As advice businesses become increasingly digital, the importance of trust and cybersecurity has never been greater. The Netwealth AdviceTech 2025 report, Turning data into growth identifies ‘Trust and cybersecurity as non negotiables’ as a critical trend, underscoring the need for robust security frameworks and governance practices.

Key takeaways:

- Cybersecurity is vital for trust and compliance.

- Multi-factor authentication and secure sharing are becoming standard.

- Backup and recovery protocols ensure resilience.

- Clients expect secure, transparent handling of their data.

Securing the data ecosystem

AdviceTech Stars, the businesses leaders in technology adoption, are setting the standard for digital trust. They understand that cybersecurity is a foundation for client confidence, regulatory compliance, and operational resilience. These businesses are investing in tools, training, and protocols that protect data, prevent breaches, and ensure continuity of service.

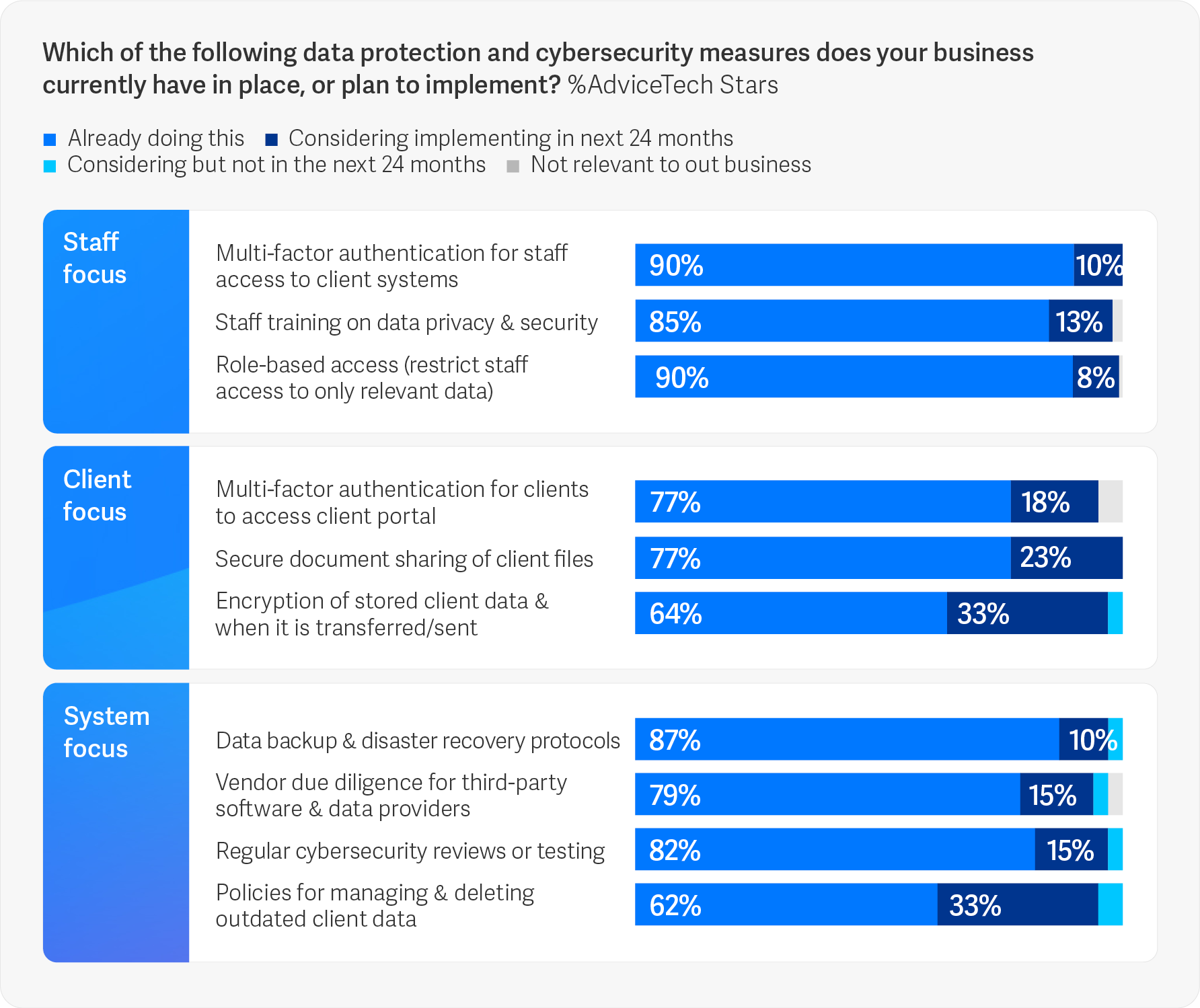

The 2025 AdviceTech report, Turning data into growth, outlines a comprehensive approach to cybersecurity, starting with access controls. AdviceTech Stars implement multi-factor authentication (MFA) for staff and client portals, ensuring that only authorised users can access sensitive information. Role-based access is also widely adopted, limiting data visibility based on job function and reducing the risk of internal breaches.

Secure document sharing tools are also widely adopted by Stars. These platforms allow advisers to exchange information with clients in a protected environment, avoiding the risks associated with email attachments or unsecured cloud storage. When combined with encrypted communication channels, these tools help maintain confidentiality and integrity.

Cybersecurity training is also a priority. Stars are focusing on best practices, emerging threats, and response protocols, creating a culture of awareness and vigilance.

Source: Netwealth AdviceTech 2025 research

Governance, backup, and recovery

Beyond frontline security measures, AdviceTech Stars are investing in governance frameworks that support long-term resilience. The report reveals that 87% of Stars have backup protocols in place, ensuring that data can be restored quickly in the event of a system failure or cyberattack. These backups are often automated, encrypted, and stored in multiple locations to mitigate risk.

Disaster recovery plans are also standard practice. Stars conduct continuity drills, test their systems, and update their procedures to reflect new threats and technologies. This readiness ensures in the event of disruption, operations can continue.

Cybersecurity reviews are conducted routinely, with 82% of Stars engaging in regular assessments. These reviews evaluate system vulnerabilities, test defences, and identify areas for improvement. They also help businesses stay ahead of regulatory requirements.

Compliance for trust

