In an era shaped by e-commerce, streaming platforms, and digital-first experiences, advice clients have come to expect hyper-personalisation as standard. Netwealth’s 2025 AdviceTech report, Turning data into growth, identifies ‘Data driven personalisation’ as a key trend reshaping how advice businesses engage with clients. This trend reflects a shift from generic communication to tailored, timely, and context-aware communications that meet clients where they are, both in life and in their financial journey.

Key takeaways:

- Clients expect tailored, timely advice.

- Triggered alerts and automated workflows enhance engagement.

- Personalisation is balanced with compliance.

Triggered alerts

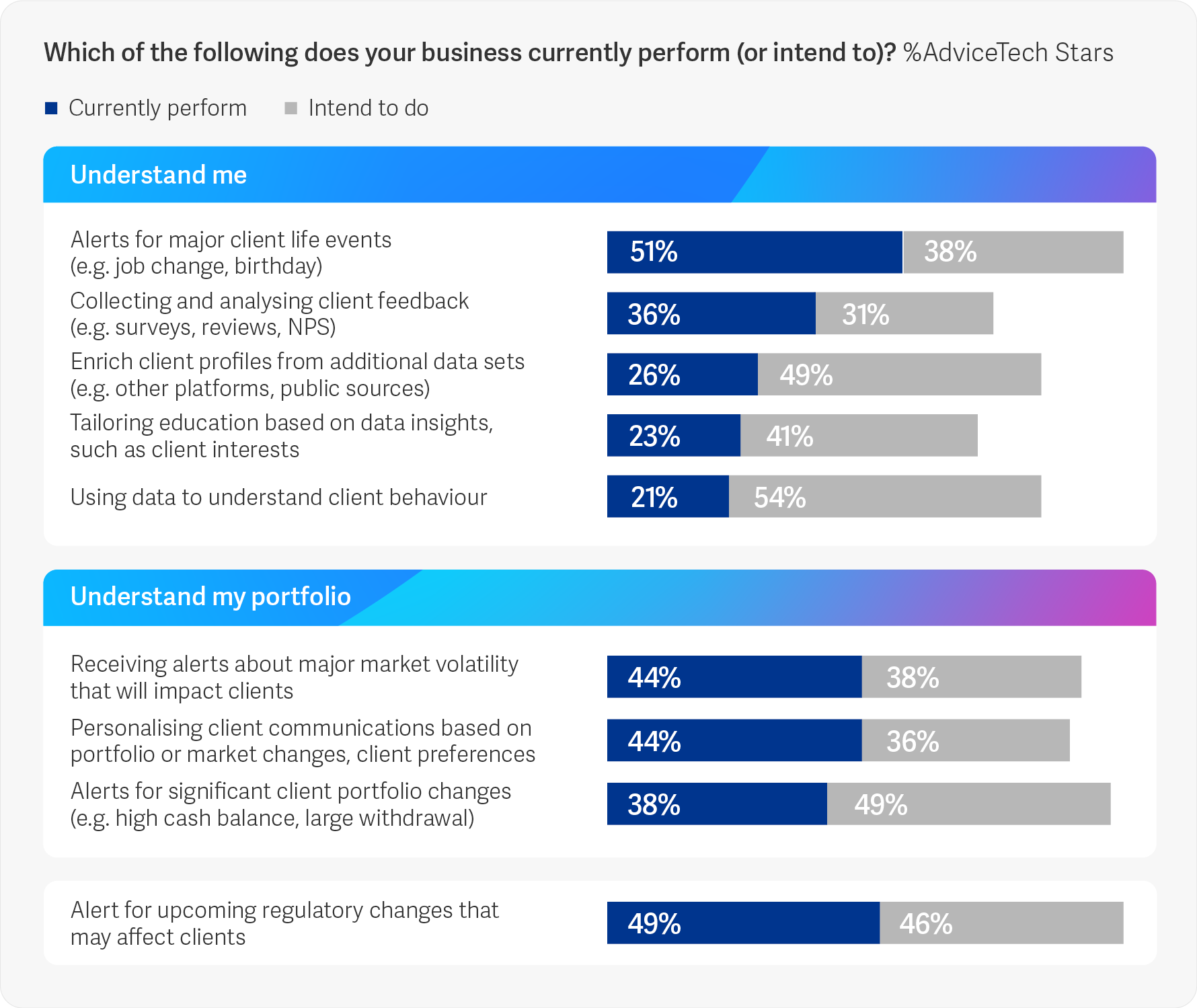

Data-driven personalisation strengthens client relationships. AdviceTech Stars, the businesses leading in technology adoption (and who enjoy greater commercial success than the average), are embracing personalisation not just as a marketing tactic, but as a core operational strategy. They are using data to understand client behaviours, anticipate needs, and deliver relevant advice at the right moment.

