Take outs

- In today’s challenging investment climate, it is possible to build a portfolio from the bottom up, with the aim of achieving a return of ‘inflation plus 5%’ over rolling five-year periods with low volatility

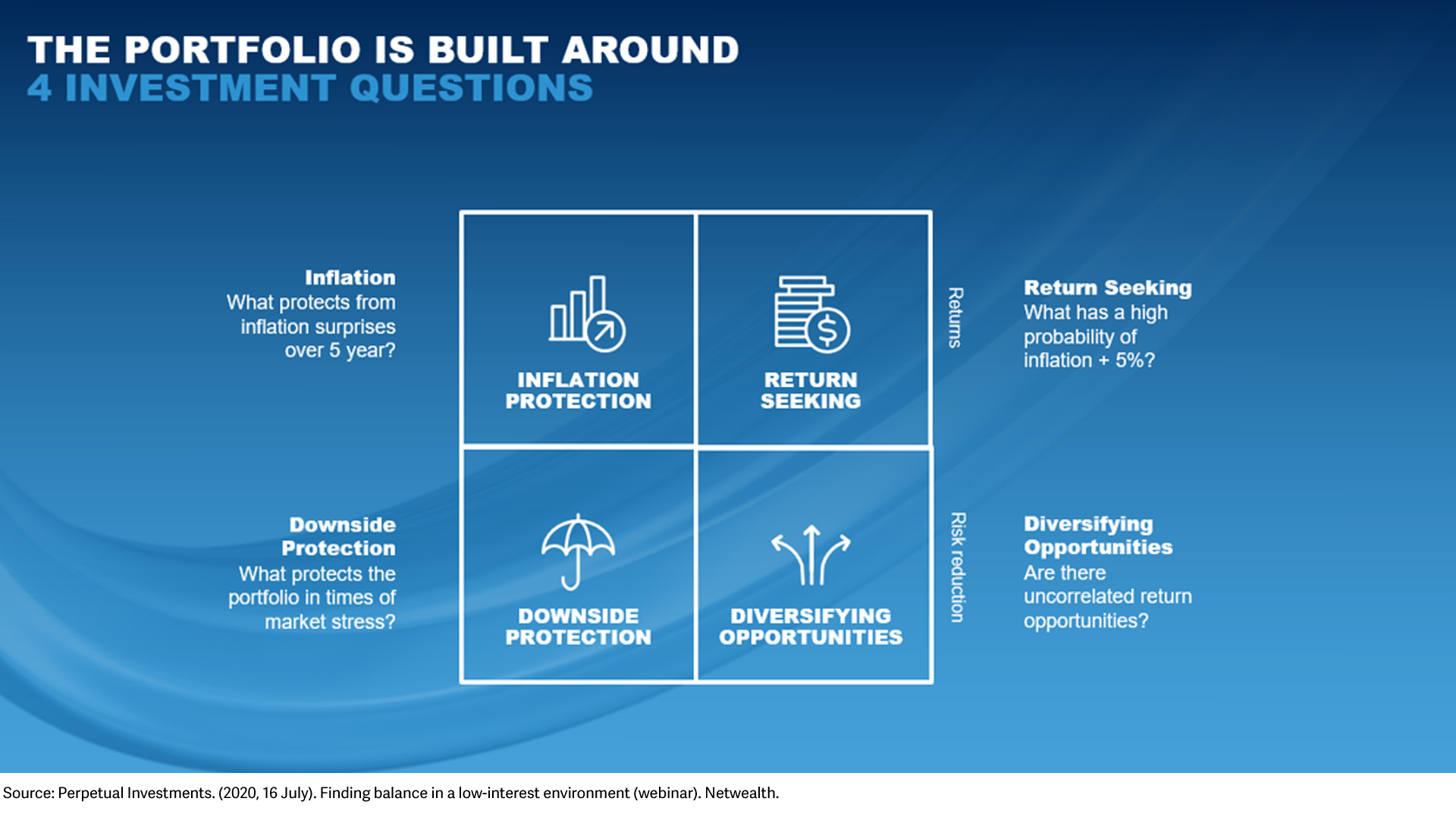

- Such a portfolio can be constructed in line with the answers to four simple investment questions, relating to protection from inflation, relevant asset selection, uncorrelated return opportunities, and protection in times of market stress

- The four questions can be managed and combined with an overarching risk framework to ensure that no single position has an outsized impact on the portfolio's performance

In response to a changed market outlook in the age of COVID, it may be time to refine previous methodologies for constructing a balanced investment portfolio.

In the Netwealth webinar, Finding balance in a low interest environment, Perpetual’s Head of Investment Strategy, Multi Asset, Matt Sherwood, explains how to build a balanced portfolio that meets the needs of investors in a difficult market environment, based on the following four questions:

- What will protect investors from inflation over five years?

- Which assets have a high probability of achieving inflation plus more than 5% over a five-year investment horizon?

- Which investments have return opportunities uncorrelated with equity?

