Take outs:

- Customer profiling is the first experience most consumers have of financial advice, and yet today, it remains one of the most time intensive and inefficient part so of the advice process.

- Customer profiling technologies including chatbots and gamification, are changing this part, dragging advice into the 21st Century and allowing it to meet consumer expectations on experience and service delivery.

- Data feeds and AI are enabling larger amounts of information to be used to profile consumers and by harnessing the potential of AI, new links and patterns can be found in the data sets, further enriching the advice experience.

The advice process is undergoing a transformation that is integrating the very best of technology and fintech innovation, to make it on par with the leading lights of customer experience. At the forefront of this transformation is client profiling technologies, which are re-shaping and redesigning the way consumer engage with advice.

These technologies are helping to make advice a more frictionless process. In the advice process, friction is generated in several ways including the use of different technologies using different data sets that slow down the process, making it inefficient and unengaging.

Throw in the use of paper, the reloading of information, not to mention the collection of information that is either not relevant or is not collected and which could be very relevant, and the customer profiling process is far from being smooth and seamless.

From a customer service point of view, a service provider that can offer its consumers a smooth and seamless experience, is not only keeping up with existing customer expectations, but providing a more engaging, timely, efficient and more enjoyable service delivery.

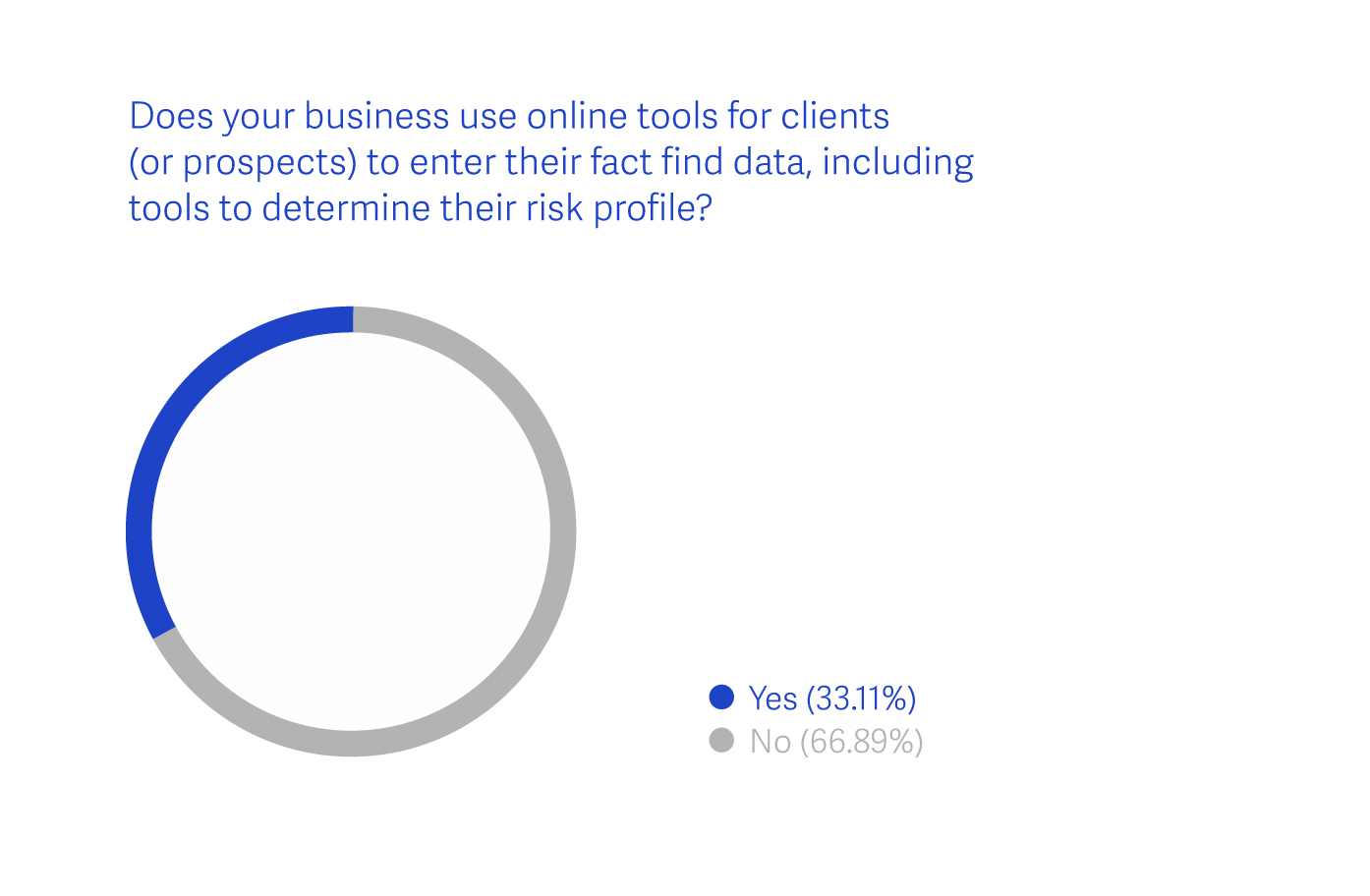

The recent Netwealth AdviceTech research report provides valuable insight into how advisers are currently approaching client profiling. The report, which looked at the technology behaviours of over 300 advisers, found 33.11% of advice businesses used online self-service tools to capture customer information, including their risk profile.

Source: 2018 Netwealth AdviceTech Report

This suggests that most customer profiling activities are happening in person, probably during face-to-face meetings. Information is most likely captured using a pen and paper to be later transcribed into a system for analysis and interpretation.

Often the information is incomplete in the sense that clients may not know what they don’t know or may not have easy access to the required information, such as how much they spent over the past 12 months and on what.

Post-meeting, the adviser will analyse this often-incomplete data, usually typing data points into a software system. And then the client will have to come back for another meeting, often face-to-face.

But it need not be like this!

Think about a scenario where prospective clients, having already bought into the process and potential fee structure, go online in their own time and complete a fact-find and risk profile. This online information then flows directly into your planning software, allowing you to analyse it prior to even meeting with the client a second time.

This means that the next meeting will be all about educating the client, confirming assumptions and discussing investment options. A lot of friction has been removed from the profiling process. Happy you and happy client!

Better still, a range of new technologies, already available, look set to further enhance things and reduce even more friction.

