The right price for advice is a vexed question in a profession wishing to demonstrate value to clients, adapting to regulatory change and new professional standards and trying to build profitable and sustainable practices.

It is also difficult because what is the right price for one practice is not necessarily right for another.

This is because, as Elixir Consulting Managing Director Sue Viskovic explained at a recent Netwealth webinar titled ‘What do other advisers charge?’, price is heavily intertwined with the service model and the type of clients being serviced.

“Pricing absolutely affects pretty much everything in your business. A lot of people are aware, obviously, it's going to affect the profit of the business, but it certainly also has an impact on cash flow, business valuation, the client value proposition.”

In the webinar, Sue provided the example of Peter 67 years and Lisa 65 years, both retirees. The couple spend six months sailing on their yacht. They are looking for an advisor to take up the management of their investments because, until now, Peter has managed his own SMSF.

They would like to ensure their children are provided for, both now and into the future, and that their income needs are met, and risk is managed within their portfolio. They own their own house valued at $1.5 million. They have personal investments of $350,000 and $1.6 million in their SMSF.

Netwealth 2017 AdviceTech Report

The report paints a picture of how technology is currently being used in the dynamic and evolving advice industry and provides insights into key areas of focus, must-have, high adoption services, and technologies that are regarded as disruptors, but are not yet being adopted.

Elixir’s Adviser Pricing Models Research canvassed 320 participants, made up of 61% advisers, 30% multi-disciplinary advice businesses, 5% accounting and financial advice and 4% risk specialists, and asked advisers how much they would charge the above client.

The findings included:

- The average engagement fee was $4,632

- The engagement fees quoted ranged from $500 to $20,000

- 16% of participants wanted to charge a fee between $5,200 and $5,800

- 8% of participants wanted to charge a fee between $1,600 and $2,200

- 15% said that they weren't in their target market, so didn't quote a fee.

“There just isn't a single model that will work in every business for every client,” said Viskovic. “It's all about finding the model that works for the client base that you want to deal with.” She suggested that the model also needs need to fit the type of service provided and the financial benefits the firm wants to achieve.

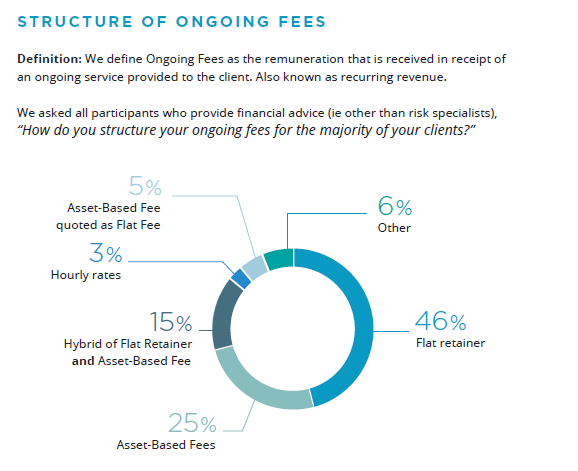

So how do most advisers charge fees? According to Elixir’s research, 25% charge an asset-based fee for their ongoing advice. This has dropped significantly from two years ago, when this pricing model accounted for 34% of participants.

Most survey participants (46%) use a flat retainer, while a hybrid pricing model of a flat retainer combined with an asset-based fee is growing in popularity. In this pricing model, a business will charge a flat fee that is specifically dollar-orientated but they also apply an asset-based fee as well to any of the assets that they manage directly.

What about hourly models? Viskovic says an hourly rate model is used quite frequently by advisors for a transactional piece of work. She says if it's project related or if it's something where you don't know the full extent to the piece of work, but it's in addition to their retainer, it can work quite well.

“But as a standalone model for pricing all your advice, it's not the best option for an advice business because it's very difficult to get the leverage that you can get through other models.”

A critical area of price is communication, and Elixir’s research shows the timing of this communication can influence the price. Of the 225 participants who said they charged their clients some type of upfront fee:

- 4.7% quoted their fee prior to the first appointment, so they used it as a pre-qualifier

- 64.4% quoted their fee either during or as a follow-up to the first appointment

- 29.5% quoted their fee at the second appointment after assessing the client's situation and already drafting some of the strategies.

The average engagement fee for comprehensive advice was in fact $70 higher where the fee was quoted and they sought engagement from the client prior to doing the strategy work, than the average for those practices who quoted their fee after drafting the strategies and talking about what they were going to advise the clients.

“This has given us the evidence, I guess, to say that no, you don't have to prove yourself by showing your advice before the client will see value and engage with you,” said Viskovic.

“What we did find, of course, is people absolutely need to be able to see value in engaging you as their advisor and taking your advice, but that doesn't have to come in the form of the specific advice itself.”

To hear the full presentation, ‘What do other advisers charge?’ click here or if you would like to speak to one of our technical services team, contact your BDM or email us.