Automation in financial advice is a now a reality that advisers can embrace. The Netwealth AdviceTech 2025 report, Turning data into growth,identifies ‘Automation across the advice lifecycle’ as a defining trend, showing how leading businesses are moving beyond experimentation and embedding automation into their core workflows. This shift is enabling advice businesses to reduce manual effort, scale efficiently, and improve compliance – all while enhancing the client experience.

Key takeaways:

- Automation reduces manual effort and improves compliance.

- Key processes like onboarding and reporting are streamlined.

- AI tools assist with drafting, freeing advisers for strategic work.

- Automation enables scalable growth and better client experiences.

Automation as a growth enabler

The Netwealth AdviceTech 2025 report demonstrates that automation is a strategic enabler for advice businesses. AdviceTech Stars are showing how automation allows businesses to scale without proportionally increasing costs, to maintain high standards of compliance, and deliver a superior client experience.

AdviceTech Stars, the businesses at the forefront of technology adoption, are automating key stages of the advice process. Manual and time-consuming tasks such as onboarding, document generation, modelling, and reviews, are now increasingly streamlined through templated workflows, data prefill, and AI-assisted drafting.

Automating the core of advice delivery

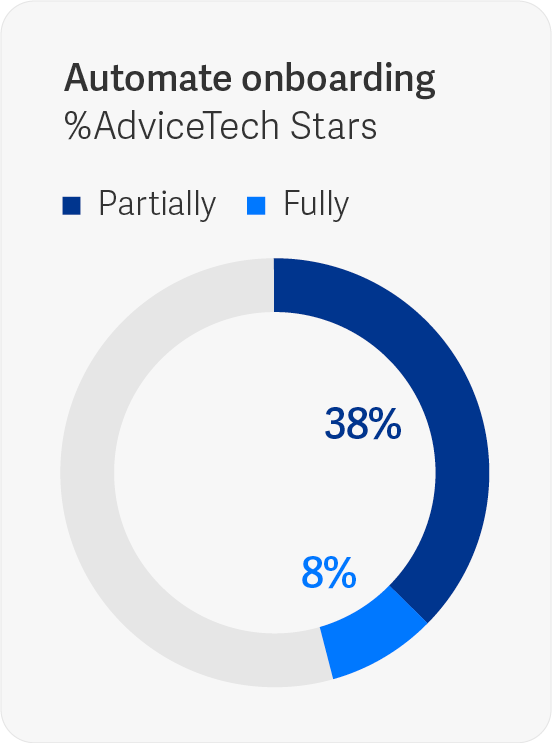

The 2025 AdvcieTech report reveals that almost half (46%) of AdviceTech Stars automate client onboarding , a critical first step in the advice journey. This includes digital forms, identity verification, and data capture that flows directly into the firm’s Customer Relationship Management (CRM) and advice platforms. By removing friction, businesses can deliver a smoother, faster onboarding experience with accuracy and compliance.