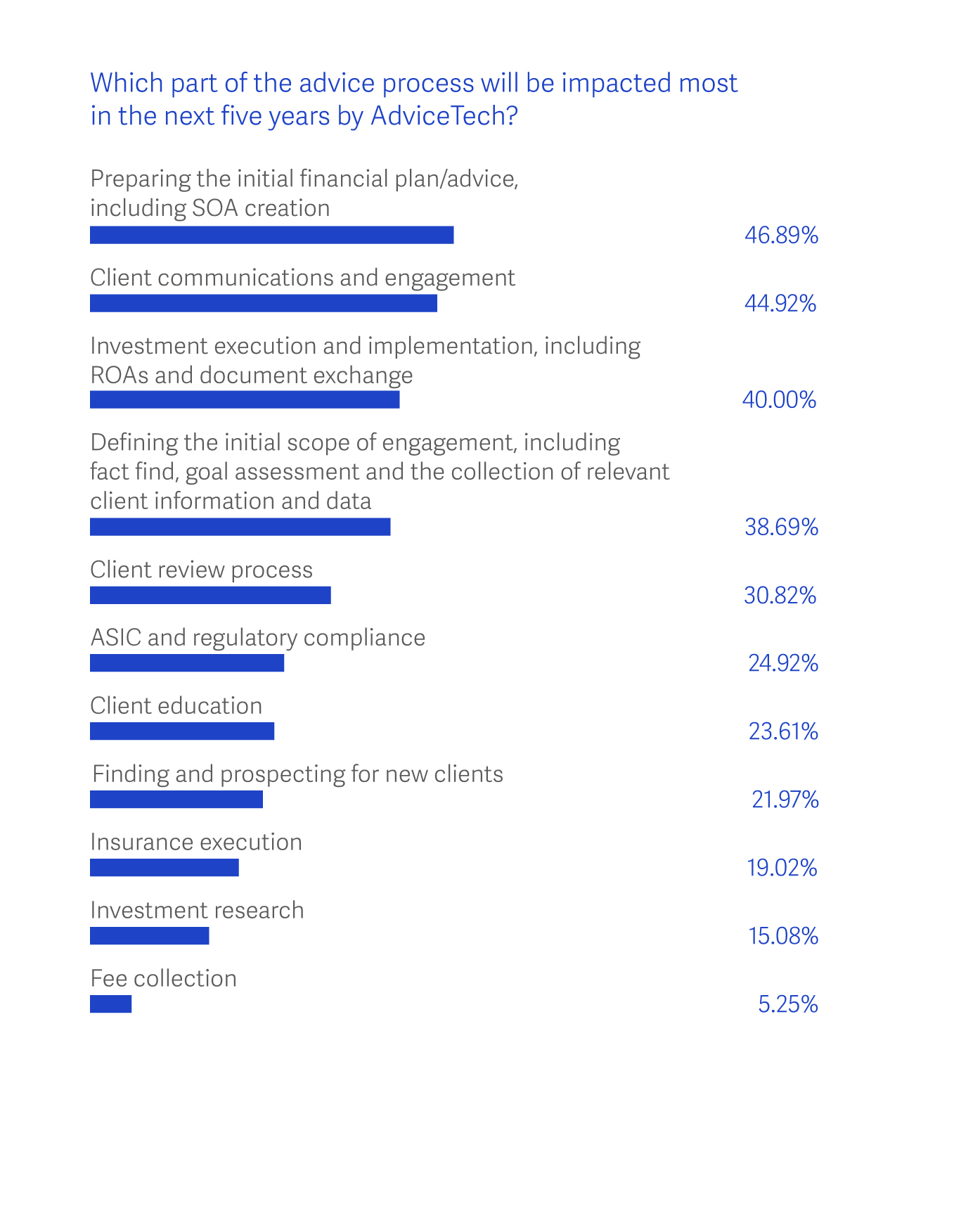

In the 2018 AdviceTech Report, 38.69% of advisers indicated that the advice process to be most impacted in the next five years was the process of defining the initial scope of engagement including the fact find, goal assessment and the collection of relevant client information and data.

Source: 2018 Netwealth AdviceTech Report

Technologies like chatbots, image-based surveys, external data feeds and AI are becoming more important in other industries and, we believe, will be used for this purpose by 2025.

Here’s an insight into how they may work:

Chatbots

Imagine that instead of using an online customer profiling survey, you engage with a prospective or existing client via a chatbot. Tools to do this, such as Surveybot or Typeform, already exist.

Firstly, you’d create a customer profile survey using an online drag and drop interface. Then you might add conversational logic, such as custom greetings and natural language responses, to make it feel less like a survey and more like a conversation.

After that, you’d invite your clients to complete the survey using their favourite messaging tool, for example, Facebook Messenger. And, they can do this where and when they want to as this technology works just as well on a mobile as it does on a desktop.

Later, you’d analyse the responses online and might even import the response data to your strategy software.

Voilà. You’ve made what is arguably a mundane consumer task more fun and engaging, and you’ve reduced the friction. Plus, you will be better engaging with a different type of audience: the younger generation which is familiar with this technology and uses it frequently.

Gamification

Most of the risk profile questionnaires we use today were designed to overcome a human problem –that our brains just aren’t wired to make accurate risk predictions.

Yet, these risk profile surveys can be flawed in many ways.

For example, their questions are often overly technical in nature. Answering questions such as ‘what would you do if your assets fell by 20%?’ or ‘what percentage decline in your portfolio’s value would you consider acceptable?’ can be very difficult for clients who are not financially literate or have had little investment experience.

Added to this are the issues of response bias (where a person says one thing, but behaves quite differently when it comes to a real-life situation) and the client’s actual ability to weather the risks of a selected investment portfolio.

