Take outs

- It is a great tool both for attracting new clients and for retaining existing clients within your practice’s ecosystem.

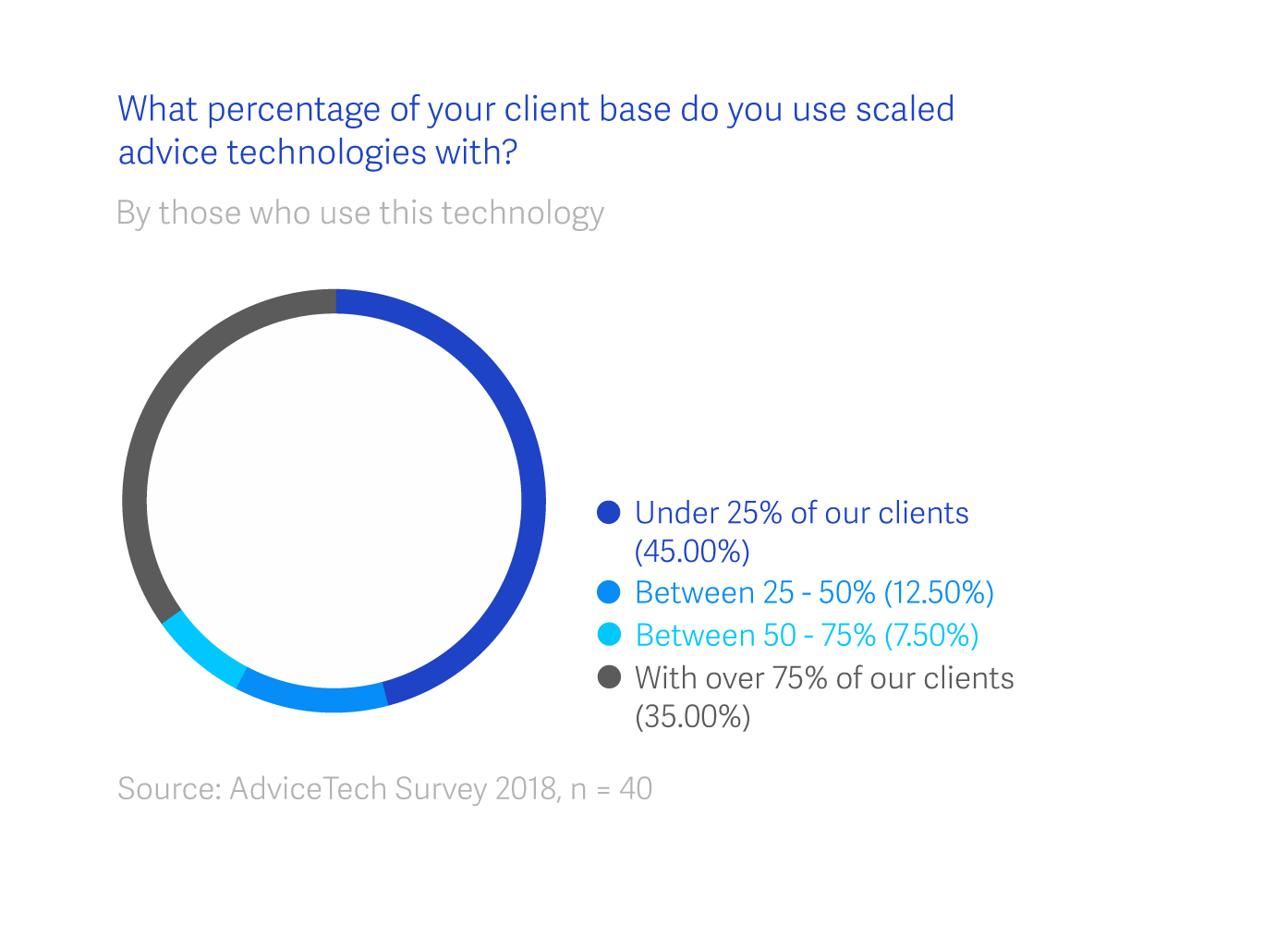

- Based on the 2018 Netwealth AdviceTech survey, this type of tech is being used by 13.11% of advice businesses.

- As scaled advice continues to grow in importance, advisers should ensure that scaled advice and comprehensive advice systems are compatible.

Scaled financial advice is nothing new, but some financial advisers still find it confusing and as a result - have been reluctant to embrace it.

