Lonsec GSS Index Plus Diversified models

Part of the Netwealth Global Specialist Series and available through our low cost Super & Wealth Accelerator Core, and Accelerator Plus accounts.

Netwealth has partnered with Lonsec Investment Solutions* to offer investors a suite of diversified managed account models that leverage Lonsec's extensive research capabilities. The models use a core-satellite investment approach, blending low-cost index funds with actively managed investments, with the intent to help reduce costs, control volatility and generate greater returns.

The 'core' allocation provides exposure to a blend of low-cost index funds to provide clients with broad market diversification.

The 'satellite' allocation contains actively managed investments designed to provide additional diversification and return potential.

There are four Lonsec GSS Index Plus models. Each model typically holds around 9-14 investments, and are constructed using a range of growth and defensive assets such as Australian and global equities, property, fixed interest and cash. All models are backed by Lonsec's rigorous governance and review process.

The Moderate Model maintains a long-term average exposure of 40% to growth assets and 60% to defensive assets, and aims to achieve a return above the Morningstar Australia Moderate Target Allocation Net Return AUD Index after fees and costs over rolling 4-year periods.

The Balance Model maintains a long-term average exposure of 60% to growth assets and 40% to defensive assets and aims to achieve a return above the Morningstar Australia Balanced Target Allocation Net Return AUD Index after fees and costs over rolling 5-year periods.

The Growth Model maintains a long-term average exposure of 80% to growth assets and 20% to defensive assets and aims to achieve a return above the Morningstar Australia Growth Target Allocation Net Return AUD Index after fees and costs over rolling 6-year periods.

The High Growth Model maintains a long-term average exposure of 99% to growth assets and 1% to defensive assets and aims to achieve a return above the Morningstar Australia Aggressive Target Allocation Net Return AUD Index after fees and costs over rolling 7-year periods.

Lonsec has played a fundamental role in building the investment capabilities of financial advisers, fund managers, superannuation funds and individuals for over 20 years. The business encompasses managed investments and listed securities research, awards and ratings, portfolio consulting, managed accounts and data and analytics.

Comprising Lonsec Research, SuperRatings, Lonsec Investment Solutions and Implemented Portfolios Limited, Lonsec rates over 2000 investment funds and equities and 500 plus superannuation products and is one of Australia’s fastest growing Managed Accounts providers.

By drawing on Lonsec’s in-depth investment product research, and extensive expertise as a specialist model portfolio manager, we have encapsulated Lonsec's best ideas in a series of managed portfolios to meet the different needs of your clients.

Lonsec Investment Solutions' philosophy underpins their investment research driven approach to portfolio construction and the processes used to build quality investment solutions. The philosophy is underpinned by four key beliefs.

A dynamic approach to portfolio management to achieve investment objectives while managing downside risk.

Investing in high quality investments underpinned by Lonsec’s extensive research.

A strong risk management culture supported by a rigorous governance process.

A diversified approach to portfolio construction.

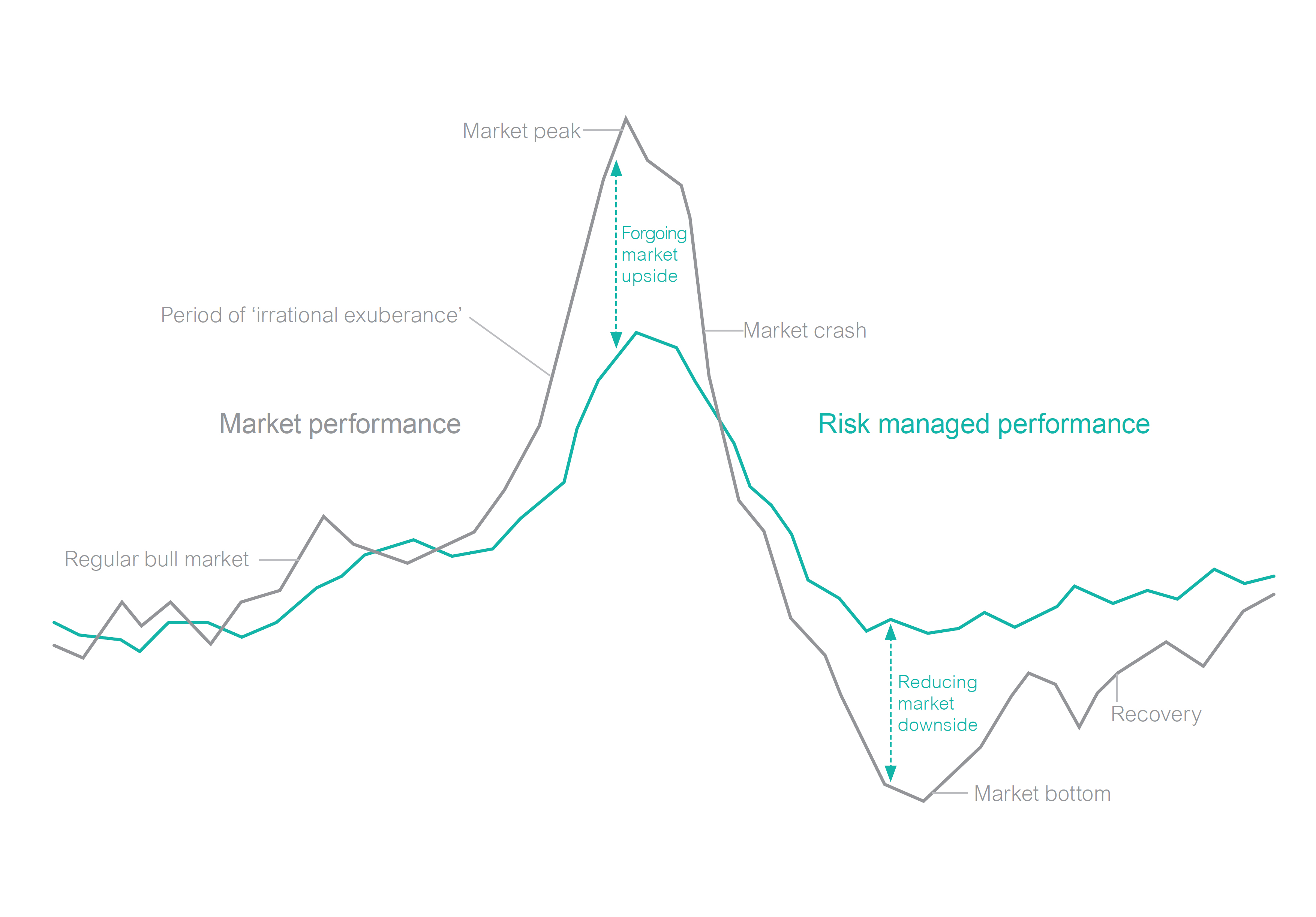

Lonsec believe smoothing out returns by forgoing some potential upside, whilst limiting the downside, will result in superior long-term performance.

Philosophically aligned to this belief, their portfolios are designed to keep pace with market returns while outperforming the market during a downturn.

Want more information? Our resources section has everything covered.

Let one of our experienced BDMs pay you a visit to discuss how our platform can be configured to meet your business needs.

Contact a BDMIf you want a hands-on experience, we can organise a quick online demonstration of some of the key features of the platform and our service.

Schedule a demo*This page describes the Lonsec Global Specialist Series ('GSS') Index Plus Diversified managed models for which Netwealth has appointed Lonsec Investment Solutions Pty Ltd (ABN 95 608 837 583) ('Lonsec') a corporate authorised representative of Lonsec Research Pty Ltd (ABN 11 151 658 561, AFSL 421445) as the Model Manager.