Take outs:

- A handful of technologies are set to emerge in the next 18 months as mainstream technologies used by most advice practices

- Budgeting tools could be the next big thing in advice practices

- Digital signatures, budgeting and virtual meeting tools are set to be the future must-have tech tools

- Advisers who are early adopters of technology look and think differently

Some advisers already use them, a lot don’t, but advisers say they have big plans for a handful of emerging technologies over the next 18 months.

Falling into this category are budgeting tools, digital marketing, online service tools, digital signature tools and virtual meeting technology.

All the tools in this emerging technology status have in common a capacity to make advice more efficient, to engage clients further and to make the consumer experience of advice more aligned to that which other brands outside of advice are offering.

According to Netwealth Joint Managing Director Matt Heine, front office tools such as the emerging technologies above, offer customers transparency and engagement, which lay the foundations for a completely transformed advice experience, more in line with what customers are experiencing in other service interactions.

“Financial planning businesses are no longer being compared to financial planning businesses down the road. Our businesses are being compared to brands like Amazon and Uber who offer a frictionless experience, and we need to catch up.”

Emerging technologies were identified by advisers in the 2017 Netwealth AdviceTech Research Report, where more than 200 advisers were asked what technologies they used, what service providers they used for that technology and their plans for the future.

Netwealth 2017 AdviceTech Report

The report paints a picture of how technology is currently being used in the dynamic and evolving advice industry and provides insights into key areas of focus, must-have, high adoption services, and technologies that are regarded as disruptors, but are not yet being adopted.

Budgeting tools could be the next big thing

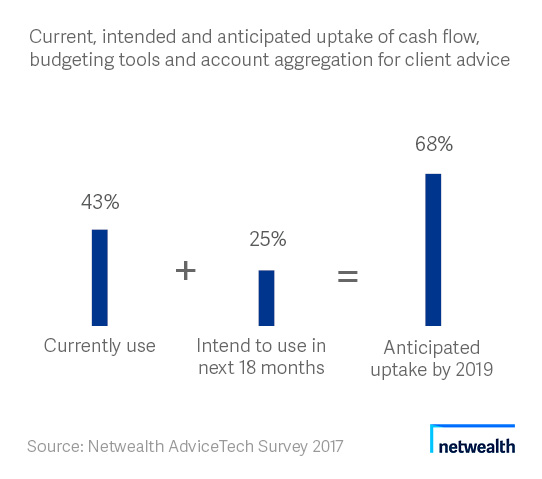

Cash flow, budgeting and account aggregation tools for client advice are currently used by 43% of the advisers surveyed. This means the advisers themselves are using these tools, or are enabling their customers to use the tools to facilitate their advice experience.

Either way, the impact on financial literacy and education is significant, empowering advisers and customers alike to work together with timely information from which to devise and follow a wealth strategy.

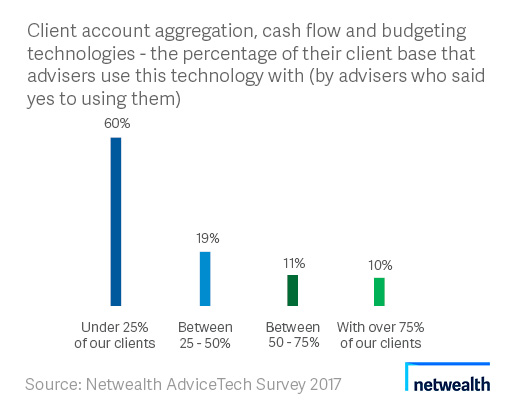

Perhaps interestingly, those advisers that do use these budgeting and account aggregation tools now, do not use them with all their client base.

That is, 60% of them use these tools for less than a quarter of their clients. One fifth or 21% of advisers surveyed use budgeting tools for more than half of their client base.

Digital marketing is starting to go mainstream

Another emerging technology in AdviceTech is digital marketing. Websites are the norm these days, regarded as the equivalent of a digital shopfront for many businesses.

However, despite the status of websites as a digital front door, making sure digital marketing content on the website is updated and current is sadly not the norm.

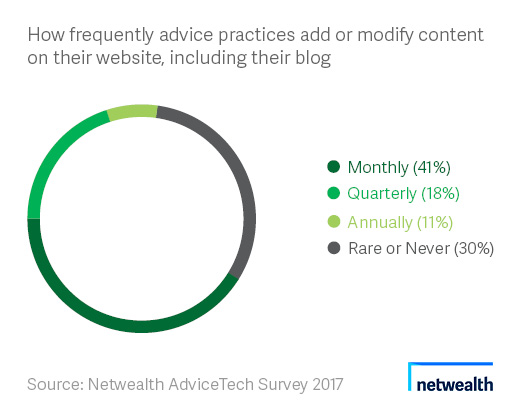

While 41% of advisers in the Netwealth AdviceTech Research Report regularly add or modify content on their website, including their blog, a significant 30% of advisers in the Report said they rarely to never add or modify content on the website, including their blog.