A powerful tool in personalisation is the use of triggered alerts. These are automated notifications that respond to a client’s life events, portfolio changes, or behavioural signals. They allow businesses to deliver advice that is not only timely, but highly relevant to the client’s situation.

The report reveals that over half (51%) of AdviceTech Stars receive triggered alerts based on client activity or portfolio exceptions. These alerts can be used to initiate personalised communications, schedule reviews, or recommend adjustments to investment strategies. For example, a change in a client’s employment status might trigger a conversation about superannuation contributions, while a portfolio deviation could prompt a rebalancing recommendation.

This approach transforms reactive advice into proactive engagement. It ensures that clients feel seen and supported, and it positions the adviser as a trusted partner who understands their evolving needs.

Source: Netwealth AdviceTech 2025 research

Automated workflows

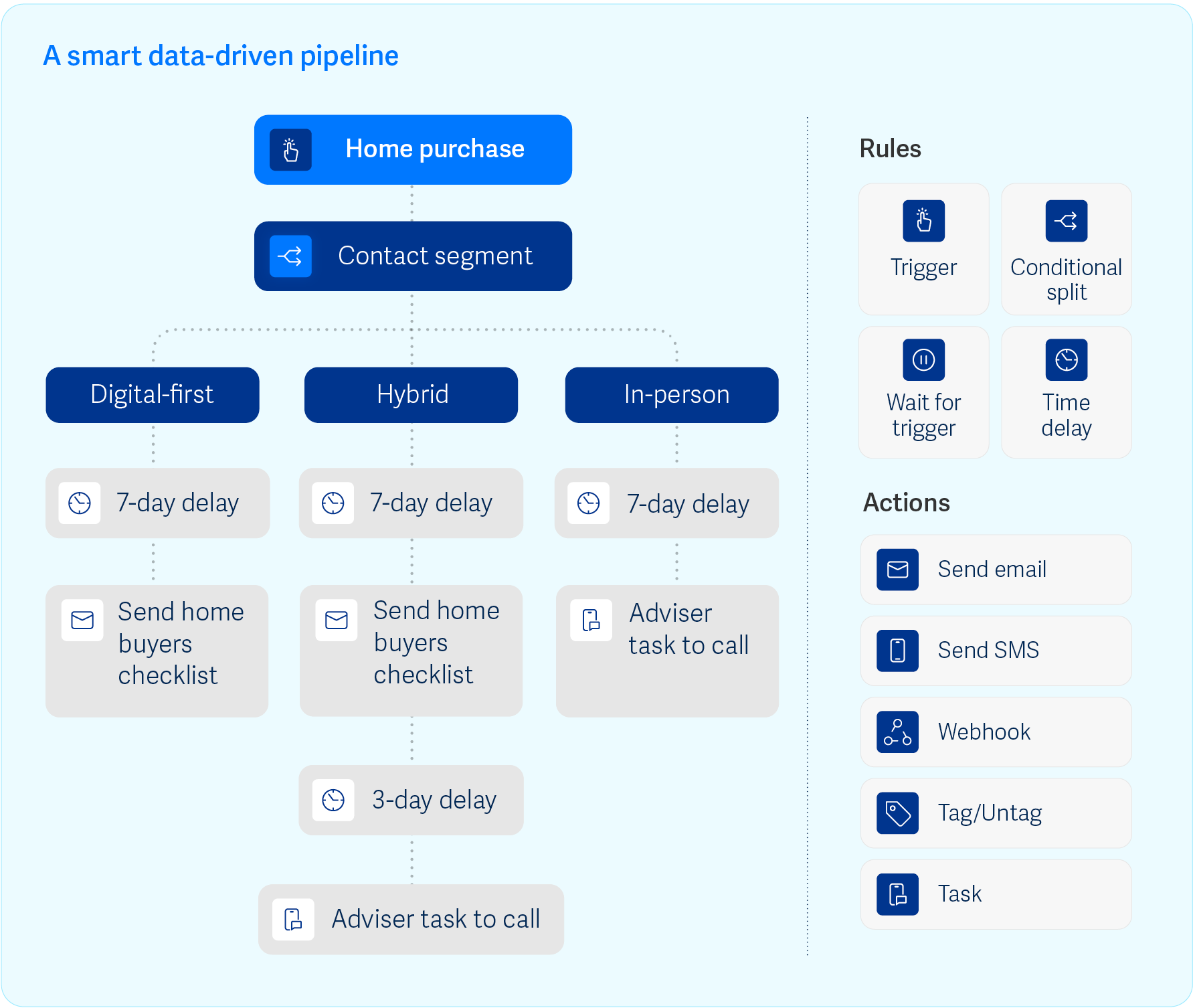

Personalisation at scale requires automation, and AdviceTech Stars are building workflows that combine structured data with behavioural insights to deliver tailored advice efficiently. These workflows respond to triggers such as a birthday, market event, or a change in financial goals, and initiate actions like sending a personalised message, scheduling a meeting, or updating a financial plan.

Importantly, these automated processes are not replacing an adviser’s judgement, but they are enhancing it. Advisers retain oversight and control, ensuring that every interaction remains compliant and aligned with the client’s best interests.

Balancing personalisation with compliance

As businesses move toward personalisation, maintaining compliance is critical. The report shows that AdviceTech Stars are successfully navigating this balance by embedding governance into their workflows. Role-based access controls, audit trails, and secure communication channels ensure that personalised advice is delivered responsibly and securely. By combining automation with strong compliance frameworks, advice businesses can personalise at scale without compromising trust or integrity.

The impact on client experience

