Advice businesses today generate vast amounts of data across client interactions, portfolio performance, compliance records, and operational metrics. However, this data is only useful if it is actively analysed to improve outcomes. The key is to turn this data from a passive asset into an engine driving smarter decisions, sharper operations, and growth.

Key takeaways:

- Businesses are embedding analytics into daily operations for smarter decisions.

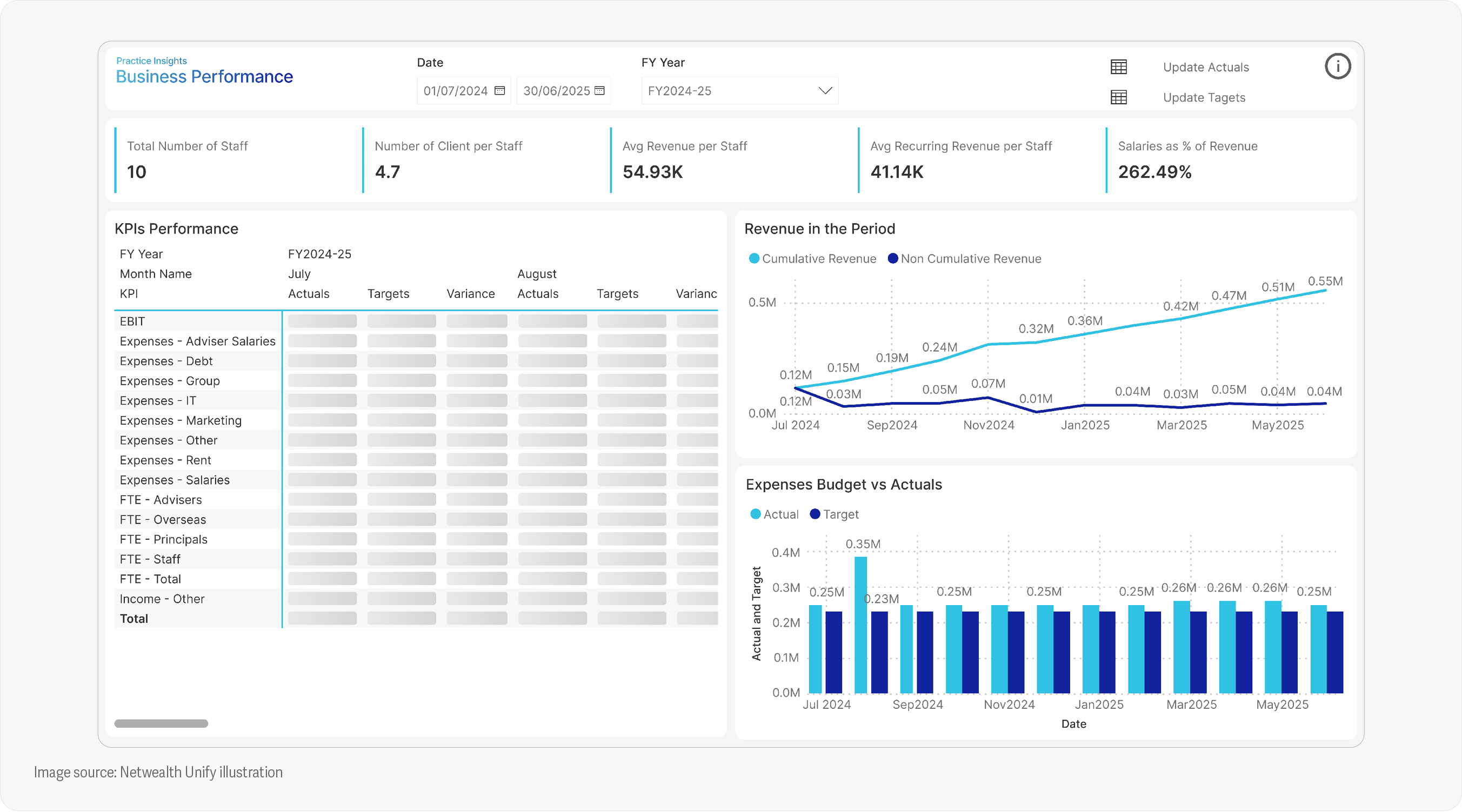

- Dashboards consolidate data for real-time insights and action.

- Integration technologies create a single source of truth.

- Data-driven strategies boost growth and efficiency.

Operational intelligence for staff effectiveness

Netwealth’s 2025 AdviceTech report identifies ‘Turning data into action’ as a key trend shaping the future of advice businesses. This trend reflects a shift from simply collecting data to embedding analytics into the daily rhythm of business, then using it to guide the strategic direction.

