You can now react quickly to time critical market events by buying or selling a managed fund across multiple clients in a few easy steps.

- Simply type in the name or code of the asset you wish to trade

- Select clients using advanced search filters

- Input the order details

- Submit the order

This functionality has the potential to save you hours as you no longer need to go into each individual client's Netwealth account to update their portfolio, particularly when needing to make a change as quickly as possible due to market activity.

Below are detailed instructions on how to conduct bulk managed funds trading.

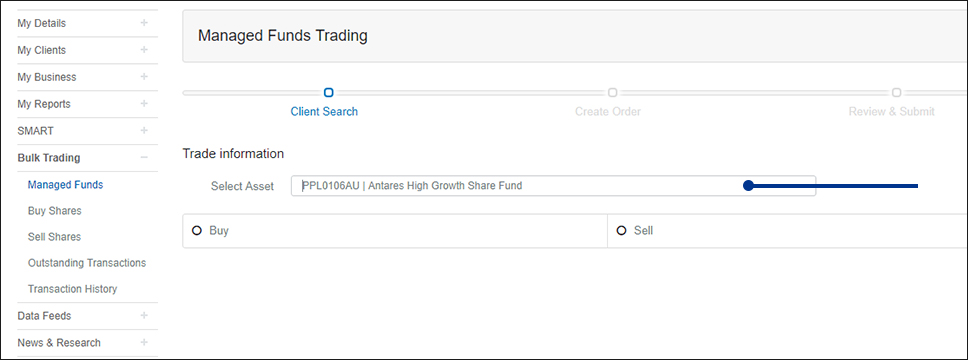

Step 1: Choose the asset

Navigate to Bulk Trading > Managed Funds and simply choose the managed fund you wish to purchase or sell on behalf of your clients by typing the fund code in the Select Asset text box.

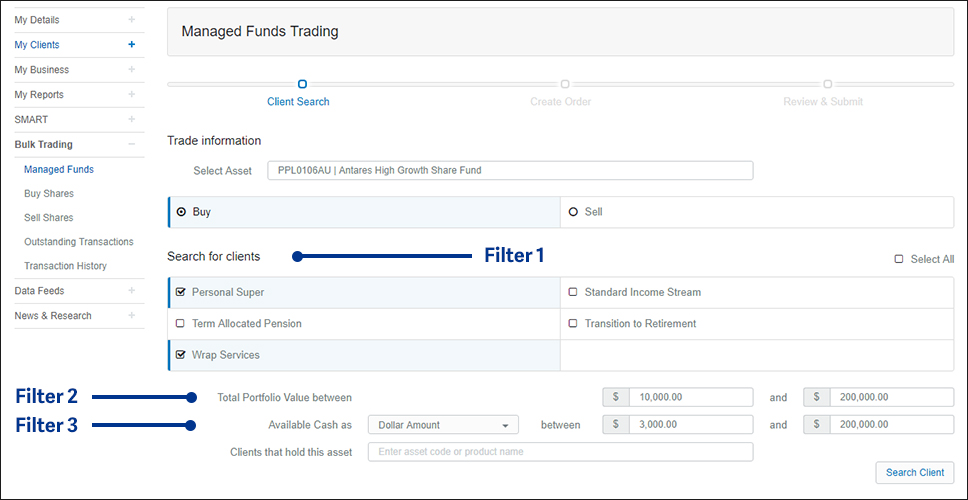

Step 2: Client search

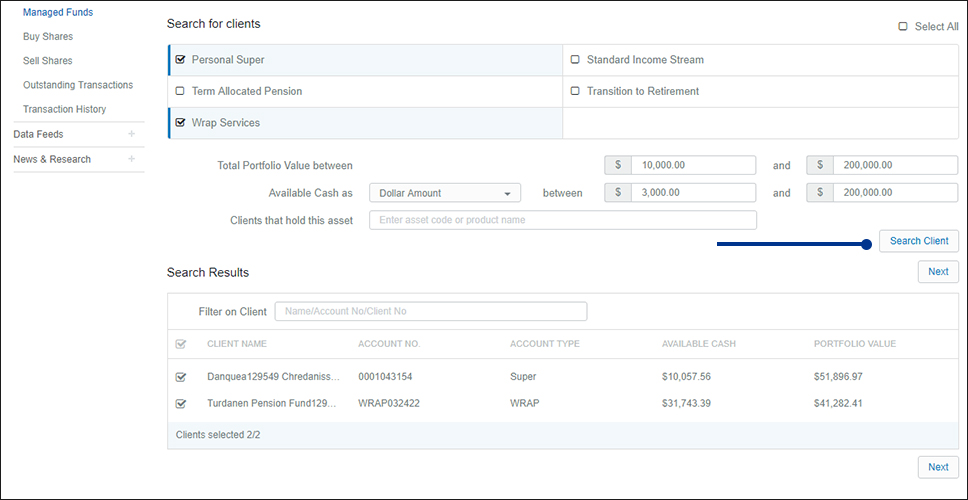

Once you choose either Buy or Sell you can identify the clients you'd like to transact on behalf of by using the available filters.

