More product updates

A summary of platform enhancements from past years

Below is a summary of our key product highlights from prior years. If you would like to learn more or to see them in action please speak with a BDM.

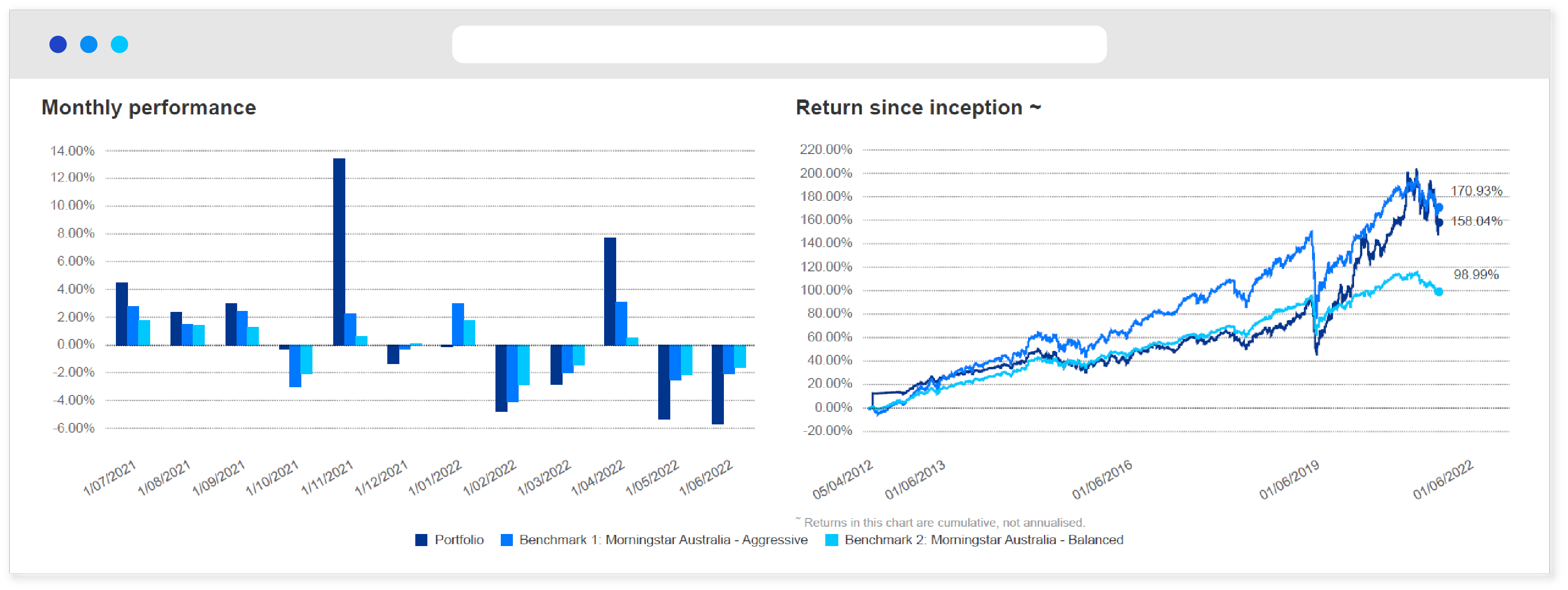

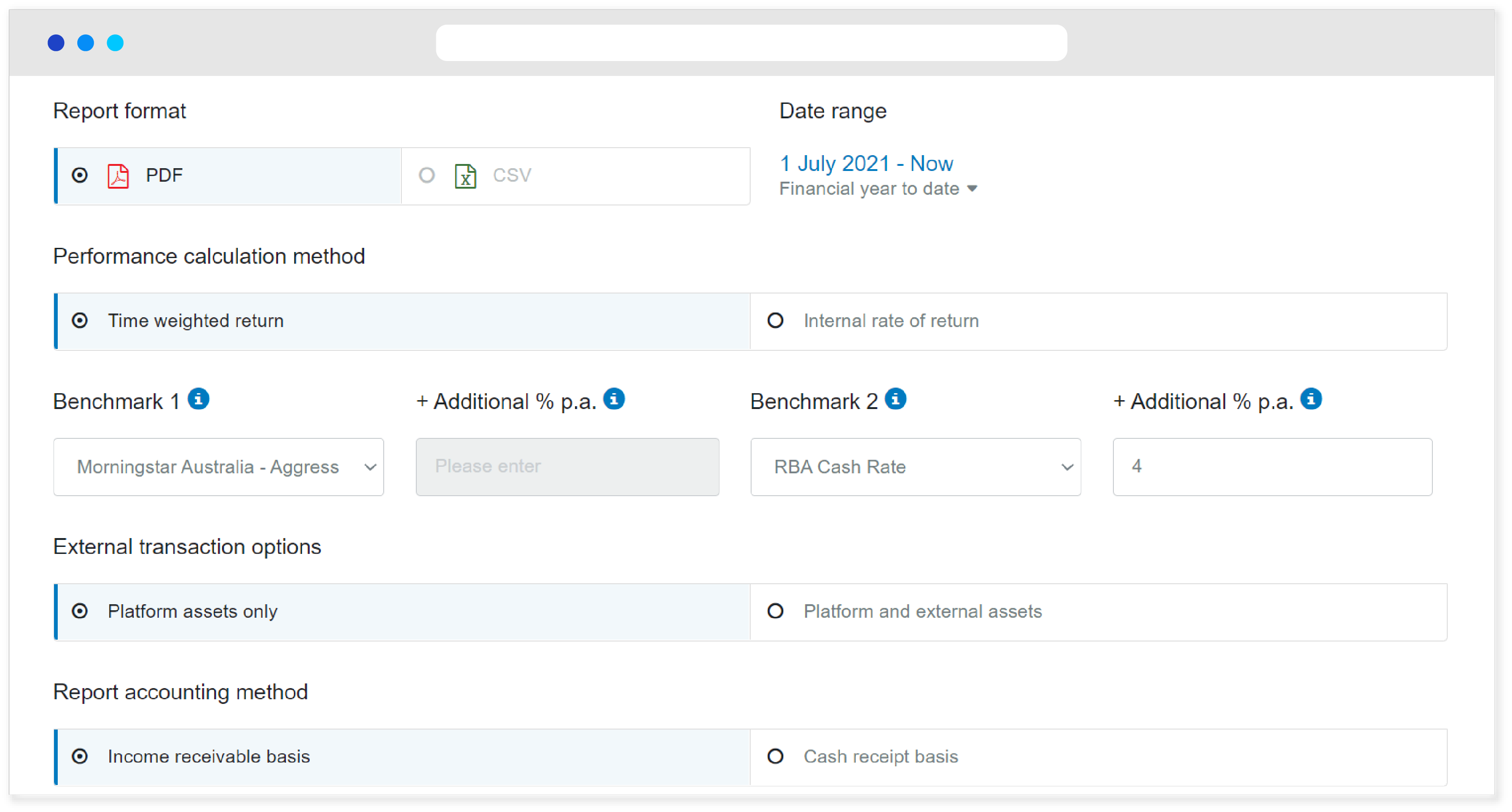

Now client portfolios can be benchmarked against pre-set benchmarks or custom objectives. With the latest enhancements to Netwealth's client reports, you can select two benchmarks, selecting from 5 Morningstar target allocations, CPI or the cash rate. You can also create a custom objective by adding a fixed % rate of return above either the CPI or RBA cash rate. For example, a portfolio may be benchmarked against RBA cash rate + 4% p.a.

More reporting enhancements:

For an in-depth and live look at any of our features, please request for one of our team to contact you.

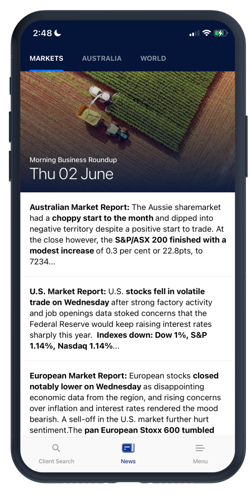

Enjoyed by over 8,000 readers, Netwealth’s Morning Business Roundup is a daily curated news feed with the latest market and company news.

It is now available for your clients using the Netwealth app, when you turn it on via ‘Communication’ located under Business Settings in the main menu.

You can also white label the Netwealth mobile App so it aligns with your branding.

Help your clients to stay informed of relevant market news whilst keeping your business front of mind.

