Take outs

- Based on the 2018 Netwealth AdviceTech survey, over 40% of advice businesses are using cash flow, budgeting and account aggregation tools

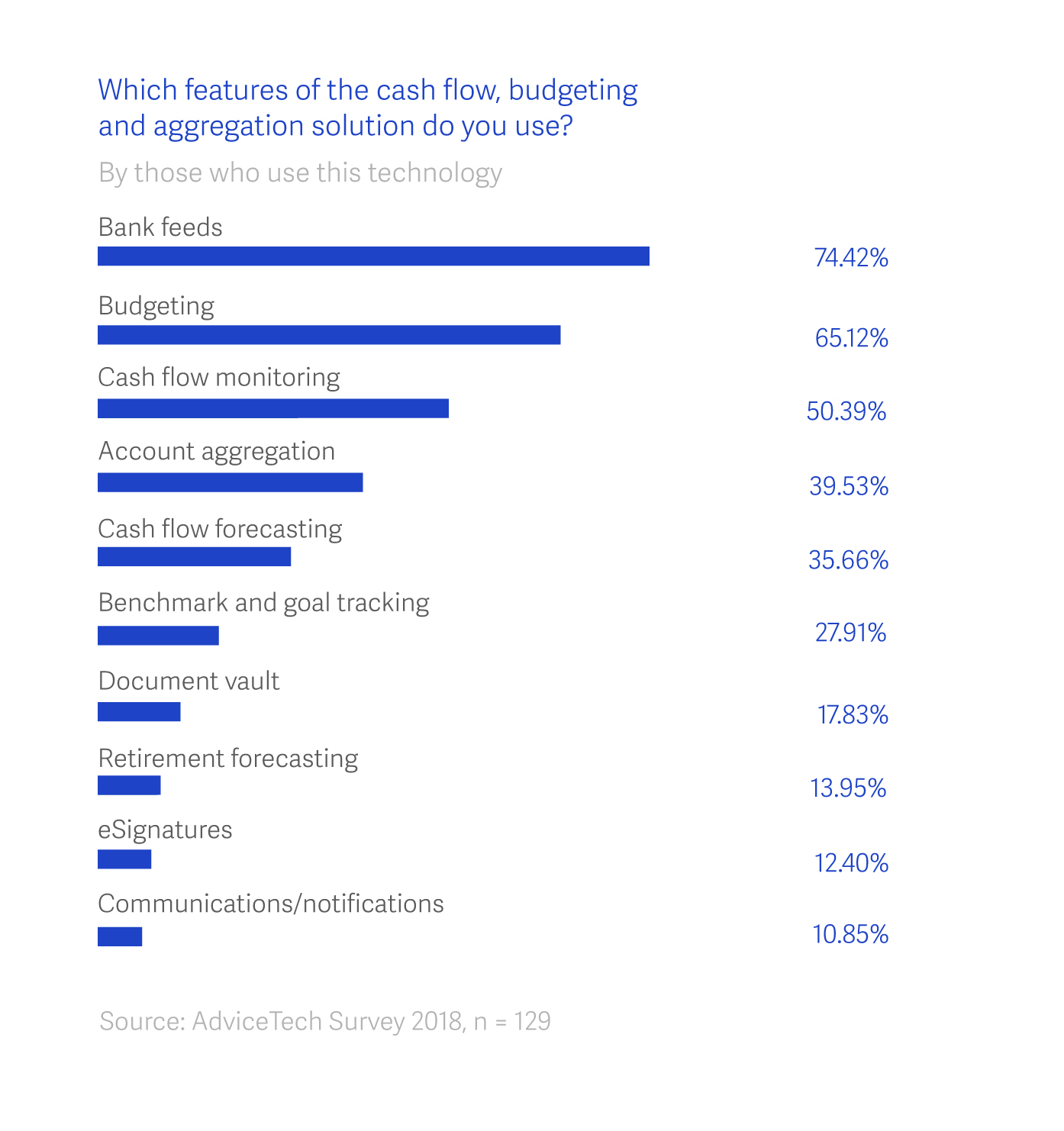

- Bank feeds and budgeting programs are the most commonly used tools

- Boosting financial literacy can lead to better client engagement and financial outcomes for clients and advisers

Customer experience is increasingly important for consumers and the brands that want them on their books.

The smartphone revolution means everyone has a powerful computer in their pocket, and they’re used to interacting with customer-centric companies like Facebook and Amazon everyday. Customer expectations are high for every type of product, service or brand interaction—financial services and money management must deliver a seamless and user-friendly experience.

Cash flow and budgeting technology may be the key to advisers engaging customers with their finances—providing the tech to make it part of their everyday digital experience by tracking spending and savings can make the difference between them meeting their money goals and falling short.

