At Netwealth we are continually enhancing current tools and releasing new features on our platform. And every month we summarise the most useful updates. In June 2018, updates to the Netwealth platform included:

1. Managed accounts are now available in SMART

You can now include approved managed accounts to new or existing SMART model portfolios.

The addition of managed accounts within Netwealth SMART gives you and your clients access to professionally managed investments, which can save you from selecting and managing individual assets within your SMART model.

To add managed accounts navigate to SMART>Models and find the model you wish to add.

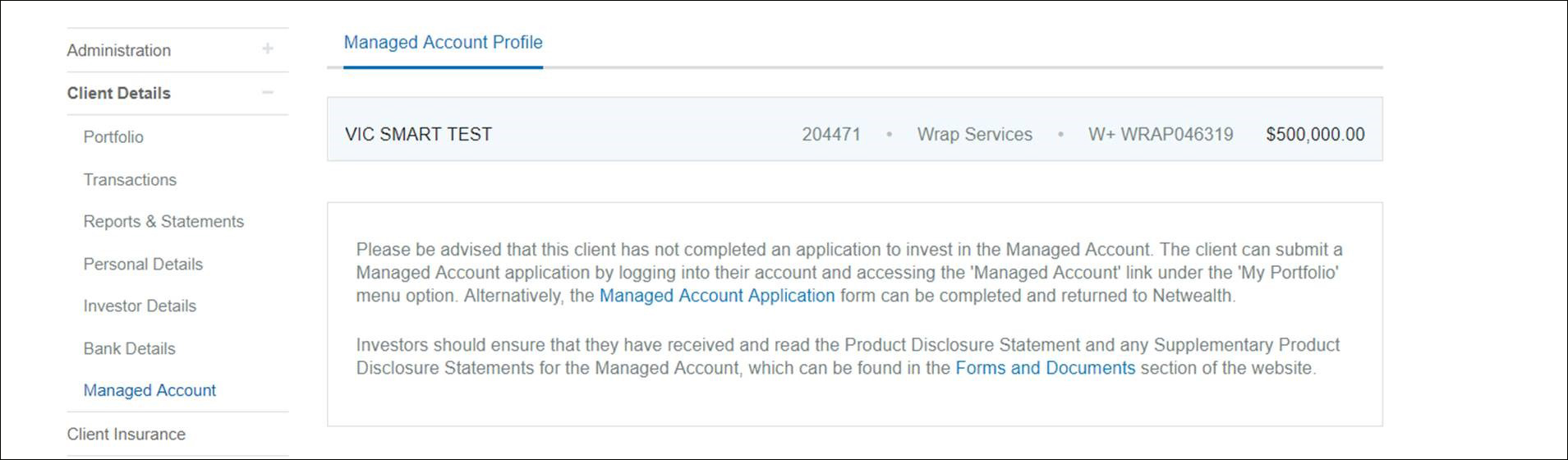

Important: Please note that the client must have approved the use of managed accounts within their portfolio to utilise managed accounts in SMART. You can check which of your clients have authorised managed accounts by navigating to My Reports>Adviser Reports>Managed Account Profiles. To check individual clients select their account and navigate to Client Details>Managed Account, if the below message appears they are not approved.

Read how you can also take advantage of our automated ROA functionality when you rebalance client portfolios within SMART.

