Take outs

- A rigorous assessment of the board and management is key

- Risk management enables you to play the defensive half of the investment game

- ESG presents an untapped source of information that can generate excess returns

An alternative investment will not always fit within the conventional asset classes, such as equities, bonds or cash. Instead, alternative investments include more exotic investment opportunities such as private equity, hedge funds, commodities and real estate.

Since alternative investments are so diverse and lie outside of the mainstream, they are not always well understood.

Jason Koo, a portfolio manager at Macquarie, joined Netwealth recently for the webinar The role of alternative investments in a diversified portfolio, to provide insight into alternative investments, and how hedge fund managers can help smooth portfolio returns through diversification.

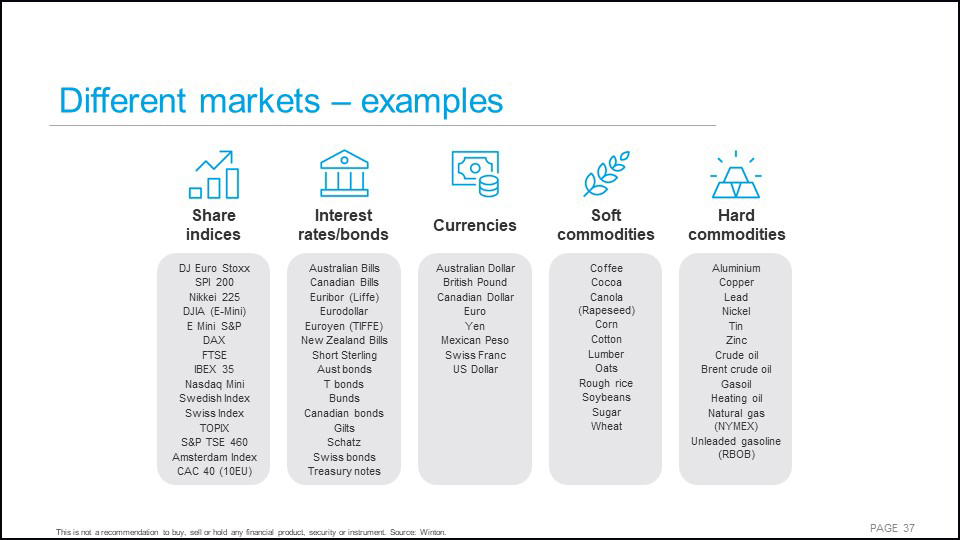

According to Jason, alternative investment managers often have a broader opportunity set than conventional managers given they can use different investment techniques, through instruments such as futures, to gain exposure to many different markets.

Below we explain four common techniques used by hedge fund managers that have the potential to deliver returns that are uncorrelated to equity and bond markets. These include directional positions, trend following, fundamental investing, and relative value investing.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.

1. Directional positions

Directional positions are employed by hedge fund managers to gain exposure to different markets to potentially profit from both up and down price movements. This is different from a traditional equity or bond investment which only profits when prices rise.

Investment Managers can implement a basic directional trading strategy by using futures contracts to take a ‘long’ position, if the investor believes the market or security is going to rise, or a ‘short’ position, if the investor believes the market or security price is going to fall.

“When trying to profit from rising prices, the investor is said to go ‘long’. When trying to profit from falling prices, the investor is said to go ‘short’,” Jason explains.

And an alternatives manager can not only trade equity and bond markets in this way, but also many other currency and commodity markets, such as the Mexican peso, coffee, natural gas or copper.

Source: Winton

“Not only can we profit when they increase in value, that is by going ‘long’, we can also profit when they fall in value, by going ‘short’. Hence, alternative investments can diversify a traditional bond and equity portfolio,” Jason says.

2. Trend following

Like directional investing, trend following aims to generate profits by predicting the direction of prices, but specifically trend followers look at price movements over time to try to identify when price trends form and then invest accordingly.

And again, through this technique a hedge fund manager can seek to profit not just from upward trends in prices, but also from downward trends.

By definition, a price trend is the direction, or momentum, of the price of a security or other asset. As an example of price trends in action, Jason points to the sustained upward and downward movements of the S&P 500 index over different periods of time.

