Artificial Intelligence (AI) and in particular Generative AI (GenAI) in financial advice has moved from a ‘promising experiment’ to a daily productivity tool. The Netwealth AdviceTech 2025 report, Turning data into growth identifies ‘AI goes mainstream with GenAI’ as a pivotal trend, showing how it is being embedded into the workflows of leading advice businesses. GenAI is not just augmenting human capability, but actively transforming how advice is delivered, documented, and scaled.

Key takeaways:

- GenAI is now essential for productivity in advice businesses.

- Used for meeting summaries, content creation, and data analysis.

- Integrated with strong governance for responsible use.

- GenAI supports advanced tasks and ongoing innovation.

Practical applications of GenAI

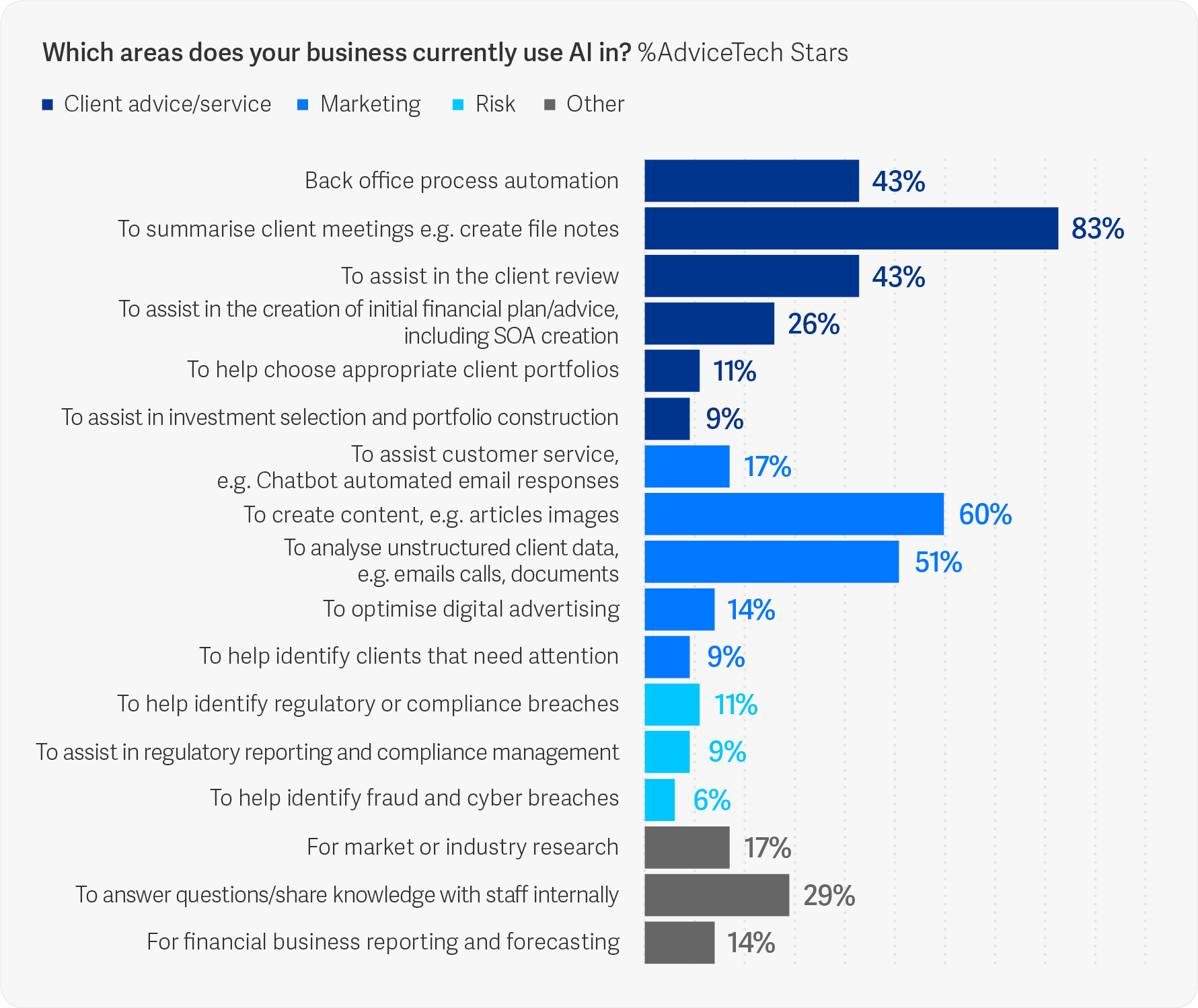

AdviceTech Stars, the businesses leading in technology adoption, are embracing GenAI tools such as Microsoft 365 Copilot, ChatGPT, and Google Gemini. These platforms are being used to summarise meetings, generate file notes, create content, and analyse unstructured data. They can help with faster turnaround, improved consistency, and more time for advisers to focus on strategic client engagement.

The Netwealth AdviceTech 2025 report reveals that 83% of AdviceTech Stars use GenAI to summarise meetings, turning lengthy transcripts or notes into concise, actionable summaries. This helps to save time and ensure that key insights are captured and shared across teams.

Source: Netwealth AdviceTech 2025 research

Content creation is another area where GenAI is making a significant impact. 60% of Stars use GenAI to generate content, whether it’s client communications, educational materials, or internal documentation. These tools help businesses maintain a consistent voice and tailor messaging to different audiences.

GenAI is also being used to analyse unstructured data including emails, meeting transcripts, feedback forms to uncover trends, identify risks, and surface opportunities. 51% of Stars are leveraging AI for this purpose, turning previously inaccessible information into strategic insight.

