Take outs

- Hybrids are generally ASX listed securities that sit between ordinary shares and debt

- Low volatility than shares but higher risk than debt

- Hybrids can add diversification to your portfolio

Investors have been attracted to hybrids in the past for their attractive franked income, low volatility and diversification benefits. But as an investment containing features of debt and equity it’s important to understand their structure, risks and rewards to make them work as part of your portfolio.

Chris Joye, Co-CIO at Coolabah Capital Institutional Investments and Portfolio Manager for Betashares Hybrid Active Australian Fund (ASX: HBRD) joined us for the Netwealth portfolio construction webinar, Hybrids: Opportunities, challenges and the state of play for Australian investors.

Chris discussed the basics of hybrids, smart management, volatility, correlations on returns and why Australian investors might consider this asset class as part of their diversified portfolio.

Getting to know hybrid investments

Hybrids are generally ASX listed securities that sit between ordinary shares and debt, often referred to as preferred equity or capital notes.

Most hybrids are issued by banks and insurers and have historically had around one-quarter to one-half the risk of shares but higher volatility than investment-grade floating-rate notes.

“They have features of debt and equity but in a corporate capital structure generally sit between equity and debt,” explains Chris.

Debt-like characteristics of hybrids:

- Pay a regular and defined margin above the bank bill rate (usually floating)

- Have a fixed date for optional repayment or conversion to shares

“Like debt, they’re ranked ahead of equity in wind up. If they don’t have a set date when they’re called in or repaid, most modern or so-called Basel 3 hybrids automatically convert to equity at around 10 years.”

Equity-like characteristics of hybrids:

- Are perpetual (no maturity date)

- May be converted into ordinary shares at a set date or by APRA during duress

- Issuers can suspend or delay payment of income like they can with dividends

“There’s normally penalties associated with suspending distributions. If they don't pay your income or interest they ordinarily aren't allowed to pay dividends on their equity either,” says Chris.

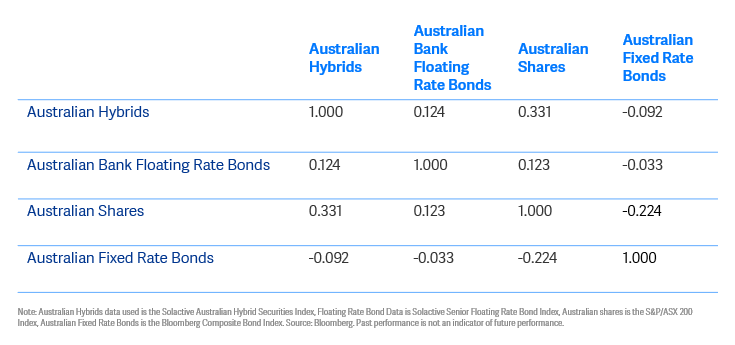

“Hybrid income is typically made up of annual cash yield that for many major bank hybrids today is around 4.0% to 4.5% plus the benefit of franking credits, which lift the total franked yield up around 6.0%.”

Running Yield across Security Types: As at 30 June 2018 (% p.a.)

Smart management of hybrids

Chris says like any investment, hybrids need to be managed carefully, paying attention to valuations, complexity, liquidity and opportunities for mispricings.

“There’s some tricks and traps with hybrids. It's a very inefficient market, and many folks can find it difficult to value these securities. They’re probably among the more complex securities in terms of trying to figure out what is the fair value spread or margin above bank bills that you should be paid,” he says.

“And with both retail and institutional investors participating, you can get overvaluations and undervaluations, which can create tremendous trading opportunities.”

Active engagement in your hybrid investments is key to leveraging their benefits.

“Most investors tend to hold their hybrids to maturity; they don't actively move in and out of hybrids. You need to be active if you want to capitalise on the mispricings that are evident day-to-day.”

The Netwealth Porfolio Construction Podcast

In this series, we speak to wealth professional experts in the investment area they are most passionate about, with the view to uncover potential investment opportunities and unique investment insights.

How volatile are hybrids?