The benefits of data-driven personalisation extend to enhancing the client experience. Clients receive advice that is relevant, timely, and tailored to their unique circumstances. Clients will feel understood and valued, and are likely to be more responsive to advice that resonates with their goals and life stage. This should strengthen the adviser-client relationship for the future.

The Netwealth AdviceTech 2025 report shows the advantages of personalisation in the advice industry. By leveraging data, automation, and behavioural insights, businesses can deliver advice that is not only compliant and efficient, but human. As client expectations evolve, businesses that embrace data-driven personalisation will be best positioned to grow, differentiate, and thrive.

More articles:

- Overview: Get to know AdviceTech Stars, and what they are doing differently.

- Trend 1: Turning data into action - how dashboards and KPIs are driving smarter decisions.

- Trend 2: Personalisation at scale - how to use data and alerts to deliver more relevant advice.

- Trend 3: Automation across the lifecycle - how to streamline onboarding, reporting and client reviews.

- Trend 4: AI goes mainstream - how you can embed GenAI into your daily advice workflows.

- Trend 5: Trust and cybersecurity - how to safeguard client confidence in a digital world.

- Trend 6: A connected data backbone - how to build the data foundation for integration and scale.

Report: 2025 AdviceTech - Turning data into growth

Report: 2025 AdviceTech - Turning data into growth

The convergence of a tech boom and a data boom are reshaping how advice is delivered. Are you turning that change into growth? This year, see how leading firms are embedding automation, dashboards and AI into daily workflows and get the practical playbook to do the same.

Download the reportKeynote: 2025 AdviceTech - The connected advice firm

Keynote: 2025 AdviceTech - The connected advice firm

Join Sophie Firminger, Head of Technology Sales & Consulting at Netwealth, as she unpacks the findings of the 2025 AdviceTech Report. Learn how the six key trends are reshaping advice, see real-world examples, and discover how you can put the playbook into practice.

Watch nowPodcast: Scaling advice with AI and avatars

Podcast: Scaling advice with AI and avatars

In this episode of Between Meetings, Dan Solin explores how AI and avatars can scale personalisation while keeping advice simple, transparent and client-first. He also explains how tech and human touch combine to deliver meaningful advice in a changing landscape.

Listen to the episode