Outlined below are some changes to the platform that were recently rolled out:

1. Better compare client contributions to the new concessional contribution cap changes

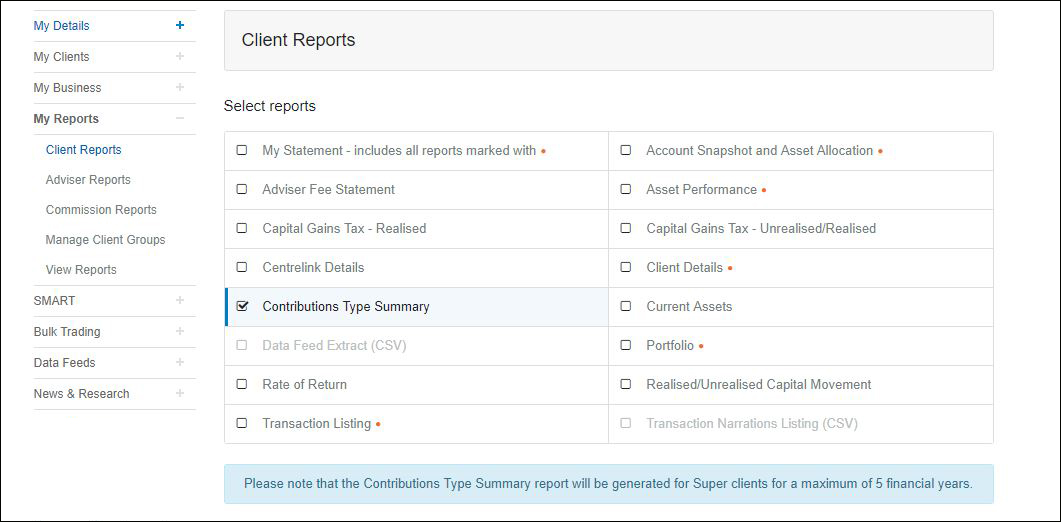

You can now run a PDF report that summarises all non-concessional and concessional contributions made into a client's account for the past 5 financial years. This can help you track contributions against the new concessional cap changes - that came into effect 1 July 2017, at an individual client level.

To access navigate to My Reports>Client Reports>Contributions Type Summary then select a client.

