They are increasingly making financial decisions, are at the receiving end of wealth transfers and are growing in affluence. Women are increasingly becoming a business opportunity for forward thinking advice practices.

Key takeaways:

- Women are a growing and potentially lucrative segment of the market, and many who are not currently advised are considering professional help

- The financial goals of women are primarily focused on security

- They are not always confident in achieving their investment goals

For advisers, women may be one of the most underserved and also most promising segments of the advice market.

The reasons for this are many. For a start, a significant segment of women are at the receiving end of a significant wealth transfer. Due to their longer average lifespans and the fact they tend to be younger than their husbands, many are in line to receive inheritance from Baby Boomer men who control a significant portion of Australia’s wealth. At the same time, females are increasingly taking on the burden of family wealth management. Meanwhile, the rise of the younger, educated, single affluent women presents an growth market for advisers (see our feature on this market segment later on).

It’s for this reason Netwealth developed the Women as the New Face of Wealth report, which surveyed 881 Australian women 18 years and over in late 2022.

The results highlighted the potential of this market. While a quarter of women currently use a financial planner, a further quarter are considering using one in the future.

What does wealth mean to women?

Developing a value proposition to target this key market goes beyond standard measures such as products, education and recruiting female advisers. It means revamping business and service models to attract and retain women as long-term clients by understanding their wealth management needs — but how?

Firstly, it’s worth recognising that for many women, wealth is a means to achieving a number of goals rather than an end in itself. The top three words women of all ages and life stages associate with wealth are: security (54 per cent), freedom (39 per cent) and stability (39 per cent).

This focus on stability becomes further evident when women were asked what financial success means to them. Topping the list was not being stressed about money (62 per cent), having enough set aside for unexpected events (53 per cent), a comfortable retirement (51 per cent) and having enough money to provide for family and loved ones (43 per cent).

These goals came above more lifestyle-oriented goals such as hobbies, travel and even spending more time with family and having more time to focus on their own health and wellbeing.

The consequences of women not achieving these financial security goals are clear, with over half of respondents (53 per cent) saying they worry about money at least weekly. This financial stress often permeates into many aspects of a woman’s life, with 35 per cent saying it had impacted their mental health in the past three years and 27 per cent their physical health. And 32 per cent said financial stress impacted family life, 33 per cent social life and 24 per cent work satisfaction.

Advisers play an important role in helping them address and manage these complex real-life stressors.

Which of the following demonstrates what financial success looks like for you?

Bridging investment goals and confidence

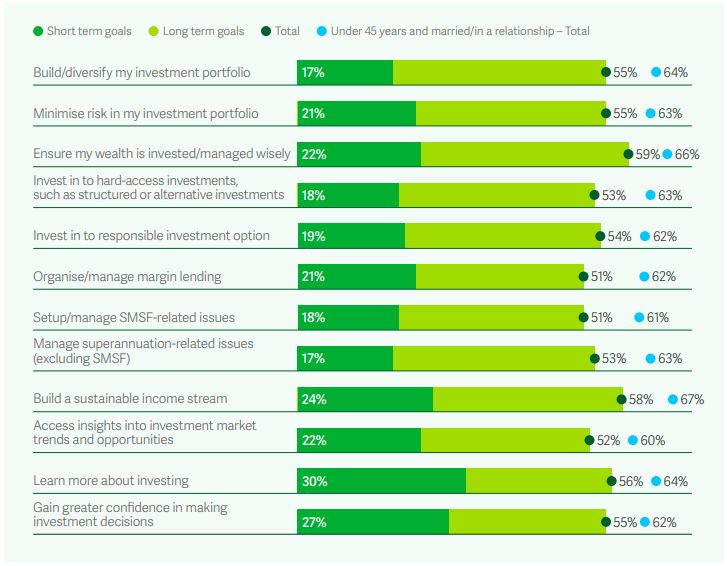

Women have plenty of investment goals, but only a small percentage feel fully confident in achieving them. Some of the top short-and-long-term financial goals they’re actively working towards include:

- Ensuring their wealth is managed and invested wisely (59 per cent)

- Building a sustainable income stream (58 per cent)

- Learning more about investing (56 per cent)

- Gaining greater confidence in making investment decisions (55 per cent)

- Building and diversifying their investment portfolios (55 per cent)

- Minimising risk in their investment portfolio (55 per cent)

Despite these clearly defined goals, the research also shows that less than 20 per cent feel very confident about achieving them. Only 42 per said they feel confident in making decisions about their investing activities, while another 23 per cent said they do not feel comfortable at all.

In line with this lack of confidence comes a desire for support. When choosing long-term investments like superannuation or a share portfolio, 53 per cent look for support or outsource decisions entirely. It’s similar for major investment decisions like buying a property, where 57 per cent rely on external help. When seeking investment advice, they primarily turn to their network of family and friends (44 per cent), followed by research from a wealth adviser (28 per cent), and investment websites, blogs or podcasts (27 per cent).

There’s also plenty of appetite for education, with 55 per cent of women saying they are eager to learn more about money matters.

Many women are underprepared for their growing wealth management responsibilities and financial security needs. Advisers ignore this segment of the market their own peril.

Women as the new face of wealth - Advisable Australian 2023

A significant shift in wealth to women is happening due to several macro-economic factors, yet women are still underserved by the wealth industry. Netwealth’s 2023 Advisable Australian report provides insights and opportunities for wealth managers to better service women and to significantly improve their financial experience and outcomes.