2. View a summary of your client's portfolio performance in our new report

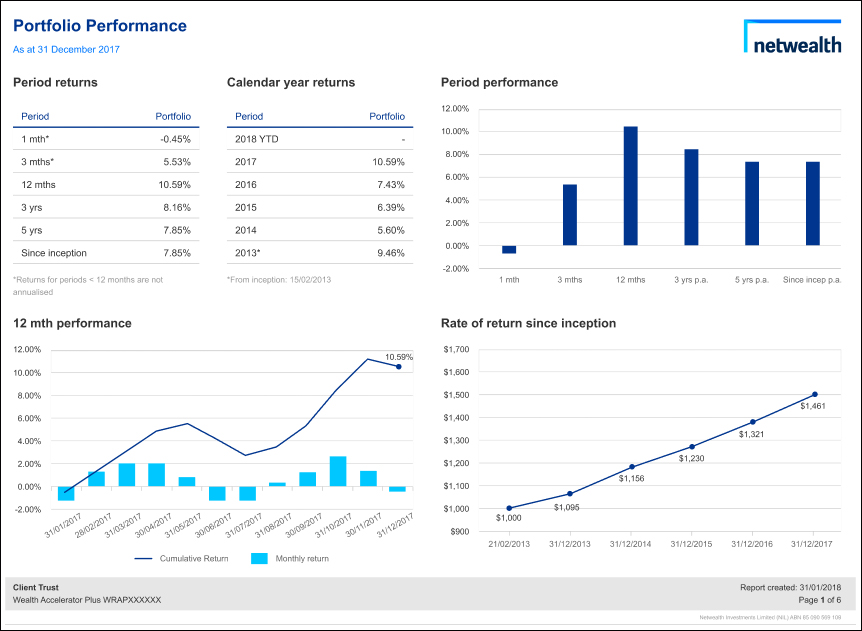

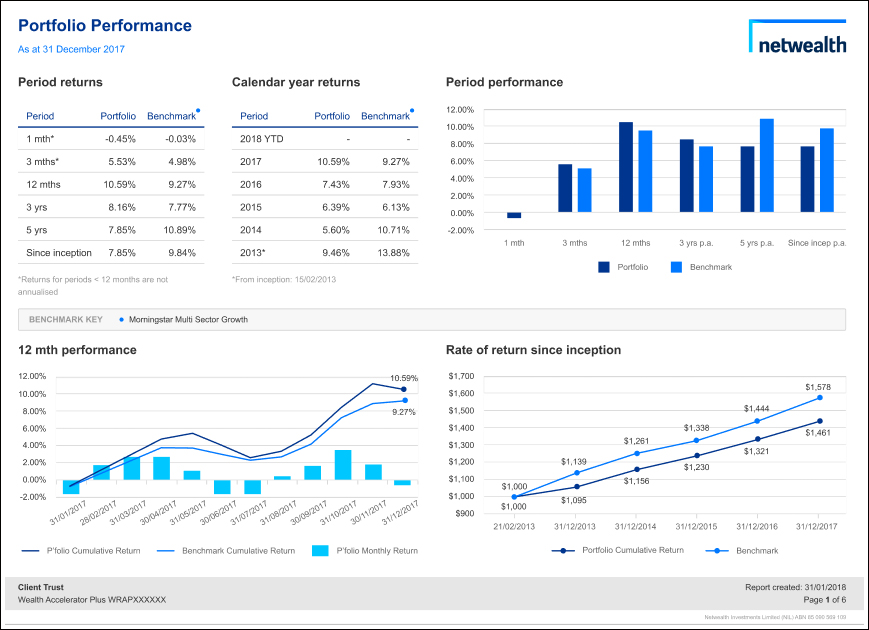

Now available for you to access is the new Portfolio Performance Report. This report provides a concise visual summary of a client's short and long term portfolio performance.

The report provides details of portfolio returns across commonly reported periods. It also displays the monthly and cumulative returns over the previous 12 months and the rate of return since inception.

You can access the Portfolio Performance Report by selecting a client and navigating to Client Details>Reports & Statements>Portfolio Performance (new format).

Coming Soon

Excel and interactive HTML formats, as well as the ability to compare returns to a range of selected benchmarks.

To see what other reports are in development, click here.

