Take outs:

- Big data is creating new possibilities around how the advice industry receives data and the type of data it can access.

- Financial institutions, Government and social media are all sources of big data, influencing the information advice businesses can access outside of client meetings.

- Budgeting, cashflow and risk profiling will all be impacted by big data which can pre-populate client information and provide richer sources of personal information about clients.

Sources of big data including financial institutions and Government such as the Census, even social media, have the potential to significantly increase the quality and quantity of information available on advice clients. They have the potential to remove friction from the advice process making it easier to engage with clients and offer new services.

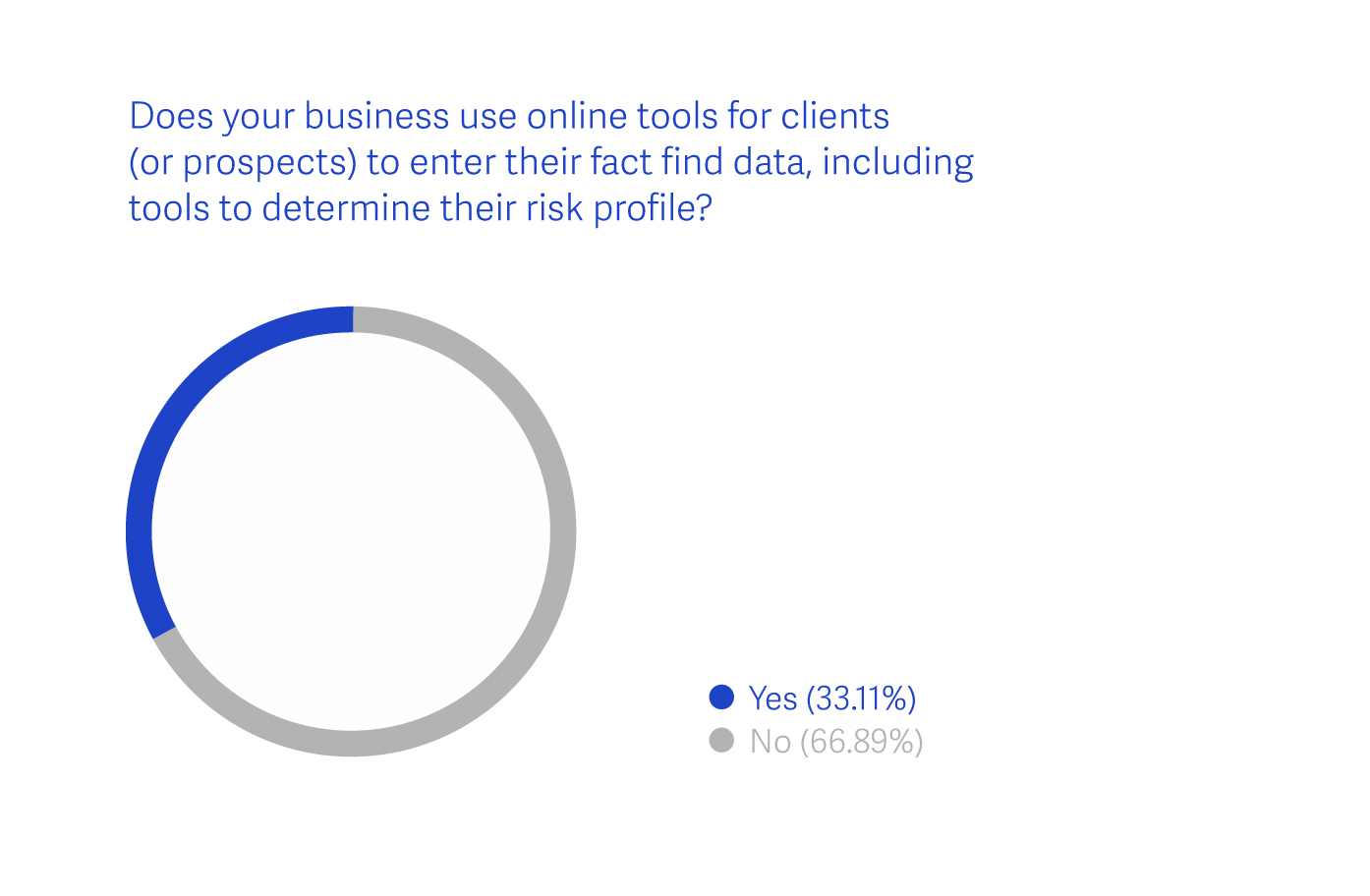

Consider this, today the majority of advisers are profiling their customers in person, in all likelihood capturing information using pen and paper which is later transcribed into a system for analysis and interpretation. Add to this the possibility that the information collected could be incomplete in the sense the “client may not know what they don’t know” or may not have access to their personal information easily (e.g. what they have spent on what in the last 12 months).