Trust in financial advice is deeply aligned to compliance. AdviceTech Stars focus on embedding compliance into their technology stack, to ensure that every interaction, document, and data point is traceable. This protects both the client and the adviser, and reinforces the firm’s reputation for integrity.

Client expectations and competitive advantage

Clients today expect their financial information to be handled with the same care and sophistication as their banking or healthcare data. They want to know that their adviser is using secure systems, protecting their privacy, and acting in their best interest. AdviceTech Stars meet these expectations by using secure portals, having transparent policies, and offering responsive support.

Security as a strategic imperative

The AdviceTech 2025 report, Turning data into growth, demonstrates how important cybersecurity is to success. AdviceTech Stars are making the most of new technologies to enhance their cybersecurity, embedding trust into every layer of their operations, from access controls and training to backup protocols and compliance frameworks. They are turning cybersecurity from a good thing to have, into a strategic imperative.

More articles:

- Overview: Get to know AdviceTech Stars, and what they are doing differently.

- Trend 1: Turning data into action - how dashboards and KPIs are driving smarter decisions.

- Trend 2: Personalisation at scale - how to use data and alerts to deliver more relevant advice.

- Trend 3: Automation across the lifecycle - how to streamline onboarding, reporting and client reviews.

- Trend 4: AI goes mainstream - how you can embed GenAI into your daily advice workflows.

- Trend 5: Trust and cybersecurity - how to safeguard client confidence in a digital world.

- Trend 6: A connected data backbone - how to build the data foundation for integration and scale.

Report: 2025 AdviceTech - Turning data into growth

Report: 2025 AdviceTech - Turning data into growth

The convergence of a tech boom and a data boom are reshaping how advice is delivered. Are you turning that change into growth? This year, see how leading firms are embedding automation, dashboards and AI into daily workflows and get the practical playbook to do the same.

Download the reportKeynote: 2025 AdviceTech - The connected advice firm

Keynote: 2025 AdviceTech - The connected advice firm

Join Sophie Firminger, Head of Technology Sales & Consulting at Netwealth, as she unpacks the findings of the 2025 AdviceTech Report. Learn how the six key trends are reshaping advice, see real-world examples, and discover how you can put the playbook into practice.

Watch nowPodcast: Scaling advice with AI and avatars

Podcast: Scaling advice with AI and avatars

In this episode of Between Meetings, Dan Solin explores how AI and avatars can scale personalisation while keeping advice simple, transparent and client-first. He also explains how tech and human touch combine to deliver meaningful advice in a changing landscape.

Listen to the episode