Source Bloomberg & Winton

“For the trend investor, if prices start in an upward movement, they will attempt to profit by going ‘long’ the asset in the hope that the trend will be sustained,” Jason explains. “If prices start a downward movement, the trend follower will ‘short’ the asset instead. They will exit their ‘long’ or ‘short’ position once the trend has ceased or has reversed.”

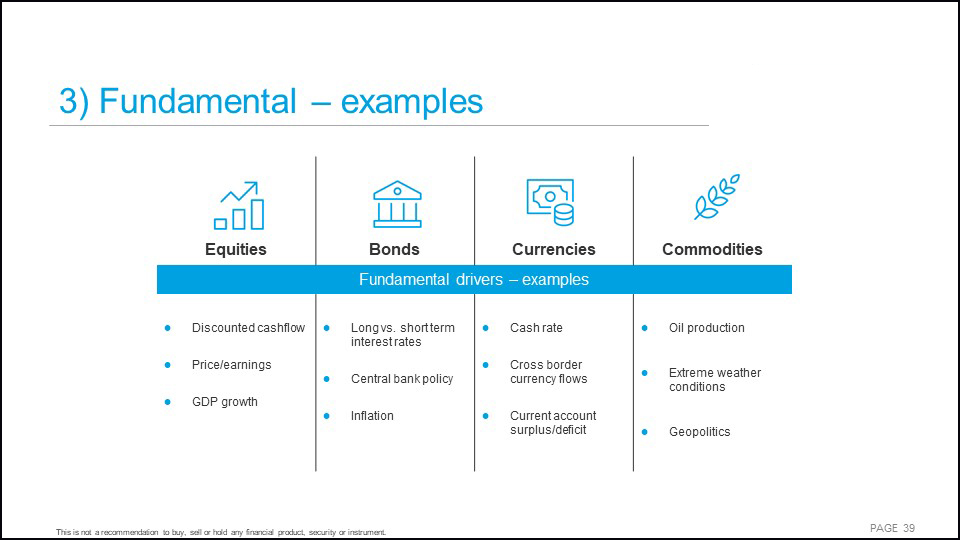

3. Fundamental investing

The third technique used by alternative managers that Jason covers in the webinar is fundamental investing. According to Jason, a fundamental investing approach can give managers access to new and different drivers of return. In other words, fundamental investing can help to diversify traditional bond and equity portfolios.

Source: Macquarie

Jason explains that when assessing the value of a physical asset, alternative managers can look to fundamentals in order to uncover their intrinsic worth.

“For example, if invested in a stock, we might perform a discounted cash flow to come up with a company’s intrinsic value,” he says.

“If the price is below an asset’s intrinsic value, the investor will go ‘long’ in the asset in the expectation that the price will eventually move towards its intrinsic value.” Conversely, if the price is above the intrinsic value, alternative managers can go ‘short’ in the asset.

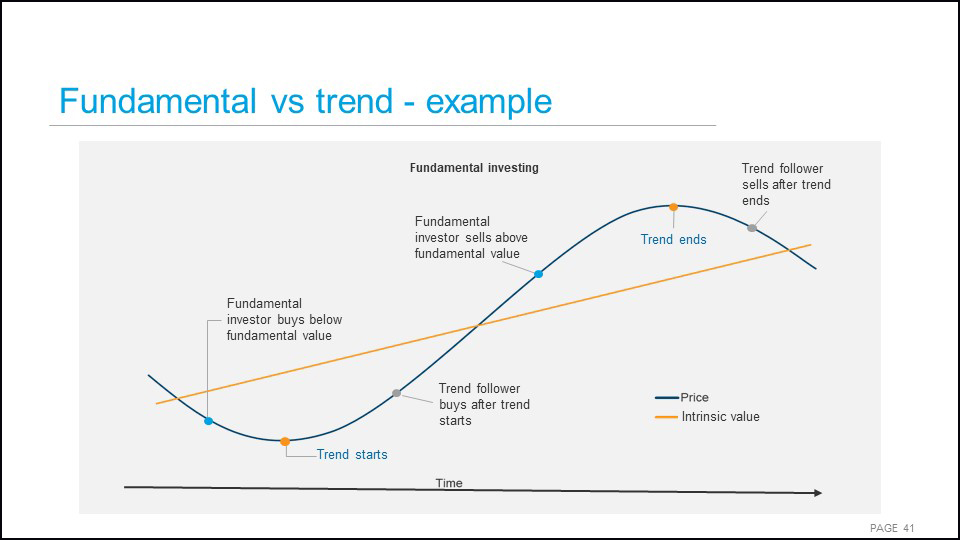

When comparing a fundamental investor with a trend follower, Jason explains that an underlying difference is the timing of when they will enter and exit their positions.