Advisers and their clients can now monitor connected insurance policies through the mobile app. Insurance sums insured are displayed in charts and upcoming premiums can be monitored with calendar alerts. Users can even download a certificate of currency for group policies straight from the app.

Netwealth is the first platform to offer NAB Equity Builder, a new type of investment loan that gives investors an alternative to a margin loan or home equity loan. NAB Equity Builder is a principal and interest (P&I) loan for purchasing managed investments such as managed funds, ETFs, LICs and SMAs. There are no margin calls and the loan uses the investments acquired through the NAB Equity Builder as security.

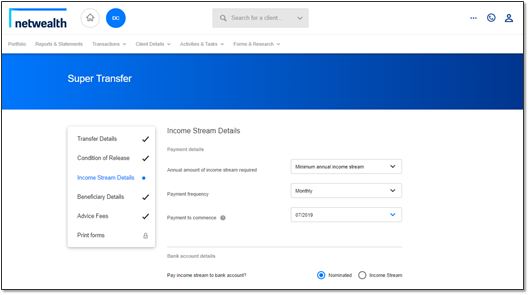

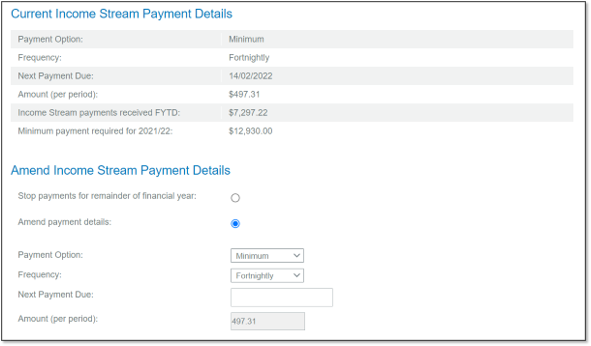

We have several new changes and enhancements to how we manage pension payments, offering greater flexibility in how and when pension payments are received. The key enhancements include:

We are releasing improvements to the mobile app every month. Here are some of the latest adviser and client enhancements:

Log into or download the app at the Apple Store or Google Play to find out more.

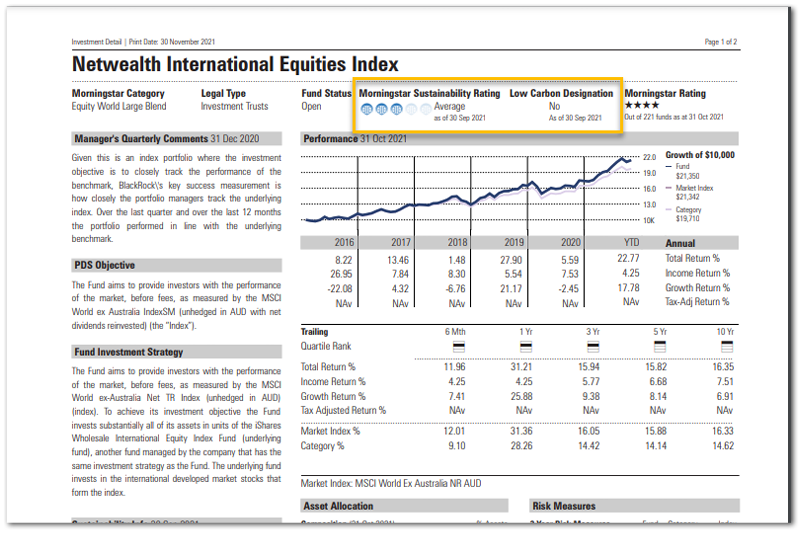

Netwealth's diversified index based funds, formally known as the Netwealth Index Opportunities funds, have been relaunched. BlackRock Investment Management (Australia) Limited have been appointed as the investment manager and the product names amended to reflect the change of manager.

