Take outs:

- For those with a less optimistic outlook for investment returns from traditional asset classes, approaches such as outcomes-based investing can be considered.

- Retirees are particularly suitable to this style of investing.

- Outcome based investing is an alternative because it aims for a return which is an absolute performance number, or which is higher than a cash or inflation rate by a defined amount, rather than trying to outperform equity indices.

Outcomes-based investing has built a loyal following with its focus on delivering an outcome for investors.

Forget beating benchmarks or even peers, outcome based investing aims to deliver financial security in retirement.

Aberdeen Asset Management Investment Specialist Josh Hall in a Netwealth webinar titled, ‘Building investment portfolios for retirement’ discussed how an outcome based investment strategy can help retirees meet their investment goals in a low return environment.

With some investment managers and investors now concerned about the outlook for returns, outcomes based investing is being debated as one way for retirees to structure their portfolios in order to meet their financial and lifestyle goals.

According to Aberdeen Asset Management Investment Specialist Josh Hall, a low return environment is a key challenge for investors in today’s environment.

“Even though it’s been a relatively prosperous time to invest in capital and financial markets over the past decade, we feel this has resulted in relatively expensive valuations and prices for most asset classes such as bonds and equities.”

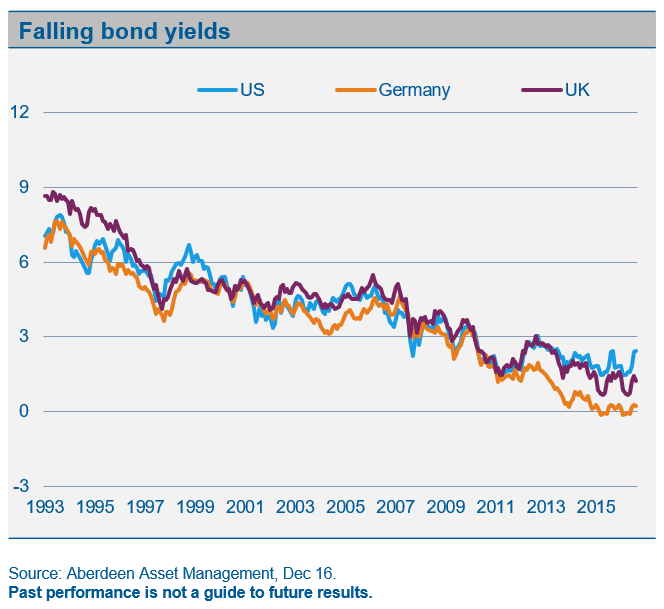

He added: “Low interest rates across the globe have meant relatively low bond yields, with subsequent returns on cash or deposits much lower than almost any period in history. And whilst equities have performed well, this has caused valuations to become stretched and relatively expensive as a result. “

Times are a changing

According to Hall, to use outcomes based investing effectively, portfolios need to be built to suit the current investment landscape, not simply benchmarking or using mainstream equities.

This is because, he argues, we have now reached a point where future returns for most traditional asset classes are likely to be a lot less than those achieved to date.

This can be seen in the chart below which outlines falling bond yields to date.

“As markets have now reached a point where future returns for most traditional asset classes are likely to be a lot less than those achieved in recent times, it’s time to address this issue when creating investment portfolios, especially for retirees.”

This means rethinking the typical balanced portfolio (for example, a 60/40 portfolio) that is invested in traditional asset classes and rebalanced periodically, which has worked well for the past 30 years.

“It’s time to evolve this approach given the more muted likely returns, especially when the traditional balanced 60/40 portfolio is likely to only deliver a something like low single digit returns pre-tax, fees and inflation ,” says Hall.

Outcome-based investing and retirees

This change in approach is essential for retirees who, according to Hall, typically have three main sets of objectives to fulfill when it comes to achieving a successful retirement:

- A ‘Pay My Bills’ bucket. These funds cover necessary and regular living expenses (e.g. groceries, health and home). Here regular and predictable cash flow, plus inflation protection is required.

- An ‘Enjoy my Retirement’ bucket. This money funds holidays, travel, new car purchases and other discretionary spending. Here total returns over set time periods (e.g. 3-7 years) are needed.

- A ‘Leave a Legacy’ bucket. These funds are for future generations or charity. Here it’s about long-term investment and high-growth assets over a longer time frame.

It’s important to note that retirees are not focused on outperforming indices; they’re focused on ensuring their money fulfills their lifestyle goals and lasts their lifetime (in absolute dollar terms).

