Take outs:

- Frictionless advice is about making advice a seamless experience, a prevailing expectation of consumers thanks to the likes of leading customer experience businesses such as Airbnb and Google.

- However, the typical advice process does not stand up to this seamless experience test, with many signs of friction including how clients are profiled and onboarded.

- Technologies like chatbots, image-based surveys, external data feeds and AI are becoming more important in other industries and will become mainstream advice technologies by 2025.

Technology is driving new business models and creating new opportunities every day and companies in just about every part of the economy, whether it be wealth management, retail, manufacturing or even fast food, are examining how they can use technology to win over and keep their customers.

However, for most companies, harnessing the benefits of new technologies will not put them ahead; it will just help them keep their heads above water as customer expectations continue to evolve at a rapid rate.

Clients are no longer comparing advice businesses to other financial planning firms, banks or institutions, they are comparing them to leading technology brands such as Google, Airbnb, Amazon and Uber and they are, or will, demand the same level of personalised service, experience and engagement they get from the services they interact with every day.

In addition to expecting more from their existing relationships the ability for your clients to connect, interact and seek answers from a vast variety of sources has never been greater and therefore you need to be able to interact and engage with them across a growing number of channels.

Technology will change the advice process and the ongoing delivery and service model. Here are two areas of the process which can easily be improved and will have a significant impact on how you service your clients.

Netwealth 2018 AdviceTech research report

The second Netwealth AdviceTech research report examines twenty-six technologies used by advisers in their practice – their adoption, benefits and key suppliers.

1. Customer profiling and onboarding

Customer profiling and onboarding, which includes the fact find, is arguable the first interaction many advisers have with a client and, in addition to meeting regulatory requirements, helps identify a client’s objectives and risk profile which subsequently shapes the strategic plan and/or investment strategy.

It is also the point at which a client establishes their view of an adviser or practice and will set expectations for the future as well as influence their decision to move ahead with a financial plan.

Today this process typically commences with an interview or perhaps an online survey, but in the future I believe we will (and need to) see this part of the advice process change significantly.