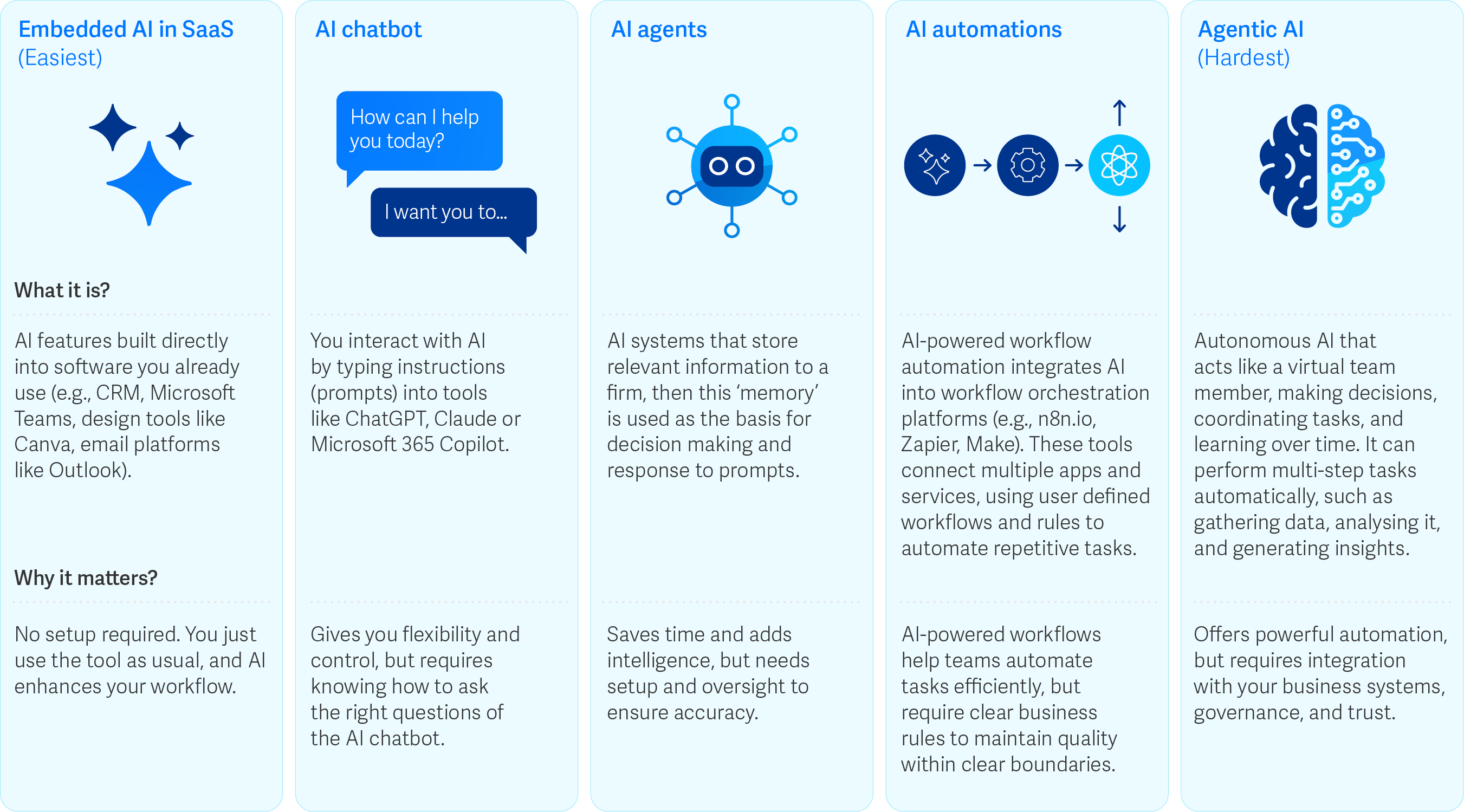

From experimentation to integration

GenAI is becoming a core part of the advice technology stack. Businesses are integrating GenAI into their existing platforms, workflows, and compliance processes to support their operations. This is enabling them to automate routine tasks, enhance documentation, and improve decision-making. It also allows advisers to spend more time on high-value activities, such as client strategy, relationship building, and complex financial modelling.

Governance and trust

As GenAI becomes more embedded in advice workflows, governance and trust are critical. The Netwealth AdviceTech 2025 report emphasises the importance of responsible AI use, particularly in areas such as compliance, data privacy, and advice suitability.

AdviceTech Stars are implementing safeguards to ensure that AI-generated outputs are reviewed, validated, and aligned with regulatory standards. They are also educating staff on the capabilities and limitations of AI, fostering a culture of informed adoption.

Specialised use cases

Advice businesses are also starting to use GenAI in specialised ways. These include AI-assisted compliance checks, predictive modelling for client outcomes, and automated scenario planning. These use cases go beyond productivity and begin to reshape how advice is constructed, delivered, and monitored. The report indicates that as knowledge and confidence grow, advice businesses will continue to expand their use of GenAI into more complex and strategic areas, requiring ongoing investment in training, governance, and integration.

The Netwealth AdviceTech 2025 report shows that Stars are engaging GenAI to enhance productivity, improve client outcomes, and scale operations without compromising quality or compliance. By embedding AI into daily workflows, these businesses are demonstrating that with the right tools, governance, and mindset, AI can be a powerful ally in delivering smarter, faster, and more personalised advice.

