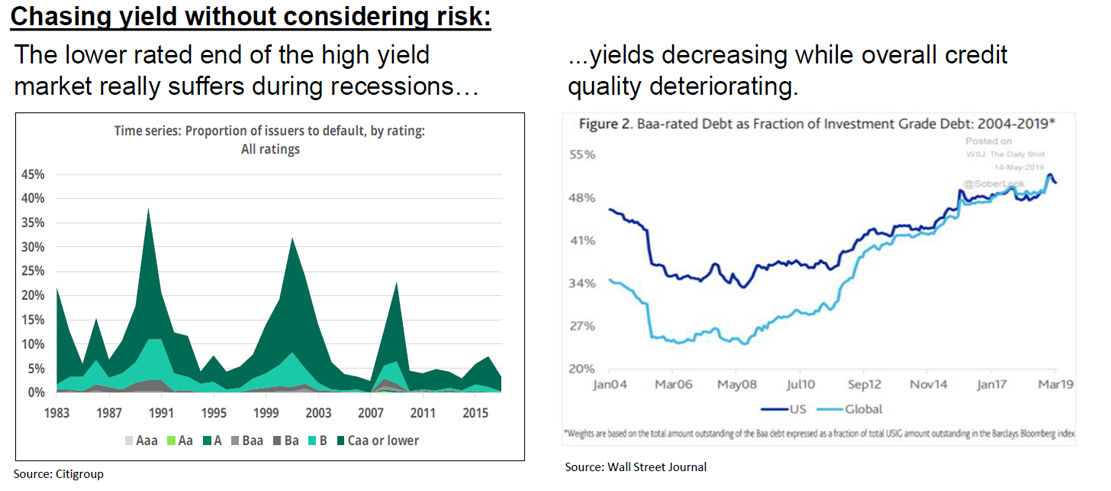

The following chart indicates the likelihood of not being paid.

The left side shows measures of credit ratings, given by agencies such as Standard & Poor's, Moody's and others. They rank from the top, AAA (the Australian Government) down through AA, A and BBB to the bottom, CCC (a company that is very unlikely to pay an investor back).

The red circled area indicates the difference between BBB (the bottom of investment-grade companies) and BB (sub-investment grade or high-yielding companies). There's a significant jump between a BBB company (which on average will pay an investor back) and BB. The chance of not being paid back jumps dramatically.

Credit risk is, therefore, something that investors need to be aware of. If an investor is paid a higher yield, they are probably taking some risk to earn that yield. Often, when investing in corporate bonds, the risk taken is credit risk.

The concept of 'credit spreads'