- What will protect the portfolio in times of market stress?

Today’s investment climate is possibly the most challenging that any fund manager, adviser or client has faced in the past 80 years. This is not only because growth is weak, but also because all traditional portfolio diversifiers are expensive. They offer less protection for growth assets, which are also richly priced.

“When equities were this expensive in 2000, as the tech bubble burst, US 10-year bond yields were 6.6%,” Matt says.

“Today they are 0.6%. At that level, most would think they offer anaemic portfolio protection at best. Today, of course, most balanced funds are based on the asset allocation of the benchmark holdings of bonds and equities.”

It may be time to move away from the benchmark and build a portfolio from the bottom up, with no minimum exposures and with assets combined in a way that provides the best opportunity to reach the investment objective of ‘inflation plus 5%’ over rolling five-year periods, with low volatility.

This can be done by simultaneously addressing sequencing and longevity risk, and constructing a portfolio in line with the answers to the four questions.

The portfolio, therefore, needs to have assets that have good correlations with inflation over short time periods. It might, for example, use assets like commodities, which can be the source of inflation, and property where rents are tied to changes in the CPI.

1. Protection from inflation

The first question is: Which assets will protect investors against inflation over a five-year period?

When an adviser or fund manager is trying to protect investors from inflation over 20 years, the answer is equities. However, although Australia has never delivered a negative 20-year rate of return in equities, or even over 10 years, there have been many occasions of this over a five-year period.

The portfolio, therefore, needs to have assets that have good correlations with inflation over short time periods. It might, for example, use assets like commodities, which can be the source of inflation, and property where rents are tied to changes in the CPI.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.

2. Assets likely to achieve inflation plus 5%

The second question is: Which assets have a high probability of achieving inflation plus 5% over the five-year investment horizon?

This is not simply about large cap equities in advanced economies. It is worthwhile looking at emerging markets, equity and credit, domestic and global small caps, as well as credit (both investment grade and high yield) in Australia, the US and Europe.

“We try to get a combination of assets that can deliver the investment objective, with less reliance on equities,” says Matt.

3. Uncorrelated return opportunities

The first two questions determine the ‘CPI plus 5%’ part of the investment objective. However, to achieve this with low volatility, the third and fourth questions become important.

The third question is: Which investments have returns uncorrelated with equity?

Approaches may include looking for a zero correlation, using portable alpha strategies and other things such as relative value strategies in foreign exchange markets, equities and bonds. It may also pay to sometimes play spread trades in, for example, the bond space.

4. Protection in times of market stress

The last question, which has been particularly important in 2020, is: Which assets have a negative correlation with equities, particularly in times of market stress.

Matt talks about using three layers of defence, by having value-based investment criteria, focusing on things that offer genuine diversification, and not things that work occasionally or worked in the last cycle.

“We augment those two sources of protection with explicit downside protection from the use of bought options to manage the risks within the portfolio,” he says.

That means having a full suite of downside protection strategies, rather than just relying on government bond yields purchased by central banks, which today may be driven into negative territory.

An overarching risk framework

The four questions – and the assets included from them – can be managed and combined with an overarching risk framework to ensure that no single position has an outsized impact on the portfolio's performance.

It is also important to have the ability to change the asset allocation within the portfolio, through time, and match it to the prevailing investment climate.

Find out more about portfolio construction

Listen to the Netwealth webinar Finding balance in a low interest environment for additional insights, or contact Netwealth.

You may also enjoy

Portfolio Construction

Generating income and capital growth with unlisted infrastructure

Accessing unlisted infrastructure, like airports and toll roads, can be challenging due to the large capital outlay required. In this episode, we chat with Rory Shapiro, Associate Director at AMP Capital, to explore how investors can generate cashflow with less volatility using unlisted infrastructure. Learn how infrastructure responds to rising inflation and discover the outlook and emerging opportunities in the sector.

Portfolio Construction

Investing in the global leaders of tomorrow

Explore the factors driving performance in the global small and mid cap sector and its future outlook with James Abela and Maroun Younes from Fidelity. Discover the opportunities outside of Australia and why more investors should consider a global small and mid cap strategy.

Portfolio Construction

Is this time different for bonds?

Bond markets are adjusting after yields moved sharply higher in the first quarter of 2021. Schroders Fund Manager Kellie Wood explores the trends set to shape markets in 2021, and explains why she believes the repricing of bonds represents a healthy reset.

The information in this article is general in nature. Any financial advice it contains is general advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. The article content is not intended to be a substitute for professional advice, so before you act on it you should determine its appropriateness having regard to your particular objectives, financial situation and needs, and seek any professional advice you require. Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.

This webinar guest is a financial product issuer. Netwealth and the guest have a commercial arrangement that enables investment in products managed by the guest through Netwealth’s platform. Under that arrangement, Netwealth may receive fees from the webinar guest. More information about the fees Netwealth receives is provided in our Financial Services Guide, which is available on our website or by contacting us.