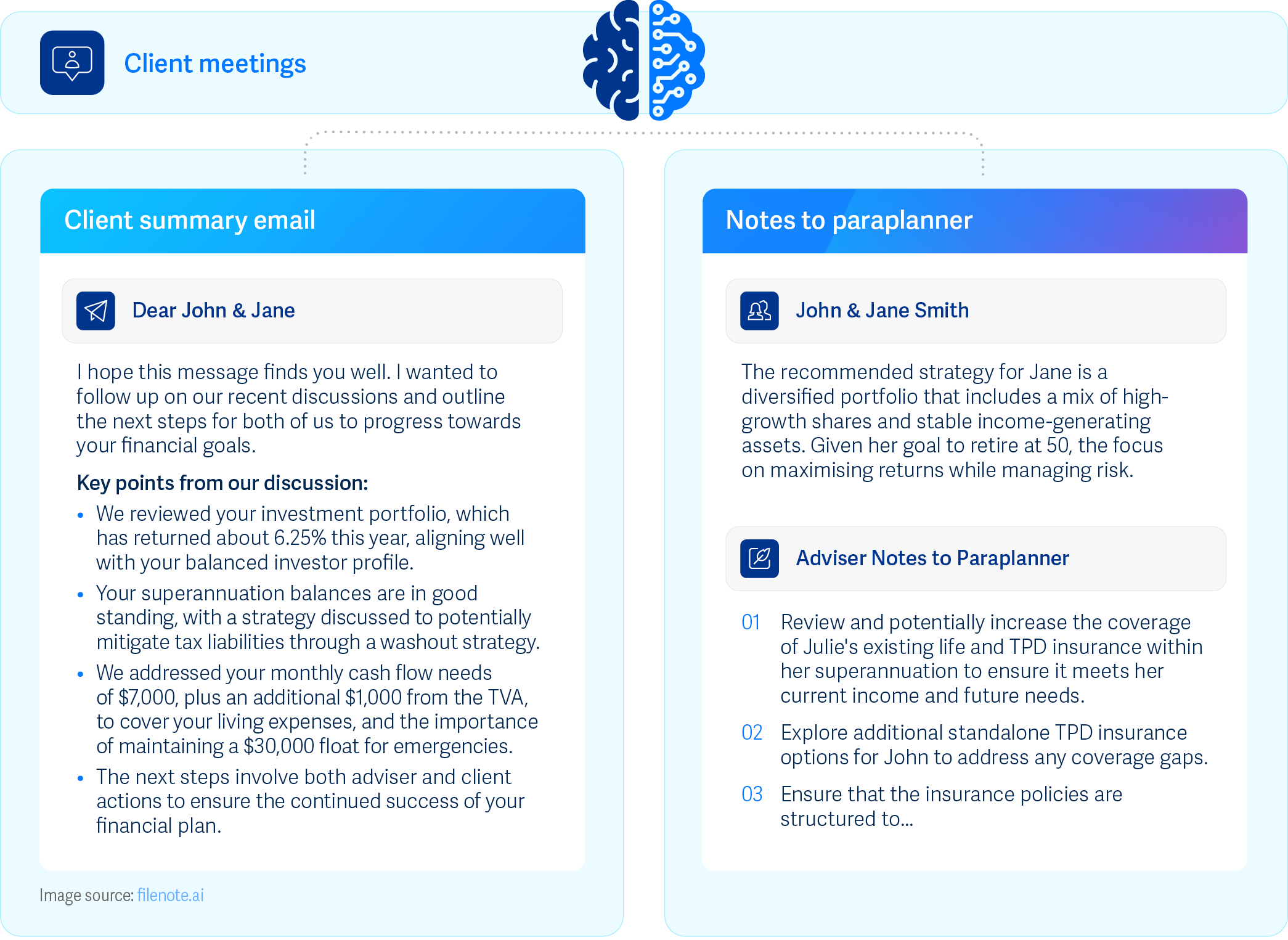

For AdviceTech Stars, automation continues throughout the lifecycle. Nearly three-quarters of Stars A automate client meeting outlines and notes, using structured templates and AI tools to prepare agendas and capture outcomes. This not only saves time, but ensures consistency and auditability.

Portfolio performance reporting is another area where automation is making a significant impact. 80% of Stars either fully or partially automate this process, allowing clients to receive timely updates without manual intervention. Reports can be customised, scheduled, and delivered through secure portals, improving transparency and engagement.

Source: Netwealth AdviceTech 2025 research

AI-assisted drafting and review

One of the most transformative developments in automation is the use of Artificial Intelligence (AI) to assist with drafting advice documents. Stars are leveraging Generative AI (GenAI) tools to create Records of Advice, Statements of Advice, and other client communications. These drafts are then reviewed and refined by advisers, combining the speed of automation with human expertise.

This approach reduces the time spent on documentation, lowers the risk of errors, and ensures that advice remains compliant and tailored. It frees up advisers to focus on higher-value activities, such as strategic planning and relationship building.

