“In the 2022 AdviceTech Report we have identified several technologies that are experiencing high year on year growth or have high intended adoption in the next 24 months – these technologies are the ones to watch out for,” claims Matt Heine, Joint Managing Director of Netwealth. “These include client portal technology, survey and client feedback tools and online fact-find and risk profiling tools.”

In the 2022 AdviceTech Report Netwealth examined the changing usage trends of AdviceTech through the lens of its newly developed AdviceTech Adoption framework. In this framework they grouped technologies that have been adopted widely by advice firms (and AdviceTech Stars a benchmark and trendsetter – see below for definition), technologies that are niche technologies and those that are growing in popularity.

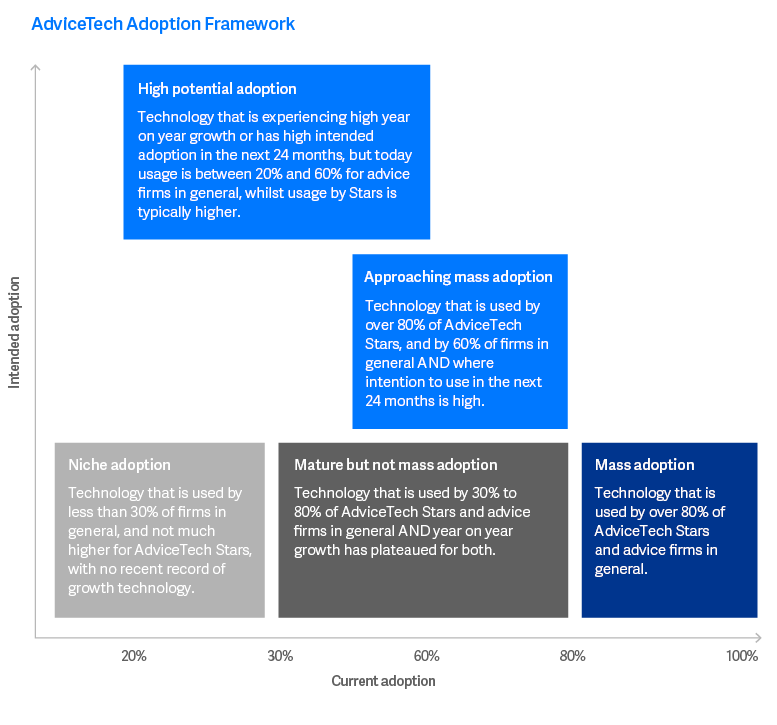

Netwealth AdviceTech Adoption Framework

Netwealth’s newly developed AdviceTech Adoption Framework considers current usage and intended usage of technology by AdviceTech Stars and firms overall. From this it identified five categories of technology adoption by advice firms:

- Mass adoption – technology that is used by over 80% of AdviceTech Stars and advice firms in general.

- Approaching mass adoption – technology that is used by over 80% of AdviceTech Stars, and by 60% of firms in general AND where intention to use in the next 24 months is high.

- Mature but not mass adoption – tech that is used by 30% to 80% of AdviceTech Stars and advice firms in general AND growth has plateaued for both.

- High potential adoption – Technology that is experiencing high year on year growth or has high intended adoption in the next 24 months, but today usage is between 20% and 60% for advice firms in general, whilst usage by Stars is typically higher.

- Niche adoption – technology that is used by less than 30% of firms in general, and not much higher for AdviceTech Stars, with no recent record of growth technology.