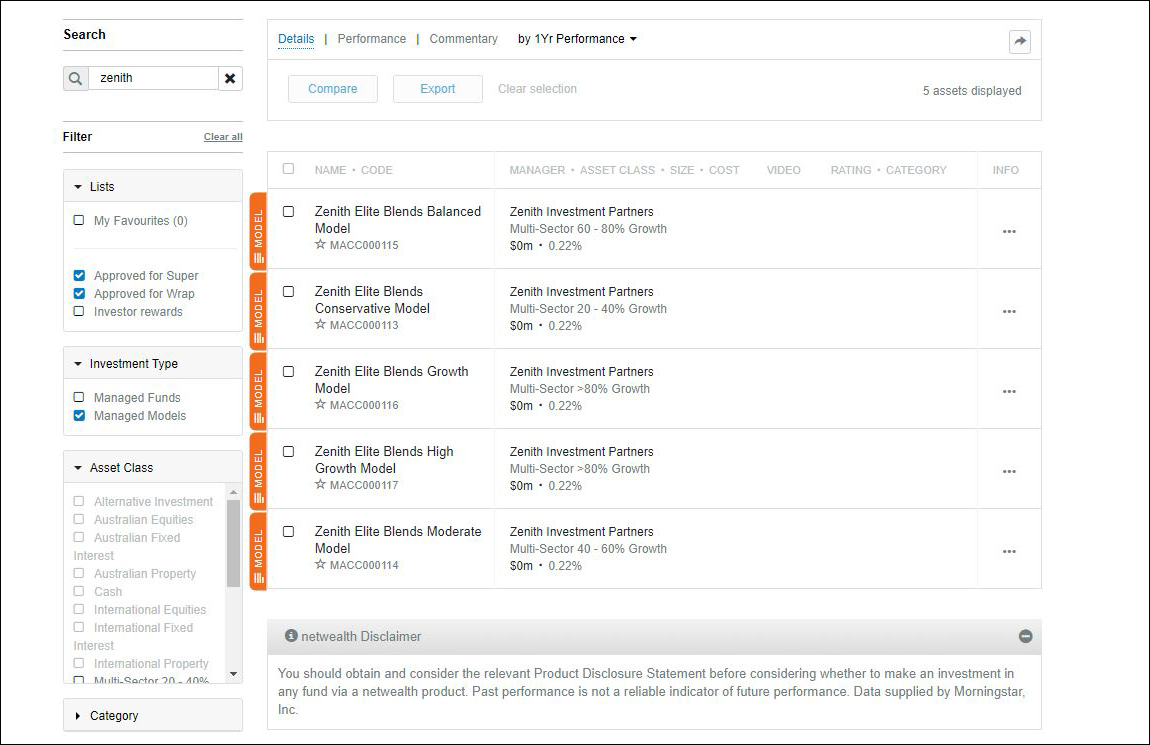

2. Access a range of managed account models from Zenith Investment Partners.

The Zenith Elite Blends have now been added to the Netwealth managed account, and are available on both the Netwealth Super Accelerator and Wealth Accelerator services.

The Zenith Elite Blends provide a differentiated set of risk based models that could be suitable for you and your clients who are looking for managed account options that invest fully into managed funds.

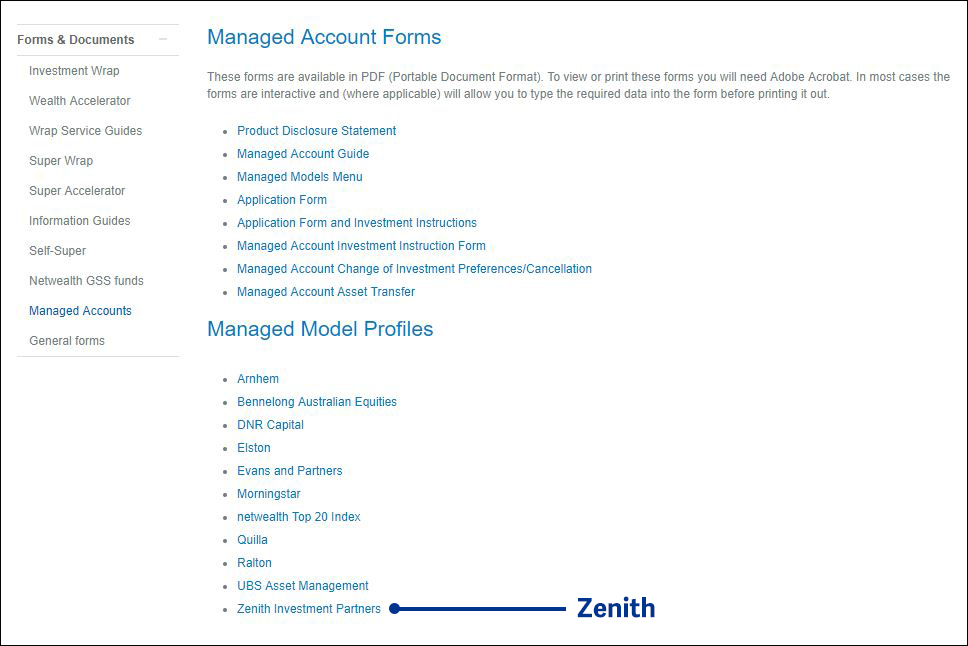

For further information on Zenith and the Models you can download the model profile, or visit the compare funds and models page. You can also access the full list of Managed Model Profiles.

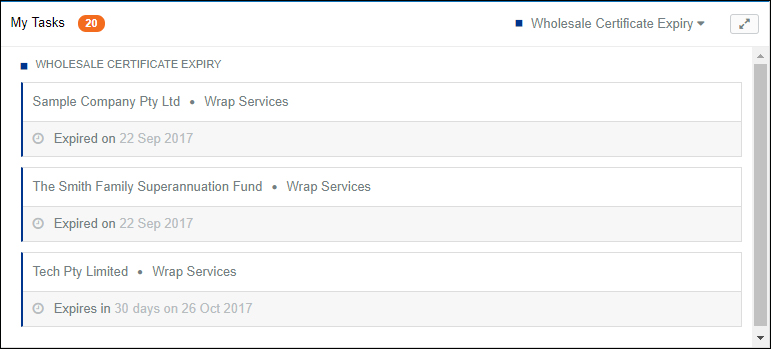

3. Be notified when a client's wholesale certificate is about to expire or has expired

If a client's wholesale certificate is due to expire within the next 60 days you will receive an alert on your dashboard under My Tasks informing you of the number of days remaining until their certificate is invalid, providing you an opportunity to advise your client that they will need to update their certificate or organise it for them.