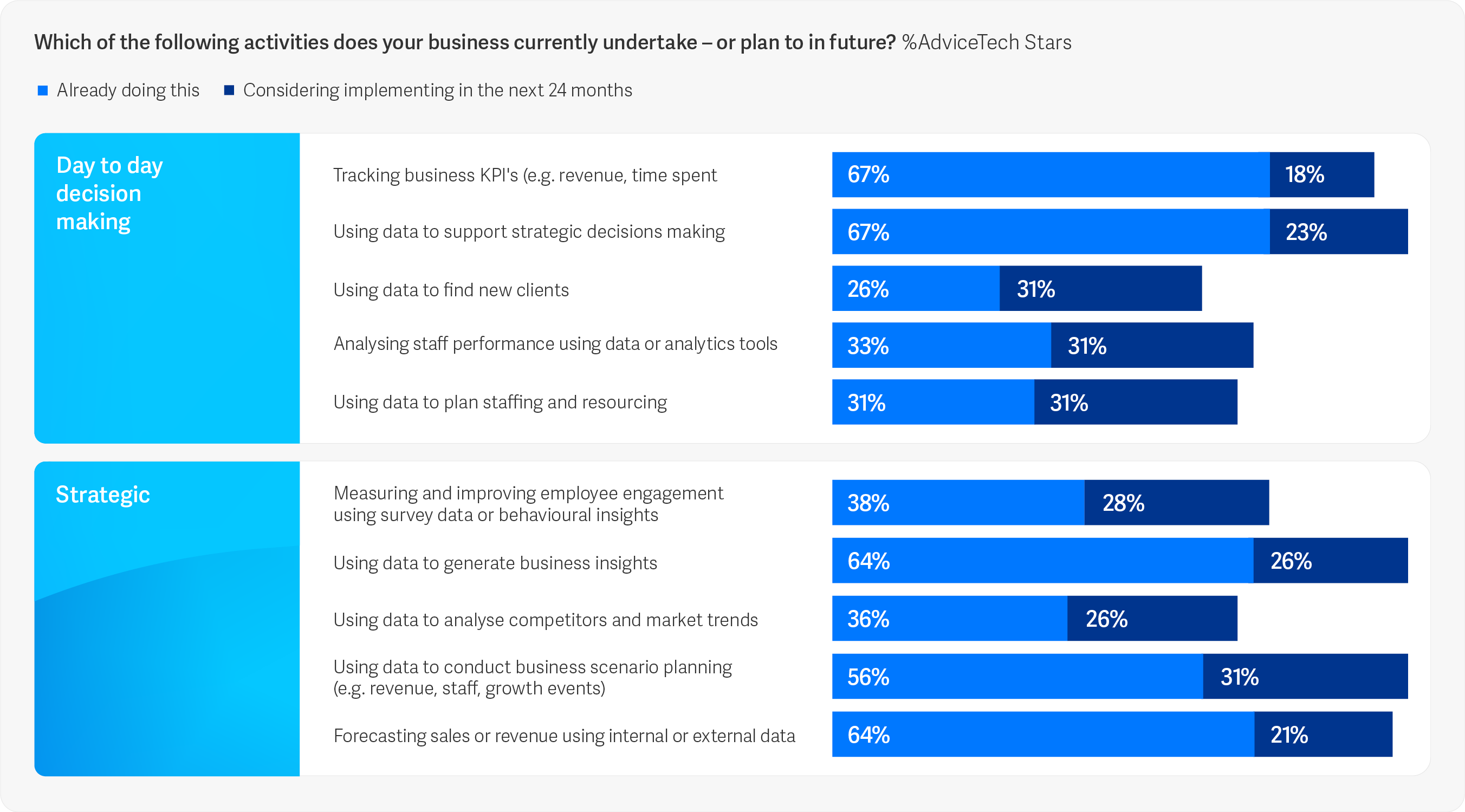

According to the report, two-thirds (67%) of AdviceTech Stars (businesses that lead in technology adoption and typically enjoy greater commercial success than the average), gather data to track key performance indicators (KPIs) such as revenue and time spent. They are using data to analyse staff performance (33%), planning resourcing (31%), and monitoring staff satisfaction (38%). These insights help identify bottlenecks, prevent burnout, and ensure that teams are operating efficiently.