These funds are diversified investments that use strategic asset allocations and invest in underlying BlackRock managed funds and ETFs. The underlying investments are a mix of index, enhanced index and active strategies. The allocation to active strategies is used where the manager sees particular opportunities due to market inefficiencies and the potential to generate alpha. These funds are also available in Accelerator Plus.

According to our latest research(1), 45% of Australian's aged 18+ say that socially responsible investing is an important consideration in their investment strategy or that they are willing to sacrifice returns / pay more for socially responsible investments. The challenge for them and for like-minded investors is to validate the authenticity of the investments they choose.

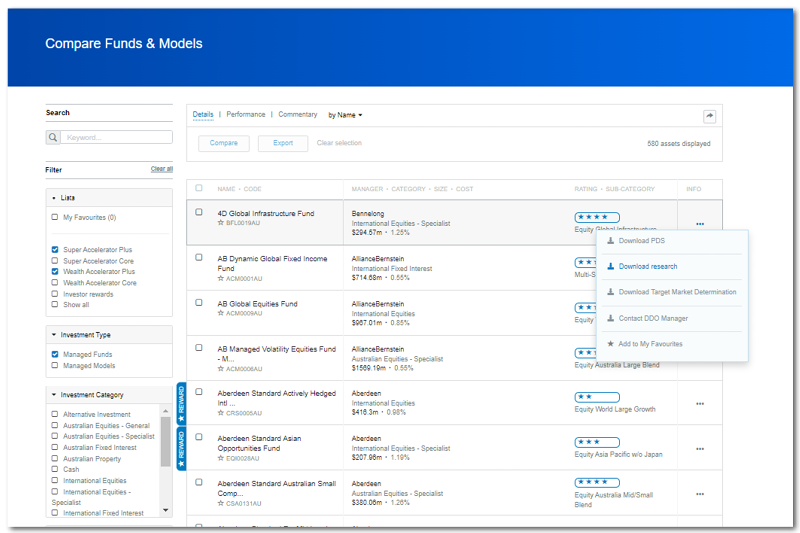

With this in mind, we are pleased to introduce ESG research and ratings on managed funds from Morningstar. The new ESG ratings available on our Compare Funds & Models page include:

We have also introduced a resource where you can access Morningstar's top-rated ESG funds across different asset classes.

(1) 2020 Advisable Australian Survey, n=1,616 people aged 18+

We are upgrading and making the login process simpler and more secure with a new login page and password issue process.

