Take outs

- Advisers helping clients develop solutions for retirement income will be able to deploy “new tools from their kitbag".

- New means testing rules for lifetime income streams commence on or after 1 July 2019.

- These rules are designed to encourage the use of lifetime income streams to help manage better longevity risk for clients.

Incoming legislative changes from 1 July will present advisers with new ways to help clients create income streams in retirement.

Advisers helping clients develop solutions for retirement income will be able to deploy “new tools from their kitbag” due to changes to the means testing of lifetime income streams, according to Andrew Lowe, Head of Technical Services at Challenger, presenting at Netwealth's Outside the super square roadshow.

The first element of the Government’s Retirement Income Framework was delivered back in 2017. “On 1 July 2017, the Innovative Superannuation Income Streams reforms were introduced,” says Lowe. “The Government legislated alternative settings for tax-free retirement income streams”.

“What we got was a new category of income stream that limits access to capital rather than limiting payments. This will be a tax-free retirement-phase income stream, so zero tax on earnings and zero tax on payments after the age of 60”.

Challenger has brought products to market that work in this particular space, including its deferred lifetime annuity, and Lowe walked advisers through how deferring payment at the start can impact client retirement income outcomes.

The next element of the Government’s Retirement Income Framework is new means testing rules for lifetime income streams commenced on or after 1 July 2019. These rules are designed to encourage the use of lifetime income streams to help manage better longevity risk for clients.

“These changes do not apply to account-based income streams, so no changes to account-based pensions. Second, these changes don’t apply to term income streams. And third: these changes do not apply to any lifetime income stream that starts before 1 July. After 1 July, however, 60% of payments count under the income test. Under the assets test, 60% of the purchase price will count as an asset to age 84 or for a minimum of five years. Thereafter, from age 84 or from that minimum of five years, 30% will count as an asset.”

These new rules mean that assets test sensitive clients (clients receiving a part Age Pension because of the assets test) could immediately increase their Age Pension by allocating a portion of their assets to a lifetime income stream.

With change comes your chance to explore new perspectives

We’ve developed a suite of resources to help you navigate this changing landscape – our Change/Chance Series. This selection of guides and articles delve into topics that are front of mind for advisers, now.

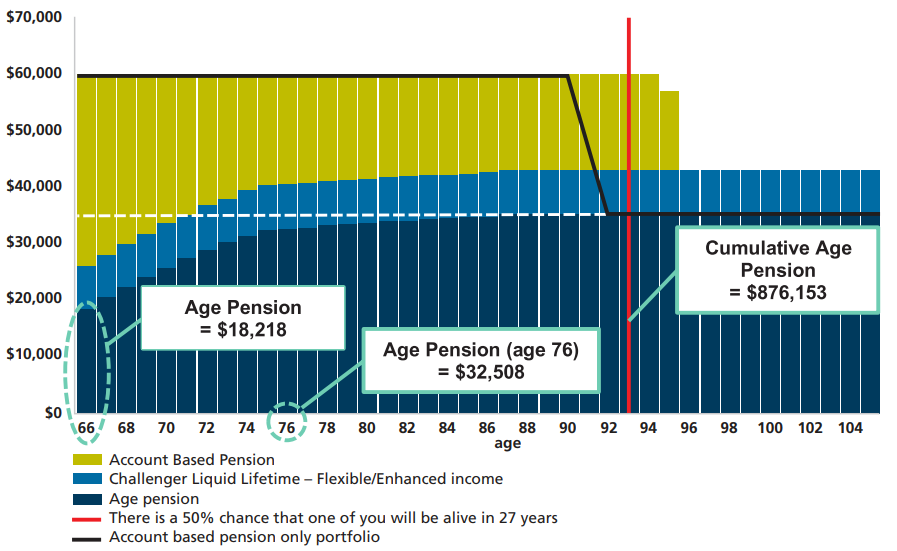

Lowe then demonstrated the combination of benefits that a partial allocation of assets to a lifetime income streams might provide a client on or after 1 July 2019. He illustrated the impact for a 66-year old client couple who own their own home and have $600,000 of assets in account-based pensions, $50,000 in bank accounts and term deposits and $20,000 in personal assets. They want $60,000 p.a. in total income to fund their retirement but, as a minimum, require $42,000 to meet needs and essentials.

Where this couple was to allocate 25% of their portfolio ($75,000 each) to lifetime income streams:

- They secure a guaranteed lifetime income stream payable in addition to their Age Pension entitlements that ensures that they can always meet their minimum income requirement of $42,000 p.a., irrespective of how investment markets perform or how long they may live; and

- They experience a higher Age Pension entitlement in the early years ($4,680 higher in the first year) due to the immediate assets test concession available from 1 July 2019.

The following graph shows the combination of income streams payable to these clients (including Age Pension, account-based pension and lifetime income streams):

Assumptions and source: Challenger Retirement Illustrator (beta version) July 2018. Clients maintain an overall asset allocation of 50/50 growth/defensive (including the allocation to the defensive lifetime annuity). Account-based pension growth assets return 7.70% p.a. and defensive assets, 3.70% p.a. before management fees of 0.80% p.a. and 0.60% p.a. respectively. In addition, platform fees are assumed to be 0.50% p.a. Values are in today’s dollars.

Explore more retirement income resources and insights from the roadshow.

Insights

Latest: Managed accounts during volatility and beyond

Four advisers share how managed accounts can enhance your client value proposition.

Special reports: Take a deep dive

Our collection of guides take a deep dive on topics including AdviceTech, managed accounts and cultural trends.

Podcasts: Between Meetings with Matt Heine

Netwealth's Matt Heine chats to industry thought leaders on the opportunities they see for financial advisers.

Webinars: Grow your Business IQ

Recordings from our monthly webinar series, covering a range of topics presented by industry professionals.

Views expressed are of the interviewee and may not be the opinion of Netwealth or its related companies.