So, while both investment styles have the potential to generate profit over the long term, these profits can occur at different points in time.

Source Macquarie

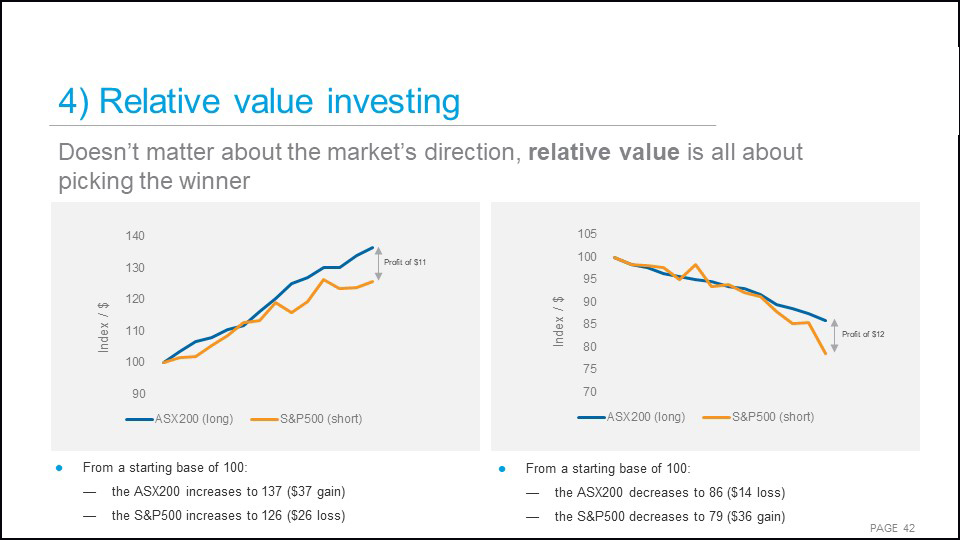

4. Relative value investing

Relative value investing is a method used to determine an asset’s worth by taking into account the value of comparable assets. It is not about picking the direction of prices, it is about picking winners and losers, says Jason.

So for example, when hedge fund investors are considering which stock to invest in, they do not solely look at the financial statements of the companies that have sparked their interest, rather they look at the financial statements in relation to their competitors to assess a stock’s value relative to its peers.

In order to demonstrate relative value investing, Jason presents two scenarios, both of which point to the ASX 200 outperforming the S&P 500. To capitalise on the outperformance of the ASX 200, the investment manager can place a ‘long’ position on the ASX 200 and a ‘short position in the S&P 500.

“It doesn't matter if the ASX 200 or S&P 500 rise or fall in value. As long as the ASX 200 outperforms the S&P 500, profits will be made,” explains Jason.

Source: Macquarie

Learn more

Listen to the Netwealth webinar, The role of alternative investments in a diversified portfolio’, for more on how to diversify your portfolio.

You may also enjoy

Investment strategies

Investing in a late-cycle market

Explore investment strategies and the potential benefits of bonds during periods of volatility.

Investment strategies

How to safeguard your investment portfolio

Learn how to develop an investment approach that considers potential risks and returns.

Investment strategies

Finding value in a volatile market

Discover how to find value in the market by identifying healthy sectors and strong stock countries.

The information in this article is general in nature. Any financial advice it contains is general advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. The article content is not intended to be a substitute for professional advice, so before you act on it you should determine its appropriateness having regard to your particular objectives, financial situation and needs, and seek any professional advice you require. Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.

This webinar guest is a financial product issuer. Netwealth and the guest have a commercial arrangement that enables investment in products managed by the guest through Netwealth’s platform. Under that arrangement, Netwealth may receive fees from the webinar guest. More information about the fees Netwealth receives is provided in our Financial Services Guide, which is available on our website or by contacting us.