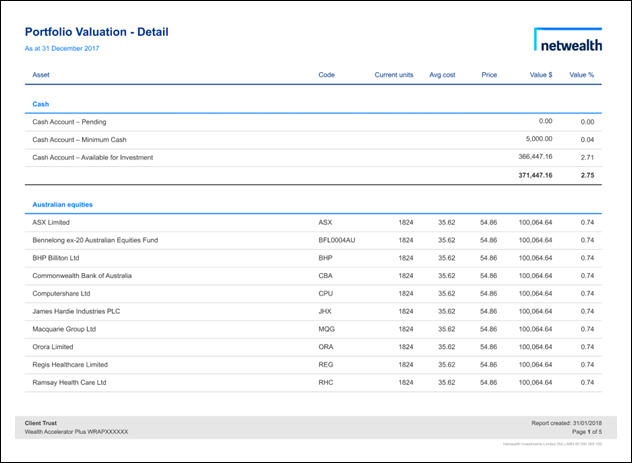

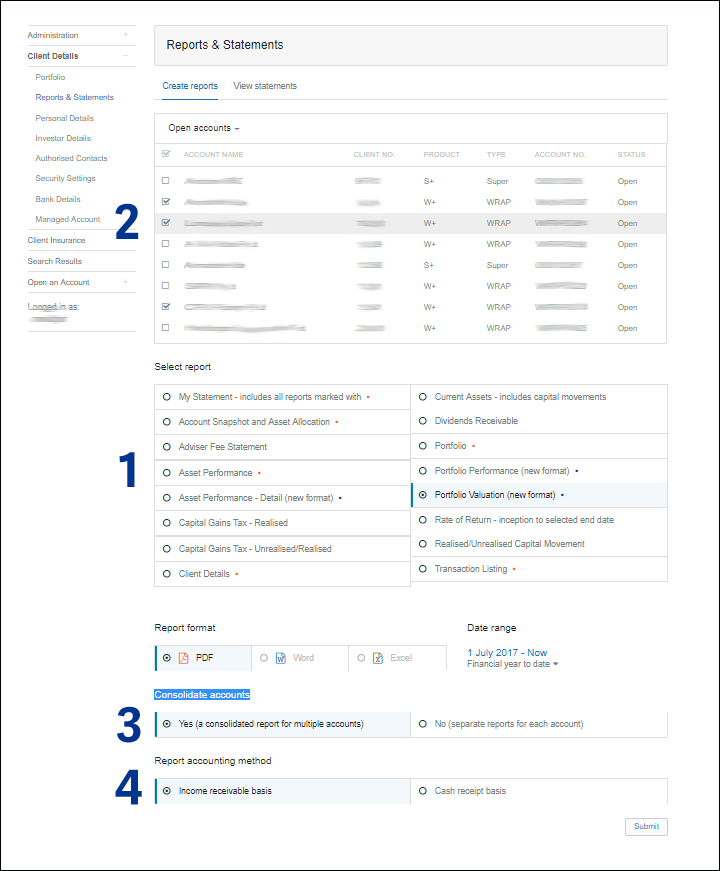

3. View your client’s portfolio valuations in a consolidated or individual account report

Our new Portfolio Valuation – Detail Report provides asset and portfolio valuation details on your client's accounts. This report also gives you the ability to produce consolidated reports across multiple selected accounts or run separate reports for each one.

To use this report select:

- A client and navigate to Client Details>Reports & Statements>Portfolio Valuation (new format)

- The accounts which you would like information on

- Whether you wish to view a consolidated report or separate reports for each account

- The accounting method and click submit.

To see what other reports are in development, click here.