In the future, these flaws will increasingly be overcome. Companies like Riskalyze and Capital Preferences, for example, are trying to simplify and gamify traditional questions to make them easier to answer and get around some of the natural biases evident in traditional risk profiling techniques.

Data feeds

Current customer profiling techniques require a person to answer a survey, converse with a chatbot or play games with a machine. But there are many other ways we can learn about a person. The use of third party data feeds, for example, is becoming more and more accessible.

Companies like Proviso, Yodlee, eWise and even MYOB can already provide data feeds from financial institutions on a real time or near real time basis.

In addition, the banks themselves are beginning to open their data via application programming interfaces (APIs) as part of an open-bank initiative, with Macquarie Bank the first to take the leap.

This means that once your clients provide the online authority to do so, their financial institutions can pass their account and transaction details to your software provider.

Netwealth 2018 AdviceTech research report

The second Netwealth AdviceTech research report examines twenty-six technologies used by advisers in their practice – their adoption, benefits and key suppliers.

So why can’t you use this data as part of your customer profiling exercise?

Fintechs, such as Moneysoft and myprosperity, are already taking advantage of this to provide cash flow and budgeting tools.

Firstly, it will help you quickly access some basic information about your clients’ financial position, such as their investable assets, income, credit card debt, living expenses and how much they might need in retirement.

It will also help you identify whether your clients have insurance and at what levels (through their premium payments), whether they have a mortgage and are in mortgage stress, and whether they are making additional super contributions.

Another future source of richer client information is likely to be the government.

As part of the Government 2.0 initiative, data.gov.au was launched, providing an easy way to find, access and reuse “national interest” datasets from the government.

Overtime, this could allow us to access government agencies like the Australian Taxation Office for information such as taxable income and assets that have been sold with a capital gains tax event.

Then there’s the national census conducted every four years. The data it produces allows us to understand the profile of households at a postcode level. And companies like Roy Morgan Research and Experian are taking this even further, using their research technologies to create even richer postcode profiles with behavioural and attitudinal information.

Just asking your clients for their postcodes in your initial customer profile could prove very valuable. So too would be asking them for their email addresses.

Modern customer relationship management (CRM) systems often have a social “plugin” that sucks in social media data about a person. Public profiles available on LinkedIn, Twitter and Facebook are often accessible by just having a person’s email address. And, by looking at a person’s social media profile, you can identify their interests, where they’ve worked and their spheres of influence. Again, you are gaining a richer view of the person.

However, with all these new techniques and data sources you could gain too much information about a person to physically or mentally handle. In fact, you may end up needing a data scientist to make head or tail of it all.

Enter AI

AI is growing in popularity as it increasingly helps find the “unknown knowns” in large data sets and identifies the links and causalities between data points that are just not obvious to the layman.

Great examples include IBM Watson’s Personality Insights and Tone Analyzer tools which help predict personality characteristics, needs, values, emotions and social tendencies through written text.

AI, of course, is still in its infancy, but it’s hard to begin to even imagine what you will be able to learn about your clients without speaking to them in the future.

Looking ahead, it’s going be far easier for your clients to deal with you and you are going to know a lot more about them. But customer profiling is just the start. New technologies will keep removing frictions across the entire customer journey. And it won’t stop as new advancements keep lifting the bar on what customers perceive as the norm.

Discover more tools to remove friction

- Examine the twenty-six technologies used by advisers in their practice in the 2018 Netwealth AdviceTech report

- Register your interest for the Netwealth Innovation Toolkit. This will provide you access to guides, activities and templates to run your own innovation workshops and transform conversations into actions.

- Contact one of our local BDM's for more information.

Recommending reading

AdviceTech Report

A comprehensive view of AdviceTech with special reports, articles, video and podcast interviews.

Glossary of AdviceTech

View a summary of 25 adviser technologies, highlighting key tech providers and benefits to advisers.

Lessons from the US

Find out which US trends in tech and innovation are set to impact the Australian advice industry.

AdviceTech landscape

Get your copy of the logo map created by Netwealth, as featured in the 2020 AdviceTech research report.