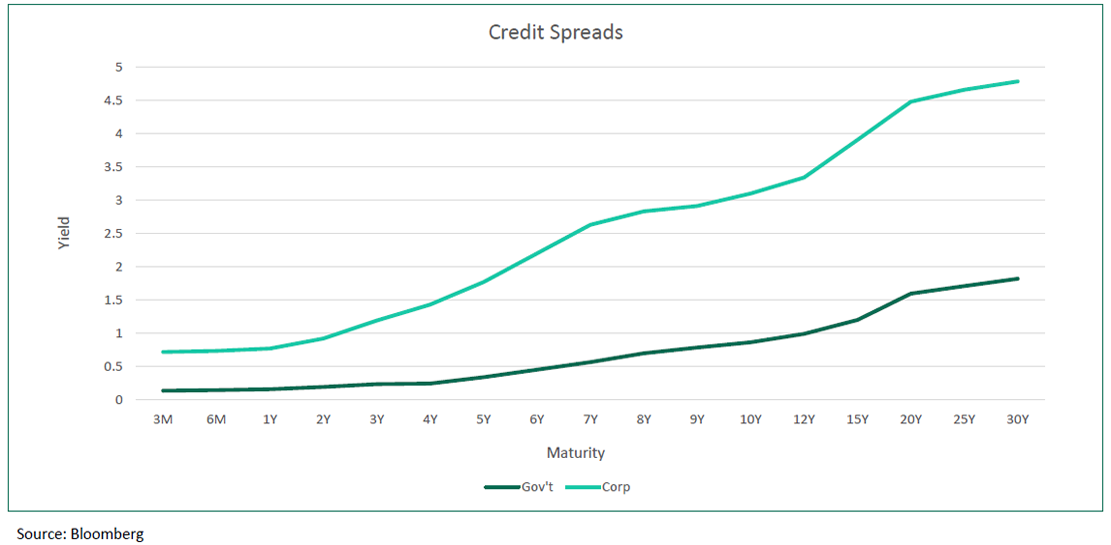

An investor who takes credit risk needs to be paid for that risk through a higher yield. In fixed-income markets, the higher yield is measured versus the government curve.

This is classified as the risk-free curve. The dark green line in the following chart shows the Australian Government bond curve. The light green line is the sort of yield that might be paid for investing in part of the credit market. There is a differential between the two, and the longer the investment, the wider that differential becomes.

Locking money away for a period of time, and taking a reasonable amount of credit risk, will come with a higher yield. Investors need to be aware of the risk they are taking to earn that higher yield.

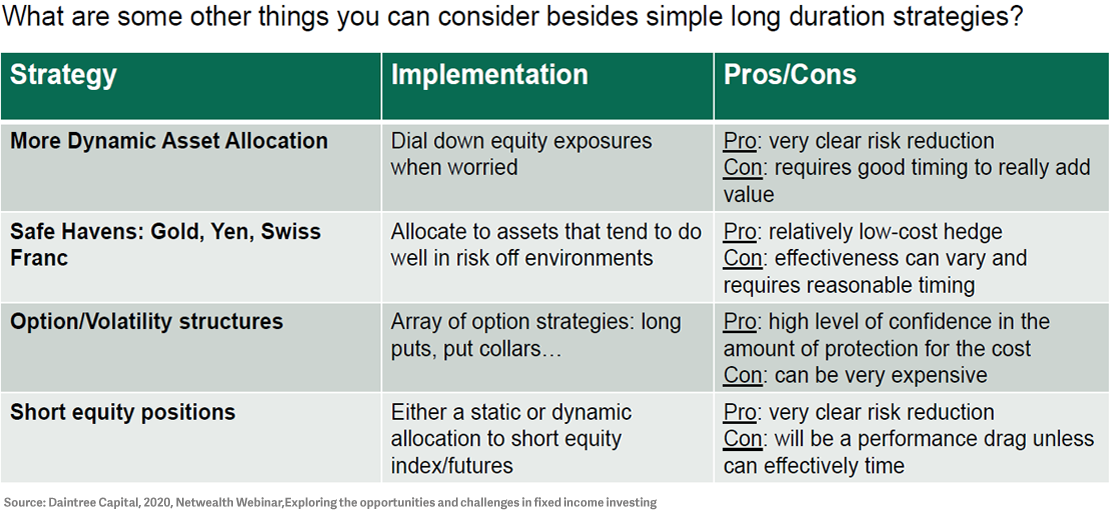

Protective strategies that investors can consider, besides simple long-term duration, include more dynamic asset allocation, safe havens (e.g. gold, yen, Swiss franc), option/volatility structures and short equity positions. To implement such strategies, investors should consult their financial adviser, because the ability to be out of equities at the right time could pay off.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.