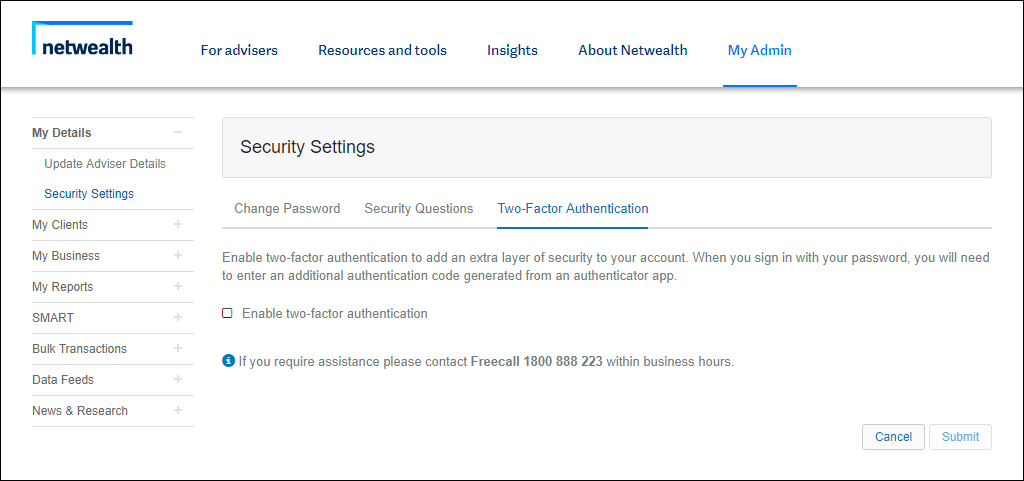

4. Add extra security to your account with two-factor authentication

We have added the ability for Netwealth users, including your clients, to turn-on two-factor authentication to better protect their Netwealth account. Once this feature is turned on, when logging in the user will be required to submit a code sent via a mobile 'authenticater app'.

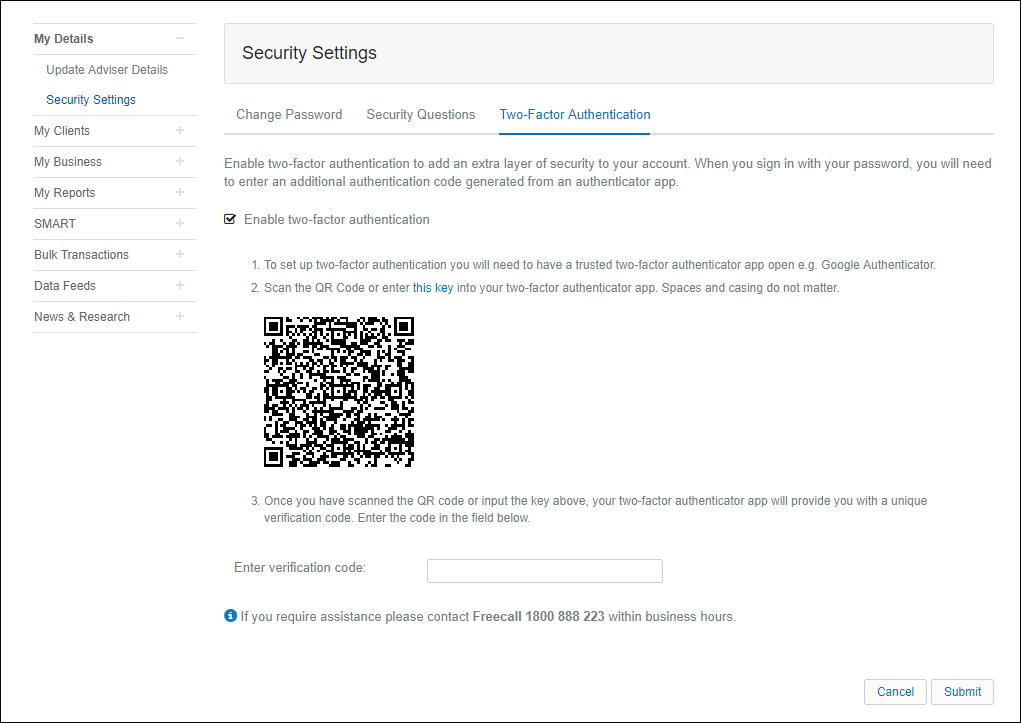

To use this feature, you will need to:

- Download a mobile authenticator app, such as Google Authenticator.

- Turn on this setting via My Details>Security Settings>Two Factor Authentication

3. Either scan a QR code or enter a key manually from your chosen authenticator app.

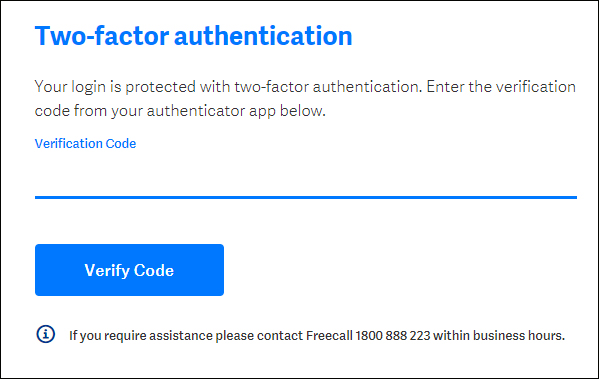

4. The next time you login you will be asked to enter a verification code (from your mobile authenticator app), after you have entered the username and password.