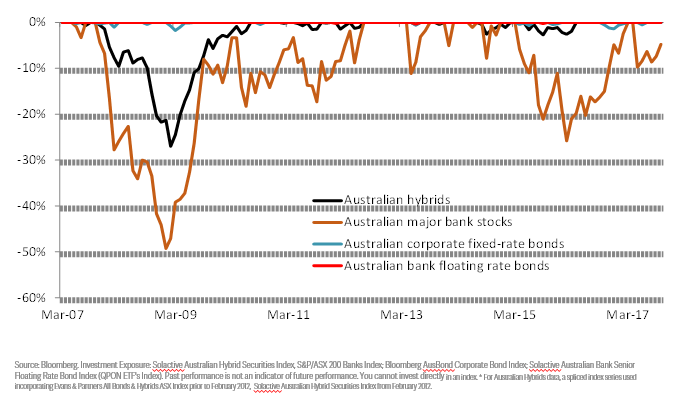

During the GFC, Australian hybrids fell about 25 percent in value compared to Australian bank stocks falling about 50 per cent.

“Since 2007 the volatility of the hybrid market has been about one third of the volatility of bank stocks,” he says.

“The major bank stocks have had return volatility of almost 19 per cent per annum whereas the hybrid market has had volatility of about six per cent per annum. That’s significantly lower risk than equities in both maximum loss and volatility terms.”

Annualised volatility

Understanding correlations

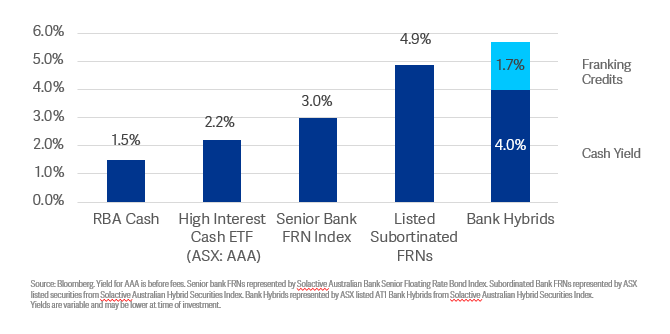

Correlations tell us how the performance of the hybrid market compares or moves relative to the performance of the equity market. If the correlation is one, they move in exactly the same way. If it's less than one, that means they're not perfectly correlated.

“The Australian hybrid market has had a 12.4 percent correlation with floating rate bonds and a 33 percent correlation with Australian shares,” Chris says.

“So, when other asset classes are moving in one direction, hybrids can move in a different direction. This speaks to the diversification gains hybrids can offer.”

Daily return correlation as at 30 June 2018

The risks of hybrids

Chris says understanding hybrids is crucial to managing the risks.

“The hybrid market is very inefficient. We see significant short-term swings in value across similar securities reflecting different investors’ perceptions on what these assets are worth, which can lead to mispricings that can be exploited,” he says.

“The bid-offer spreads (the difference between ASX best purchase price and best offer price) over time can be very wide while the liquidity can also be dispersed across multiple stock brokers’ internal networks or so-called dark pools.”

Hybrids issued by banks and insurers can be forcibly converted into equity or ordinary shares if the regulator APRA deems that the institution needs more core equity capital. This means that during a crisis you could end up holding riskier shares, although that might come at a time when those shares are relatively cheap.

Why hybrids could be part of building your portfolio

Hybrids can play a valuable role in portfolios in terms of both yield and diversification.

“Most hybrid securities have either a BBB or BB credit rating which means that they're either investment grade, sub-investment grade (aka high yield),” says Chris.

“Whether it's a defensive equity holding or high yield fixed income holding, we think there's a role from an asset allocation perspective for hybrids.”

The inefficiencies in the hybrid market open up the possibility for investors and active managers to generate alpha, which means improving returns without increasing risk.

“The smart way to leverage the market is by finding mis-priced hybrids. Look for securities that aren’t valued correctly, that are cheap, that are paying too much interest or income relative to their risk,” Chris explains.

“We will buy those securities, wait for the interest or income to normalise back to fair value, then sell them subject to any holding period rules around franking credits.”

Want to know more about hybrids for your portfolio?

Listen to the complete Netwealth webinar, Hybrids: Opportunities, challenges and the state of play for Australian investors.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.

The information in this article is general in nature. Any financial advice it contains is general advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. The article content is not intended to be a substitute for professional advice, so before you act on it you should determine its appropriateness having regard to your particular objectives, financial situation and needs, and seek any professional advice you require. Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.