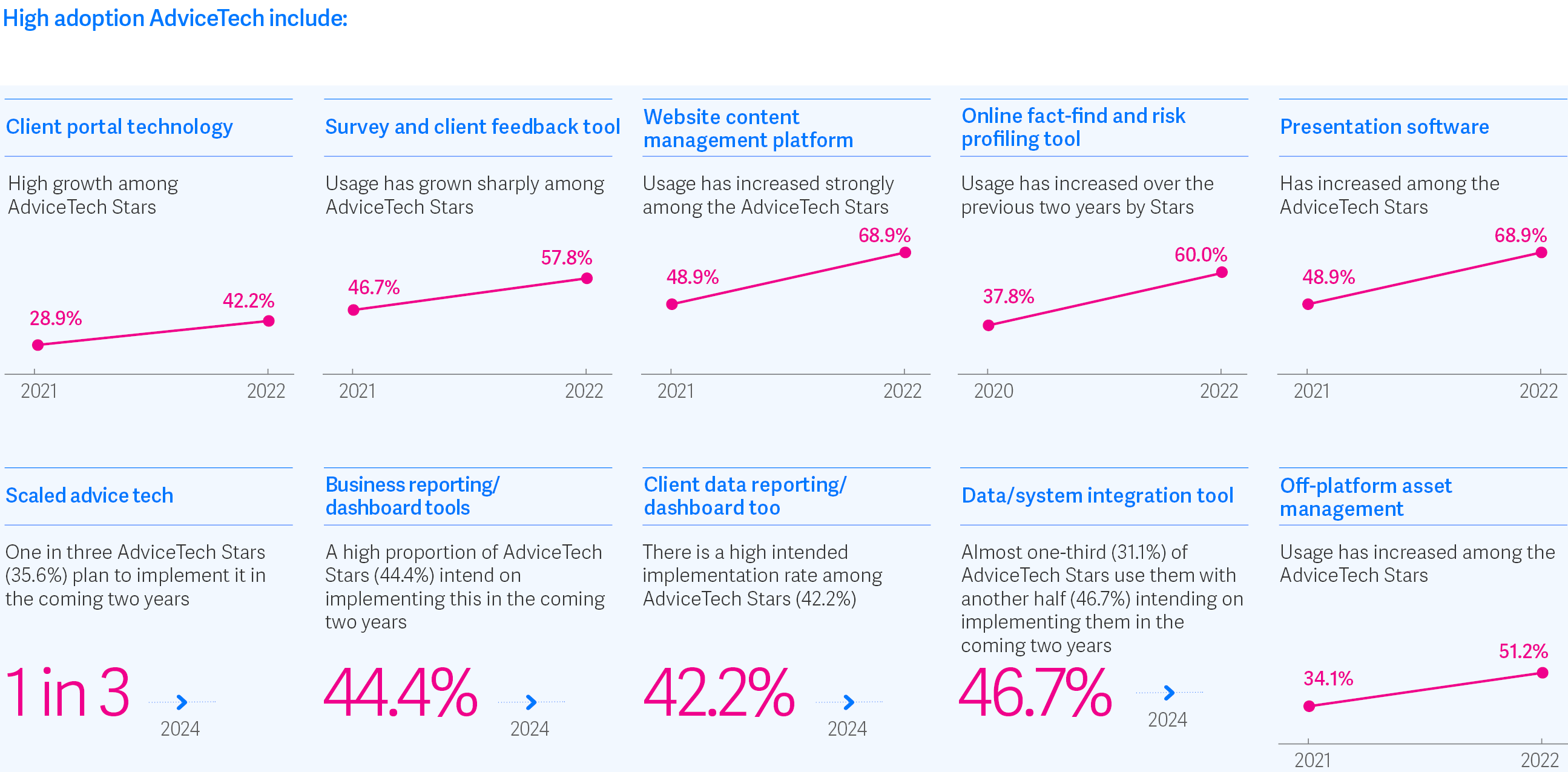

High potential adoption AdviceTech

Using Netwealth’s Technology Adoption Framework, Netwealth identified several technologies that are experiencing high year on year growth or have high intended adoption in the next 24 months.

In summary they were:

High Adoption AdviceTech

- Client portal technology: Although not yet highly adopted by most firms (30.4%), high growth among AdviceTech Stars (42.2% from 28.9%) and high intention to adopt among AdviceTech Stars (33.3%) means client portal technology has the potential to grow steeply in uptake.

- Survey and client feedback tools: Usage of this technology has grown sharply among AdviceTech Stars (57.8% from 46.7%) and a further one in five (20.0%) intends on adopting it in the coming two years meaning it has potential to become another popular tech.

- Website content management platform: Adopted by two in five firms (40.6%), usage has increased strongly among the AdviceTech Stars (68.9% from 48.9%) as a further quarter (24.4%) intend on adopting technology to manage content on websites and blogs, meaning it has high growth potential.