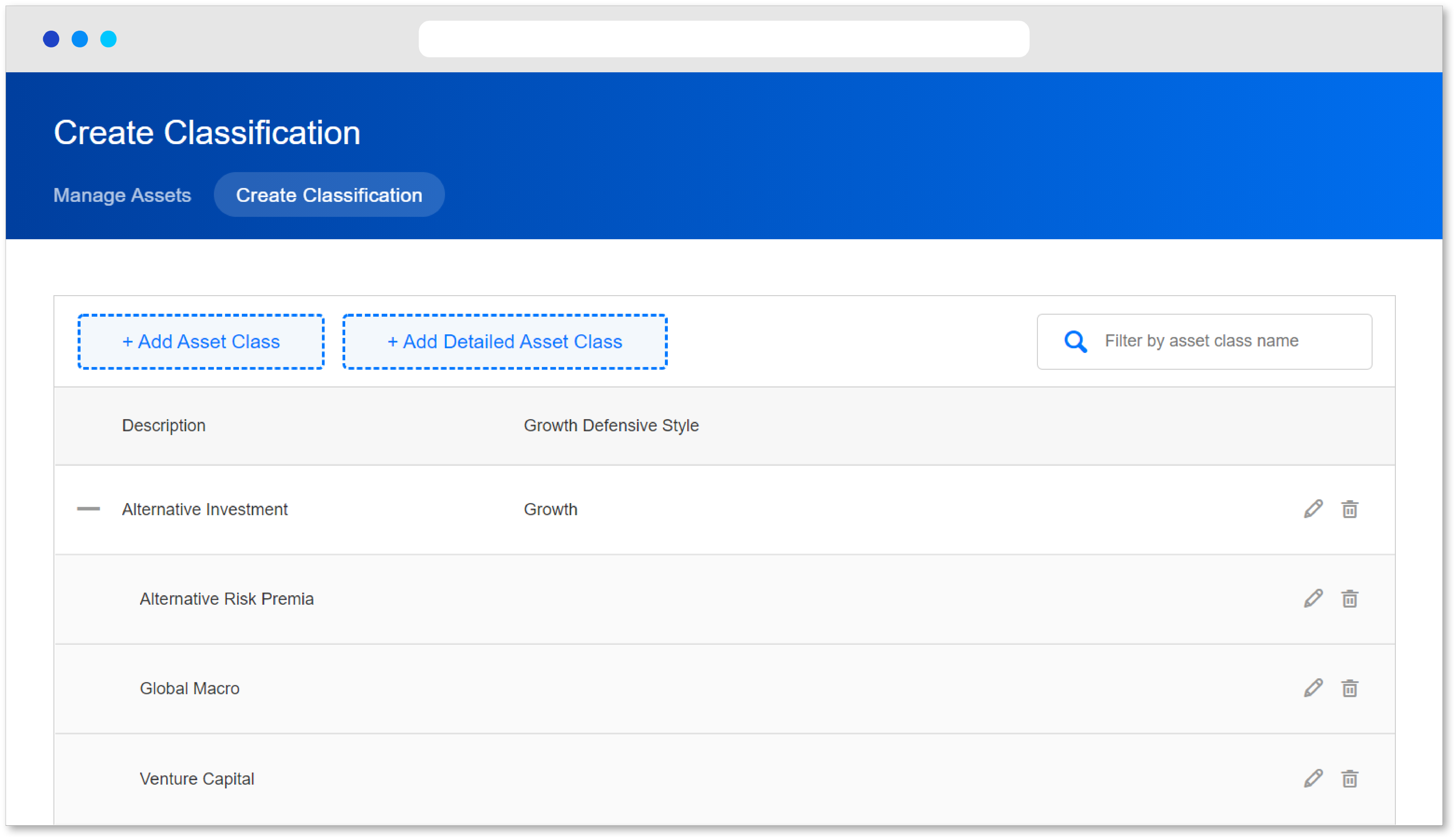

You can now define your own asset and detailed (sub-asset) classes to override Netwealth's default asset classifications. Giving you the ability run customised client reports and have online portfolios that reflect the asset allocation and terminology used by your practice. For example, some firms may want to change "multisector" to "diversified" or create custom asset classes for investments currently assigned to 'other' or 'miscellaneous' categories.

Asset Classification is available now and requires licensee approval, contact your BDM for more information.

Improve client engagement, service levels and build trust with Netwealth's new mobile app for clients.

With two in five advisers that use client portals benefiting from improved client engagement and client satisfaction* we are pleased to launch Netwealth's next-gen client portal, a mobile app for your clients.

*Source: 2021 Netwealth AdviceTech Report, n=348 respondents

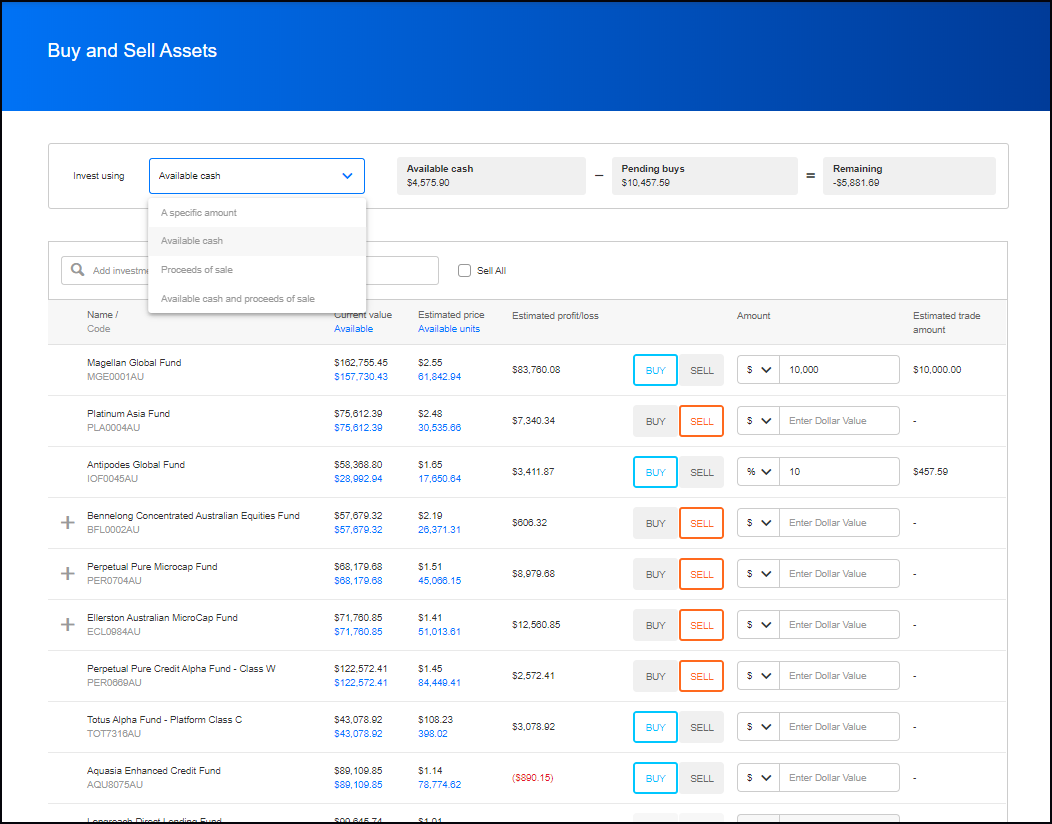

It is now easier to buy and sell investments through Netwealth via our updated investment order pad.

To save time and remove complexity, we have integrated ASX trading into one screen so you can trade ASX securities, managed funds, term deposits and managed account models in a single transaction.

We are pleased to announce our new partnership with Citigroup Global Markets Australia Pty Limited (‘Citi’) as our preferred platform broker for trading of ASX securities.

Citi is a well-established global equities trading business with a strong local presence in Australia, extensive industry experience and market-leading technology. Through our partnership with Citi, we believe financial advisers and clients will enjoy an even better trading experience.

As a result of this new partnership, we have refined certain platform ASX security trading rules:

Provide a better client experience and service offering by sharing account information with your clients' professional support network.

Professionals such as accountants, stockbrokers, and mortgage brokers can now create a Netwealth Professional Third Party account and be given permission to view the details of your clients' accounts online. Providing them with a range of benefits including:

We've put together a guide on how to facilitate the creation of Professional Third Party accounts and how to provide client access.

Under the Financial Sector Reform Act 2021, new requirements for client fee consent begin from 1 July 2021.

To simplify the collection of advice fees for your business, we're building out new functionality and updating our process, including electronic fee consent options, embedded fee consent, and online tracking.