Tools for tax time

At Netwealth we have a number of tax tools that help you manage the busy end of year activities.

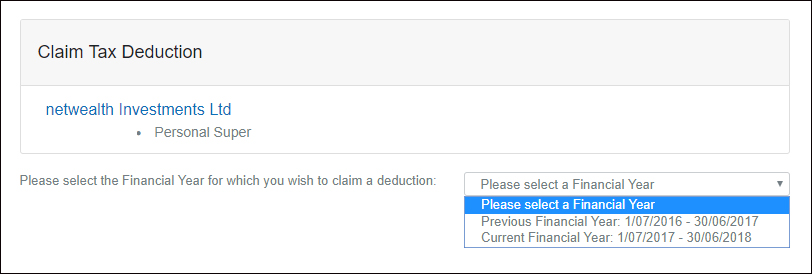

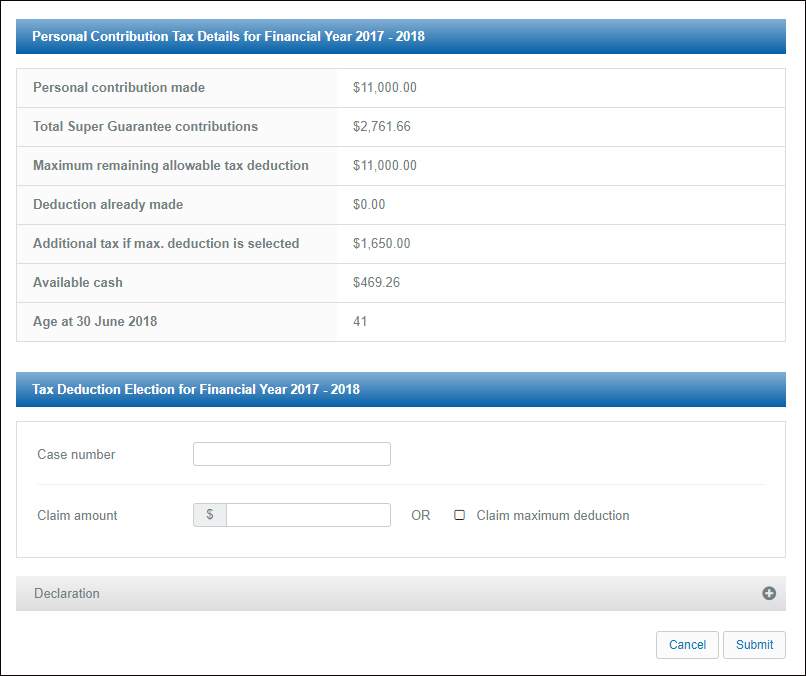

1. Claim tax deductions online

You can process a Section 290 – 170 Tax Deduction online for your client, saving you from submitting the ATO form to Netwealth.

To do so select a client and navigate to SUPER Transaction>Claim Tax Deduction, then enter the case number and specify the amount to claim or choose the maximum deduction based off contributions received for the current or prior financial year.

2. Save time notifying clients of outstanding tax information

Our Tax Tracker tool gives you and your clients the ability to see what assets are yet to provide their tax information for us to complete the tax statement.

By encouraging your clients to check their statements online, they can view what assets have tax information outstanding, empowering your clients and potentially removing unecessary communications.

Your client can check the status of their tax statement by

- Navigating to Client Reports>View Statements.

- If they click on a statement that cannot be generated they will be presented with an alert similar to the below.

![]()

As an adviser, you can also check this per client or track the status of multiple clients' statements by navigating to Adviser Reports>Tax Statement Tracking.

![]()

To learn more about any of these features, contact your Training and Relationship Manager.