Eighteen percent update quarterly and 11% update their website annually.

The difficulty could be the maintenance of this content when faced with other competing business responsibilities and functions. In the absence of a dedicated resource or an inclusion in someone’s existing job description, the updating of digital material can fall down the priority list.

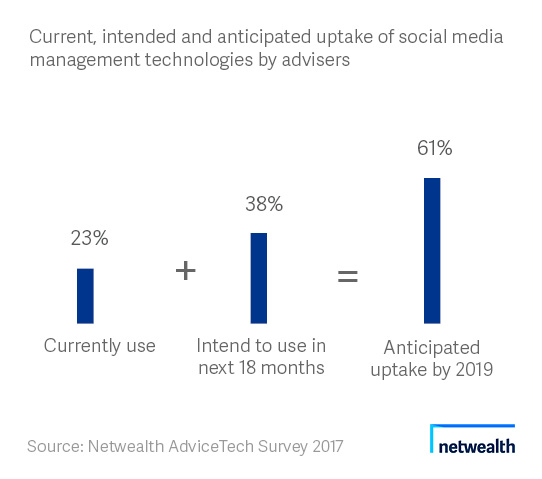

However, there are tools to help. Twenty-three percent of advisers in the Netwealth AdviceTech Research Report said they use technology to manage their posts and activities on social media, with 38% intending to use social media management technologies in the next 18 months. This data shows us advisers are keen to change their ways and be more systematic in the updating of their digital marketing content.

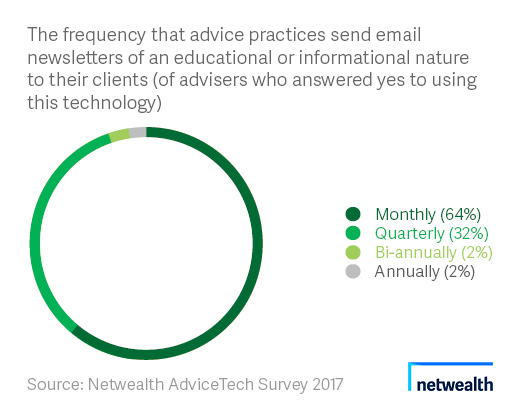

In other digital marketing content such as newsletters and emails, advisers take a more frequent communication approach. That is, while 71% of advisers reported using technology to create and send emails and newsletters, with Mailchimp the dominant service provider, 64% do this activity monthly and 32% do it quarterly.

Future must-have tech tools

Online service tools, digital signature tools and virtual meeting technology are three other AdviceTech tools to be the future must-have technologies for the advice industry.

By 2020, 59% of advisers will use online service tools compared to 23% who currently use online self-service tools to help advice practices capture client information used in the fact finding and risk profiling process.

Meanwhile, 78% of advisers say by 2020 they will be using digital signature tools, up from 34% who use them now.

Digital signature tools offer advice practices authentication, non-repudiation and integrity benefits, and are used in industries such as software distribution and financial transactions to detect forgery or tampering.

And 52% of advisers currently use virtual meeting technology, increasing to 59% by 2020.

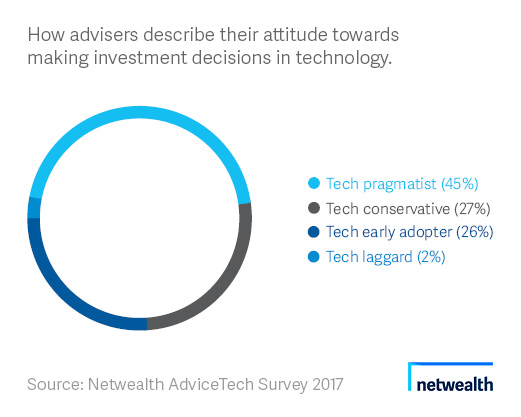

Impacting the adoption of all these technologies is how advisers define themselves in terms of technology. That is, how do they describe their relationship with technology.

Early adopters of technology look and think differently

The Netwealth AdviceTech Research Report found 26% of advisers described themselves as early adopters (see page 4 of report).

It is this same cohort that identified virtual meeting capabilities, block chain, virtual reality, artificial intelligence and scaled advice as the technologies they believe will most impact advice in the next five years.

Most advisers described themselves as a technology pragmatist (45%), willing to use stable but not yet common technology to develop a competitive advantage.

A further 27% described themselves as a technology conservative, willing to deploy proven technology to deliver services.

The future of these emerging technologies is set to be bright, but a word of warning from the elusive Bill Gates when discussing disruption.

‘We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.”

More from the AdviceTech Special Report

AdviceTech set to open doors for advice