As part of our flexible fee management tools that help you manage fees and disclosures, fee updates, discounts and client release from fees, we are pleased to announce the upcoming release of our fixed term advice fee solution.

With Live Chat, you can chat with a Netwealth customer service representative using instant messaging from your desktop, eliminating the need to call us. Get answers to your questions from a real person in real time, during business hours, 8:30am to 5pm AEST.

Almost 3 in 5 advice firms manage 25% of their clients' investment and super portfolios externally to the platform ('off-platform'), with a further 20% managing over half of their client's portfolio 'off-platform'*.

This creates the reporting challenge of getting a true understanding of a clients' portfolio, as well as the additional administrative overhead of using workaround systems when entering and managing external data.

XWrap is Netwealth's solution to change this. We've simplified the process for recording 'off-platform' asset data for a client, including unit price history, income, fees and other transactions. We've also enhanced our reporting suite so you can use it to view XWrap data consolidated with Netwealth accounts or as stand-alone.

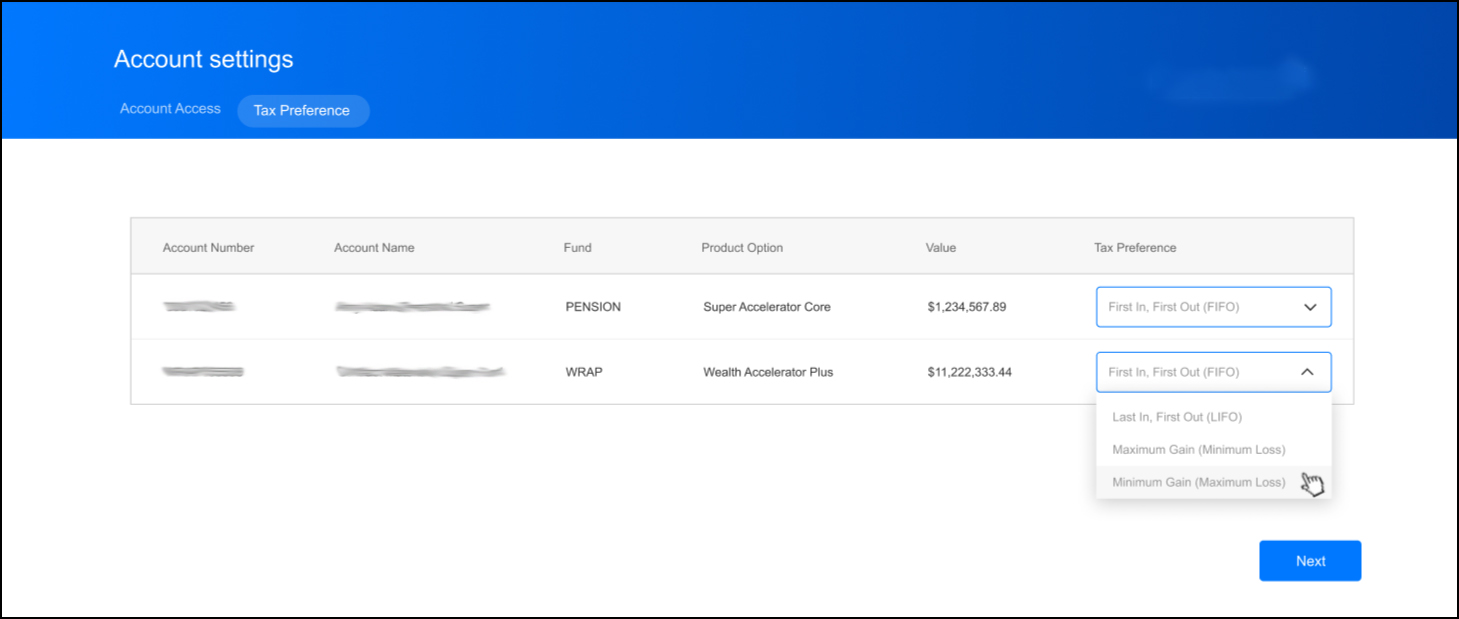

Instead of having to select preferred tax options for each parcel sold, you can now set a preferred tax option for sale at an account level. You can choose from First In First Out, Last In First Out, Maximise Gains or Minimise Gains methods for CGT calculations. This can be set via Client Details > Account Settings > Tax Preference.

We've refreshed the look of our annual super statements to give your clients a clearer view of their super account. The new design features:

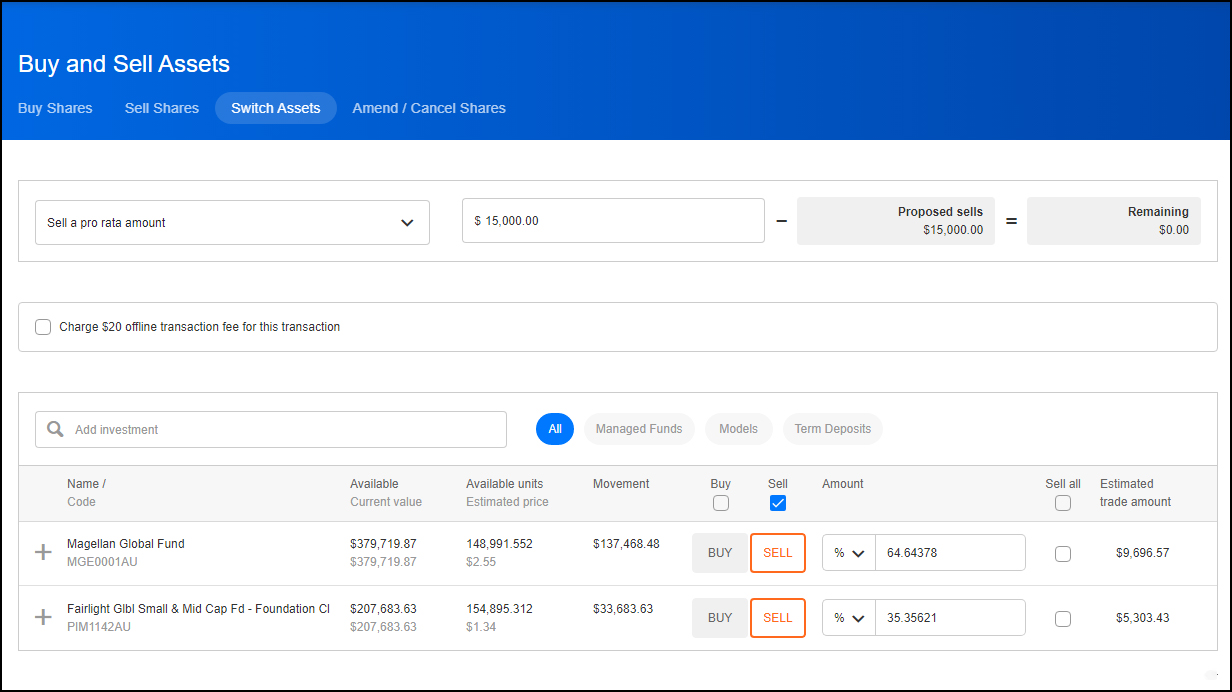

With our new 'Pro-rata' sell option you can set a fixed total sales amount and the selected managed funds will sell down at the percentage they are held. Go to Buy & Sell assets>Switch assets and select 'Pro-rata' from the drop down in horizontal calculator at the top.

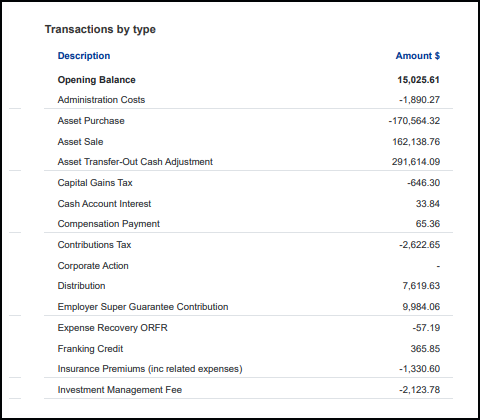

A “Transactions by type” summary has been added to the Client Cash Transaction Listing Report to show the total value of each transaction type for a chosen date range.

We are expanding our Accelerator Core investment menu over the next 12 months, and are pleased to announce these first release strategies:

GSS Active Single Sector Funds

Managed by Magellan and based on the same strategy as their flagship funds, the Magellan GSS Funds are suitable for long-term investors seeking an active exposure to listed global securities or listed global infrastructure securities.

GSS Risk-Managed Models

With built-in risk protection, the Milliman Smartshield GSS Managed account models are designed for investors seeking to reduce volatility in their portfolio.

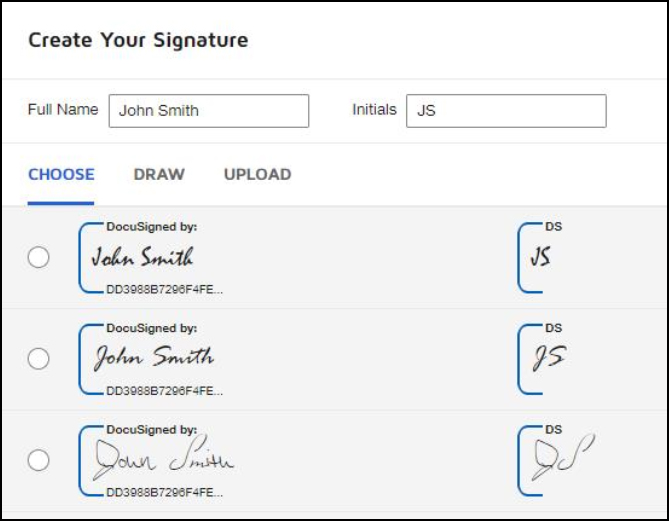

We now permanently accept Docusign generated e-signatures for many Netwealth documents, in addition to accepting drawn electronic signatures from any provider.

To take advantage of this:

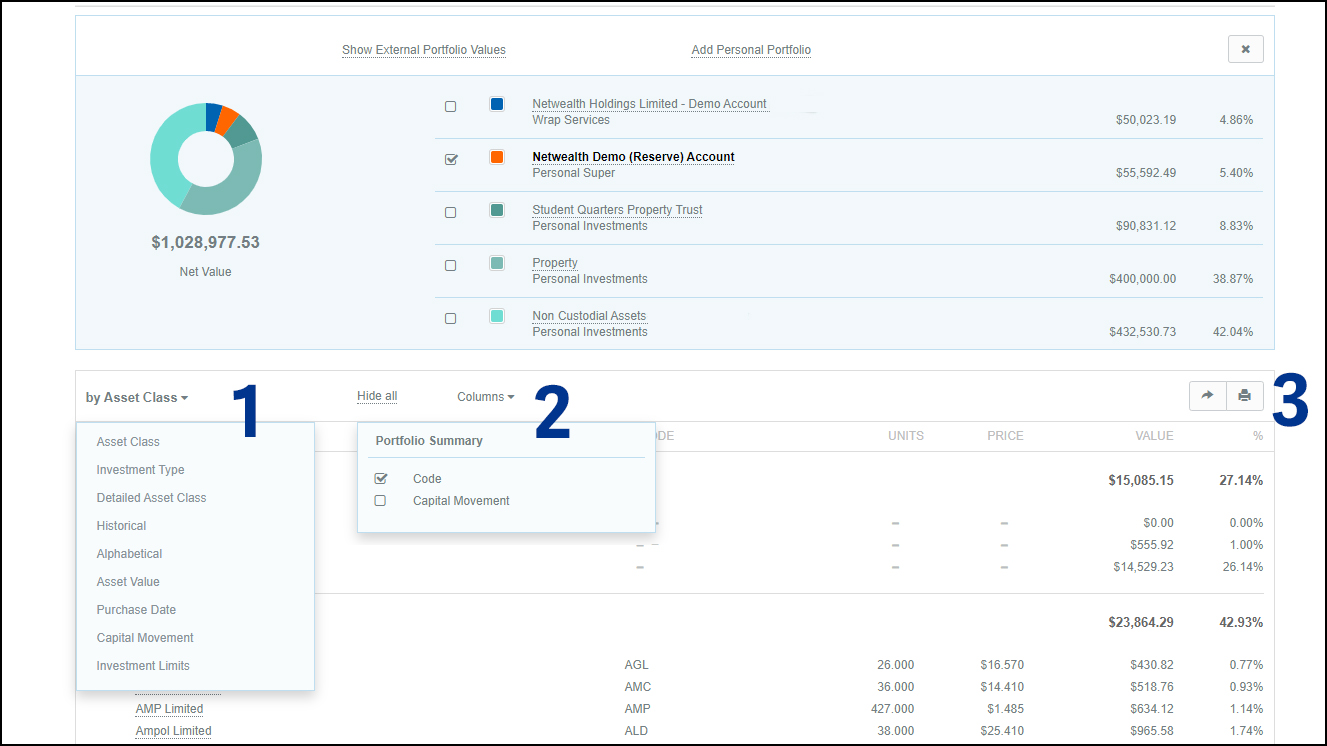

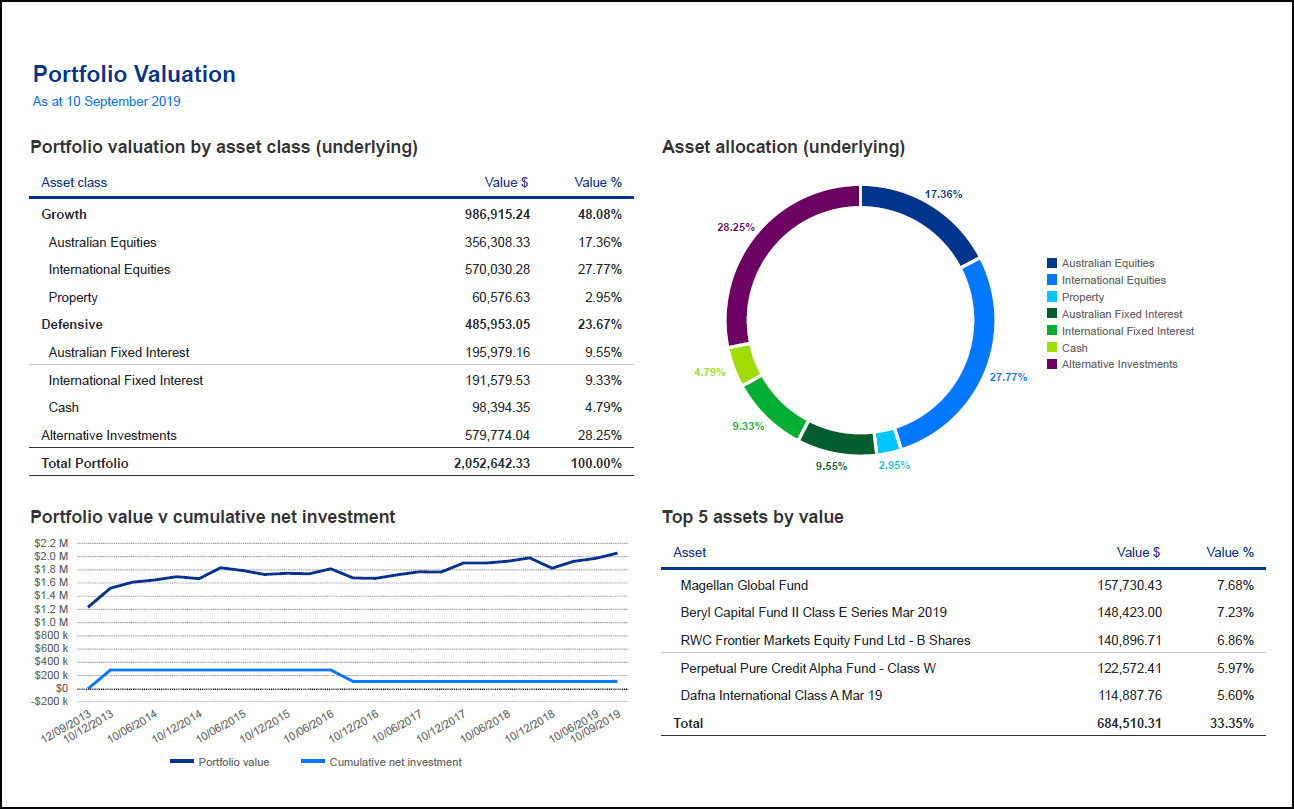

You can export a summary of a client's holdings and configure the information shown in our updated Portfolio report.

To configure and download:

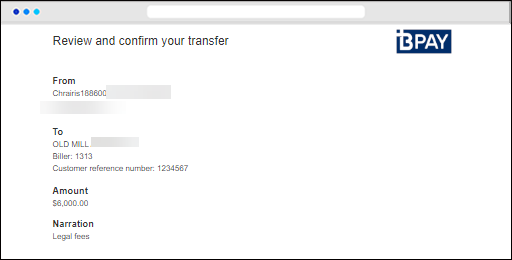

We've introduced BPAY to supplement our Pay Anyone functionality, providing another easy and convenient way for Wealth Accelerator clients to make one-off or recurring payments through their Netwealth account.

You can also schedule payments and save biller details.