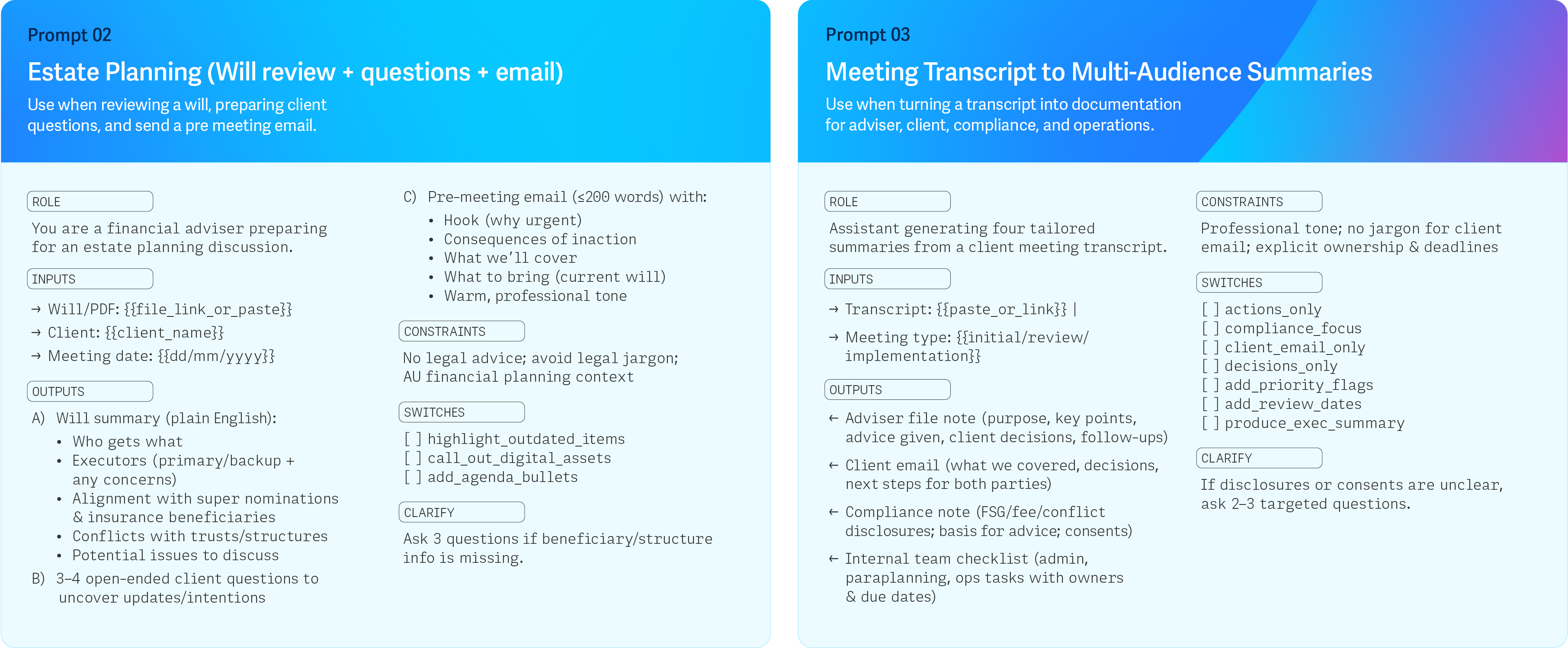

Example prompts from AdviceTech Report 2025, Turning date into growth

More articles:

- Overview: Get to know AdviceTech Stars, and what they are doing differently.

- Trend 1: Turning data into action - how dashboards and KPIs are driving smarter decisions.

- Trend 2: Personalisation at scale - how to use data and alerts to deliver more relevant advice.

- Trend 3: Automation across the lifecycle - how to streamline onboarding, reporting and client reviews.

- Trend 4: AI goes mainstream - how you can embed GenAI into your daily advice workflows.

- Trend 5: Trust and cybersecurity - how to safeguard client confidence in a digital world.

- Trend 6: A connected data backbone - how to build the data foundation for integration and scale.

Report: 2025 AdviceTech - Turning data into growth

Report: 2025 AdviceTech - Turning data into growth

The convergence of a tech boom and a data boom are reshaping how advice is delivered. Are you turning that change into growth? This year, see how leading firms are embedding automation, dashboards and AI into daily workflows and get the practical playbook to do the same.

Download the reportKeynote: 2025 AdviceTech - The connected advice firm

Keynote: 2025 AdviceTech - The connected advice firm

Join Sophie Firminger, Head of Technology Sales & Consulting at Netwealth, as she unpacks the findings of the 2025 AdviceTech Report. Learn how the six key trends are reshaping advice, see real-world examples, and discover how you can put the playbook into practice.

Watch nowPodcast: Scaling advice with AI and avatars

Podcast: Scaling advice with AI and avatars

In this episode of Between Meetings, Dan Solin explores how AI and avatars can scale personalisation while keeping advice simple, transparent and client-first. He also explains how tech and human touch combine to deliver meaningful advice in a changing landscape.

Listen to the episode