Fixed income investment options

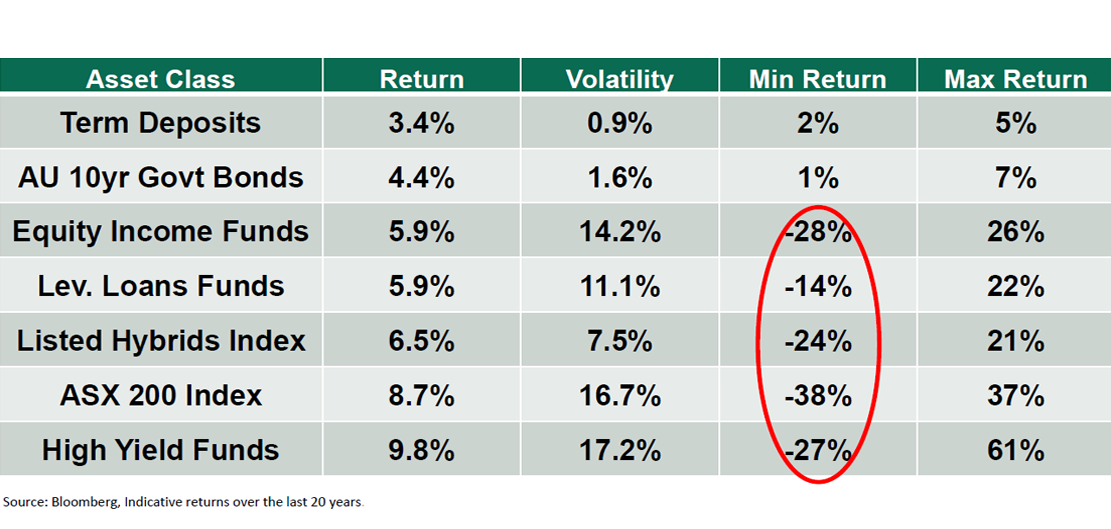

With fixed income products, the greater the risk taken, the more the drawdown can be. Looking at some representative indices, and what the drawdowns can be, March 2020 was a reminder that markets can go down quickly. It is therefore important to understand the volatility and downside risk taken.

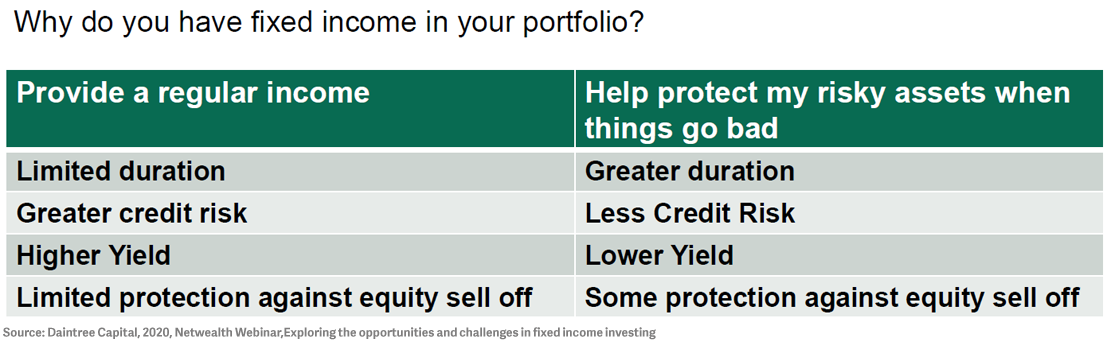

One reason for including fixed income in a portfolio is the opportunity to achieve a more regular income or higher return than can be achieved with cash or term deposits. Another is the opportunity to diversify the portfolio and to hedge out potential risk – specifically listed equity risk.