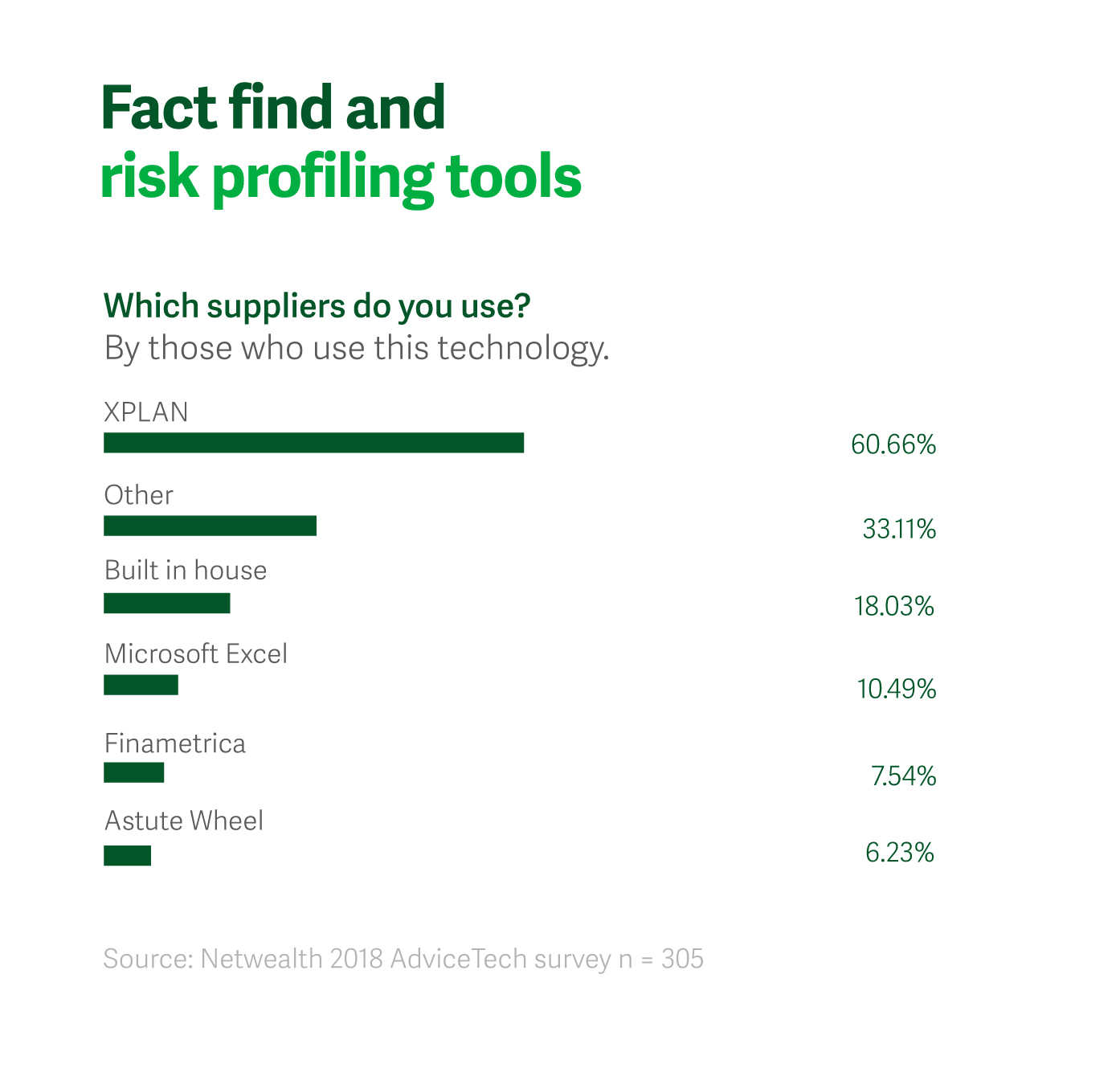

According to the 2018 Netwealth AdviceTech Research Report, only 33.11% of advisers use online self-service tools to capture client (or prospect) information used in the fact find process and risk profiling process.

Given the obvious benefits to clients and the relative ease of implementing this technology, we feel this statistic should improve in the coming years. Technologies already exist such as chatbots, where advisers can easily create online surveys and publish them to a person’s preferred messaging tool such as Facebook Messenger which then directly sync with the various systems required to complete the onboarding process.

One of the important benefits of a chatbot is that they are inherently appealing to younger generations who are already using their phone and messaging app to engage with businesses and resolve customer service enquires.

Simpler technology like online surveys can be implemented with little overhead or tech experience and tools such as Typeform (whose slogan is ‘ask awesomely’) can easily transform what is currently a “clunky” process.

In addition to data collection, “big data” and artificial intelligence (AI) is increasingly being used to source and analyse information such as Census, social media and banking data to enrich the information advisers can use to profile and understand their clients.