Further, according to the 2018 Netwealth AdviceTech research report, which surveyed 300 advisers, only 33.11% of advice practices use online self-service tools to capture customer information, including their risk profile. And only a further 37.05% plan to use them in the next 12 months.

Source: 2018 Netwealth AdviceTech Report

But what if technologies removed friction from this process? Think about a scenario where a qualified prospect in their own time goes online and completes a fact-find and risk profile. They authorise their bank and the ATO to provide select information, such as account balances and the previous years tax return to be sent to the adviser. This online information flows directly into an advice practices planning software plus other third party data such as ABS Census data or Credit risk data.

Imagine how much richer your initial advice and strategies could be with such data?

With big datasets you will be able to quickly understand a clients’ investable assets, income, credit card debt, living expenses and how much they may need in retirement (through their bank transaction details). You will also be able to identify whether they have insurance and adequate levels (through their premium payments), whether they have a mortgage and are in mortgage stress, and whether they are making additional super contributions.

Big data is available, right now

Currently fintechs such as Netwealth, IRESS, myprosperity and Moneysoft use client authorisation to access information from financial institutions such as account details and transaction details. They rely on technology provided from companies such as Proviso, Yodlee and eWise who offer data feeds from financial institutions in real time or near real time basis. RPData provides real estate prices and Redbook offers car prices as well.

Banks are also opening their data as part of an open bank initiative, with Macquarie Bank the first to adopt this. In fact, in a Productivity Commission Report released in May 2017, it suggested that an individual should have the ‘comprehensive right’ to a machine-readable copy of their financial data.

Providing this backdrop for sharing information is Government 2.0, an initiative the Federal Government announced in 2010 to use datasets in a way that is collaborative and open to ensure an open approach to business and government.

With such a platform central to Government, the opportunity to collaborate and connect with technology and data sets that are rich in nature, will profoundly impact the profiling of advice customers.