Data-driven growth strategies

Data is also playing a central role in guiding growth strategies. A quarter (24%) of AdviceTech Stars use data to identify new client opportunities, and nearly a third (31%) are considering this. Advice businesses are leveraging analytics to support strategic decisions (67%), generate broader insights (64%), run scenario planning on revenue and staffing (56%), forecast sales (64%), and track competitors and market trends (36%). These capabilities allow advice firms to spot unprofitable clients, underused services, and cross-sell opportunities. The insights also help determine where to invest in training and focus marketing efforts.

Dashboards as the new operating system

One of the most transformative tools aligned to data is the connected, real-time dashboard. These dashboards consolidate data from multiple systems, such as Customer Relationship Management (CRM) platforms, investment and super platforms, and commission management software, into a single, interactive view.

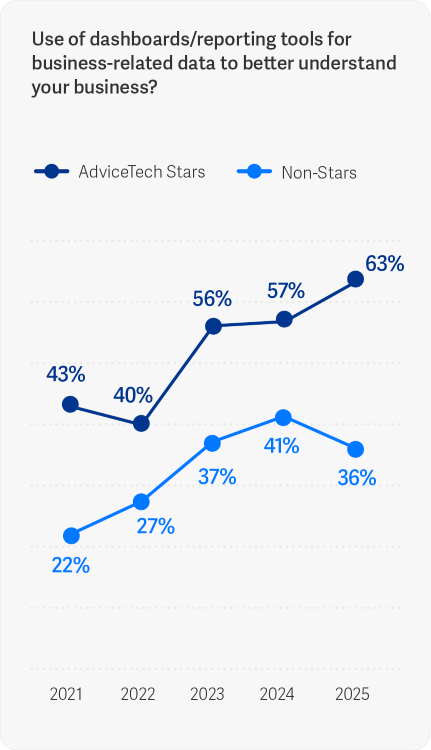

Among AdviceTech Stars, usage of dashboards surged to 63% in 2025, up from 43% in 2021. An additional 24% plan to adopt them, meaning nearly nine in 10 businesses are either using or intending to use them.

