Take outs:

- Virtual meetings will be a mainstream tech tool for advisers by 2019, with advisers quick to adopt and budget for the technology.

- Tailoring communication to the tastes of groups in your client base is the way of the future, using different mediums and modes for different audiences.

- Virtual reality is a logical next step, where clients can visually experience and be immersed in their own financial position

Imagine instead of a monitor and microphone, your next virtual meeting is where your clients wear a virtual reality headset.

In front of their very eyes they are transported to a meeting place where you can talk to them about their financial future.

Adding to the experience is the ability for you to walk clients through a three dimensional view of their financial situation. Charts and future plans come to life, so they can add things in and change it around, to see how it looks.

In this virtual world, they are in control but with your help, adding in inputs such as interest rates, property prices and census data. With a slight movement of the hand or a visual command you and your clients can explore what-if scenarios and build out decision trees, where one decision shapes the next question.

With Facebook launching the Oculus Go in early 2018 with a starting price under $350, and other companies like Microsoft investing heavily, virtual reality is likely to be mainstream by 2025.

From an adviser’s perspective, virtual reality brings the possibility of taking engagement and relationship building to a whole new level, especially for younger generations.

But for many, 2025 is too far away and virtual reality feels like walking on the moon. That is ok, but it is important to recognise that a fundamental shift is happening in the way we communicate both in business and privately.

For example today, sending an SMS is easier than a phone call, and an instant chat message has more capabilities than an SMS. A video message tells a thousand words.

When you combine these new communication methods with the fact that people respond to text, data, words and imagery in different ways, the future of succinct, timely and personalised communications is very complex.

Consider some of your clients today and this becomes clear. Those who are visual may prefer charts or infographics. Others who like the details, probably like data and tables. You will have some that want face to face meetings and others who would prefer to communicate after hours using email.

Netwealth 2018 AdviceTech research report

The second Netwealth AdviceTech research report examines twenty-six technologies used by advisers in their practice – their adoption, benefits and key suppliers.

The 2018 Netwealth AdviceTech Research Report highlighted advisers are at varying stages of their advicetech communication journey, with some opting for more traditional methods while others are keen to move to virtual realities.