Chris Ridd, CEO of myprosperity, and Peter Malekas, founder and Managing Director of Moneysoft, recently spoke with Netwealth about the role of cash flow, budgeting and aggregation technologies for client engagement and advisers. Both businesses specialise in cash flow and budgeting tools that help advisers manage and monitor client wealth and expenses.

Cash flow tech in a ‘do it for me’ world

Imagine all a customer’s financial information in one spot, with bank, super and investment accounts together in a single online interface. Add in real time data feeds to track what’s coming in and going out, and this tech can make a difference to money behaviours in the short and long term. Based on the 2018 Netwealth AdviceTech research report, 42.30% of advice practises are already using this type of software.

Peter Malekas from Moneysoft says smart use of this technology requires the right mix of technology, data, process and people.

“The client and the adviser use the technology to develop an ongoing relationship. It’s more than access to the client’s information—it’s translating and interpreting that information against their goals now and for their financial future,” he says.

Chris agrees access to cash flow and expenses data is key to engaging clients, and that advisers play the key role in interpreting the data.

“This is a 'do it for me' market. As much as clients want to get all their finances in one place, and they see the benefits, the adviser has to push it and get the right data sources to feed into the cash flow and budgeting platforms,” he says.

“Once it’s there they see the value and that’s when the magic starts.”

Peter says the challenge for advisers can be to explain to clients the real value of this technology.

“It's not the tool, it's not the technology, it's the advice they can get based on the data that the tool provides.”

Netwealth 2018 AdviceTech research report

The second Netwealth AdviceTech research report examines twenty-six technologies used by advisers in their practice – their adoption, benefits and key suppliers.

Getting the right data is not enough

As we ride the wave of big data, it's important to remember there’s advantages to the micro view of an individual client’s finances.

“The Cloud, APIs1 and data feeds provide a real time view of what's happening in the financial world of that client. And that's incredibly powerful,” he says.

Chris says while big data gets the attention, data analytics on a day-to-day scale is key for this type of AdviceTech to translate to meaningful insights for the adviser.

“Most advisers don't have that ‘small data,” he explains.

“They have to ask clients where things are at. What have you got and where do you want to be? With rich insights from real data, all the cards are on the table and you can have a real conversation anchored in reality, not in ifs and buts.”

A personal trainer for financial fitness

User-friendly budgeting and cash flow tools a client can access from their phone creates an immediate awareness of where their money is going. The difference between a simple tool to categorise your spending and cash flow tech linked to a smarter system is that a holistic approach enables clients to see long term outcomes.

“Clients start to realise the impact of their everyday decisions,” Peter explains.

“Having a financial adviser is like a personal trainer—they educate you on your body and your fitness so you can achieve a target,” he says.

“Just as you might think twice about that chocolate after a visit with your trainer, cash flow and budgeting tools have led to greater savings capabilities across the board. More client savings means more engagement with advice practices, who in turn need to up their game with personalised service offerings.”

Making the most of a spike in customer engagement and savings

If your clients get on board with cash flow tech, smart advisers have the opportunity to look at the data as part of a complete financial profile. More meaningful data means advisers can identify where to add value with new products and services.

“This is the key to why this type of tech is so significant to the industry. If you don't have accurate data, it's very difficult to advise a client,” says Peter.

With efficient, ongoing access to client data, advisers can tailor advice solutions based on need and individual circumstances - the ability to monitor client progress without relying on their feedback alone creates a deeper partnership where the adviser acts as a financial coach through every age and stage.

Upgrading from the spreadsheet

Chris says despite the impact of cloud accounting on small (and big) business, there’s a gap in the personal and household wealth space that advisers can fill.

“Personal finance seems to be missing from the big consumer categories where tech has had a huge impact,” he says.

Chris says there’s a huge opportunity for advisers to transform the consumer finance journey.

“We still have finances sitting in filing cabinets. We still use Excel to try and make sense of our finances,” he says.

“Our bet is that advisers are key to changing that.”

Find out more

Read more about AdviceTech usage today and tomorrow in the 2018 Netwealth AdviceTech Research Report, or learn more about cash flow, budgeting and account aggregation tools in ‘5 ways to make the most of cash flow and budgeting technology’.

Recommending reading

AdviceTech Report

A comprehensive view of AdviceTech with special reports, articles, video and podcast interviews.

Glossary of AdviceTech

View a summary of 25 adviser technologies, highlighting key tech providers and benefits to advisers.

Lessons from the US

Find out which US trends in tech and innovation are set to impact the Australian advice industry.

AdviceTech landscape

Get your copy of the logo map created by Netwealth, as featured in the 2020 AdviceTech research report.

Definition

1 API stands for 'application programming interface' which is a set of subroutine definitions, protocols, and tools for building application software. In general terms, it is a set of clearly defined methods of communication between various software components.