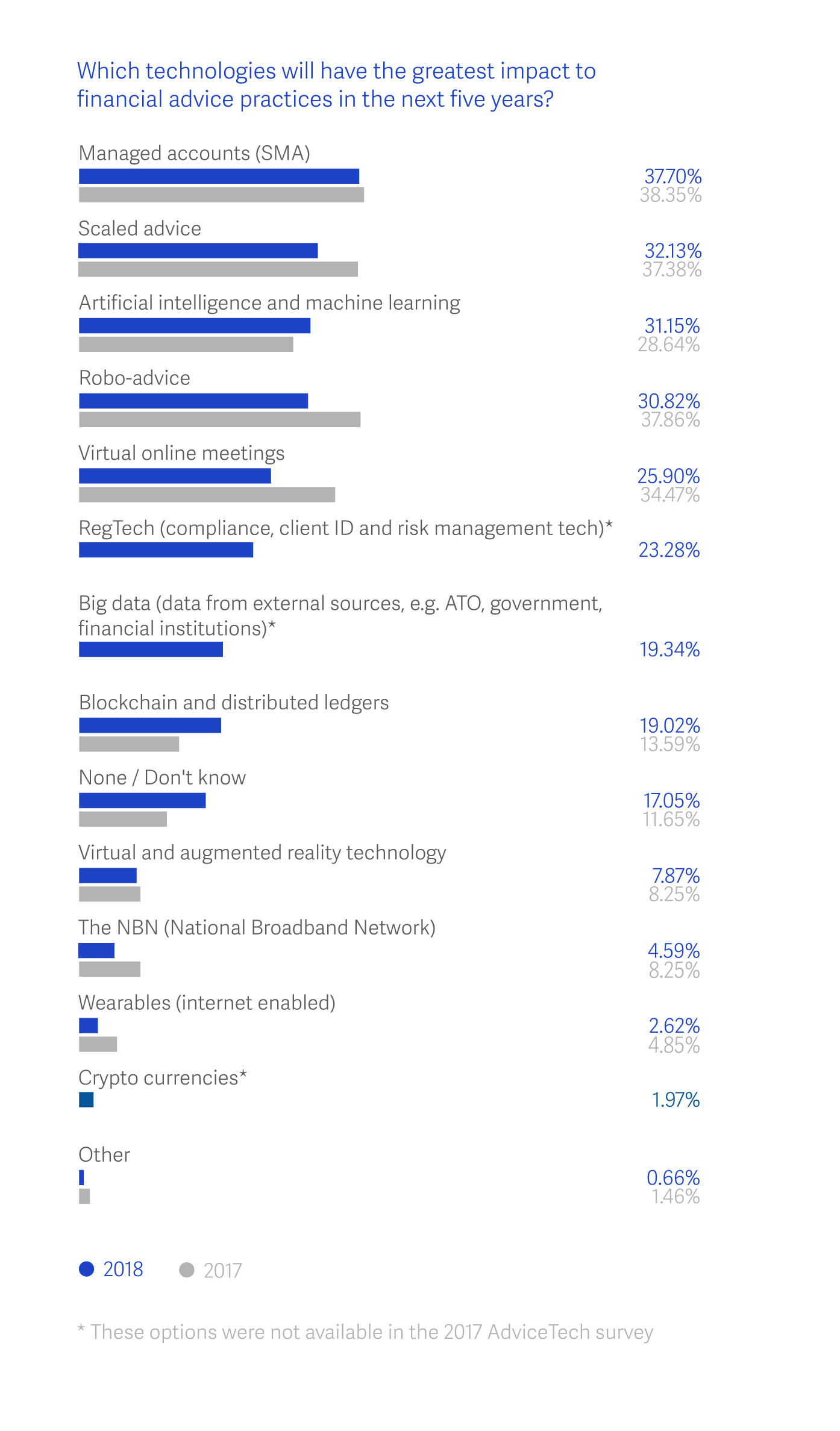

According to the 2018 AdviceTech Research Report 19.34% of advisers believe the big data (from external sources, e.g. ATO, government, financial institutions) will have the greatest impact to financial advice practices in the next five years.