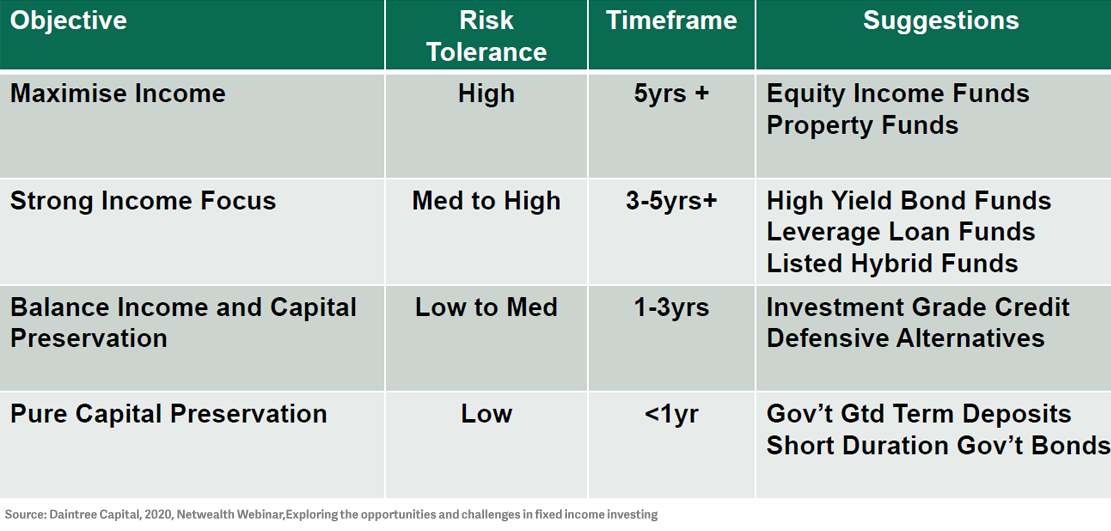

With any investment option, two important characteristics should be taken into consideration – risk tolerance and timeframe.

The higher the risk, the longer the investment horizon needs to be due to market volatility. If an investor is unlucky with timing, the investment may provide a good income or yield, but the market could be down 10-30% and it might then take years to earn the capital back.

“Most people, when they look at a prospective return, will probably look at the average return,” says Mark Mitchell.

“If the return is higher, they'll be happy with that. But we think it's important, with any asset, to look at the downside case and ‘What's the worst that can happen?’ That should be the bar for whether or not the investment makes sense for you, not what the average return is. Can you handle the drawdown? Can you handle the downside mentally, emotionally and financially? You should probably use that as your litmus test as to whether or not the asset makes sense for you personally.”

Mark argues that it is important for investors to be clear about what they want to achieve with income or defensive-oriented investments.

Generating income is not the same thing as being defensive. Being defensive involves assessing the risk of permanent capital loss, the risk that something sells off and the investor has lost capital that they will never get back.

Fixed income investors should always ensure they have the ability and willingness to hold an investment for long enough whenever they take more risk.

Find out more about fixed income investing

Listen to the Netwealth webinar Exploring the opportunities and challenges in fixed income investing for additional insights, or contact Netwealth.

You may also enjoy

Portfolio Construction

Generating income and capital growth with unlisted infrastructure

Accessing unlisted infrastructure, like airports and toll roads, can be challenging due to the large capital outlay required. In this episode, we chat with Rory Shapiro, Associate Director at AMP Capital, to explore how investors can generate cashflow with less volatility using unlisted infrastructure. Learn how infrastructure responds to rising inflation and discover the outlook and emerging opportunities in the sector.

Portfolio Construction

Investing in the global leaders of tomorrow

Explore the factors driving performance in the global small and mid cap sector and its future outlook with James Abela and Maroun Younes from Fidelity. Discover the opportunities outside of Australia and why more investors should consider a global small and mid cap strategy.

Portfolio Construction

Is this time different for bonds?

Bond markets are adjusting after yields moved sharply higher in the first quarter of 2021. Schroders Fund Manager Kellie Wood explores the trends set to shape markets in 2021, and explains why she believes the repricing of bonds represents a healthy reset.

The information in this article is general in nature. Any financial advice it contains is general advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. The article content is not intended to be a substitute for professional advice, so before you act on it you should determine its appropriateness having regard to your particular objectives, financial situation and needs, and seek any professional advice you require. Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.

This webinar guest is a financial product issuer. Netwealth and the guest have a commercial arrangement that enables investment in products managed by the guest through Netwealth’s platform. Under that arrangement, Netwealth may receive fees from the webinar guest. More information about the fees Netwealth receives is provided in our Financial Services Guide, which is available on our website or by contacting us.