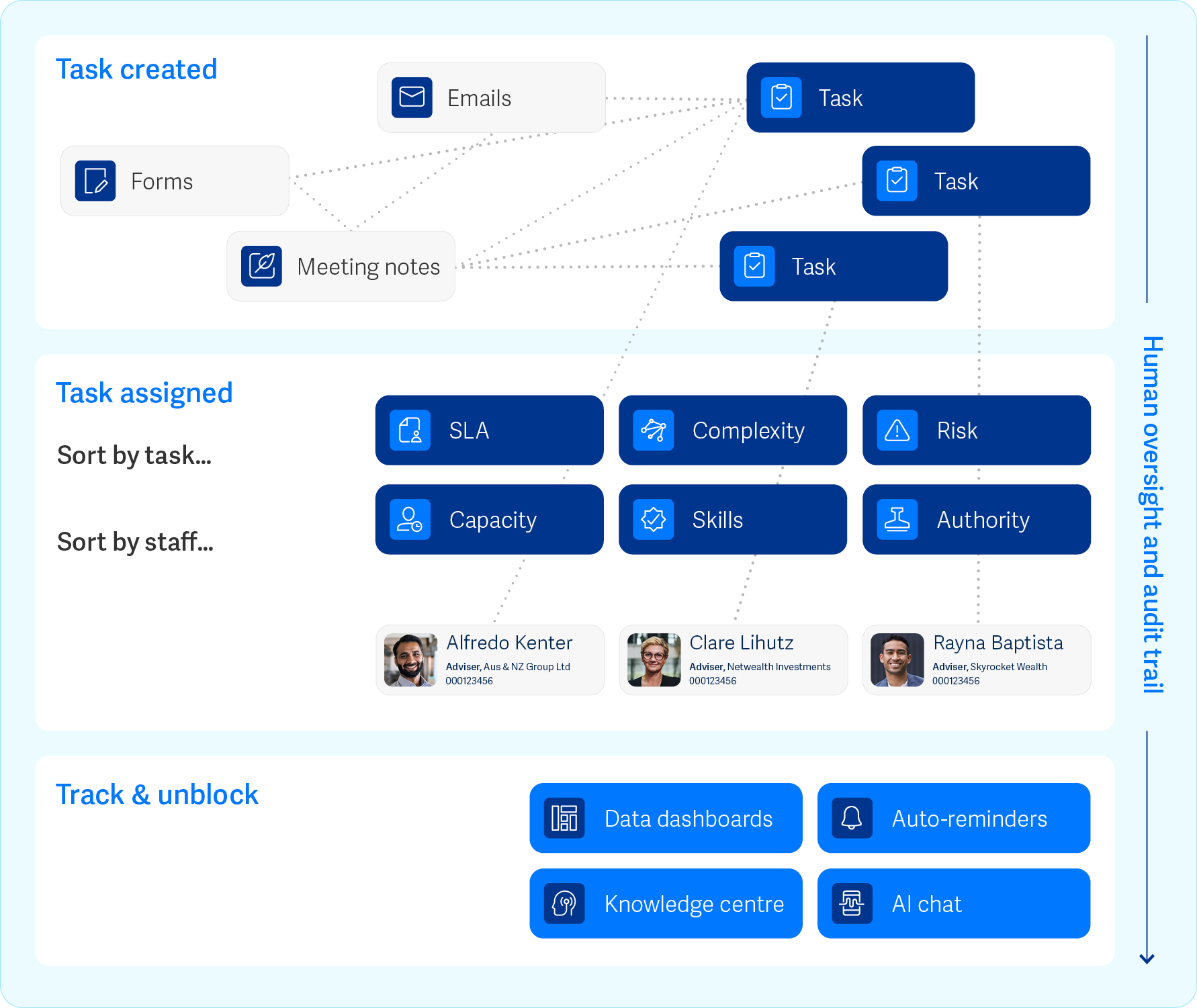

Automating workflows for scale across the entire journey

Automation is being used by AdviceTech Stars to build workflows that are repeatable, auditable, and aligned with regulatory requirements. These workflows incorporate data prefill from integrated systems, conditional logic to guide decision-making, and automated alerts to flag exceptions or required actions. Compliance is being embedded into these automated workflows, helping to reduce risk and ensure that every step of the advice process is documented and defensible.

The benefits of automation for advisers includes reduced administrative burden, improved turnaround times, and greater visibility into client progress. Importantly, automation does not replace the adviser, but it helps to empower them. By handling routine tasks, automation allows advisers to spend more time understanding client goals, exploring strategies, and delivering personalised advice. For clients, it means faster service, clearer communication, and more consistent engagement.

More articles:

- Overview: Get to know AdviceTech Stars, and what they are doing differently.

- Trend 1: Turning data into action - how dashboards and KPIs are driving smarter decisions.

- Trend 2: Personalisation at scale - how to use data and alerts to deliver more relevant advice.

- Trend 3: Automation across the lifecycle - how to streamline onboarding, reporting and client reviews.

- Trend 4: AI goes mainstream - how you can embed GenAI into your daily advice workflows.

- Trend 5: Trust and cybersecurity - how to safeguard client confidence in a digital world.

- Trend 6: A connected data backbone - how to build the data foundation for integration and scale.

Report: 2025 AdviceTech - Turning data into growth

Report: 2025 AdviceTech - Turning data into growth

The convergence of a tech boom and a data boom are reshaping how advice is delivered. Are you turning that change into growth? This year, see how leading firms are embedding automation, dashboards and AI into daily workflows and get the practical playbook to do the same.

Download the reportKeynote: 2025 AdviceTech - The connected advice firm

Keynote: 2025 AdviceTech - The connected advice firm

Join Sophie Firminger, Head of Technology Sales & Consulting at Netwealth, as she unpacks the findings of the 2025 AdviceTech Report. Learn how the six key trends are reshaping advice, see real-world examples, and discover how you can put the playbook into practice.

Watch nowPodcast: Scaling advice with AI and avatars

Podcast: Scaling advice with AI and avatars

In this episode of Between Meetings, Dan Solin explores how AI and avatars can scale personalisation while keeping advice simple, transparent and client-first. He also explains how tech and human touch combine to deliver meaningful advice in a changing landscape.

Listen to the episode