Financial advice firms are in an era defined by the convergence of two powerful forces: a data boom and a tech boom. The volume, variety, and velocity of data available to advisers has exploded, from portfolio performance and market movements to personal client details spread across multiple accounts. At the same time, technology is evolving rapidly, offering new tools to manage, analyse, and act on this data with unprecedented speed and precision.

Key takeaways:

- Data and tech are reshaping advice delivery and scaling.

- Six trends define the future: data, personalisation, automation, AI, cybersecurity, integration.

- Leading firms invest in tech and adopt integrated systems.

- These pillars drive smarter, faster, and more personalised advice.

Driving forces - a data boom meets tech acceleration

There are some powerful technology driving forces reshaping the industry today.

Firstly, the digitalisation of advice has turned once paper-based processes into data-rich digital workflows. Information is abundant and accessible, but only if systems are integrated and data is well-managed.

Secondly, client expectations have changed. Today’s clients, especially younger generations, expect seamless digital experiences. They want to access their financial information in real time and across devices, and they want advice that reflects their unique circumstances.

Third, regulatory and security pressures are intensifying. Privacy laws and cybersecurity threats demand rigorous data governance, and firms must protect sensitive information while maintaining transparency and auditability.

Fourth, firms are under pressure to expand their client base while sustaining profitability. Technology and data are emerging as critical enablers for this, allowing firms to scale without compromising service quality or compliance.

Fifth, the proliferation of tech stacks is driving a need for integration. The average advice firm uses 21 different technologies, leading to inefficiencies and fragmented experiences. Integration tools are helping unify these systems.

Sixth, advanced technologies like AI are revolutionising data management. From automating routine tasks to uncovering insights in large datasets, AI is becoming a strategic asset.

Finally, industry consolidation is accelerating. An increase in the potential for M&A activity means firms need clean, accessible data for due diligence and post-acquisition integration.

The Netwealth AdviceTech 2025 report, Turning data into growth, reveals how leading firms, known as AdviceTech Stars, are responding to this shift. These firms are not just adopting new technologies, but they are rethinking how advice is delivered, scaled, and experienced. They are building integrated systems, automating workflows, embedding Artificial Intelligence (AI), and reinforcing trust through cybersecurity.

AdviceTech Stars: A profile in leadership

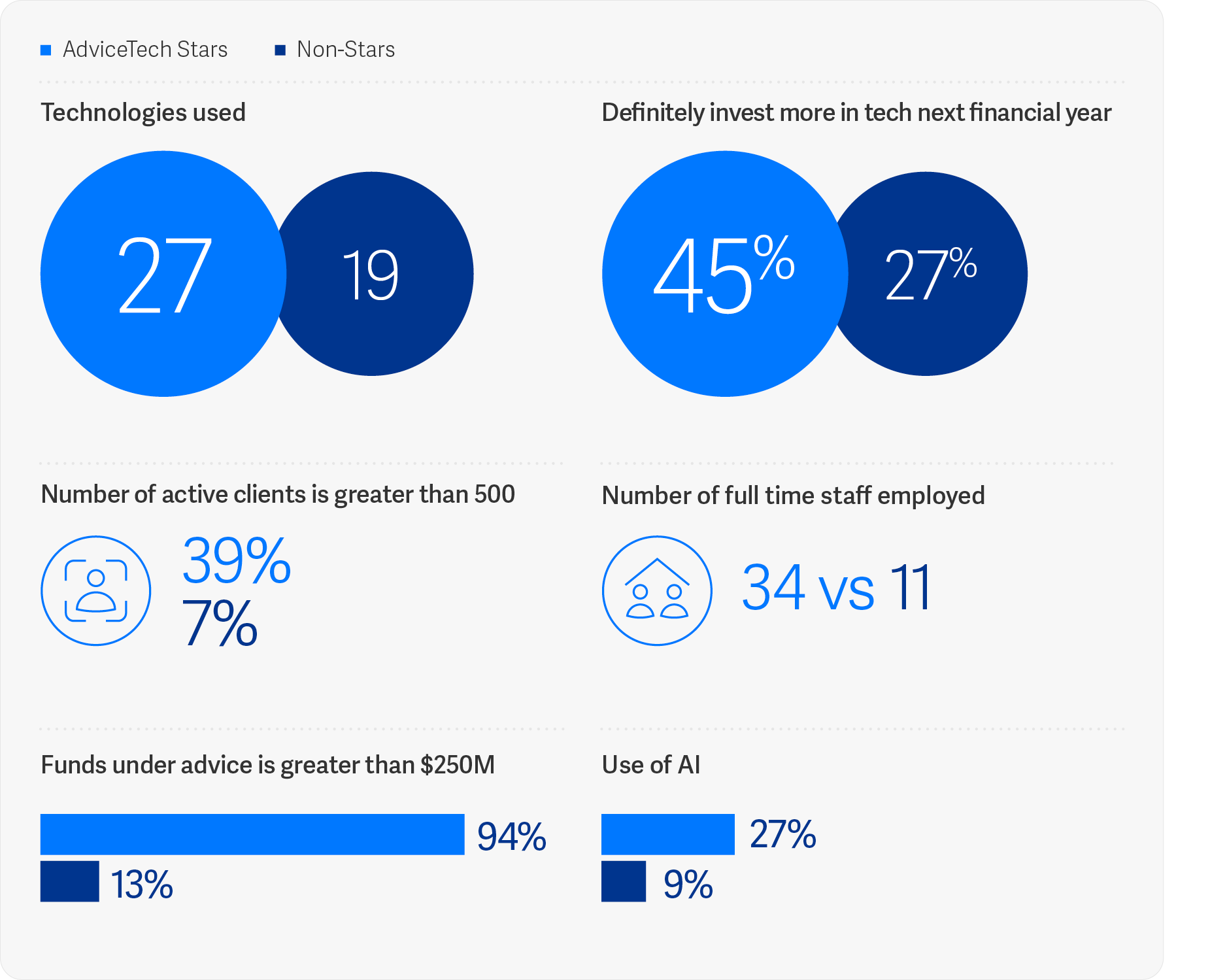

The Netwealth AdviceTech 2025 report paints a detailed picture of AdviceTech Stars – firms that are leading the way:

- 42% are multi-disciplinary (vs. 24% of non-Stars)

- 66% hold an Australian Financial Services Licence (vs. 40%)

- They manage larger teams (34 FTEs vs. 11) and more capital (94% manage over $250m vs. 13%)

- 27% have a high-net-worth client base (vs. 14%)

- They adopt more technologies (27 technologies vs. 19), with 41% having in-house tech managers (vs. 15%)

- 76% identify as early adopters (vs. 52%)

- 45% plan to increase tech investment (vs. 27%)

- Their tech spend remains consistent at 7.9% of revenue.

Source: Netwealth AdviceTech 2025 research

Six trends defining the future of advice

Against this backdrop, the Netwealth AdviceTech 2025 report identifies six key trends that are shaping the future of financial advice. These trends are not isolated, but they are interconnected responses to the challenges and opportunities of a data-driven world.

1. Turning data into action

AdviceTech Stars are embedding analytics into their daily operations and strategic planning. Two-thirds (67%) track core KPIs like revenue and time spent. 56% use data for scenario planning, 64% for forecasting, and 36% to monitor competitors. Dashboard usage among Stars has surged to 63%, while another 24% plan to adopt dashboards, meaning that 87% of Stars are either using or planning to use them.

2. Data driven personalisation

Clients expect advice that reflects their unique goals, behaviours, and life events. Over half (51%) of AdviceTech Stars use data-triggered alerts to deliver timely, relevant advice. This automation allows advisers to engage clients proactively, enhancing client satisfaction and maintaining compliance.

3. Data-driven client management

Automation is streamlining every stage of the advice process. 51% of Stars automate client onboarding, 79% automate portfolio performance reporting, and above three-quarters (77%) automate meeting notes and outlines. AI-assisted drafting is also gaining traction, allowing advisers to focus on strategic engagement while maintaining documentation quality and auditability.

4. AI goes mainstream with GenAI

Generative AI (GenAI) is now used daily, with 83% of Stars using it to summarise meetings, 60% to create content, and 51% to analyse unstructured data. Platforms like Microsoft 365 Copilot, ChatGPT, and Google Gemini are helping firms improve productivity, uncover insights, and enhance client communications. Governance frameworks ensure responsible use and regulatory alignment.

5. Trust and cybersecurity as non negotiables

AdviceTech Stars are focused on cybersecurity, using multi-factor authentication, role-based access, secure document sharing, and delivering regular training. 92% conduct cybersecurity reviews, and 87% have backup protocols in place. These measures protect client data, support compliance, and reinforce trust in digital advice delivery.

6. A connected data backbone

Data integration is the foundation of scalable, intelligent advice. Firms operate an average of 27 technology systems, however the use of integration technologies among Stars has jumped from 21% in 2020 to 63% in 2025. Centralised data warehouses and low-code tools like Workato enable cleaner data, fewer manual fixes, and better reporting. This backbone supports personalisation, automation, and AI readiness.

A blueprint for growth

The AdviceTech 2025 report, Turning data into growth, provides a strategic blueprint for advice firms to grow in the future. The six trends – data action, personalisation, automation, AI, cybersecurity, and integration – are interdependent pillars of growth, efficiency, and trust. For every advice business, the opportunity is clear: use technology as a lever for smarter, faster, and more personalised advice.

More articles:

- Overview: Get to know AdviceTech Stars, and what they are doing differently.

- Trend 1: Turning data into action - how dashboards and KPIs are driving smarter decisions.

- Trend 2: Personalisation at scale - how to use data and alerts to deliver more relevant advice.

- Trend 3: Automation across the lifecycle - how to streamline onboarding, reporting and client reviews.

- Trend 4: AI goes mainstream - how you can embed GenAI into your daily advice workflows.

- Trend 5: Trust and cybersecurity - how to safeguard client confidence in a digital world.

- Trend 6: A connected data backbone - how to build the data foundation for integration and scale.

Report: 2025 AdviceTech - Turning data into growth

Report: 2025 AdviceTech - Turning data into growth

The convergence of a tech boom and a data boom are reshaping how advice is delivered. Are you turning that change into growth? This year, see how leading firms are embedding automation, dashboards and AI into daily workflows and get the practical playbook to do the same.

Download the reportKeynote: 2025 AdviceTech - The connected advice firm

Keynote: 2025 AdviceTech - The connected advice firm

Join Sophie Firminger, Head of Technology Sales & Consulting at Netwealth, as she unpacks the findings of the 2025 AdviceTech Report. Learn how the six key trends are reshaping advice, see real-world examples, and discover how you can put the playbook into practice.

Watch nowPodcast: Scaling advice with AI and avatars

Podcast: Scaling advice with AI and avatars

In this episode of Between Meetings, Dan Solin explores how AI and avatars can scale personalisation while keeping advice simple, transparent and client-first. He also explains how tech and human touch combine to deliver meaningful advice in a changing landscape.

Listen to the episode