® Registered to BPAY Pty Ltd, ABN 69 079 137 518

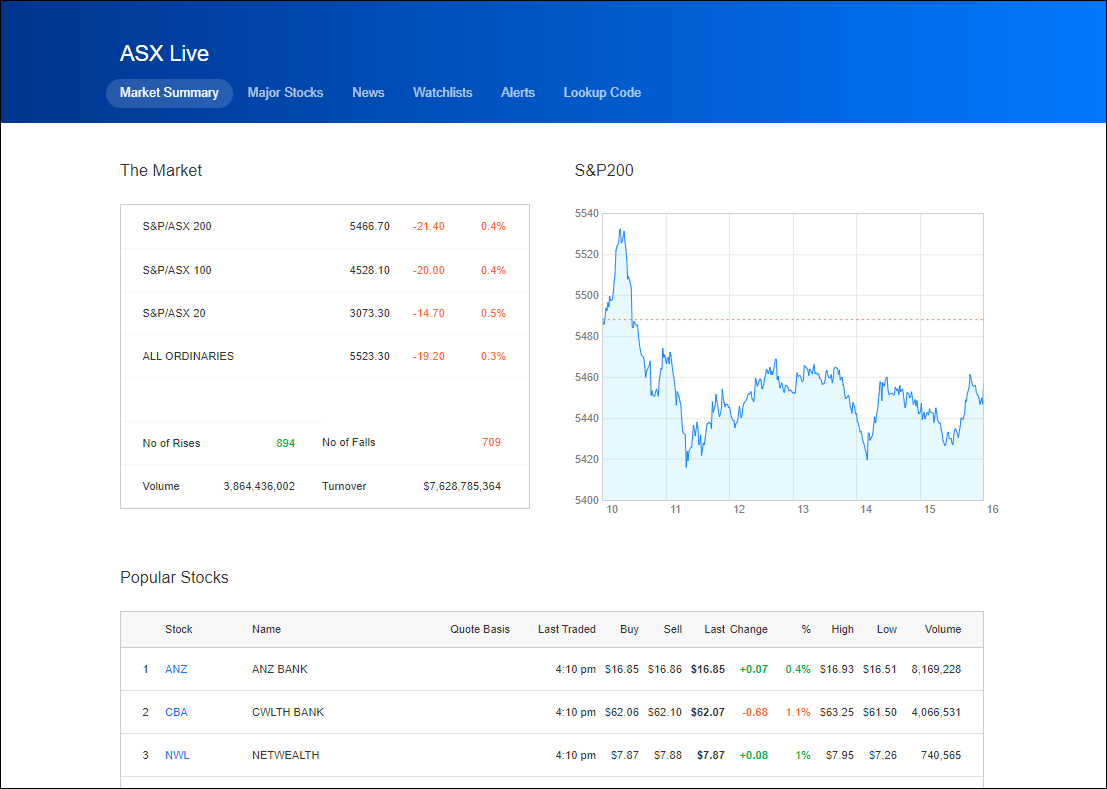

Our redesigned ASX Live data centre can help you stay on top of the local market:

In addition to 170 banks and credit unions, you can also include bank feeds for:

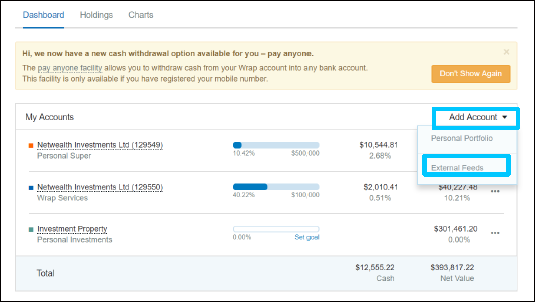

A client can add a bank feed to their accounts through My Accounts on their Dashboard by selecting Add account>External account.

We have revamped our Buy/Sell functionality giving you the ability to:

We've added new reports and capabilities to help you see a better picture of your client's position:

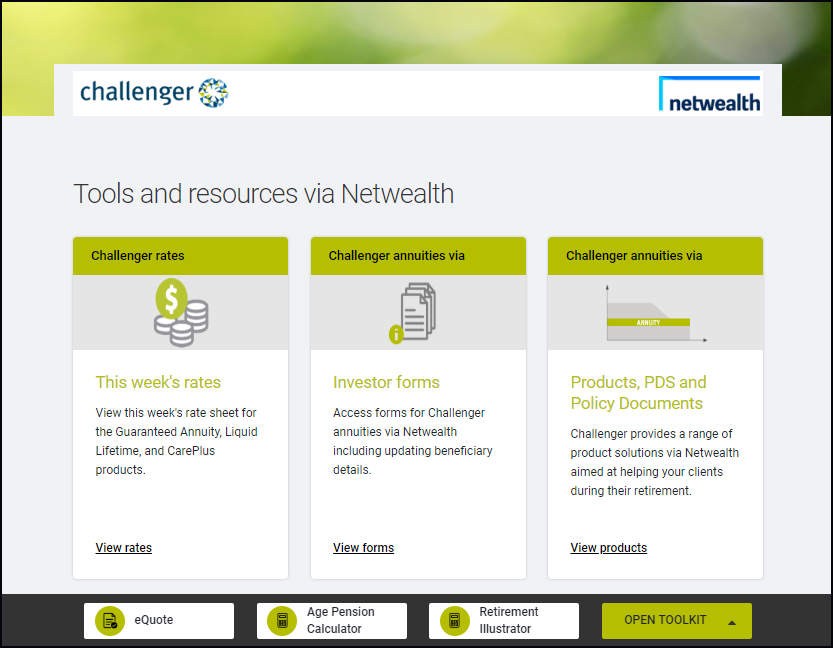

To help your clients during retirement we teamed up with Challenger to provide access to annuities:

Our super transfer tool helps to remove any guesswork from pension to super account transfers (or vice-versa):

To use, select a client with a super or income stream account and navigate via the main menu to Activities and Tasks > Transfer Between Accounts. Follow the prompts and download the transfer documents for client sign-off.