Staying current

According to Hall, outcome-based investing is a more appropriate approach to use when creating effective investment portfolios for retirees as it focusses on more relevant performance objectives such as returns above cash or inflation rather than traditional market indices.

This is because aiming for a return which is an absolute performance number or which aims to beat a cash or inflation rate by a defined amount, rather than trying to outperform traditional indices, better aligns to the lifestyle objectives of those in retirement .

However, in addition to outcome-based investing, it’s important that investors think outside the square and look beyond traditional asset classes like Australian and developed market equities and fixed income, property or cash.

This means looking for less traditional sources of return, newer markets and higher growth parts of the world to ensure portfolios are constructed in a way that makes the most of the current environment, rather than adhering to traditional constraints.

Example of outside the square

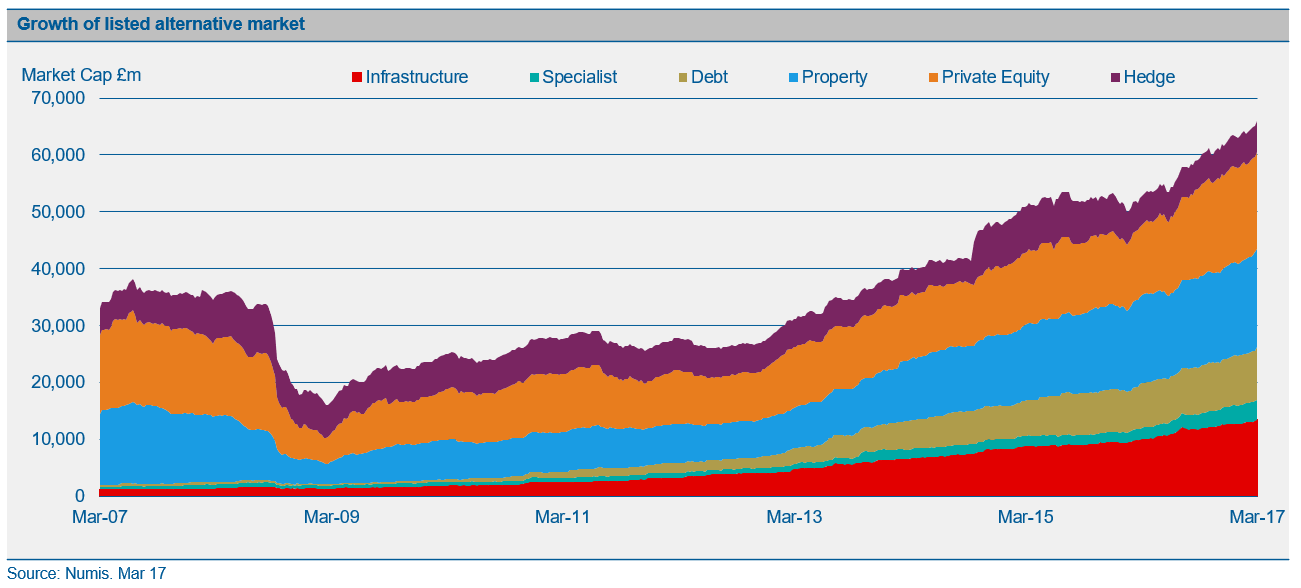

One such example is listed alternative markets (outlined in the chart below).

These are listed entities, companies or funds, which generally have underlying exposures or investments that can be considered less mainstream than the norm such as infrastructure, specialist asset classes, debts, property, private equity and hedge funds.

“A key benefit of these types of investments is the significant protection they can offer when equity markets or other mainstream growth asset markets perform quite poorly.”

Some examples of these alternative markets are aircraft leasing, litigation finance, peer to peer lending, asset back securities amongst others.

These asset classes can typically offer investors returns of high single digit to low double digit returns with very low correlation to traditional equity markets.

Conclusion

According to Hall, outcomes-based investing, combined with a mindset of looking outside the square for investment opportunities is a great way to create a appropriate portfolio for investors given the current investment environment.

To hear the full presentation, ‘Building investment portfolios for retirement’ or click here if you would like to speak to us.

Any reference to a particular investment is not a recommendation to buy, sell or hold the investment. The relevant disclosure document should be obtained from Netwealth and considered before deciding whether to acquire, dispose of, or to continue to hold, an investment in any Netwealth product.

Compare managed funds and models

Get the latest research data and commentary to search and compare managed funds and managed account models. See performance data, costs and use powerful filtering tools to identify funds by manager and asset classes.