- Online fact-find and risk profiling tool: Usage has increased over the previous two years (38.9% from 34.2% in 2020) and is even more widely adopted by AdviceTech Stars (60.0%). Advisers are moving away from Astute Wheel (15.3% from 24.2%) and are spread across a large variety of providers.

- Presentation software: Presentation software usage has remained consistent in most advice firms (43.9%) but has increased among the AdviceTech Stars (68.9% from 48.9%) meaning this is a technology that has potential for increased adoption more widely.

- Social media content management platform: Although not yet adopted by many firms (19.5%), usage of technology to efficiently manage social media posts across multiple social media platforms has grown this year among AdviceTech Stars (40.0% from 24.4% who post to social media) making this a technology with growth potential.

- Scaled advice tools: Usage of scaled advice technology has grown among AdviceTech Stars (37.8% from 31.1%), and a further one in three (35.6%) plan to implement it in the coming two years. Further, two in five advice firms (38.0%) flag scaled advice tools as a tech that will have the greatest impact on advice firms in the next five years, indicating this is a technology with the potential for high adoption.

- Business reporting/dashboard tools: Adopted by almost one-third of firms (30.4%), a high proportion of AdviceTech Stars (44.4%) intend on implementing this in the coming two years meaning it is likely overall usage of this technology will increase.

- Client data reporting/dashboard tools: These tools have not yet been widely adopted (31.4%) but have a high intended implementation rate among AdviceTech Stars (42.2%).

- Data/system integration tools: Usage of data and system integration tools to integrate disparate systems or data sets remains low among advice firms (17.8% overall), but almost one-third (31.1%) of AdviceTech Stars use them with another half (46.7%) intending on implementing them in the coming two years. Further, over a quarter of firms (27.2%) believe they are a technology that will have the greatest impact on advice practices in the next five years meaning they have a large growth potential.

- Off-platform asset management: Usage of off-platform asset management technology to manage non-custodial investment has remained steady for most advice firms (26.7%) but has increased among the AdviceTech Stars (51.2% from 34.1%) meaning usage of this technology has potential to grow.

More about AdviceTech Stars

AdviceTech Stars are firms that lead the way in many aspects of technology use, and which provide a useful guide to other firms wishing to take advantage of AdviceTech. AdviceTech Stars lead the way on both technology adoption and business performance. They’ve found the sweet spot of using the right AdviceTech in the right way, to address clearly identified issues and to generate tangible business and client benefits.

While many (64.4%) advice firms increased their revenue last year, more than 9 in 10 AdviceTech Stars (91.1%) increased theirs. Nearly half of Stars (46.7%) increased their revenue by between 11% and 25%; and more than one in six (17.8%) increased their revenue by more than 25%.

AdviceTech Stars use a greater number (17) of technologies than the average firm (14). They spend more as a percentage of revenue of technology – 9.7%, on average (compared to 8.0% of overall firms), and they also plan to spend more in future. Critically, they dedicate appropriate capital, resources and planning to technology. Over half (57.8%) have a clear map of the technology road ahead (versus 34.3%).

About the survey

The 2022 Netwealth AdviceTech Research Report surveyed 303 advice firms. Fieldwork took place from April 13 to May 19, 2022. The report is available at www.netwealth.com.au/advicetech.

Reports

2022 AdviceTech report

Explore the human side of adviser technology with the 2022 AdviceTech suite of reports on staff, clients and technology suppliers.

AdviceTech and the staff experience

This report examines how technology is linked to staff satisfaction and ultimately client satisfaction. You will learn what you can do to maximise staff engagement and satisfaction in a hybrid working environment, and the support, training and infrastructure required to properly support your staff.

Download the report

AdviceTech and the client experience

In this report we unpack eight important technology trends that matter to clients. You will understand the role of hybrid client communications, the shift to self-service digital tools, how to unlock opportunities with data, and discover the importance of data visualisation in client education.

Download the report

AdviceTech 2022 Buyer's Guide

Technology selection and implementation is challenging. In this guide we provide you with the information to help - with descriptions of over 35 different technologies and the most used suppliers in their categories. The report also examines the factors to consider when selecting a technology partner.

Download the guide