If it does expire the 'WHOLESALE CERTIFICATE EXPIRY' alert stays on your dashboard until a client's certificate is updated to a valid date. Clients with an expired Wholesale Certificate will not be able to transact with Information Memorandums online.

Other features you may find useful

1. Save time chasing up outstanding client tax information

By encouraging your clients to check their statement online, they can view what assets have tax information outstanding that needs to be provided to Netwealth in order to complete the report. Hopefully, this will reduce the need for you to follow up clients about missing information.

To do this, the client can navigate to Client Reports> View Statements. If they click on a report that cannot be generated they will be presented with an alert similar to the below.

As an adviser, you can also check this per client or track the status of multiple clients' statements in bulk by navigating to Adviser Reports > Tax Statement Tracking.

![]()

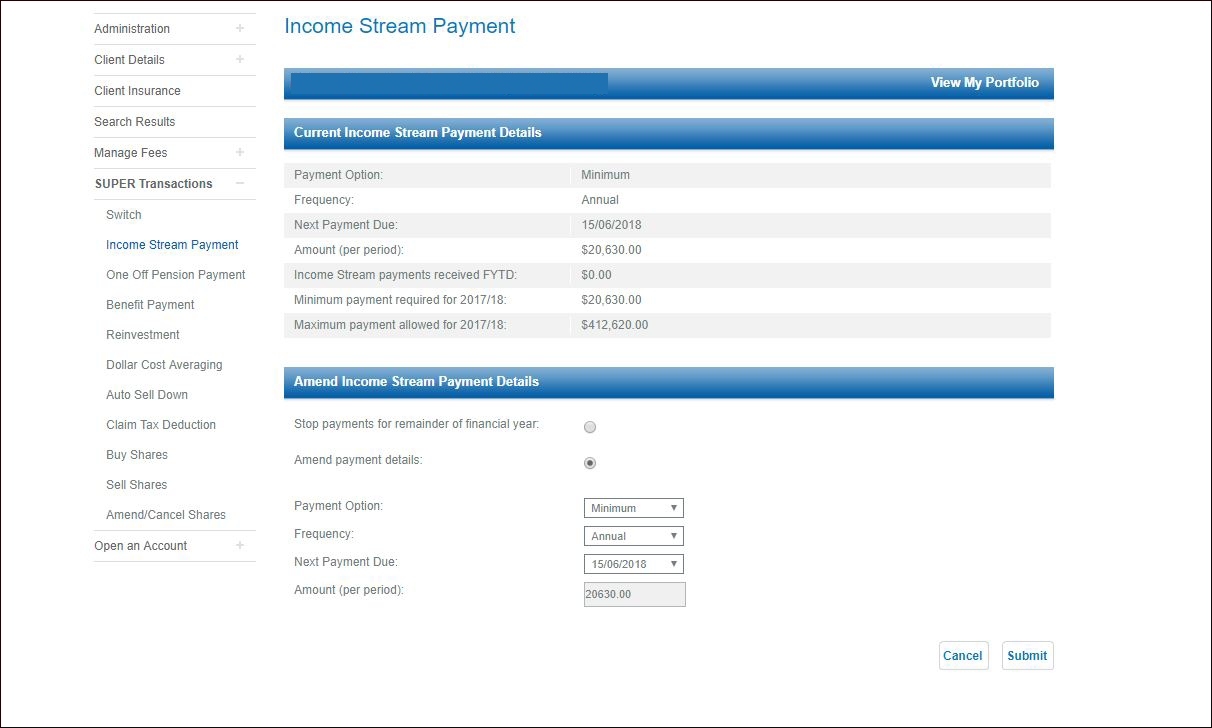

2. Update income stream payments online

If a change to a client's pension amount or pension frequency is required, you can update these details up to two days prior to the payment. This replaces the need to send a "Change of details" form to us for manual processing.

To access select the client then navigate to SUPER Transactions>Income Stream Payment. To check your client pension amounts in bulk, you can also run an excel report via Adviser Reports>Income Stream or Pension.

Enhancements you may have missed!

Identify future income for clients with our newly introduced Dividend Receivable report, manage fees online with electronic approvals and scenario plan the trading impact to a client's managed account when transitioning assets. To learn more click here.