When the relevant filters have been populated click Search Client to see the clients that meet your parameters. In the client list that appears, choose which clients you'd like to purchase/sell a managed fund for by ticking the box to the left of their name, and click Next.

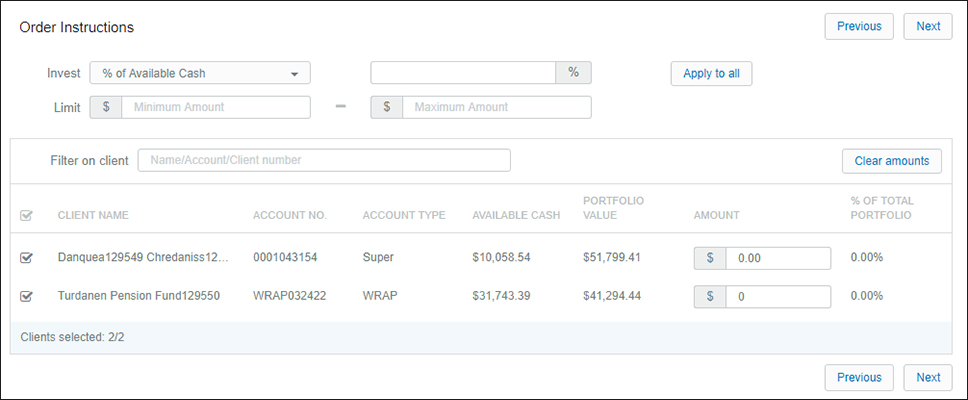

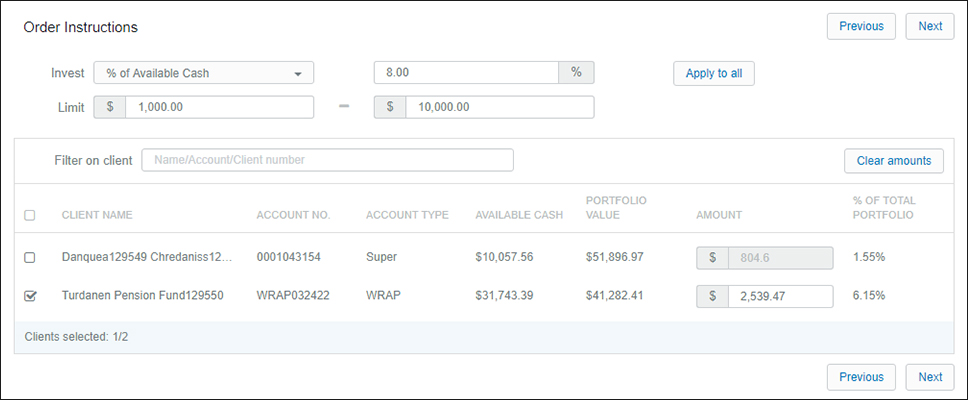

Step 3: Input order instructions

You can either:

(a) manually enter the amount of money you would like each client to invest into the managed fund

OR

(b) use the Order Instructions filter to determine how much of a client's Available Cash or Total Portfolio balance should be invested into the managed fund, and the minimum and maximum amount of available cash they must have in order to invest. This could be a valuable, time-saving feature to use if you have a large group of clients investing into the fund.

How to use the Order Instructions filter:

Once you populate the filter parameters and click Apply to all, the clients that meet your order instructions will be ticked, and those who do not will be unticked and greyed out.

Note:

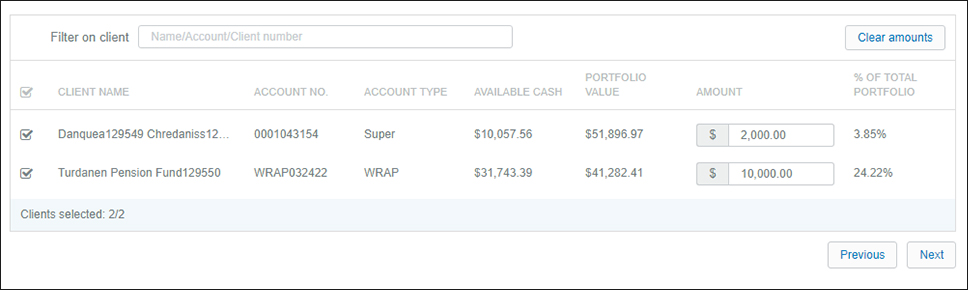

(i) You have the added flexibility to overwrite the amount a client can invest in by clicking into the Amount text box.

(ii) You are able to tick a client who was unticked in order to add them to the managed fund order should you want to overwrite the order instructions for this client.

Step 4: Submit the order

Finally, when you click Next the system automatically validates your translation.

If a client doesn't have enough cash in their portfolio or if investing in the managed fund exceeds the super restrictions, you will be notified prior to the transaction being processed, allowing you to amend the investment amount for the client/s prior to submitting the order.