This is a mistake, says Julian Plummer - Managing Director of Midwinter Financial Services, because scaled advice offers significant benefits for both advisers and their clients.

“A lot of advisers are now concentrating on scaled advice, and we're seeing that open up opportunities for them … and then there are those who just don't use it at all,’’ says Plummer in a recent interview with Netwealth.

So, what exactly is scaled advice? When the FOFA reforms were announced, the Federal Government expressed concern about access to and the affordability of financial advice. Scaled advice is designed to address these concerns: it is personal advice that is limited to a specific range of issues.

“Scaled advice is limited in scope, but it's still just personal financial advice,’’ says Plummer. “Its main benefits are being able to take quite complex topics and attack them one by one, helping Australians understand the benefits of advice and helping them get advice that is cheap and accessible.’’

Democratising advice

A major advantage of scaled advice is that its limited scope brings down the cost of providing it, making it accessible to a wider range of potential clients.

“Advice is expensive, and that is one of the main inhibitors to people getting advice,’’ says Plummer.

“Using scaled advice tools, we can decrease the cost of delivering advice. That means more Australians are getting more advice, and we're helping them lead a more dignified lifestyle in retirement, which is the ultimate aim of what we're doing.’’

Of course, there are many circumstances where scaled advice is not suitable, such as for example complex cash flow and capital modelling. However, in their daily lives, clients often need limited advice to deal with specific situations.

“If you're changing jobs and you're moving from one role to another, when you're changing superannuation funds, that might be a more appropriate opportunity for scaled advice,’’ says Plummer.

The on-ramp to comprehensive advice

Scaled advice is a great opportunity to introduce potential new clients, such as younger people, to the world of financial advice for the first time, and in a format with which they are familiar.

“We're seeing a lot of the younger clients that are just wanting short, sharp bits of advice,’’ Plummer says. “They don't want to sit there and talk about a whole comprehensive plan for the future.

“It's the smartphone generation. Being able to produce advice and then deliver it through digital tools is where scaled advice really shines.’’

Scaled advice is a great chance to draw people into the advice conversation for the first time: to get them talking about their wants and their needs, where they see themselves in five years, and to become their trusted adviser or trusted coach.

“Scaled advice is the on-ramp to comprehensive advice,’’ says Plummer.

Netwealth 2018 AdviceTech research report

The second Netwealth AdviceTech research report examines twenty-six technologies used by advisers in their practice – their adoption, benefits and key suppliers.

Keeping clients in your ecosystem

Offering scaled advice is sometimes likened to customer engagement, says Plummer. It's about being able to talk to clients, and to bring them up the value chain of advice. It is also an opportunity for you to keep existing clients in your ecosystem.

“It may be the case that you specialise in comprehensive advice, but if you have a client who wants a specific piece of advice then you don't want them going off and talking to another financial planner,’’ he says.

Plummer says some advisers are using scaled advice to prevent erosion of market share to super funds, which are encroaching into the market for advice.

Future-proof your practice with good systems.

Midwinter Financial Services, of which Plummer is managing director, specialises in technology for the financial planning industry and provides a range of scaled advice and comprehensive advice tools.

As scaled advice continues to grow in popularity, it will become increasingly important for advisers to ensure their scaled and comprehensive advice solutions are compatible. This not only ensures that outputs and outcomes are consistent, but also allows client information to be retained and reused.

By being able to piggyback or leverage off earlier scaled advice, and then escalate that up into comprehensive advice, an adviser can reduce the marginal cost of producing that advice, increasing profitability.

“Having one system, consistent outcomes, consistent outputs, and ensuring that the information travels freely between comprehensive and scaled, I think will be key in the next five years,’’ says Plummer.

Find out more

Learn more about scaled advice and twenty-five other technologies used by advisers in the 2018 Netwealth AdviceTech report or contact one of our local BDM's for more information.

Recommending reading

AdviceTech Report

A comprehensive view of AdviceTech with special reports, articles, video and podcast interviews.

Glossary of AdviceTech

View a summary of 25 adviser technologies, highlighting key tech providers and benefits to advisers.

Lessons from the US

Find out which US trends in tech and innovation are set to impact the Australian advice industry.

AdviceTech landscape

Get your copy of the logo map created by Netwealth, as featured in the 2020 AdviceTech research report.