Source: 2018 Netwealth AdviceTech Report

Big data, cash flow and budgeting

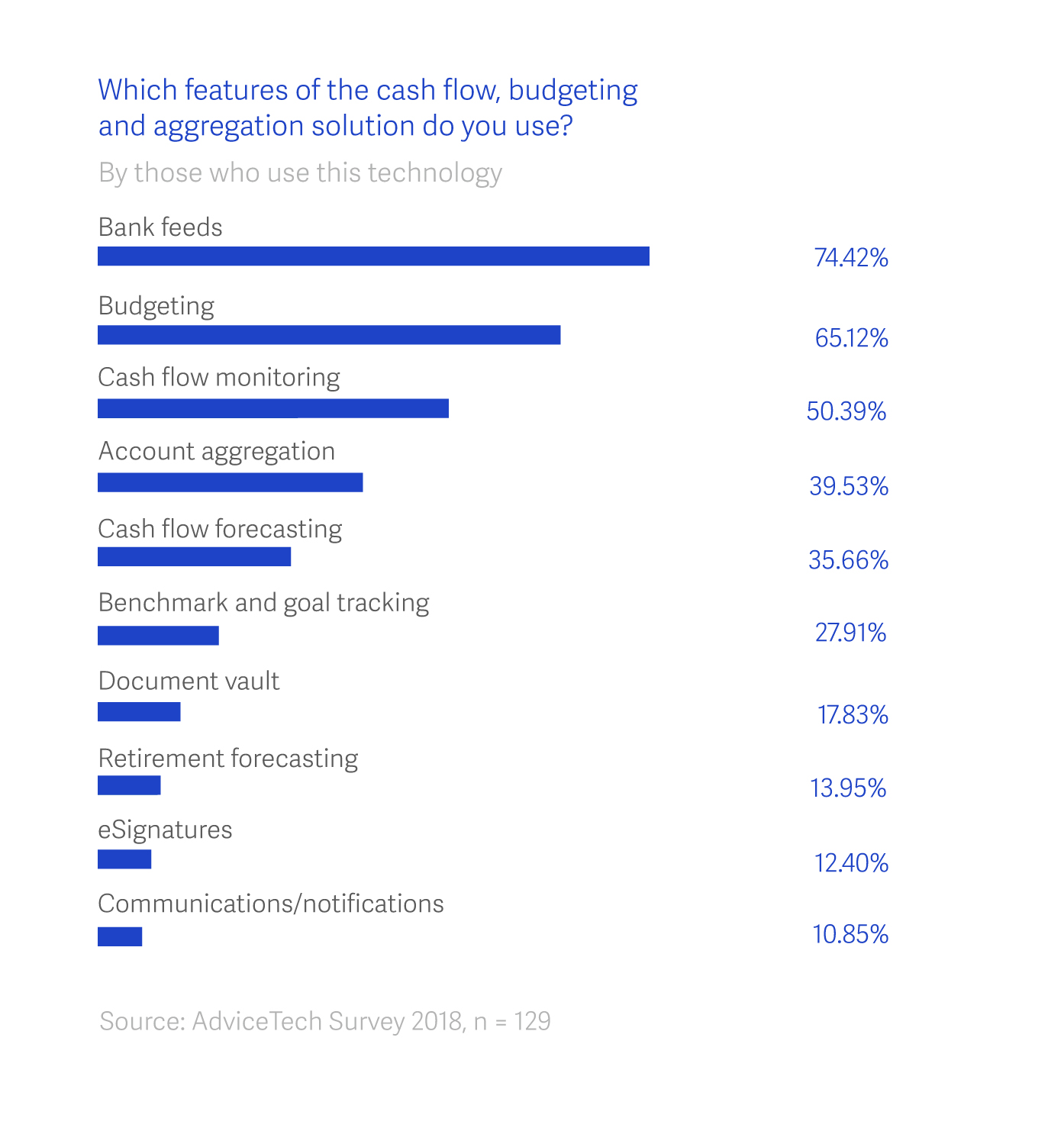

The 2018 Netwealth AdviceTech Research Report, gave a strong indication of the impact big data sources could have on advice, particularly around budgeting and cash flow tools.

Real time data feeds from hundreds of financial institutions means these sorts of tools can be pre-populated, up-to-date and living documents, enhancing the role of advisers and the experience customers who want to be educated and involved in the process.