Source: Netwealth AdviceTech 2025 research

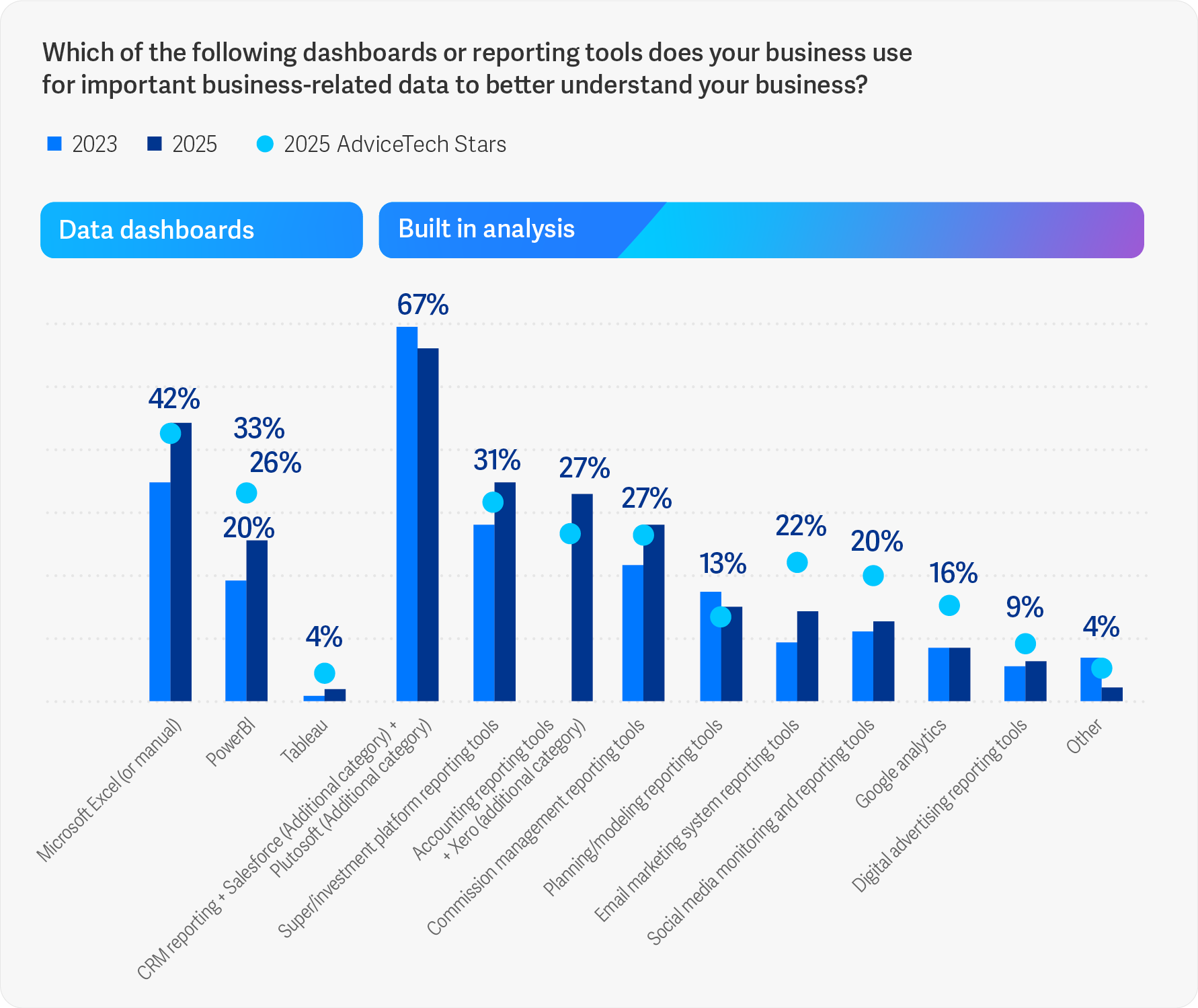

While many businesses still rely on built-in reports from their core systems, or use Excel to bring data together, the trend is moving toward purpose-built dashboard platforms such as Power BI and Tableau. Power BI, for example, is now used by a third (33%) of AdviceTech Stars, and its adoption across all businesses has climbed from 20% in 2023 to 26% in 2025.

Source: Netwealth AdviceTech 2025 research

Data dashboards also offer features like live data refresh, customisable layouts, filters and drill-downs, intelligent alerts, and AI-assisted insights. This turns static reports into dynamic decision-making tools, enabling businesses to respond in real time to changes in client behaviour, market conditions, or internal performance.

Building a connected data backbone

To make dashboards and analytics work effectively, businesses need a connected data backbone. Most advice businesses operate over 20 technology systems, which creates complexity and potential for mismatches or incomplete reporting. AdviceTech Stars are solving this challenge through integration technologies and governance frameworks that establish a single source of truth (63% in 2025, notably up from 21% in 2020).

Integration begins with built-in data feeds between core systems, then progresses to low-code tools like Workato, and then to the adoption of centralised data warehouses or data lakes that normalise, match, and merge records across a variety of platforms and databases (like connecting Xplan, Xero, and Netwealth). Some build bespoke integrations using public APIs.

The shift from passive data collection to active data utilisation is a strategic transformation. Netwealth’s 2025 AdviceTech report shows that with the right tools, including dashboards, integration technologies, and a governed data backbone , data can be transformed into a strategic insight. AdviceTech Stars are using technology to embed analytics into every layer of their business, setting new benchmarks for the industry.

More articles:

- Overview: Get to know AdviceTech Stars, and what they are doing differently.

- Trend 1: Turning data into action - how dashboards and KPIs are driving smarter decisions.

- Trend 2: Personalisation at scale - how to use data and alerts to deliver more relevant advice.

- Trend 3: Automation across the lifecycle - how to streamline onboarding, reporting and client reviews.

- Trend 4: AI goes mainstream - how you can embed GenAI into your daily advice workflows.

- Trend 5: Trust and cybersecurity - how to safeguard client confidence in a digital world.

- Trend 6: A connected data backbone - how to build the data foundation for integration and scale.

Report: 2025 AdviceTech - Turning data into growth

Report: 2025 AdviceTech - Turning data into growth

The convergence of a tech boom and a data boom are reshaping how advice is delivered. Are you turning that change into growth? This year, see how leading firms are embedding automation, dashboards and AI into daily workflows and get the practical playbook to do the same.

Download the reportKeynote: 2025 AdviceTech - The connected advice firm

Keynote: 2025 AdviceTech - The connected advice firm

Join Sophie Firminger, Head of Technology Sales & Consulting at Netwealth, as she unpacks the findings of the 2025 AdviceTech Report. Learn how the six key trends are reshaping advice, see real-world examples, and discover how you can put the playbook into practice.

Watch nowPodcast: Scaling advice with AI and avatars

Podcast: Scaling advice with AI and avatars

In this episode of Between Meetings, Dan Solin explores how AI and avatars can scale personalisation while keeping advice simple, transparent and client-first. He also explains how tech and human touch combine to deliver meaningful advice in a changing landscape.

Listen to the episode