2. Investment execution

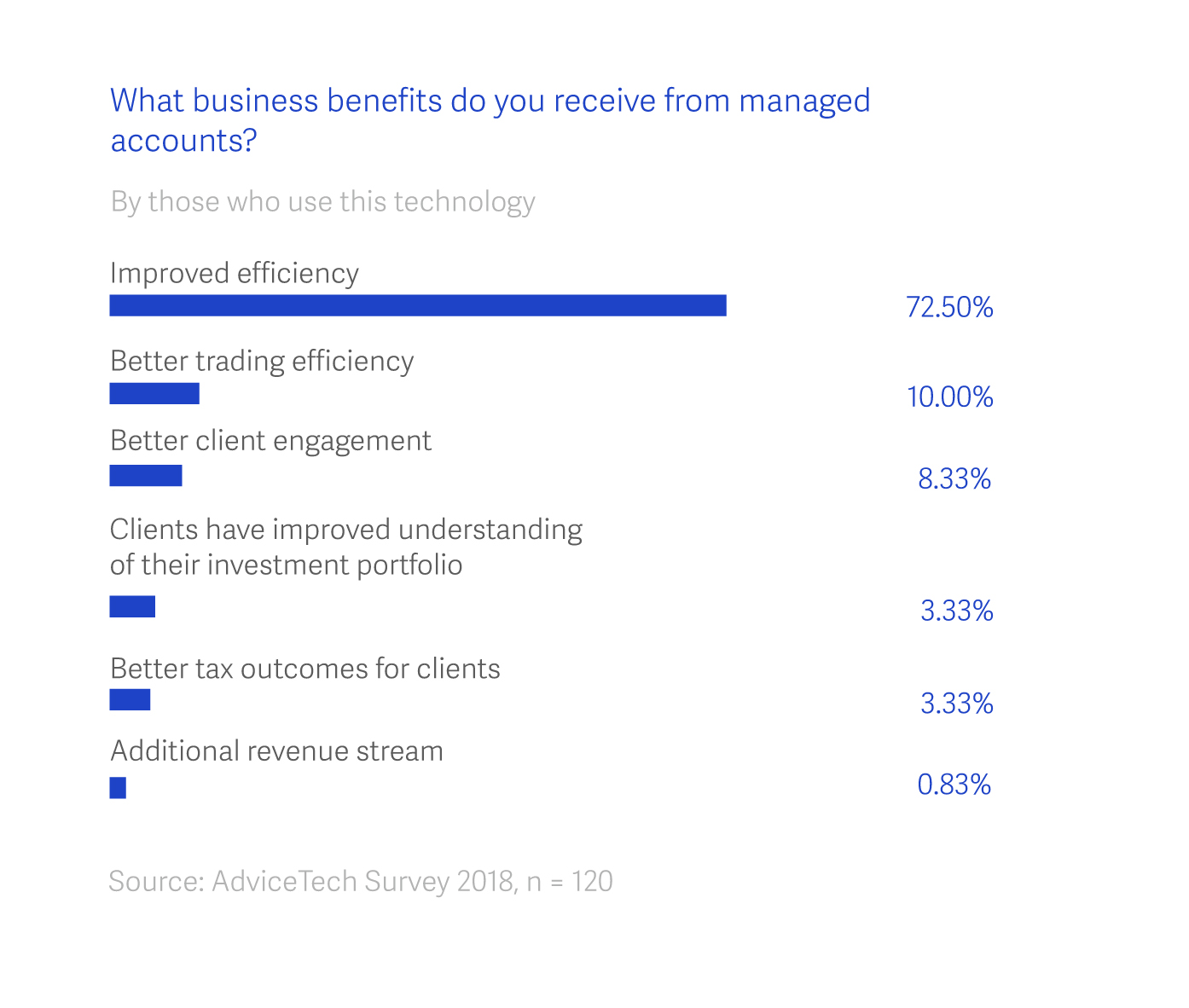

With the continued evolution and adoption of managed accounts and scalable investment solutions there are ample opportunities to deliver superior client outcomes whilst also making investment and portfolio implementation simpler and less time-consuming.

A lot has been written about the benefits of managed accounts and today 39.34% of advisers are utilising them in some way in their practice (2018 Netwealth AdviceTech Research Report). Importantly managed accounts are becoming increasingly sophisticated to support a broader set of asset classes, including international equities, as well as providing greater levels of customisation and “model of model” solutions that broaden the appeal to different client segments.

Further developments such as the ability to mass generate ROAs (Records of Advice) from a platform look to remove friction from the investment process and ensure a timely and consistent client experience more akin to the tech giants referenced earlier.

While robo-investing services are still in their infancy (only 3.61% of advisers are using them, according to the 2018 Netwealth AdviceTech Research Report), it is foreseeable that robo-investing will evolve and service parts of the market which are not currently viable for an adviser to manage due to the cost of delivering advice or geographical barriers.

Friction is the enemy of technology

Technology has the ability to impact and improve many parts of the advice process including how advice is delivered, client communications, the management of risk, compliance and to create operational efficiencies. With a focus on the client and their friction (or “pain”) points throughout the advice process, practices will go a long way in identifying and prioritising which parts of the process they should focus on first to deliver an outstanding and engaging client experience.

Discover more tools to remove friction

Examine the twenty-six technologies used by advisers in their practice in the 2018 Netwealth AdviceTech report or contact one of our local BDM's for more information.

Recommending reading

AdviceTech Report

A comprehensive view of AdviceTech with special reports, articles, video and podcast interviews.

Glossary of AdviceTech

View a summary of 25 adviser technologies, highlighting key tech providers and benefits to advisers.

Lessons from the US

Find out which US trends in tech and innovation are set to impact the Australian advice industry.

AdviceTech landscape

Get your copy of the logo map created by Netwealth, as featured in the 2020 AdviceTech research report.