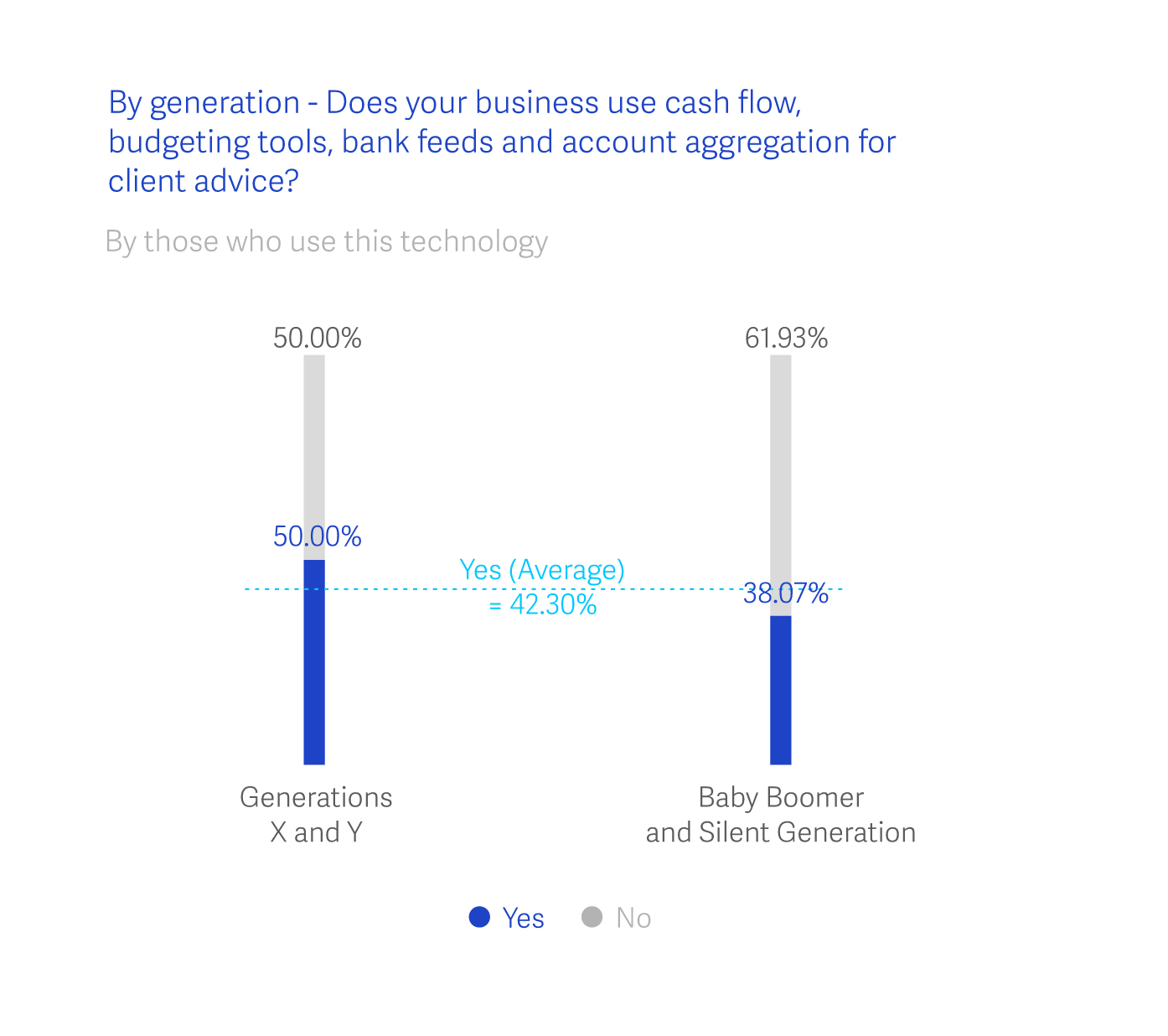

At the time, 42.30% of advice business surveyed used cashflow, budgeting and account aggregation tools and by 2020 61.97% report they will be using them.

Interestingly, advisers servicing Gen X and/or Gen Y clients, are bigger users of cash flow, budgeting and account aggregation tools. Fifty percent of these advice businesses use these tools, compared to only 38.07% who primarily service Baby Boomers and Silent Generation clients.

Source: 2018 Netwealth AdviceTech Report

Based on these usage statistics from the Netwealth AdviceTech Report, it is fair to say the capabilities of these tools are relatively untapped, however this may change by 2020.

This reflects the growing understanding advisers have of how advicetech tools can fit into their businesses.

Further, the list of features that these technologies can offer, are hard to ignore. The fore mentioned real time data feeds from many financial institutions not only helps clients keep on track, but also helps advisers to understand their clients position and to engage with them.

Moving forward, accessing data feeds will provide advisers with information on an individual’s income, credit card debt, insurance, living expenses – basic risk profiling information that currently is time consuming and laborious.

Customer (data) DNA

But not only will risk profiling and budget and cashflow tools be living documents with real time updates, the scope of the information advisers can access is much wider.

Today research companies such as Roy Morgan Research and Experian overlay the Government’s Census data with research techniques that give us deeper understandings of groups of people.

For example, they can overlay the age, income and car information that relates to a postcode, with information that groups people by beliefs, financial approach, retail and leisure preferences and attitudes to technology.

For an adviser to unlock this enriched Census data and get a richer profile of their clients, a residential postcode of the customer is all they will need.

Social media profiles also offer great insight into a client. Often these are accessible by having a client’s email. Using a customers LinkedIn, Facebook or Twitter profile can provide you information including their work histories, their interests and who they follow.

Removing friction from the advice process

Advisers are going to know a lot more about their clients, thanks to big data sources that create a three-dimensional profile of clients. This enhanced knowledge of customers, will lead to significant improvements in client engagement and new service offerings.

The age of the consumer means they expect a frictionless process where information can be transmitted between institutions, so time spent with an adviser is about uncovering their financial goals and identifying strategies that will help them protect and growth their wealth.

The age of big data and consumerism – will shape advice and how it is delivered.

Discover more tools to remove friction

- Examine the twenty-six technologies used by advisers in their practice in the 2018 Netwealth AdviceTech report

- Register your interest for the Netwealth Innovation Toolkit. This will provide you access to guides, activities and templates to run your own innovation workshops and transform conversations into actions.

- Contact one of our local BDM's for more information.

Recommending reading

AdviceTech Report

A comprehensive view of AdviceTech with special reports, articles, video and podcast interviews.

Glossary of AdviceTech

View a summary of 25 adviser technologies, highlighting key tech providers and benefits to advisers.

Lessons from the US

Find out which US trends in tech and innovation are set to impact the Australian advice industry.

AdviceTech landscape

Get your copy of the logo map created by Netwealth, as featured in the 2020 AdviceTech research report.