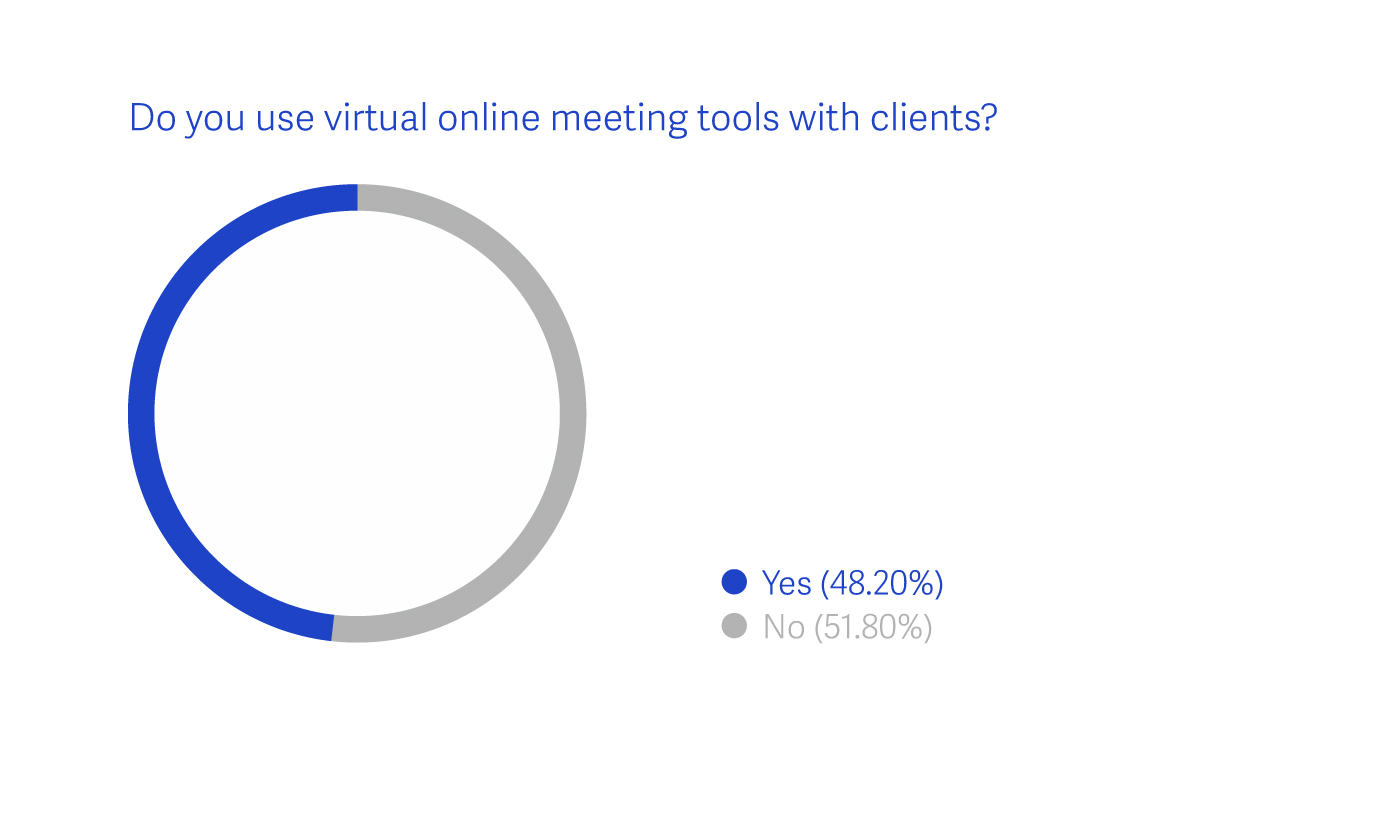

Virtual meetings are a communication tool which advisers have embraced and continue to do so, with 79.68% of advice practices reporting they plan to be using them by 2020. Today, 48.20% of advice practices use technologies such as Skype and GoToMeetings.

The ability to connect with time poor clients, with clients who may be unable to travel or leave their homes, or to connect with regional clients, all in the comfort of their home or office, matters today.

Source: 2018 Netwealth AdviceTech Report

The next step in this mode of communication are 3D experiences using virtual and augmented realities.

Virtual reality provides clients with a way to interact with data in a way that is meaningful to them. The experience is more personal, deeper, because they are immersed into an interactive world.

It is the power of imagery that is the cornerstone of this technology. And evidence supports imagery is a powerful form of communication for a large group of people.

Using data visualisation tools, concepts such as investment performance, asset allocation and market movements, traditionally explained via data tables, can be given a fresh and appealing approach.

Fidelity, Comarch and Citigroup are prototyping virtual reality in the wealth industry. Users might be presented with investment portfolios in outer space where planets are a visual and virtual metaphor for asset allocation and performance. Whilst novel in its approach, such tools are interactive and fun, they are emotive and personalised and can aid informed decision making.

So, while these options present a lot of opportunities for advisers, they also pose new challenges in terms of selecting the right formula for the right group of clients. In this way, a blanket approach to communication is now regarded an outdated concept.

The secret of any good communication strategy is making sure it is right for your clients, and knowing them enough, to know what they like. Using the right tools at the right times can streamline the delivery of the strategy and make it a valuable part of your business.

Discover more tools to remove friction

- Examine the twenty-six technologies used by advisers in their practice in the 2018 Netwealth AdviceTech report

- Register your interest for the Netwealth Innovation Toolkit. This will provide you access to guides, activities and templates to run your own innovation workshops and transform conversations into actions.

- Contact one of our local BDM's for more information.

Recommending reading

AdviceTech Report

A comprehensive view of AdviceTech with special reports, articles, video and podcast interviews.

Glossary of AdviceTech

View a summary of 25 adviser technologies, highlighting key tech providers and benefits to advisers.

Lessons from the US

Find out which US trends in tech and innovation are set to impact the Australian advice industry.

AdviceTech landscape

Get your copy of the logo map created by Netwealth, as featured in the 2020 AdviceTech research report.